Who Pays Vat Tax In Mexico According to Mexican Value Added Tax Law MVATL companies and individuals that perform the following activities in Mexican territory are obliged to pay Value Added Tax VAT Alienation of goods Render of independent services

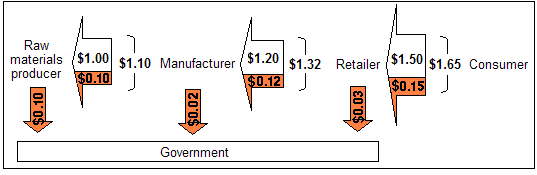

The consumer pays the VAT to the seller who collects the VAT Then the seller must pay the VAT to the Tax Authority through a tax declaration or filing This process is done on a monthly basis How do you calculate payable VAT First you take all the collected VAT that your customers paid The main indirect tax of Mexico is the Value Added Tax locally known as IVA which generally applies to all imports supplies of goods and the provision of services by a taxable person unless specifically exempted by a particular law

Who Pays Vat Tax In Mexico

Who Pays Vat Tax In Mexico

https://www.expatinsurance.com/_next/image?url=https:%2F%2Fexpat-strapi.s3.amazonaws.com%2Fincome_tax_mexico_6ba0250e78.jpg&w=640&q=75

Airbnb Vacation Rental Income Taxes In Mexico With An RFC

https://beachpleasemexico.com/wp-content/uploads/2021/12/vat-value-added-tax-document-4184607-1024x660.jpg

Tax Vat Brainergy Digital

https://brainergy.digital/wp-content/uploads/2022/12/314746985_532749638866275_5156121311147018646_n.jpg

Local Taxes No Tax threshold MXN 0 for digital goods Website Servicio de Administraci n Tributaria SAT Mexico s tax agency No matter where you live or where your online business is based if you have customers in Mexico you gotta follow Mexican VAT rules That s what this guide is for IVA on a Mexican bill is the tax added to the sale of goods and services Mexico IVA is a value added tax implicated on all the buying and purchasing of goods and services within the country currently it is 16 of the total revenue

Mexico has a range of VAT rates including Standard VAT rate 16 Borders Reduced VAT rate of 11 was dropped in 2014 Zero Rated Supplies foodstuffs water agricultural supplies books and magazines Mexican manufacturers are not obligated to pay Value Added Tax VAT or IEPS on any items or components brought into the country for the purpose of processing assembling or completing products that are meant to be exported

Download Who Pays Vat Tax In Mexico

More picture related to Who Pays Vat Tax In Mexico

All About Property Tax In Mexico Donner Asociados

https://ryandonner.com/wp-content/uploads/2021/09/tax-768x513.jpg

Corporate Tax In Mexico What You Need To Know Start Ops

https://start-ops.com.mx/wp-content/uploads/2022/05/Custom-dimensions-900x1200-px.jpeg

Who Pays VAT Buyer Or Seller Sovos UK

https://sovos.com/en-gb/wp-content/uploads/sites/5/2023/02/who-pays-VAT-buyer-or-seller.jpg.optimal.jpg

One of the most significant benefits is the value added tax VAT savings implemented when working under a shelter operation To better understand how this can benefit you we re defining Mexico s VAT rate and how it s calculated who s exempt from the VAT in Mexico and recent changes manufacturers need to know Defining Mexico s VAT Tax VAT in Mexico is governed by the Value Added Tax Act Ley del Impuesto al Valor Agregado It is the country s main indirect tax and is applied at a standard rate of 16 however there is a 0 rate for exports and the supply of local goods and services As with any other indirect tax VAT

[desc-10] [desc-11]

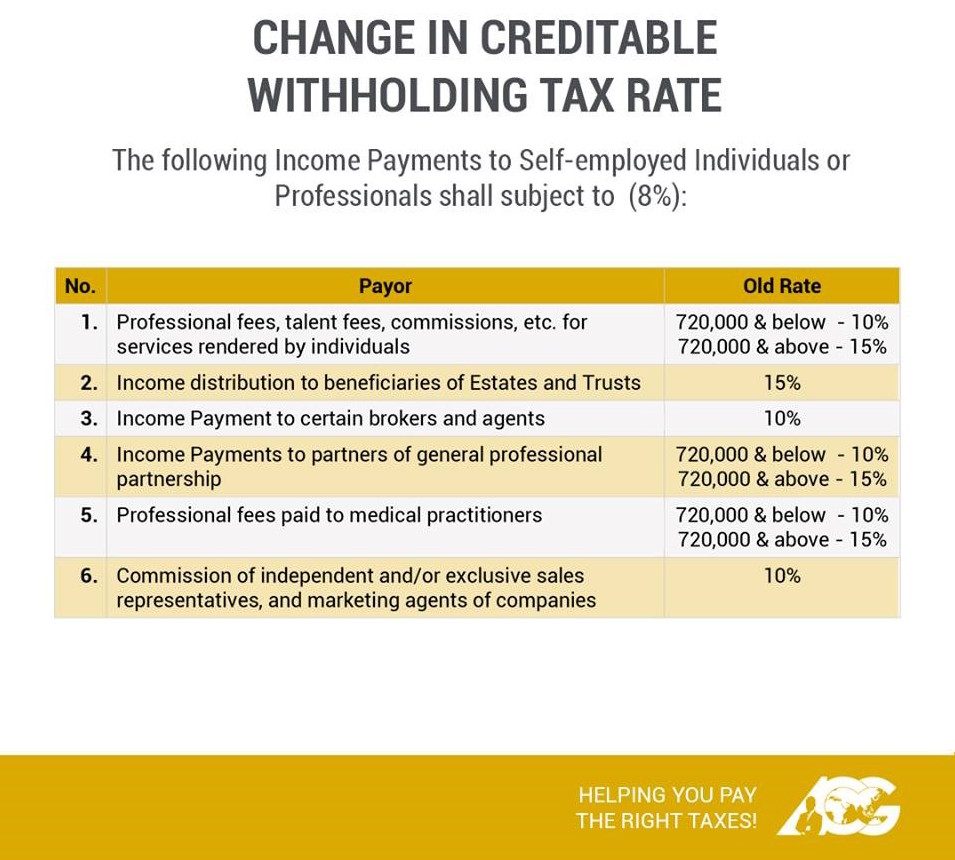

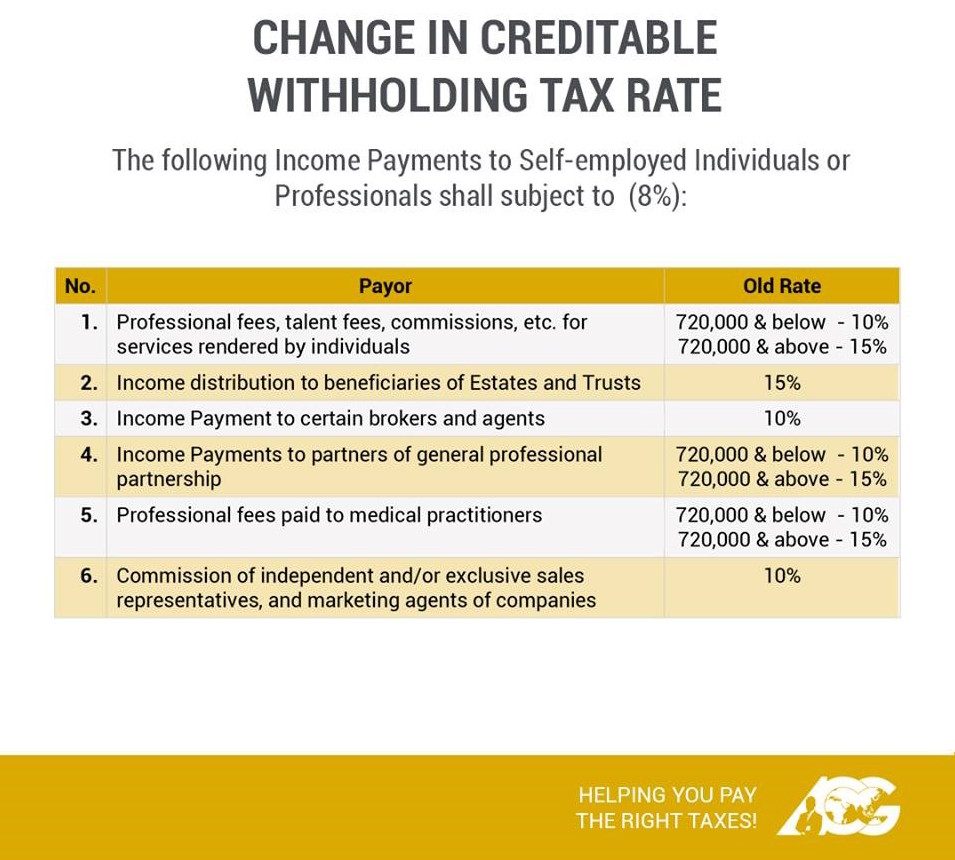

AskTheTaxWhiz Withholding Tax

https://www.rappler.com/tachyon/r3-assets/4ACB916E5A1249EB9CB3D98C3B8013ED/img/A6076DE2D06E4B24A92D8497C1EC3C55/20180222-tax-whiz-1.jpg

Tax After Coronavirus Treasury Committee House Of Commons

https://publications.parliament.uk/pa/cm5801/cmselect/cmtreasy/664/IDExport-web-resources/image/figure-7.png

https://www.roedl.com/insights/vat-guidelines/...

According to Mexican Value Added Tax Law MVATL companies and individuals that perform the following activities in Mexican territory are obliged to pay Value Added Tax VAT Alienation of goods Render of independent services

https://doingbusiness-mexico.com/vat-in-mexico

The consumer pays the VAT to the seller who collects the VAT Then the seller must pay the VAT to the Tax Authority through a tax declaration or filing This process is done on a monthly basis How do you calculate payable VAT First you take all the collected VAT that your customers paid

Mexico Aims To Reduce Smuggling And Increase Tax Collection MEXICONOW

AskTheTaxWhiz Withholding Tax

IRS How To Avoid A Surprise Tax Bill Before January 17 Marca

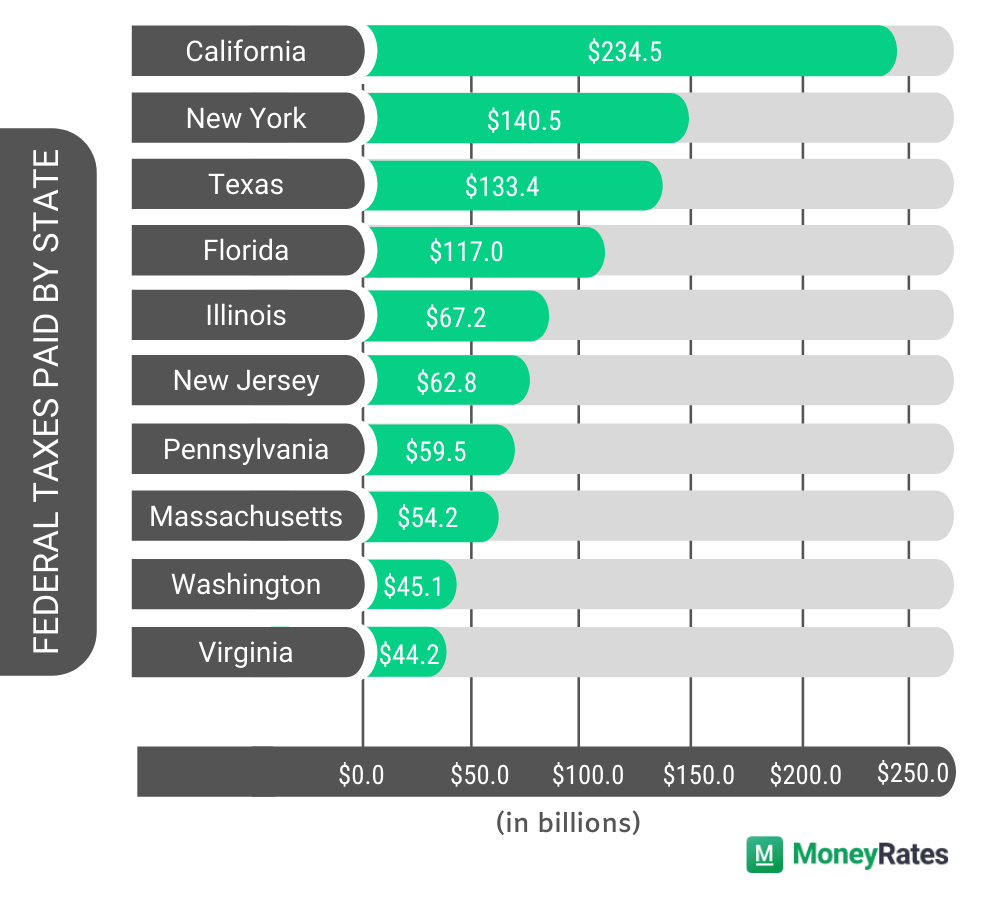

Which States Pay The Most Federal Taxes MoneyRates

Understanding The VAT Tax Benefits IVA Tax In Mexico NAPS

A Complete Guide About VAT And Related Legalities In India

A Complete Guide About VAT And Related Legalities In India

Value Added Tax Facts For Kids

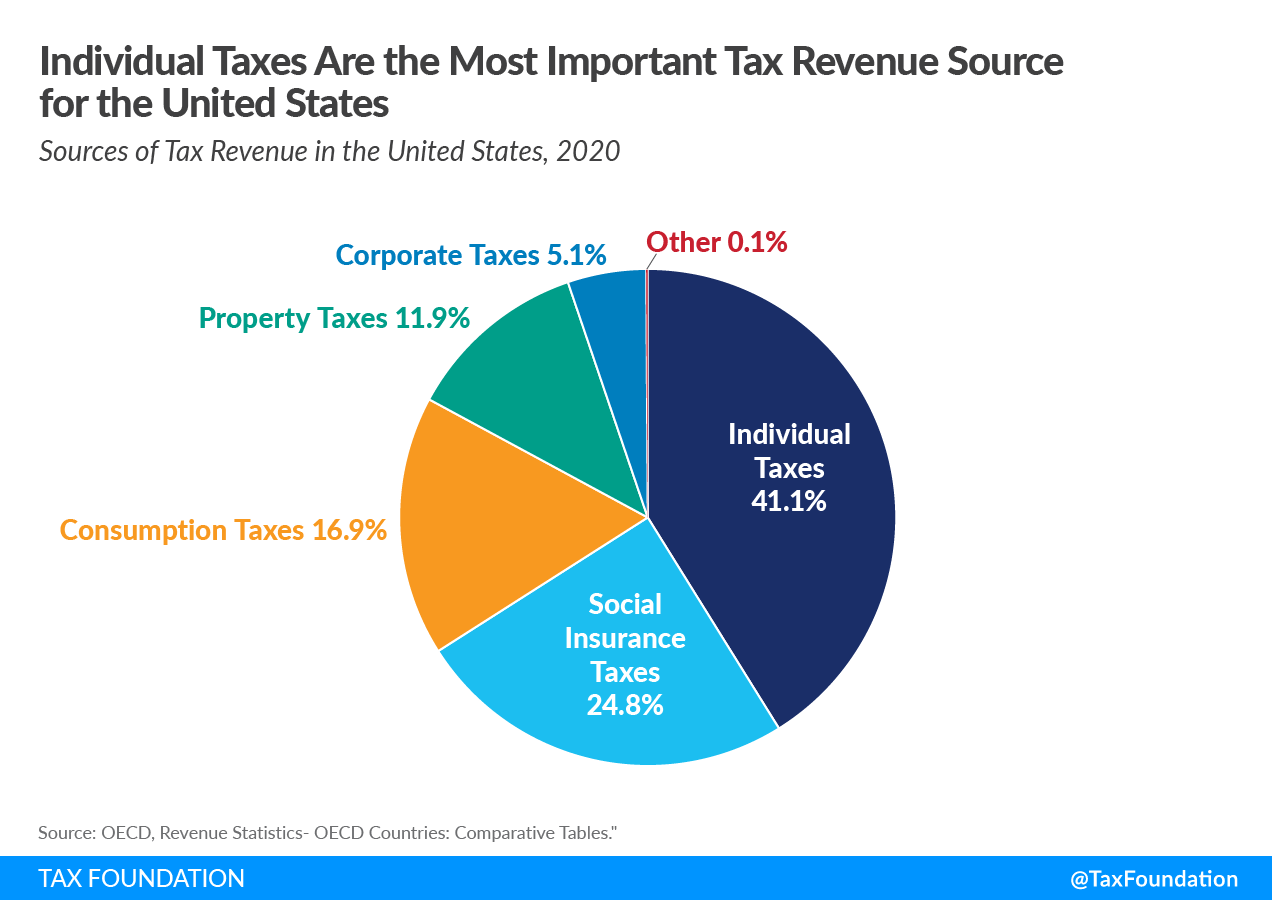

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

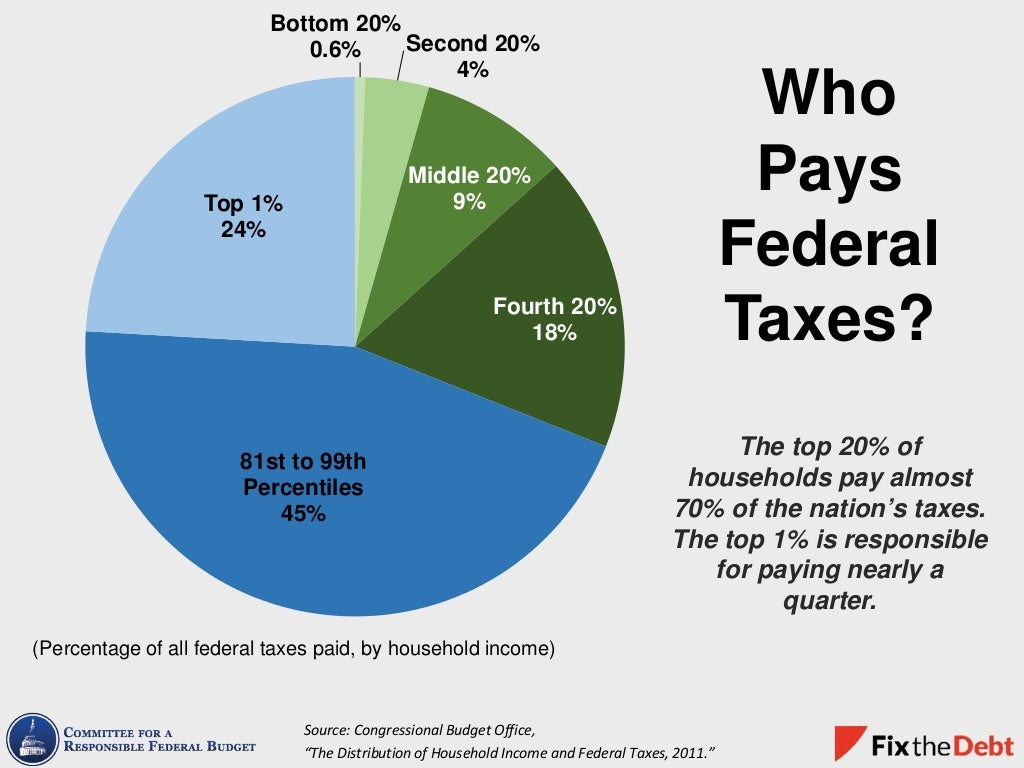

Who Pays Federal Taxes Source

Who Pays Vat Tax In Mexico - Mexico has a range of VAT rates including Standard VAT rate 16 Borders Reduced VAT rate of 11 was dropped in 2014 Zero Rated Supplies foodstuffs water agricultural supplies books and magazines