Who Pays Transfer Tax In Pa Buyer Or Seller Who pays transfer taxes in Pennsylvania The buyer or the seller According to the Pennsylvania Department of Revenue both the seller and buyer are held jointly liable for the payment of

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed instrument long term Who pays the PA deed transfer tax at closing The buyer and seller customarily split the PA deed transfer tax down the middle the buyer pays 1 and the seller pays 1

Who Pays Transfer Tax In Pa Buyer Or Seller

Who Pays Transfer Tax In Pa Buyer Or Seller

https://s3.us-east-1.amazonaws.com/contents.newzenler.com/2112/library/50e4d3464b50b114a6d98774c52f337a083edbed5b5079487d2b7b5ea9bb5e9761f_lg.jpg

A Breakdown Of Transfer Tax In Real Estate UpNest

https://www.upnest.com/1/post/files/2021/08/shutterstock_1060115645-1.jpg

Who Pays Transfer Tax Seller Or Buyer YouTube

https://i.ytimg.com/vi/ipUHTUhZTB0/maxresdefault.jpg

Transfer taxes In Pennsylvania this tax to transfer ownership of property usually runs 1 percent of the sale price for state tax and another 1 percent for local tax Transfer taxes are fees imposed by local state or county governments when transferring property ownership between people or entities These taxes can significantly impact the total

In Pennsylvania both the buyer and sellers are held responsible for paying the state transfer tax It s a norm for both the buyer and seller to evenly split the total transfer tax bill Who pays it In Pennsylvania it is customary for the buyer and the seller to split the payment realty transfer tax sometimes equally but the cost to each party may be negotiated

Download Who Pays Transfer Tax In Pa Buyer Or Seller

More picture related to Who Pays Transfer Tax In Pa Buyer Or Seller

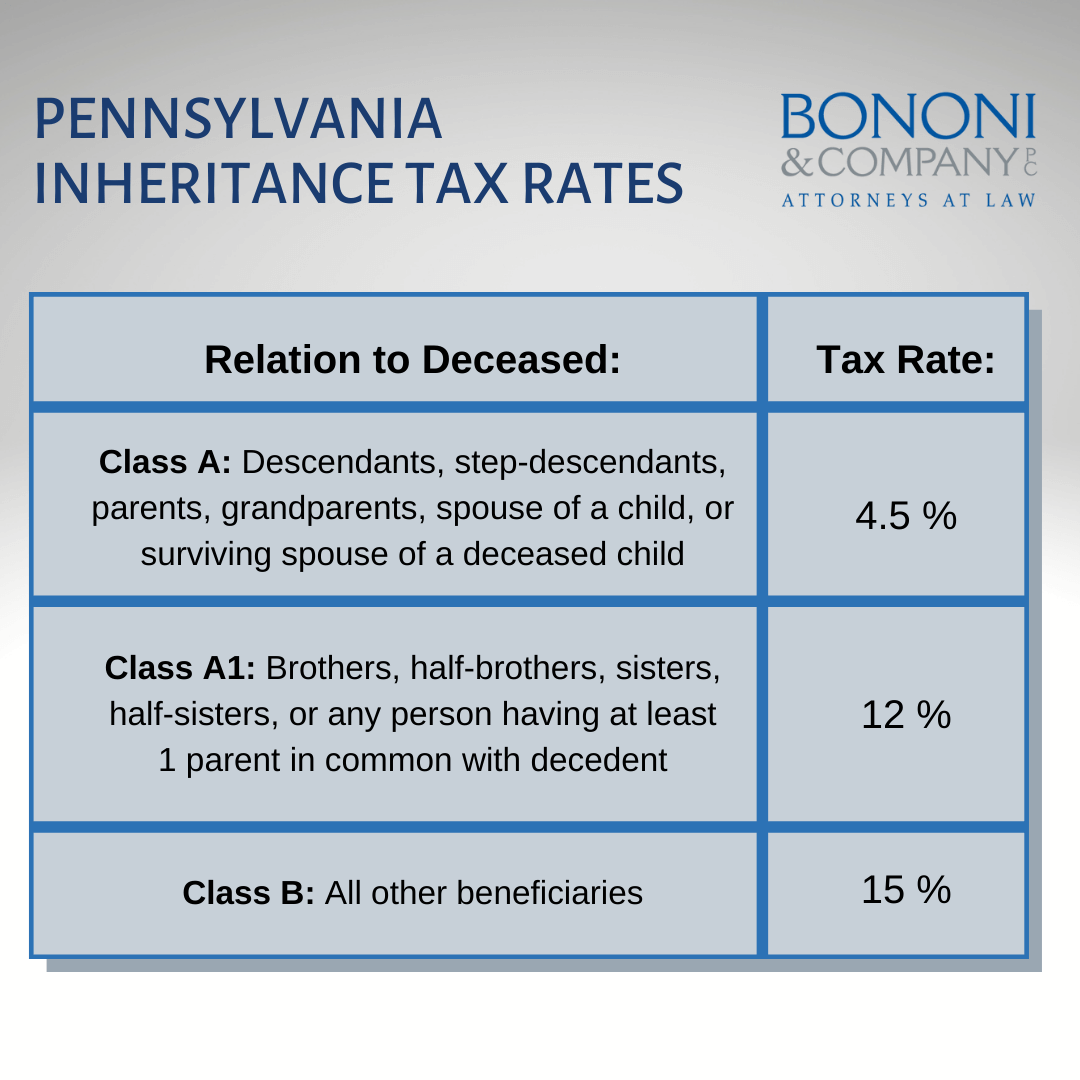

How To Avoid Pennsylvania Inheritance Tax Bononi And Company PC

https://bononiandbononi.com/wp-content/uploads/2022/02/20220221-PA-inheritance-tax-rates.png

Asset Sale Of Business Guess Who Gets The Cash In The Bank

https://irp.cdn-website.com/94ac8541/dms3rep/multi/Asset+Sale+Of+Business+Who+Gets+The+Cash+In+The+Bank-+Buyer+or+Seller+RBS_Blog_Post+1920+x+1279+xp+.jpg

Buyer s Vs Seller s Market How To Tell The Difference

https://assurancemortgage.com/wp-content/uploads/2021/11/09-How-to-Tell-if-Its-a-Buyers-or-Sellers-Market-min.jpg

Key Takeaways Real estate transfer tax is a mandatory cost in Pennsylvania property transactions Payment responsibilities and exemptions vary and are critical for transaction The PA realty transfer tax is imposed at the rate of 1 percent of the actual consideration paid or to be paid for the transfer of an interest in real estate When no consideration or nominal

The 2 Transfer Tax is paid at the time of recording State and local governments do not stipulate who pays the Transfer Tax In most sale agreements the seller and buyer divide the tax One of the costs associated with the purchase of a home in Pennsylvania is the imposition of the realty transfer tax In most cities townships and boroughs within the Commonwealth the

Real Estate Salespeople How To Preserve Those Generous Commissions

https://upandrunningin30days.com/wp-content/uploads/2011/01/toolkit.jpg

Land Transfer Tax What It Is Who Pays It Darren Robinson

https://www.darrenrobinson.ca/wp-content/uploads/2016/10/ThinkstockPhotos-538048010-WEB.jpg

https://listwithclever.com/real-estate-blog/...

Who pays transfer taxes in Pennsylvania The buyer or the seller According to the Pennsylvania Department of Revenue both the seller and buyer are held jointly liable for the payment of

https://www.revenue.pa.gov/TaxTypes/RTT

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed instrument long term

Who Pays Transfer Tax In California And How Much Does It Cost

Real Estate Salespeople How To Preserve Those Generous Commissions

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates

Transfer Tax In The Philippines Lumina Homes

Who Pays Transfer Tax In Philadelphia Splendour Day By Day Account

Transfer Taxes Design Recipes

Transfer Taxes Design Recipes

Who Pays Transfer Tax In Philadelphia Splendour Day By Day Account

Who Pays Federal Taxes Source

Does A Real Estate Attorney Represent Buyer Or Seller

Who Pays Transfer Tax In Pa Buyer Or Seller - Transfer taxes In Pennsylvania this tax to transfer ownership of property usually runs 1 percent of the sale price for state tax and another 1 percent for local tax