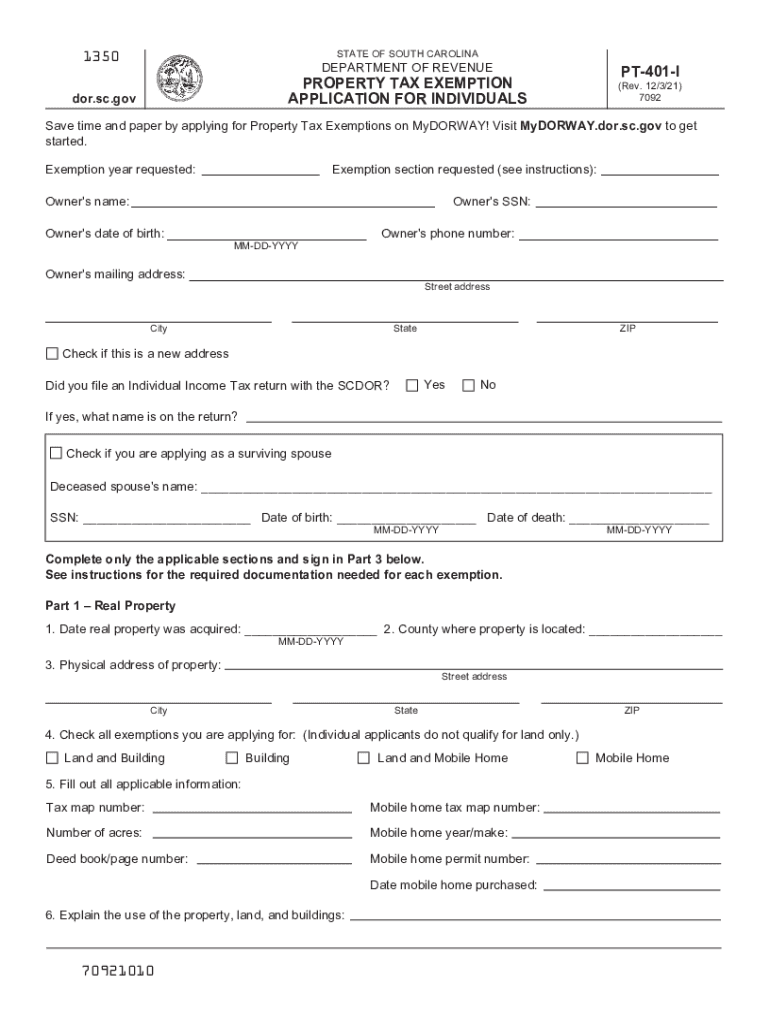

Who Qualifies For Homestead Exemption In Sc The Homestead Exemption is a complete exemption of taxes on the first 50 000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind

In order to qualify for the Homestead Exemption you will need to prove the following You re the title holder of your main legal residence the life estate to your main legal residence or you are the beneficiary of a trust which holds the title to your main legal residence South Carolina Homestead Exemption Program How the Homestead Exemption Program Can Reduce Your Property Tax Bill Do I Qualify I hold complete fee simple title or life estate to my primary residence As of December 31 preceding the tax year of the exemption I was a legal resident of South Carolina for one year

Who Qualifies For Homestead Exemption In Sc

Who Qualifies For Homestead Exemption In Sc

https://offgridgrandpa.com/wp-content/uploads/2023/10/who-qualifies-for-homestead-exemption-in-kentucky.jpg

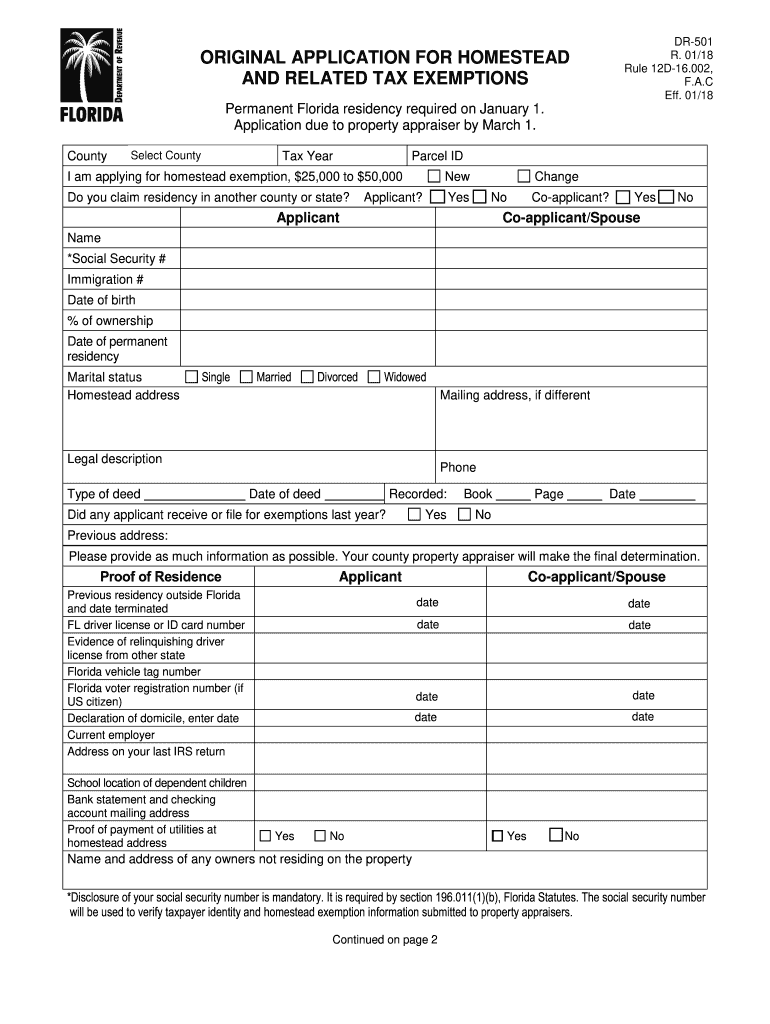

Miami Dade Homestead Exemption Form Fill Online Printable Fillable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/miami-dade-homestead-exemption-form-fill-online-printable-fillable-1.png

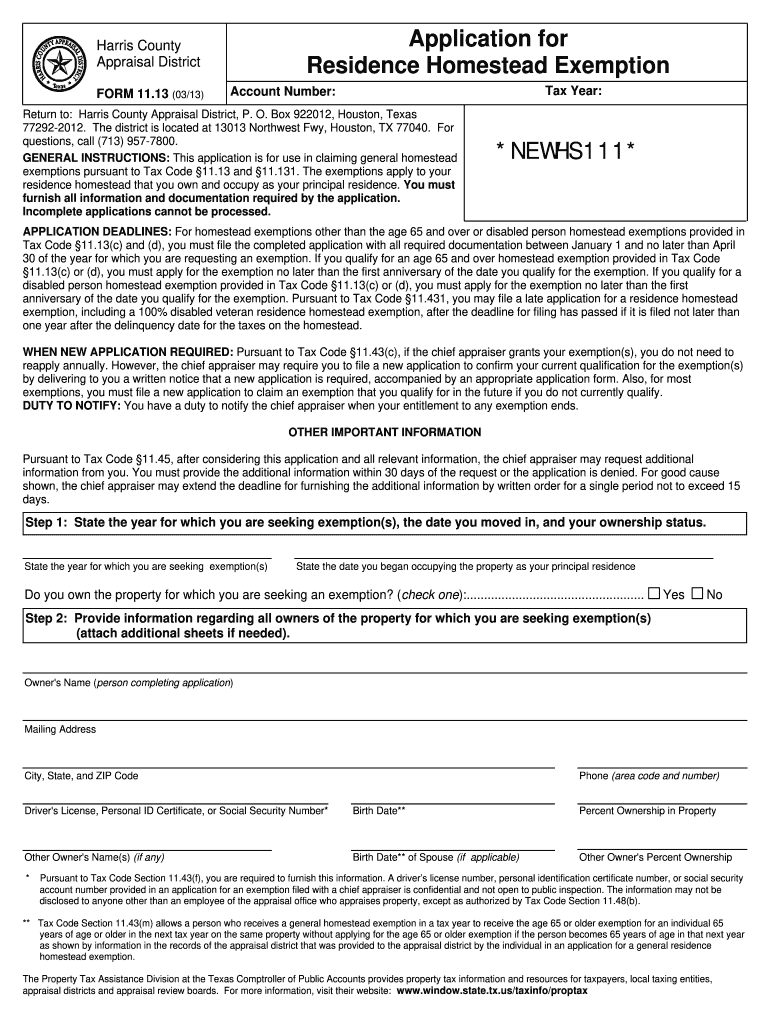

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-4.png?fit=530%2C749&ssl=1

If you think you may qualify for the Homestead Exemption read the general information below and contact the Dorchester County Auditor s Office to apply Who Qualifies for the Homestead Exemption To qualify for the Homestead Exemption statements 1 2 and 3 must be true To qualify for the Homestead Exemption statements 1 2 and 3 must be true You hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of a trust that holds title to your primary legal residence

Q How do I qualify for the Homestead Exemption You may be qualified for the Homestead Exemption if you ARE at least 65 years of age on or before December 31 st preceding the tax year in which you wish to claim the exemption OR ARE certified totally and permanently disabled by a state or federal agency OR ARE legally blind OR Application Period The year after you turned 65 or classified 100 disabled or legally blind apply between January 1st and July 15th Post application Period Apply between July 16th and before the first penalty date of the tax year that the exemption can first be claimed

Download Who Qualifies For Homestead Exemption In Sc

More picture related to Who Qualifies For Homestead Exemption In Sc

501 Homestead 2018 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/446/788/446788151/large.png

News Notices Dorchester County SC Website

https://www.dorchestercountysc.gov/home/showpublishedimage/4945/637382726711070000

Who Qualifies For Homestead Exemption In South Dakota Guide Off

https://offgridgrandpa.com/wp-content/uploads/2023/10/who-qualifies-for-homestead-exemption-in-south-dakota.jpg

The Homestead Exemption Program is a State funded program authorized under Section 12 37 250 of the South Carolina Code of Laws The program exempts the first 50 000 fair market value of primary residence from all property taxes The benefit is known as homestead tax exemption and provides that the first 50 000 of the fair market value of the dwelling place including mobile homes on leased land shall be exempt from municipal county school and special assessment real property taxes

The Homestead Exemption If you are at least 65 legally blind or physically disabled you may apply to your county auditor for a Homestead Exemption which exempts all the remaining taxes for the first 50 000 of value for You may be qualified for the Homestead Exemption if you ARE at least 65 years of age on or before December 31 preceding the tax year in which you wish to claim the exemption OR ARE certified totally and permanently disabled by a state or federal agency OR ARE legally blind OR

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Homestead Exemption

https://static.wixstatic.com/media/3a5a64_a2dc98c068b34d5ab0e28ba9d0cb98f7~mv2.png/v1/fit/w_1024,h_1024,al_c,q_80/file.png

https://dor.sc.gov/tax/exempt-property

The Homestead Exemption is a complete exemption of taxes on the first 50 000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind

https://www.ezhomesearch.com/blog/your-homestead...

In order to qualify for the Homestead Exemption you will need to prove the following You re the title holder of your main legal residence the life estate to your main legal residence or you are the beneficiary of a trust which holds the title to your main legal residence

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

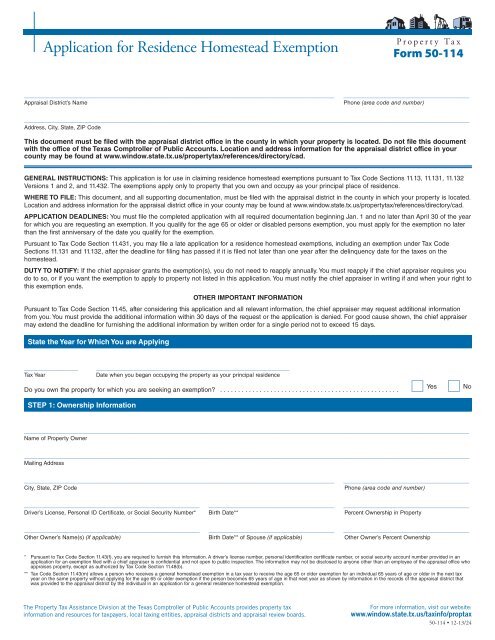

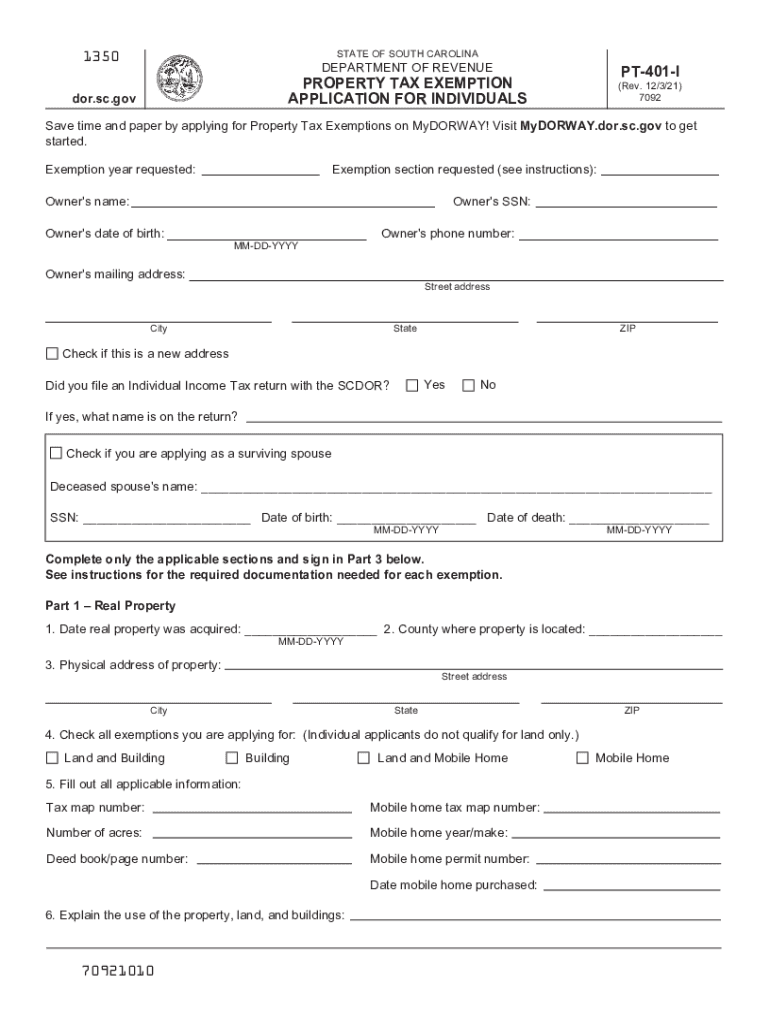

Property Tax Exemption For Individuals For South Carolina Pt 401 1

Homestead Exemption Form Fill Out Sign Online DocHub

Homestead Exemption Form Hidalgo County Appraisal District

Sc Homestead Exemption 2021 2024 Form Fill Out And Sign Printable PDF

Sc Homestead Exemption 2021 2024 Form Fill Out And Sign Printable PDF

Who Qualifies For Homestead Exemption In Louisiana Guide Off

What Are Cherokee County Homestead Exemption Codes About Indian

Homestead Exemption Letter Reminder Template Etsy

Who Qualifies For Homestead Exemption In Sc - To qualify for the Homestead Exemption statements 1 2 and 3 must be true You hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of a trust that holds title to your primary legal residence