Who Qualifies For Hst New Housing Rebate In Ontario Who Is Eligible To Apply For A GST HST Rebate In Ontario Whether you purchase an owner built house or a pre construction condo developed by builders you are eligible to apply for New Housing

For residential rental properties located in Ontario you may be eligible to claim the Ontario NRRP rebate if you are not eligible to claim the NRRP rebate for some of the federal Ontario New Housing HST Rebate Everything You Need to Know Did you Qualify for an HST Rebate How to Get the GST HST Rebate on New Housing in Canada

Who Qualifies For Hst New Housing Rebate In Ontario

Who Qualifies For Hst New Housing Rebate In Ontario

https://i.ytimg.com/vi/FntQ5Tr3jIQ/maxresdefault.jpg

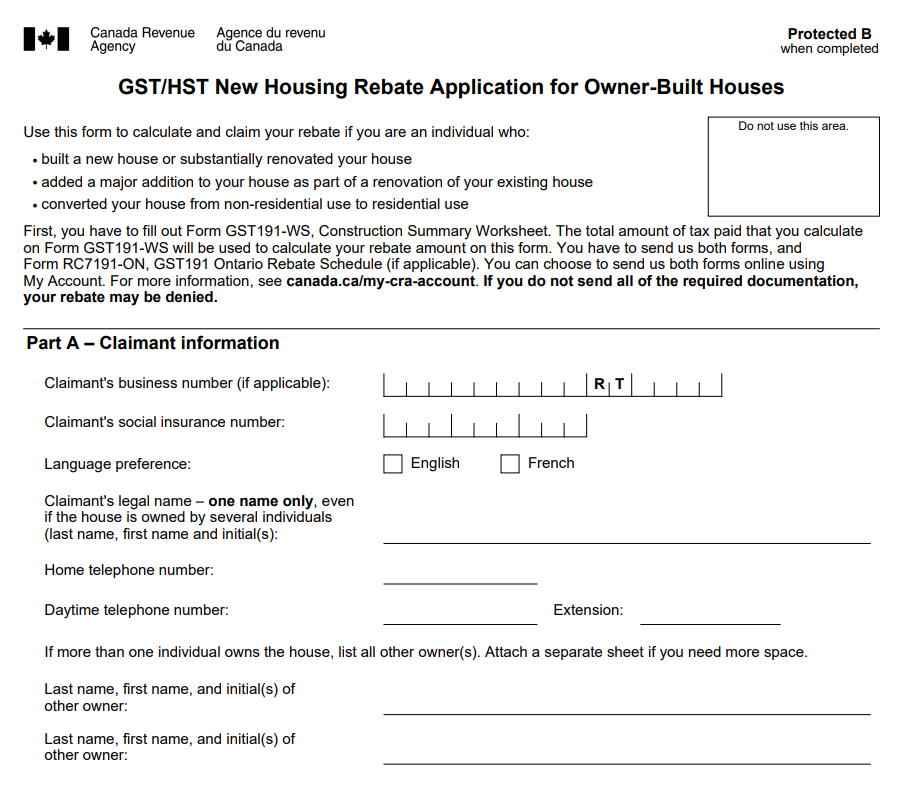

Applicability Of The GST HST New Housing Rebate

https://goodservicetax.com/wp-content/uploads/2021/12/image-7-1024x683.png

HST Rebate Ontario Services New Custom Homes Condos Rentals

https://hstrebatehub.ca/wp-content/uploads/2020/10/hst-rebate-custom-home.jpg

3 New Home HST Rebate Calculator 4 Special Conditions and Considerations 5 Pesonal Insights on the HST Rebate 6 Strategies for Navigating the HST Rebate Process Eligibility Criteria for the New Here s how it works Ontario offers buyers of new homes a 75 rebate on the provincial portion of the HST which is 8 You hit the maximum 24 000 rebate at a purchase price of 400 000 400 000 x

Who is eligible to claim the GST HST rebate in Ontario Both Canadian and foreign buyers are eligible to receive the HST rebate New Housing Rebate or NRRP rebate on the purchase of a pre construction condo The GST HST New Housing Rebate applies to newly built homes and some renovations on existing properties Qualifying is not as hard you think Ontario Housing Rebate The HST rate in Ontario is 13 made up

Download Who Qualifies For Hst New Housing Rebate In Ontario

More picture related to Who Qualifies For Hst New Housing Rebate In Ontario

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

New Condo HST Rebates Sproule Associates

https://my-rebate.ca/wp-content/uploads/2022/09/34372240_new-condo-building-construction-in-progress_900x600.jpg

How Do I Claim GST HST Housing Rebate RKB Accounting Tax Services

https://www.rkbaccounting.ca/wp-content/uploads/2021/01/Home-renovation-contractors-rkb-accounting-1.jpg

Ontario New Housing Rebate The HST in Ontario is 13 in which GST is 5 and the provincial sales tax is 8 The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to The GST HST New Housing Rebate is a valuable tax relief program for Canadians purchasing or constructing a new home This rebate helps reduce the financial burden

The new housing rebate is worth 36 of the GST or federal portion of the HST paid on a newly constructed home up to a maximum of 6 300 The rebate is valid This guide contains instructions to help you complete Form GST190 It describes the different rebates available and their eligibility requirements

Manikin Balance Discount House HST Rebate Blog Housing Rebate

https://www.rebate4u.ca/rebate-blog/wp-content/uploads/2018/01/fotolia_70603480.jpg

GST HST New Housing Rebate Jenna Lee Law

https://jennaleelaw.com/wp-content/uploads/2021/10/thumb.jpg

https://pierrecarapetian.com/understanding …

Who Is Eligible To Apply For A GST HST Rebate In Ontario Whether you purchase an owner built house or a pre construction condo developed by builders you are eligible to apply for New Housing

https://www.canada.ca/en/revenue-agency/services/...

For residential rental properties located in Ontario you may be eligible to claim the Ontario NRRP rebate if you are not eligible to claim the NRRP rebate for some of the federal

HST GST New Home Rebate Ontario Ontario New Housing HST Rebate

Manikin Balance Discount House HST Rebate Blog Housing Rebate

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

Ontario New Housing Rebate Form 2023 Printable Rebate Form

HST Rebate

GST HST New Housing Rebate Living In Toronto YouTube

GST HST New Housing Rebate Living In Toronto YouTube

HST Rebate Form For New Housing 2022 Printable Rebate Form

GST HST New Housing Rebate Top Realtor In GTA Farhan Malik

Why Was I Denied An HST Rebate In Ontario My Rebate

Who Qualifies For Hst New Housing Rebate In Ontario - Who is eligible to claim the GST HST rebate in Ontario Both Canadian and foreign buyers are eligible to receive the HST rebate New Housing Rebate or NRRP rebate on the purchase of a pre construction condo