Who Qualifies For Low Income Tax Credit To qualify for the earned income tax credit the individual must have earned income for the year that is lower than the EITC income threshold for that year

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be The earned income tax credit EIC or EITC is for low and moderate income workers See qualifications and credit amounts for 2024 2025

Who Qualifies For Low Income Tax Credit

Who Qualifies For Low Income Tax Credit

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

Who Qualifies For The Earned Income Credit Lucke And Associates CPAs

http://luckecpa.com/wp-content/uploads/2021/02/611523179-scaled-2560x1280.jpg

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you What Is the EITC The earned income tax credit has been around since 1975 designed to help low and moderate income households It s a work credit so you have to be employed to get it and

See Who Qualifies for the EITC The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year Find the dollar The EITC is a tax credit for certain people who work and have low to moderate income A tax credit usually reduces tax owed and may also result in a refund For tax year

Download Who Qualifies For Low Income Tax Credit

More picture related to Who Qualifies For Low Income Tax Credit

Who Qualifies For The Low Income Housing Tax Credit Program

https://www.complianceprime.com/blog/wp-content/uploads/2021/11/Who-Qualifies-for-the-Low-Income-Housing-Tax-Credit-Program-768x256.jpg

Earned Income Credit The Only Things You Need To Know Income

https://i.pinimg.com/originals/fa/72/ec/fa72ec5d477a4309bb49673a5f76f757.jpg

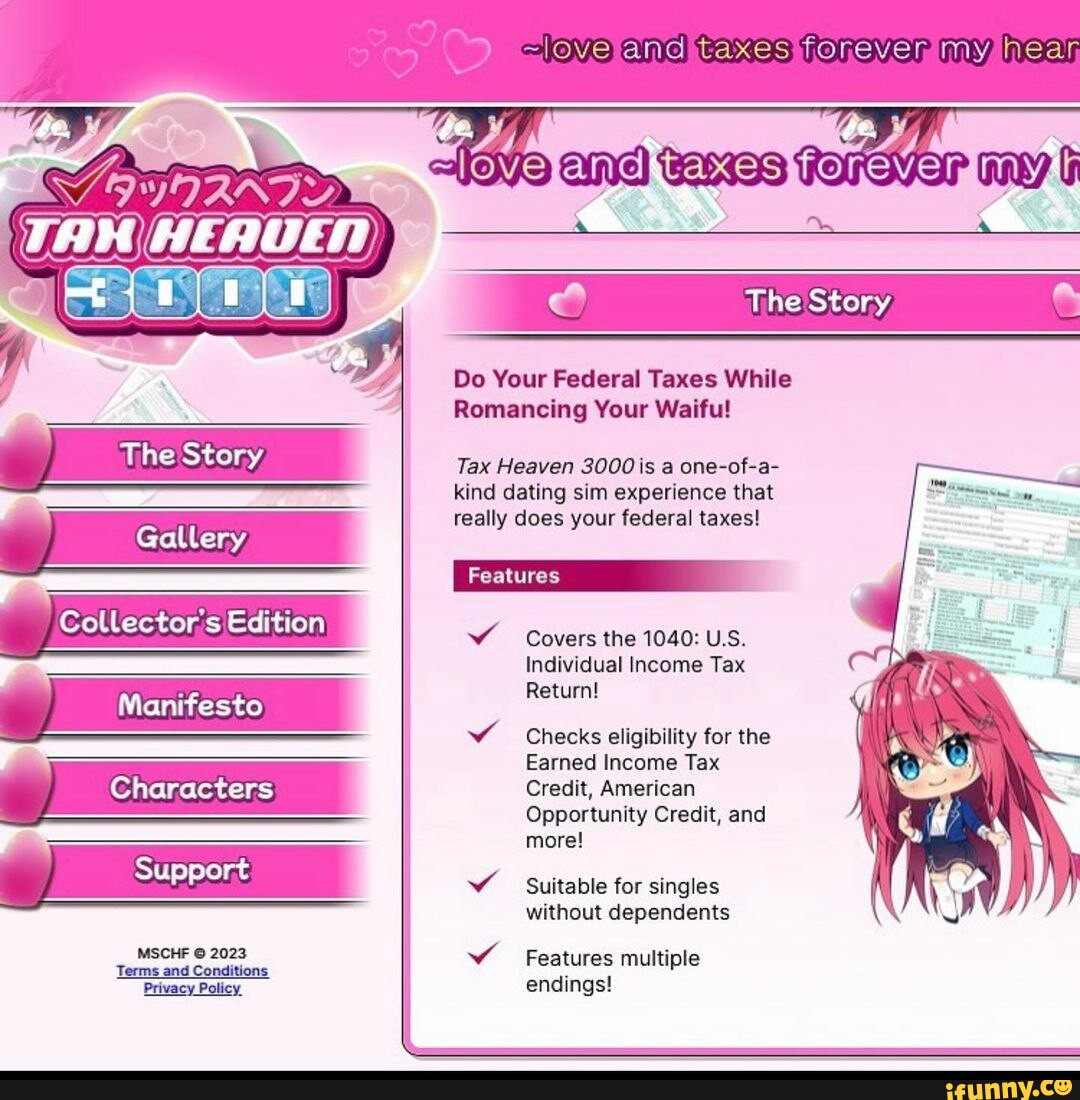

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

https://img.ifunny.co/images/3382f1a55559bec88f3b196fd0b64c54d0b7f05c9859b9db8752c14bce201f36_1.jpg

The federal Earned Income Tax Credit which is aimed at people in the lowest paid jobs is being tripled for a group of workers who typically don t benefit much from it If you earned less than 66 819 if Married Filing Jointly or 59 899 if filing as Single Qualifying Surviving Spouse or Head of Household in tax year 2024 you may qualify for the Earned Income Credit EIC These

If you re a low to moderate income worker you could qualify for the Earned Income Tax Credit EITC however if you re 65 and older it is no longer available to you Tax credits are offered on both the federal and state levels to incentivize certain actions such as purchasing an electric vehicle or to offset the cost of certain expenses e g

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

https://journalistsresource.org/wp-content/uploads/2018/04/tax-forms.jpg

A State Earned Income Tax Credit Would Aid Pa Working Families

https://www.gannett-cdn.com/presto/2022/02/07/NETN/fea7d07e-330c-4d39-a52b-f73203782a0f-MarybelleMartin.jpg?crop=5503,3095,x0,y1651&width=3200&height=1800&format=pjpg&auto=webp

https://www.investopedia.com/terms/e/…

To qualify for the earned income tax credit the individual must have earned income for the year that is lower than the EITC income threshold for that year

https://www.irs.gov/credits-deductions/individuals/...

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be

Calculate My Income Tax SuellenGiorgio

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Earned Income Tax Credit EITC Are You Eligible Kiplinger

Understanding The Earned Income Tax Credit LPL Financial Virtual

Astounding Gallery Of Eic Tax Table Concept Turtaras

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

Earned Income Tax Credit City Of Detroit Free Nude Porn Photos

Opinion Here s How San Diegans Can Access Earned Income Tax Credits

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Who Qualifies For Low Income Tax Credit - Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you