Who Qualifies For Homestead Rebate In Nj You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in New

The property tax rebate is tied into your New Jersey gross personal income tax filings said Neil Becourtney a certified public accountant and tax partner You will need the assigned Identification Number and PIN of your principal residence you owned and occupied on Oct 1 2018 to file by phone at 877 658 2972

Who Qualifies For Homestead Rebate In Nj

Who Qualifies For Homestead Rebate In Nj

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2020/03/biz324.jpg

Is The Homestead Rebate For Homeowners Running Late Nj

https://www.nj.com/resizer/Z-Lasop-fy7Cz2Lo9wlvlTFVzPw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RW7W4DUDE5BIHBJBZMV2YOV254.jpg

What s The Maximum For The Homestead Rebate Nj

https://www.nj.com/resizer/FP-9_AOC9tQclFc-fQSuX5aG2Dg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WXCOADJAKREWPHN56T4KBMGARY.jpg

Governor Murphy Unveils ANCHOR Property Tax Relief Program 03 3 2022 New Program Makes 1 8 Million New Jerseyans Eligible for Property Tax Rebates Under the new program known as ANCHOR homeowners making up to 150 000 will receive 1 500 rebates on their property tax bills and those making

You must have earned 150 000 or less for homeowners age 65 or over or are blind or disabled Otherwise the income level is 75 000 or less for those less than To be eligible you must Be at least 65 years old or receive Social Security Disability benefits Have lived in New Jersey continuously for at least the last 10 years as either a homeowner or a

Download Who Qualifies For Homestead Rebate In Nj

More picture related to Who Qualifies For Homestead Rebate In Nj

Who Qualifies For NJ Homestead Rebate 2022 YouTube

https://i.ytimg.com/vi/vklEBvf_5vE/maxresdefault.jpg

What Happened To My Homestead Rebate Nj

https://www.nj.com/resizer/YBH6_5GrDFwkGpufG-YhRgbK53g=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.nj.com/home/njo-media/width2048/img/business_impact/photo/old-man-3617304-1920jpg-452fcfe731a60d12.jpg

Is It Too Late To Get The Homestead Rebate After I Sell NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2021/04/house-finance-4503755_1920-1-1536x1153.jpg

Homeowners making up to 75 000 annually are eligible for Homestead benefits as are seniors and disabled homeowners who make up to 150 000 annually Officials in New Jersey are urging people to apply for property tax relief under the new ANCHOR program before the Jan 31 2023 deadline Qualified

About 730 000 property owners qualified to receive an average 473 credit on their property tax bill this year The application It s relatively easy to apply for the A You re correct that the ANCHOR program will be replacing the Homestead Rebate That s short for the Affordable New Jersey Communities for Homeowners and

Can I File An Appeal For The Homestead Rebate Nj

https://www.nj.com/resizer/K_5PPZV0VL06-8B5OVxOlQXI8Gs=/1280x0/smart/image.nj.com/home/njo-media/width600/img/business_impact/photo/house-961401-1920jpg-4f85a1902413665d.jpg

Can I Get Tax Breaks For Seniors On This Home NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/03/home-2953306_1920.jpg

https://www. nj.gov /treasury/taxation/proptaxdeduc_credit.shtml

You are eligible for a property tax deduction or a property tax credit only if You were domiciled and maintained a primary residence as a homeowner or tenant in New

https:// njmoneyhelp.com /2022/07/do-i-need-to-apply...

The property tax rebate is tied into your New Jersey gross personal income tax filings said Neil Becourtney a certified public accountant and tax partner

Do I Qualify For The Homestead Rebate Or The Senior Freeze Nj

Can I File An Appeal For The Homestead Rebate Nj

When Can I Apply For The Homestead Rebate Nj

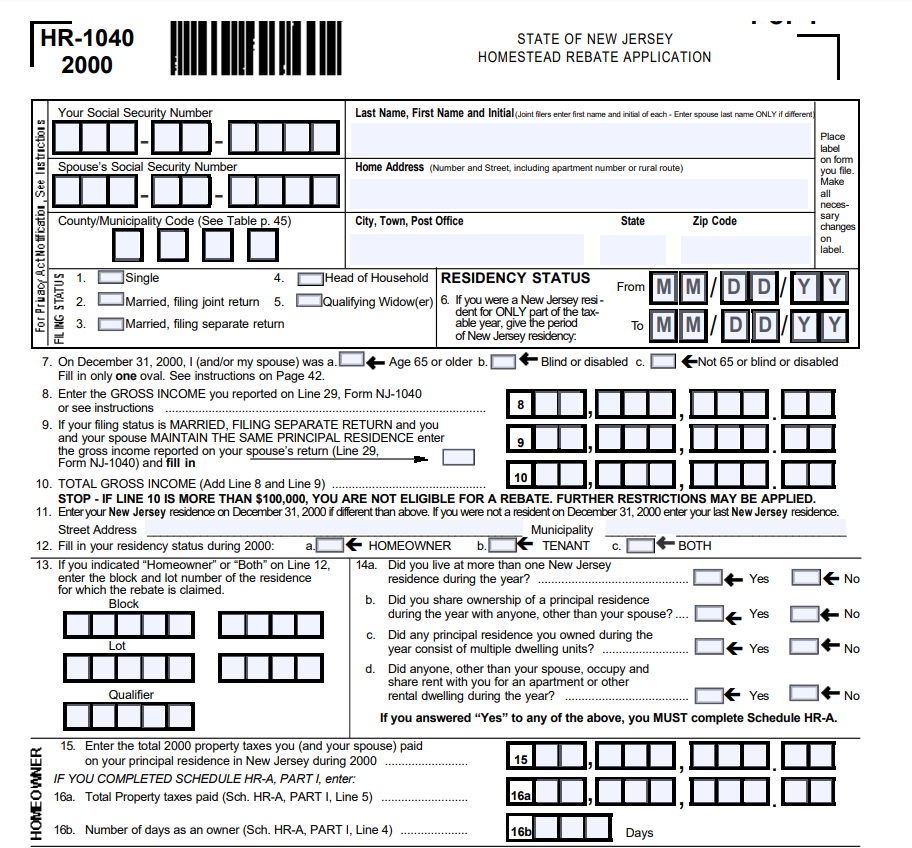

NJ Homestead Printable Rebate Form

Nj Homestead Rebate 2022 Renters RentersRebate

Explainer How State s Homestead Rebates Work Who s Qualified To Get

Explainer How State s Homestead Rebates Work Who s Qualified To Get

NJ Homestead Rebate What To Know Credit Karma

Nj Homestead Rebate 2023 Rebate2022

When Will I Be Eligible For The Homestead Rebate NJMoneyHelp

Who Qualifies For Homestead Rebate In Nj - Under the new program known as ANCHOR homeowners making up to 150 000 will receive 1 500 rebates on their property tax bills and those making