Who Qualifies For Illinois Property Tax Credit The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To The property tax credit is available to residents who paid taxes on their main home that was located in Illinois for the time you owned and lived in the home Nonresidents of

Who Qualifies For Illinois Property Tax Credit

Who Qualifies For Illinois Property Tax Credit

https://res.cloudinary.com/yansusanto/image/upload/v1622380808/CA.png

Beneficiary Designation Vs Will Huizenga Law Firm P C

https://huizengalaw.com/wp-content/uploads/91710136-scaled.jpg

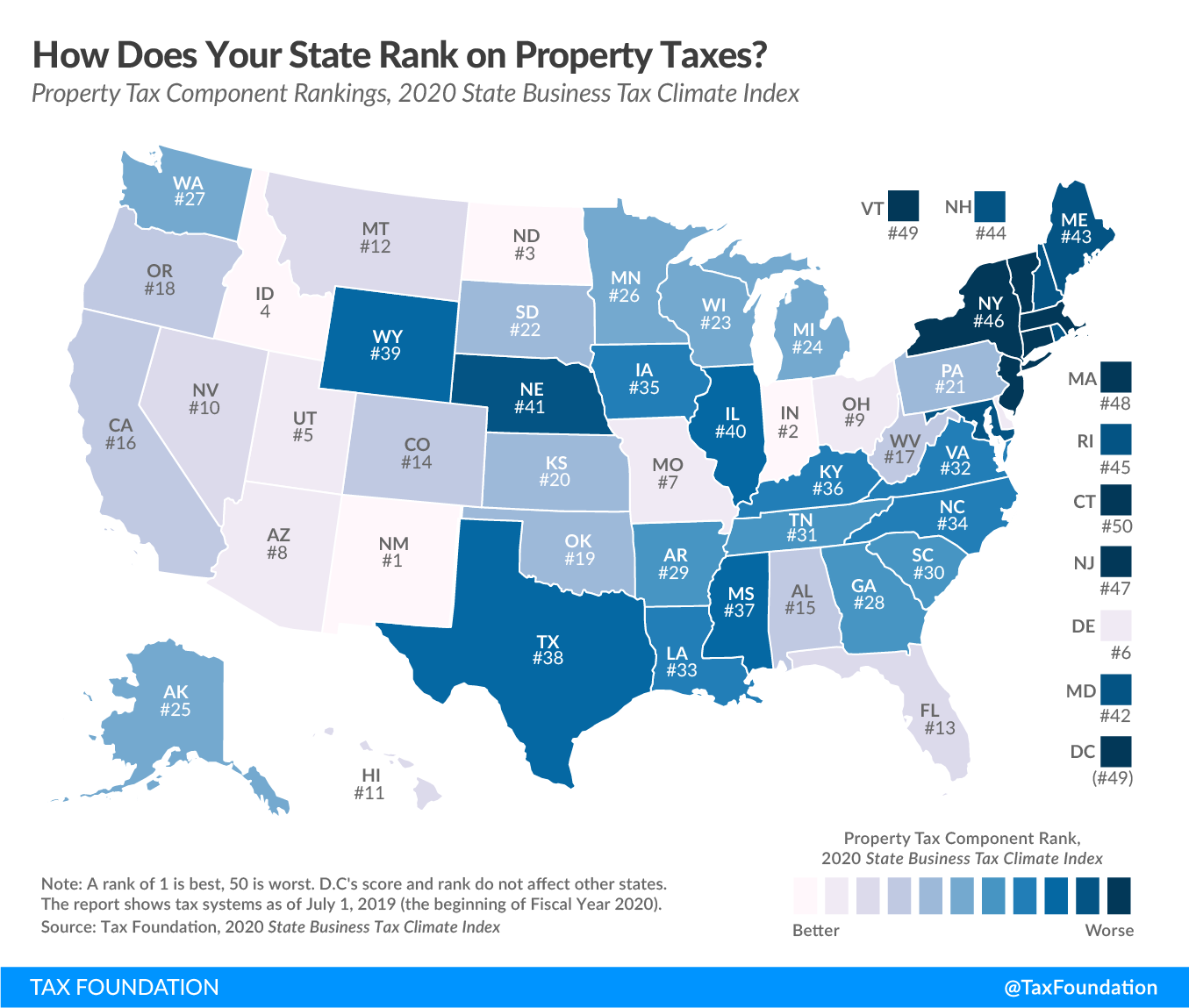

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 You may qualify for a homeowner exemption if the house in question is your primary residence Depending on local tax rates and assessment increases as well as

If so you may qualify for a state loan of up to 7 500 to pay current property tax bills The program requirements include The property must have been your primary residence for Illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021 Form IL 1040 is under

Download Who Qualifies For Illinois Property Tax Credit

More picture related to Who Qualifies For Illinois Property Tax Credit

Why Your Property Tax Bill Is So High And How To Fix It Madison St

https://files.illinoispolicy.org/wp-content/uploads/2018/08/Messages-Image3325486203.jpeg

Property Taxes By State County Median Property Tax Bills Tax

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

Tax Form Accountable Tax Services

https://accountabletaxservices.com/wp-content/uploads/2021/01/AccountAble-Tax-Services-1.png

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if

Homeowners who paid Illinois property taxes in 2021 on their primary residence in 2020 are eligible for the property tax rebate though they will need to take Am I eligible for a property tax credit You may figure a credit for the Illinois property taxes you paid in 2022 on your principal residence not a vacation home or rental property

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

https://img.hechtgroup.com/1662947805514.jpeg

Thought Property Tax Hikes Were Over For Chicago Think Again The

https://www.realpropertyalliance.org/wp-content/uploads/2016/09/bigstock-Tax-Taxing-Taxation-Taxable-Ta-108676346.jpg

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

https://www.nbcchicago.com/news/local/illinois...

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To

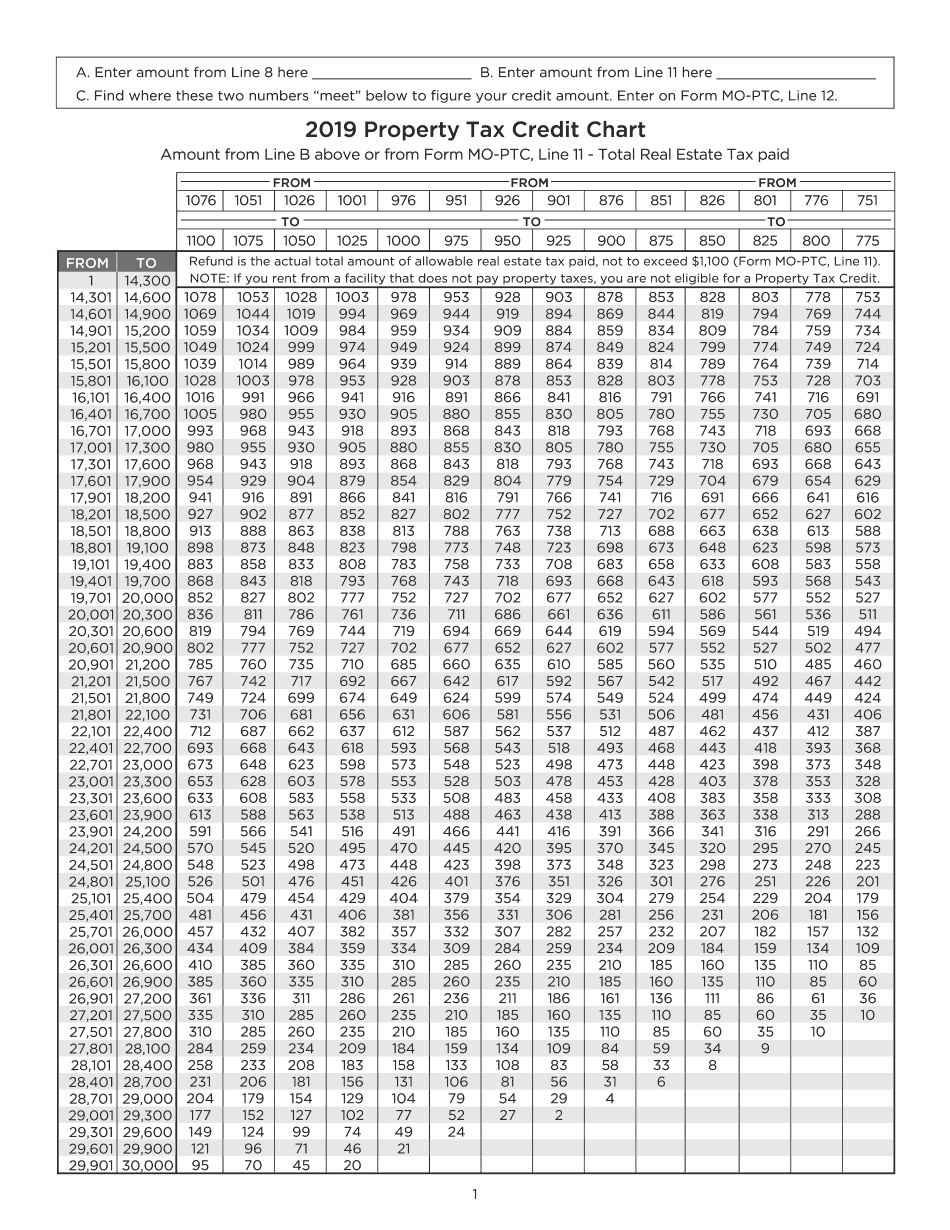

Create Fillable Property Tax Credit Chart Form With Us Fastly Easyly

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

Ranking Property Taxes On The 2020 State Business Tax Climate Index

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template

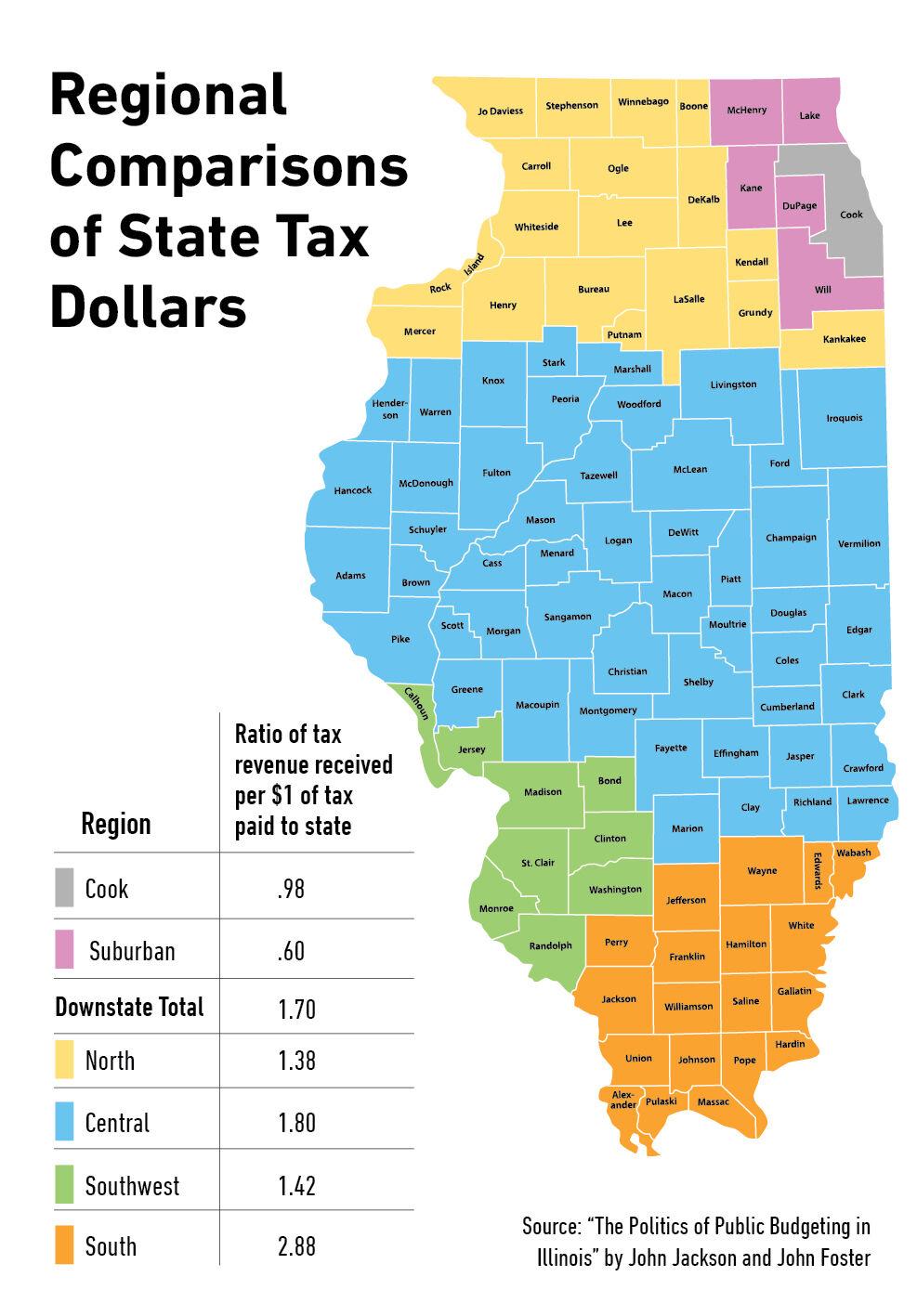

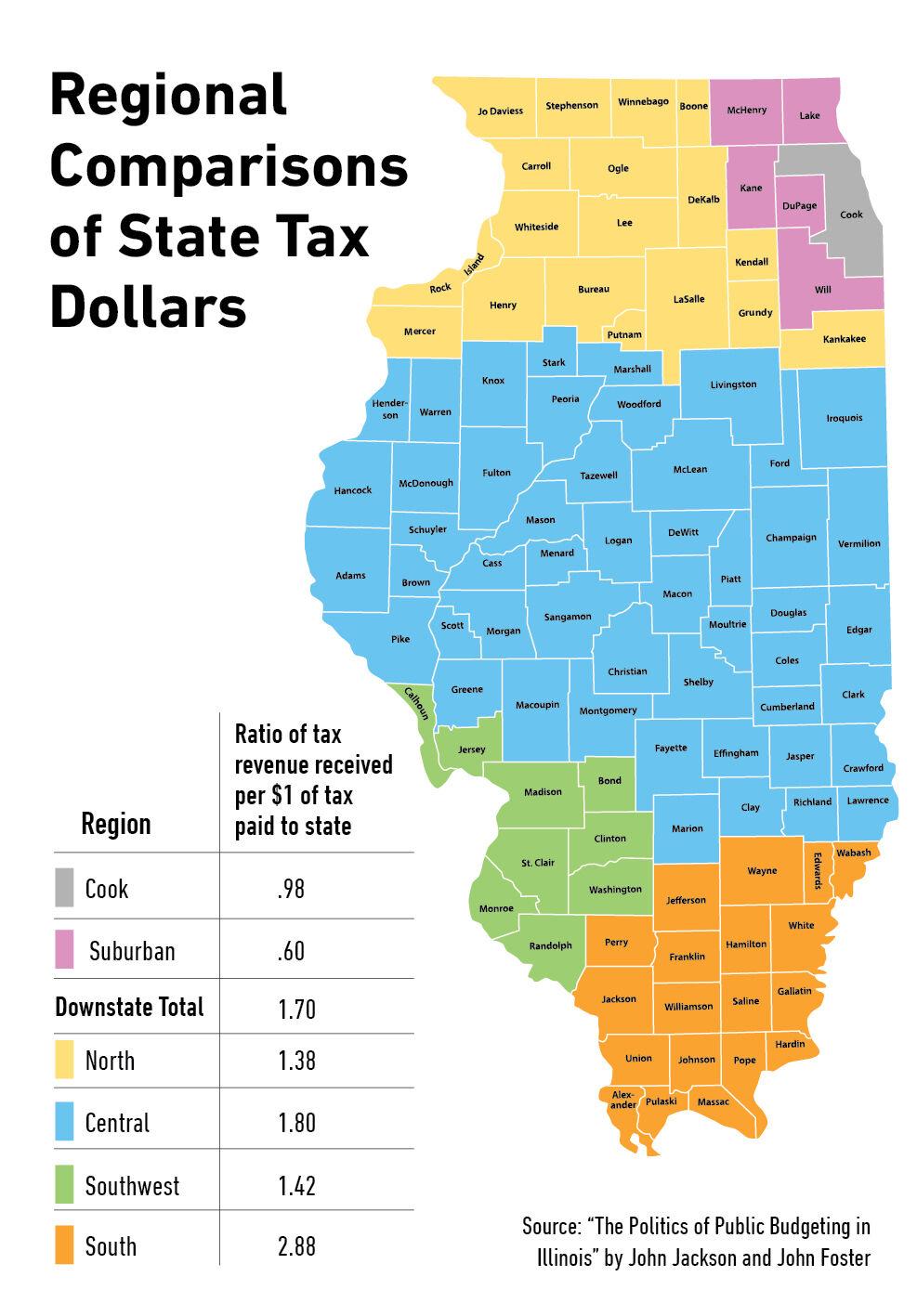

State Tax Dollars Benefit Downstate Region More Than Others Chronicle

State Tax Dollars Benefit Downstate Region More Than Others Chronicle

Hecht Group The American Frontier A Land Of Opportunity High

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

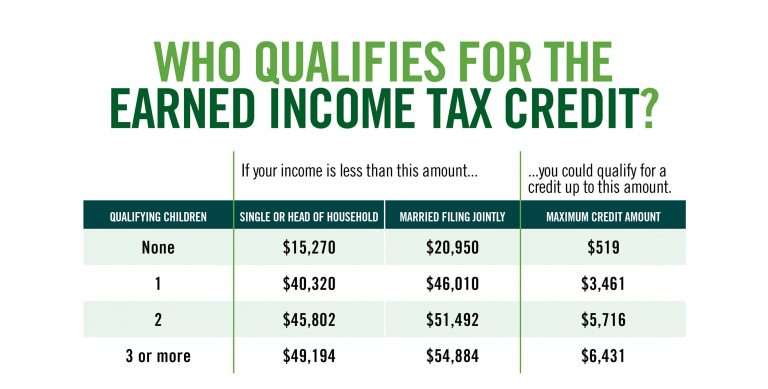

Earning Income Tax Credit Table

Who Qualifies For Illinois Property Tax Credit - You may qualify for a homeowner exemption if the house in question is your primary residence Depending on local tax rates and assessment increases as well as