Who Qualifies For Nj Homestead Rebate 2024 We expect to release several large batches of ANCHOR benefits starting January 2 2024 If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

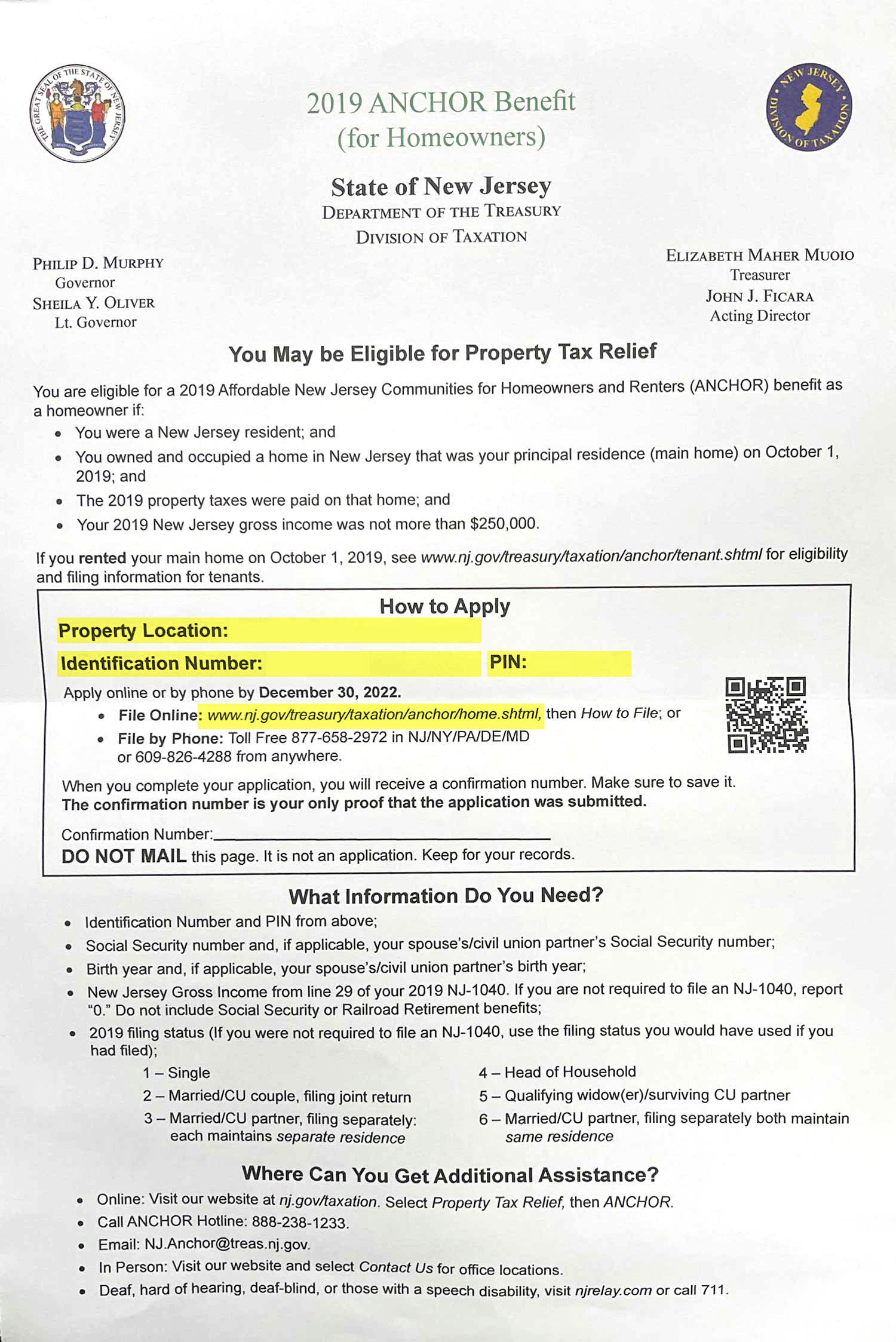

If you own a home primary residence but were a temporary resident of an Assisted Living Facility ALF and did not change your primary domicile you are eligible to apply for the benefit on the home you owned on October 1 2020 as long as you meet all other program requirements In 2022 the state of New Jersey aimed to provide relief to residents by replacing the Homestead Benefit program with the Affordable New Jersey Communities for Homeowners and Renters ANCHOR program Based on income taxpayers who owned a home in 2019 received up to 1 500 while tenants received up to 450

Who Qualifies For Nj Homestead Rebate 2024

Who Qualifies For Nj Homestead Rebate 2024

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/property-tax-rebates-check-if-you-are-eligible-for-anchor-program-3.jpg

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2019/03/Homestead-968x643.jpg

Do I Qualify For The Homestead Rebate Or The Senior Freeze NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2020/04/houston-3267075_1920-1024x683.jpg

A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits Who can qualify for NJ ANCHOR rebates in 2024 Treasury As many as 15 000 applicatio ns still being worked on ANCHOR replaced the Homestead Benefit More than 870 000 homeowners with incomes up to 150 000 will be eligible to receive 1 500 in relief more than 290 000 homeowners with incomes over 150 000 and up to 250 000 will be

To get the property tax rebate from New Jersey homeowners and renters must have filed state income taxes and met income requirements It must be noted that the rebate applies to primary Officials in New Jersey are urging people to apply for property tax relief under the new ANCHOR program before the Jan 31 2023 deadline Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will get a tax credit of 1 000 Renters who made 150 000 or less will

Download Who Qualifies For Nj Homestead Rebate 2024

More picture related to Who Qualifies For Nj Homestead Rebate 2024

Is The Homestead Rebate For Homeowners Running Late Nj

https://www.nj.com/resizer/Z-Lasop-fy7Cz2Lo9wlvlTFVzPw=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RW7W4DUDE5BIHBJBZMV2YOV254.jpg

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Who qualifies How much will I get Homeowners who had 2019 gross incomes of up to 150 000 will get up to 1 500 Those with gross incomes between 150 000 and 250 000 will get up to 1 000 You are considered a renter if on Oct 1 2019 you rented an apartment condominium house or rented or owned a mobile home located in a mobile home park Who doesn t qualify Owners with

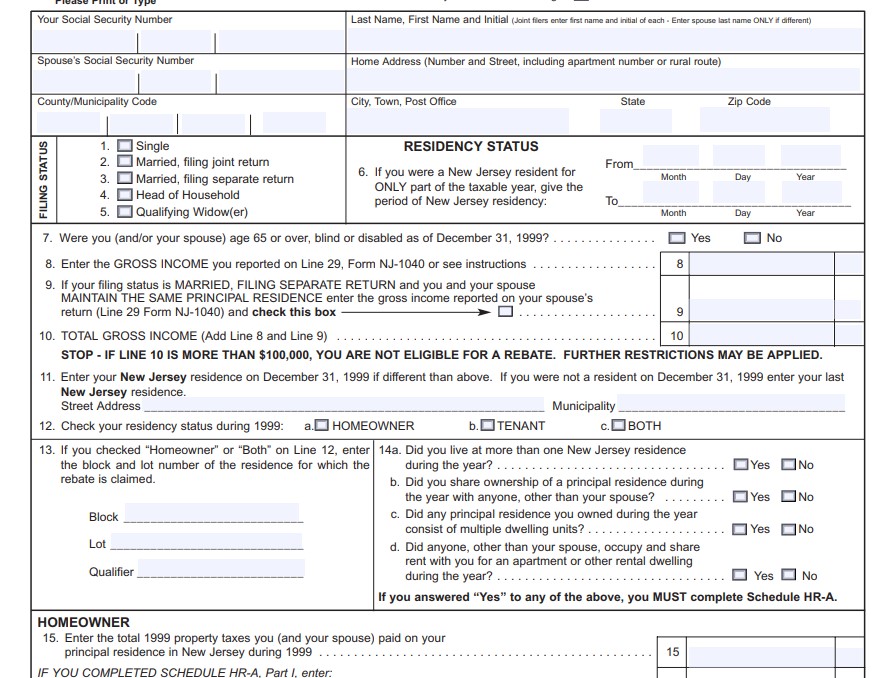

Further the restoration of renter rebates would add more than 630 000 to the total number of residents who could qualify for the state funded tax relief Senior and disabled renters making between 70 000 and 100 000 and all other renters making up to 100 000 would get 150 rebates while senior and disabled renters making up to 70 000 To qualify you must have been a New Jersey resident who has owned as well as occupied a home in the state as your primary residence on Oct 1 2018 she said If you were only a homeowner for

When Can I Apply For The Homestead Rebate Nj

https://www.nj.com/resizer/WfzofNgNS6RS5_07sop3Uj6NajY=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/7EXC62DK6ZFY5GOH676MXVD2QA.jpg

What Happened To My Homestead Rebate Nj

https://www.nj.com/resizer/lnFRLLMV-oHSml1s4d1b8o7uJnc=/800x0/smart/image.nj.com/home/njo-media/width600/img/business_impact/photo/old-man-3617304-1920jpg-452fcfe731a60d12.jpg

https://nj.gov/treasury/taxation/anchor/index.shtml

We expect to release several large batches of ANCHOR benefits starting January 2 2024 If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits

https://nj.gov/treasury/taxation/anchor/home-faq.shtml

If you own a home primary residence but were a temporary resident of an Assisted Living Facility ALF and did not change your primary domicile you are eligible to apply for the benefit on the home you owned on October 1 2020 as long as you meet all other program requirements

New Jersey Renters Rebate 2023 Printable Rebate Form

When Can I Apply For The Homestead Rebate Nj

Is This Estate Eligible For The Homestead Rebate NJMoneyHelp

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Can I Submit A Paper Application For The Homestead Rebate Nj

Do I Have To Report The Homestead Rebate On My Federal Taxes NJMoneyHelp

Do I Have To Report The Homestead Rebate On My Federal Taxes NJMoneyHelp

State Freezes Payments For Homestead Rebate Program Video NJ Spotlight News

When Will I Be Eligible For The Homestead Rebate Nj

The Homestead Rebate Isn t Cutting It Sheneman Nj

Who Qualifies For Nj Homestead Rebate 2024 - A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits