Who Qualifies For Homestead Tax Exemption In Ohio Ohio Department of Taxation Menu Home Resources for Individuals Resources for Businesses Resources for How do I apply for the homestead exemption Web Content Viewer

The limit for tax year 2020 payable 2021 is 33 600 Ohio adjusted gross income line 3 on tax return For 2021 payable 2022 the limit is 34 200 Homestead recipients prior to 2014 are The Homestead Exemption allows low income senior citizens and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market value of

Who Qualifies For Homestead Tax Exemption In Ohio

Who Qualifies For Homestead Tax Exemption In Ohio

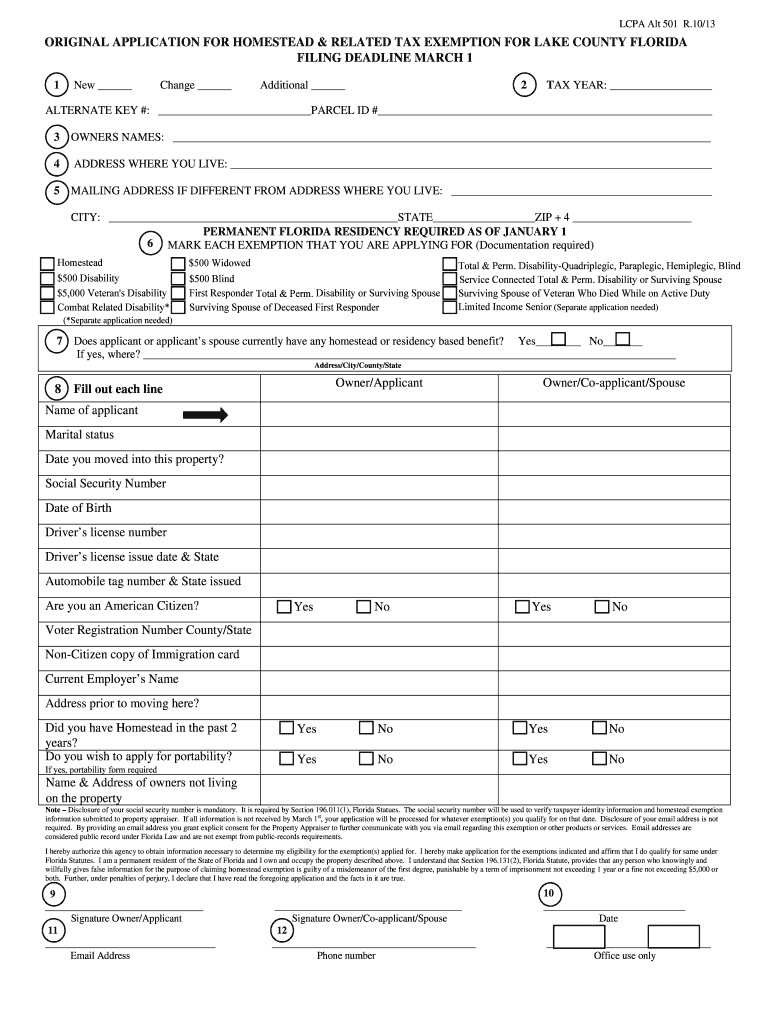

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Riverside County Homestead Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/deadline-for-filing-for-homestead-exemption-will-be-march-1-fill-out-2.png

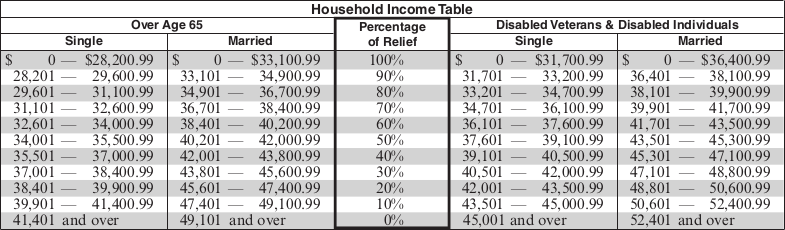

Homestead Exemptions DC Assessor

http://www.dcassessor.org/uploads/2018 Income Table.png

Homeowners who are seniors or disabled may qualify for the Homestead Exemption which allows them to exempt the first 28 000 of their home s value from taxation To qualify you must Who qualifies for the new Homestead Exemption Ohio Homeowners who Occupy their home as their principal residence as of January 1 of the tax year they are applying for Are able to show

The new Homestead Exemption starts with tax bills payable in the following year For real property bills due cover the preceding year For manufactured or mobile homes bills are a Who qualifies for the new Homestead Exemption and when can I apply To qualify any Ohio resident homeowner who Is at least 65 years old as of January 1st the year he she applies or

Download Who Qualifies For Homestead Tax Exemption In Ohio

More picture related to Who Qualifies For Homestead Tax Exemption In Ohio

Ohio Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/13/287/13287923/large.png

Homestead Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/224/224079/large.png

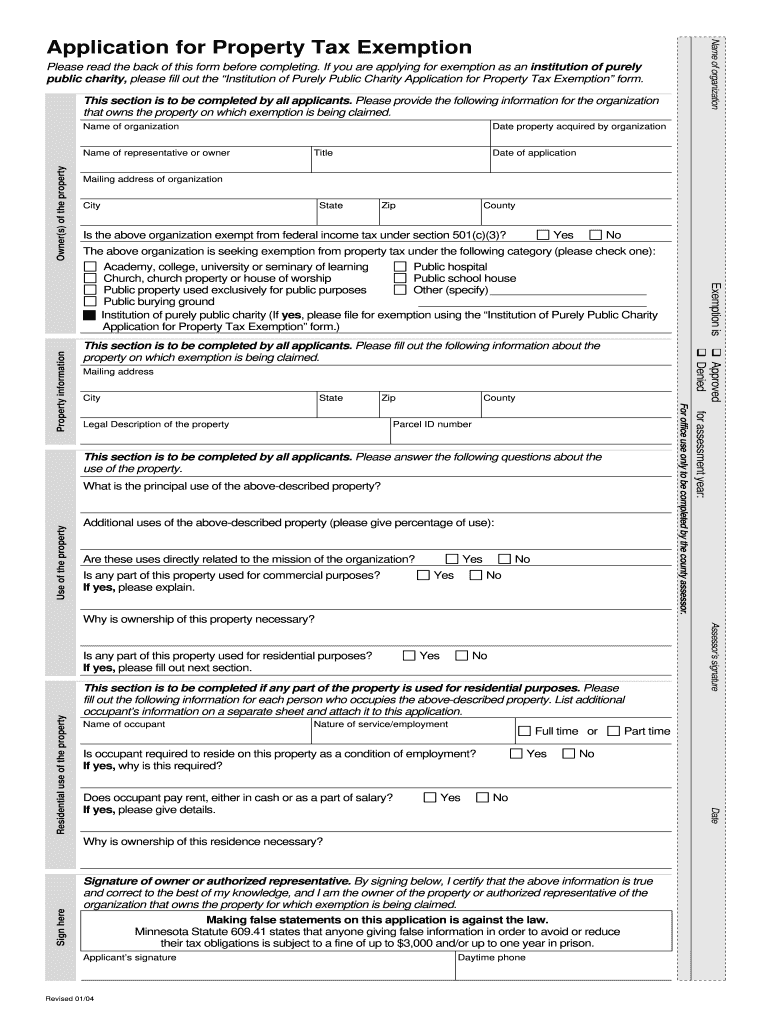

Minnesota Property Tax Exemptions Fill Online Printable Fillable

https://www.pdffiller.com/preview/0/211/211717/large.png

WHO IS ELIGIBLE FOR THE HOMESTEAD EXEMPTION To qualify for the Homestead Exemption you must Be at least 65 years old or will reach age 65 during the current tax year Who Qualifies for a Homestead in Ohio The Ohio Homestead Exemption is composed of two types 1 Senior and Disabled Persons Homestead Exemption and 2

The Homestead Exemption program allows senior citizens and permanently and totally disabled Ohioans that meet annual state set income requirements to reduce their property tax burden The Ohio Homestead Exemption allows low income older adults and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market value of

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

https://tax.ohio.gov › ... › how-do-i-apply-for-the-homestead-exemption

Ohio Department of Taxation Menu Home Resources for Individuals Resources for Businesses Resources for How do I apply for the homestead exemption Web Content Viewer

https://www.williamscountyoh.gov › Faq.aspx

The limit for tax year 2020 payable 2021 is 33 600 Ohio adjusted gross income line 3 on tax return For 2021 payable 2022 the limit is 34 200 Homestead recipients prior to 2014 are

Texas Homestead Tax Exemption

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

Miami Dade Homestead Exemption Form Fill Online Printable Fillable

Tax Exempt Form Ohio Fill Out Sign Online DocHub

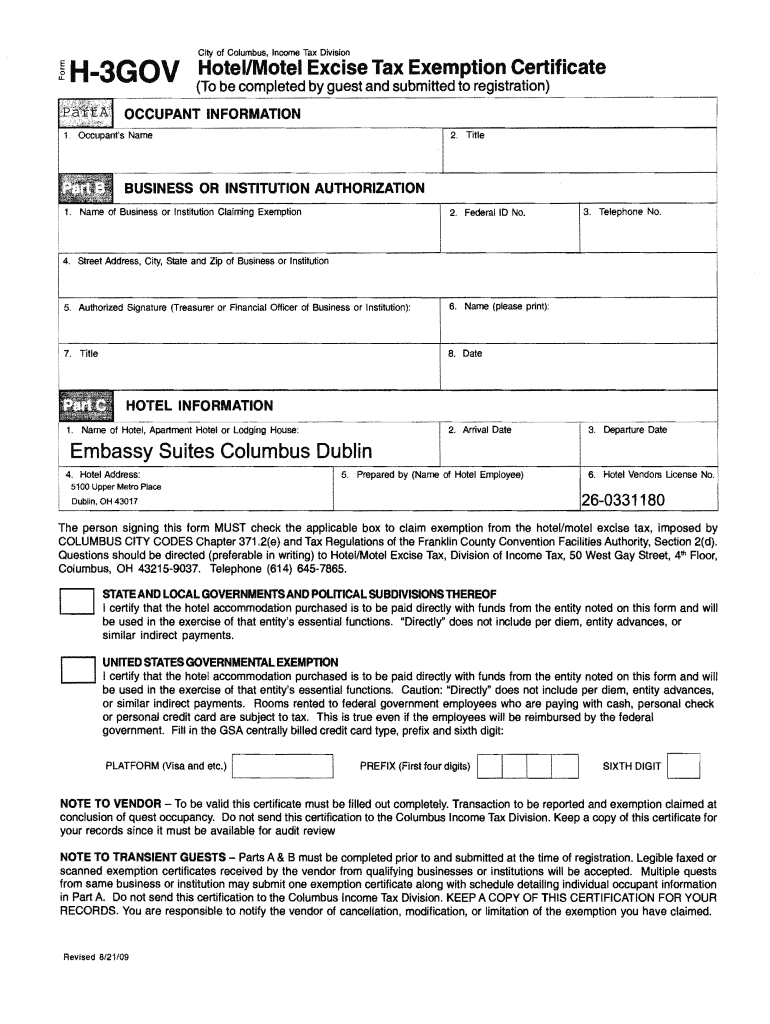

Ohio Hotel Tax Exempt 2009 2024 Form Fill Out And Sign Printable PDF

Who Qualifies For Homestead Exemption In Kentucky Guide Off Grid

Who Qualifies For Homestead Exemption In Kentucky Guide Off Grid

Who Qualifies For Homestead Exemption In Minnesota Guide Off

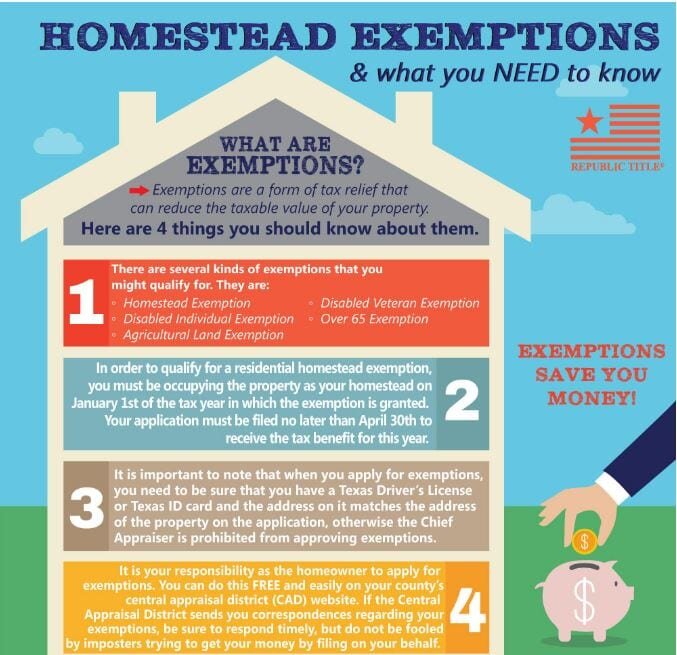

Homestead Exemptions What You Need To Know Rachael V Peterson

Florida Homestead Tax Exemption Form ExemptForm

Who Qualifies For Homestead Tax Exemption In Ohio - The new Homestead Exemption starts with tax bills payable in the following year For real property bills due cover the preceding year For manufactured or mobile homes bills are a