Who Qualifies For Homestead Tax Credit In Ohio To qualify you must meet the following criteria You are at least 65 years old or will turn 65 the year you apply or permanently and totally disabled as of January

To qualify for the exemption you must be an Ohio resident who is at least 65 years old under 65 and totally and permanently disabled or 59 years old and the widow widower The homestead exemption is a statewide property tax reduction program for senior citizens those who are disabled and surviving spouses of fallen first responders

Who Qualifies For Homestead Tax Credit In Ohio

Who Qualifies For Homestead Tax Credit In Ohio

https://offgridgrandpa.com/wp-content/uploads/2023/11/who-qualifies-for-homestead-exemption-in-Minnesota.jpg

A State Earned Income Tax Credit Would Aid Pa Working Families

https://www.gannett-cdn.com/presto/2022/02/07/NETN/fea7d07e-330c-4d39-a52b-f73203782a0f-MarybelleMartin.jpg?crop=5503,3095,x0,y1651&width=3200&height=1800&format=pjpg&auto=webp

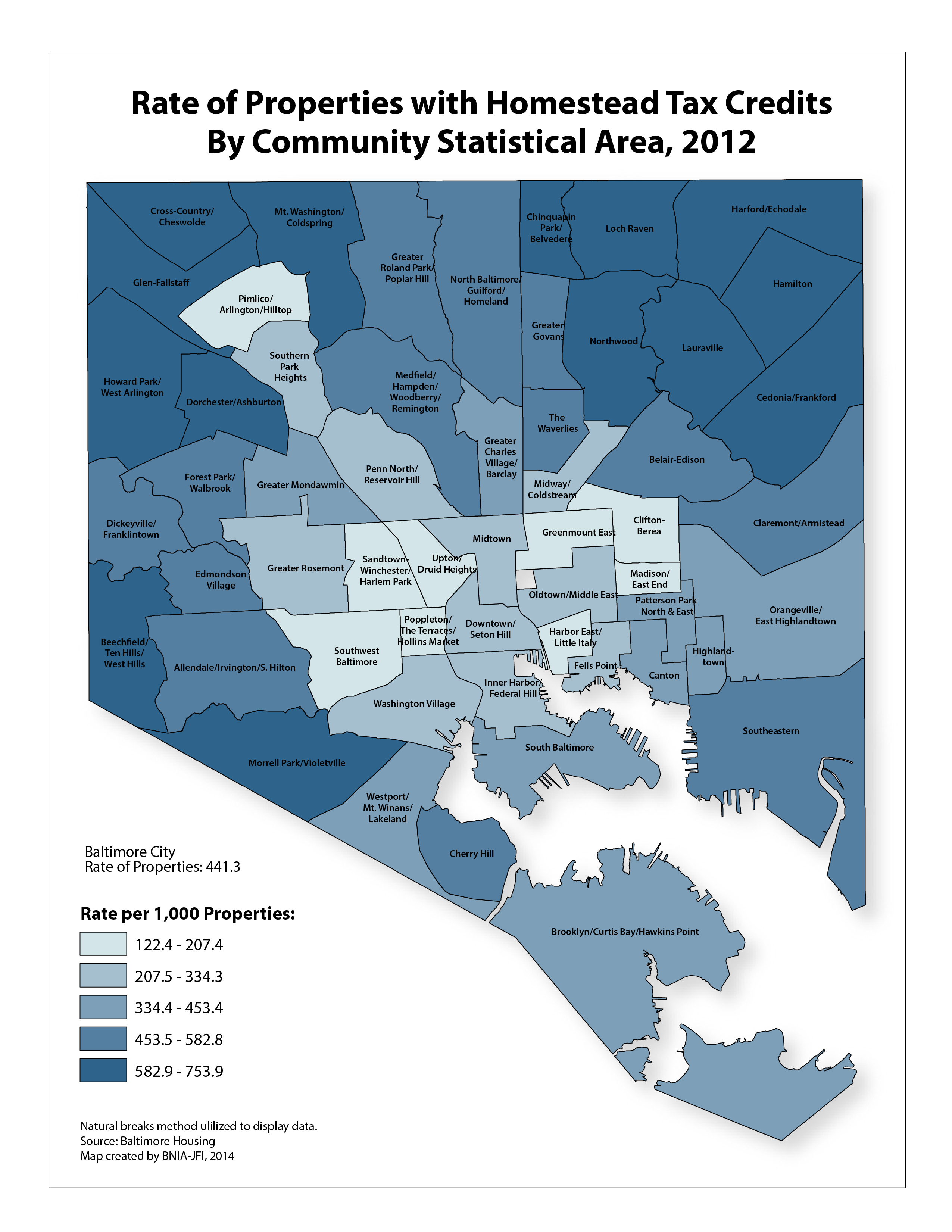

Homestead Tax Credits 2012 BNIA Baltimore Neighborhood Indicators

https://bniajfi.org/wp-content/uploads/2014/04/Homestead-Tax-Credits-2012.jpg

All Ohio homeowners must meet the following criteria Own and occupy a home in Ohio as your principal place of residence on January 1 2013 and Are 65 Qualifications You may qualify for a lower tax on your home if you Are at least 65 years old OR Are determined to be permanently and totally disabled OR Are a Veteran who

The homestead exemption is a statewide program which allows qualified senior citizens and permanently and totally disabled homeowners to reduce their property tax burden For late applications for the 2021 application period the maximum allowed is 34 200 total income in 2020 Please note Homeowners who received a Homestead Exemption

Download Who Qualifies For Homestead Tax Credit In Ohio

More picture related to Who Qualifies For Homestead Tax Credit In Ohio

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://cdn.uslegal.com/uslegal-preview/TX/TX-HM-001/1.png

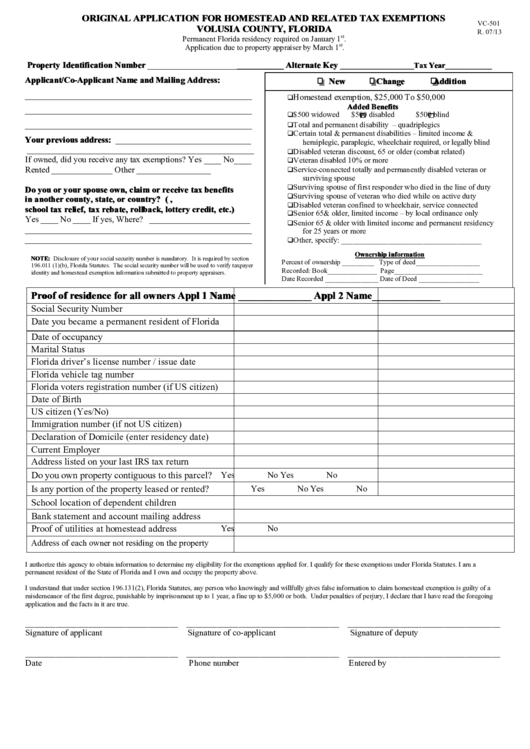

501 Homestead 2018 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/446/788/446788151/large.png

Who Qualifies For A Residential Homestead Exemption

https://s.hdnux.com/photos/01/32/52/05/23765340/3/rawImage.jpg

1 What is the Homestead Exemption Program 2 What kind of property tax savings will I receive 3 Who is eligible for the Homestead Exemption program 4 Is there an On average those who qualify are saving 400 per year The Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled

Currently an individual can qualify for the homestead credit if he or she meets the following criteria The individual must own and occupy the home as the primary To qualify you must own and occupy your home as of January 1 of the year you apply for the reduction A homeowner and spouse may only apply for one property in Ohio

Who Qualifies For Homestead Exemption In Louisiana Guide Off

https://offgridgrandpa.com/wp-content/uploads/2023/10/who-qualifies-for-homestead-exemption-in-Louisiana-1024x661.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

https://www.hml-law.net/2023/05/ohio-homestead-law

To qualify you must meet the following criteria You are at least 65 years old or will turn 65 the year you apply or permanently and totally disabled as of January

https://finance.zacks.com/qualify-homestead...

To qualify for the exemption you must be an Ohio resident who is at least 65 years old under 65 and totally and permanently disabled or 59 years old and the widow widower

What Do I Do If I Haven t Received Child Tax Credit In August

Who Qualifies For Homestead Exemption In Louisiana Guide Off

How To Apply For Homestead Tax Credit In Ohio PRORFETY

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Earned Income Tax Credit City Of Detroit

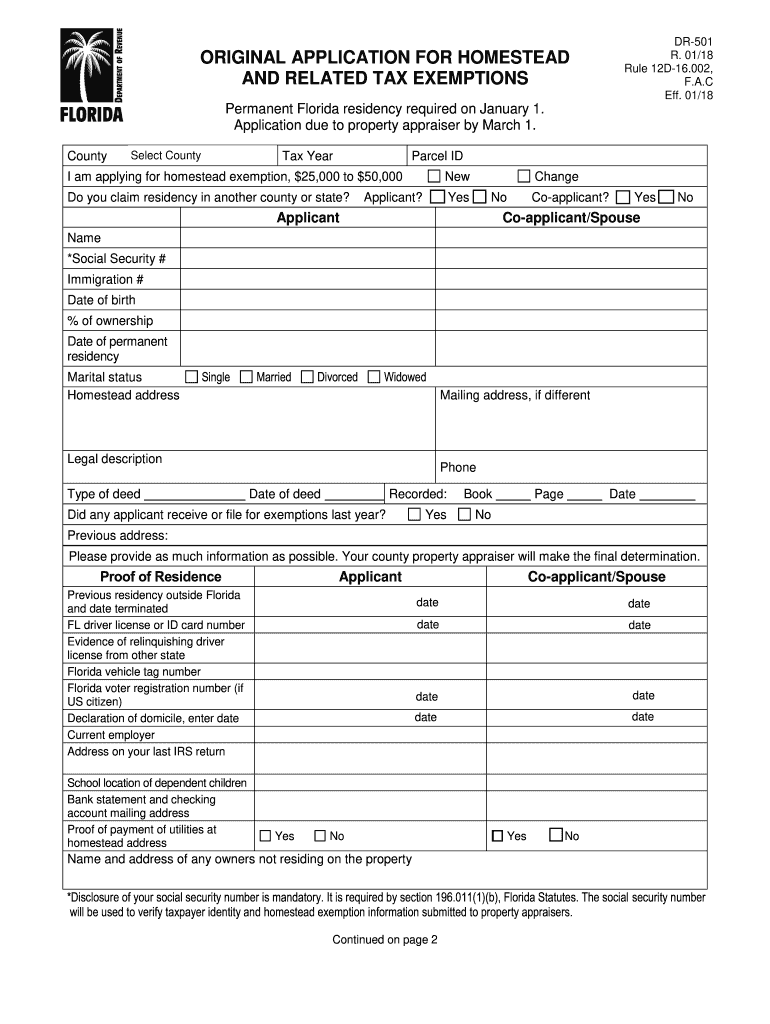

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Who Qualifies For Texas Homestead Exemption Avidian Wealth Solutions

2019 2021 Form TX HCAD 11 13 Fill Online Printable Fillable Blank

Florida Homestead Tax Exemption Form ExemptForm

Who Qualifies For Homestead Tax Credit In Ohio - Taxes on 50 000 of the auditor s fair market value as opposed to the current homestead reduction to the taxes on 25 000 Under this new classification disabled veterans are