Who Qualifies For Property Tax Credit In Illinois Verkko 29 syysk 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have

Verkko 11 elok 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly If filing alone your Verkko 31 elok 2022 nbsp 0183 32 The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000 or

Who Qualifies For Property Tax Credit In Illinois

Who Qualifies For Property Tax Credit In Illinois

https://image.cnbcfm.com/api/v1/image/106851342-1615306408482-gettyimages-1301590454-dsc05910.jpeg?v=1615306445

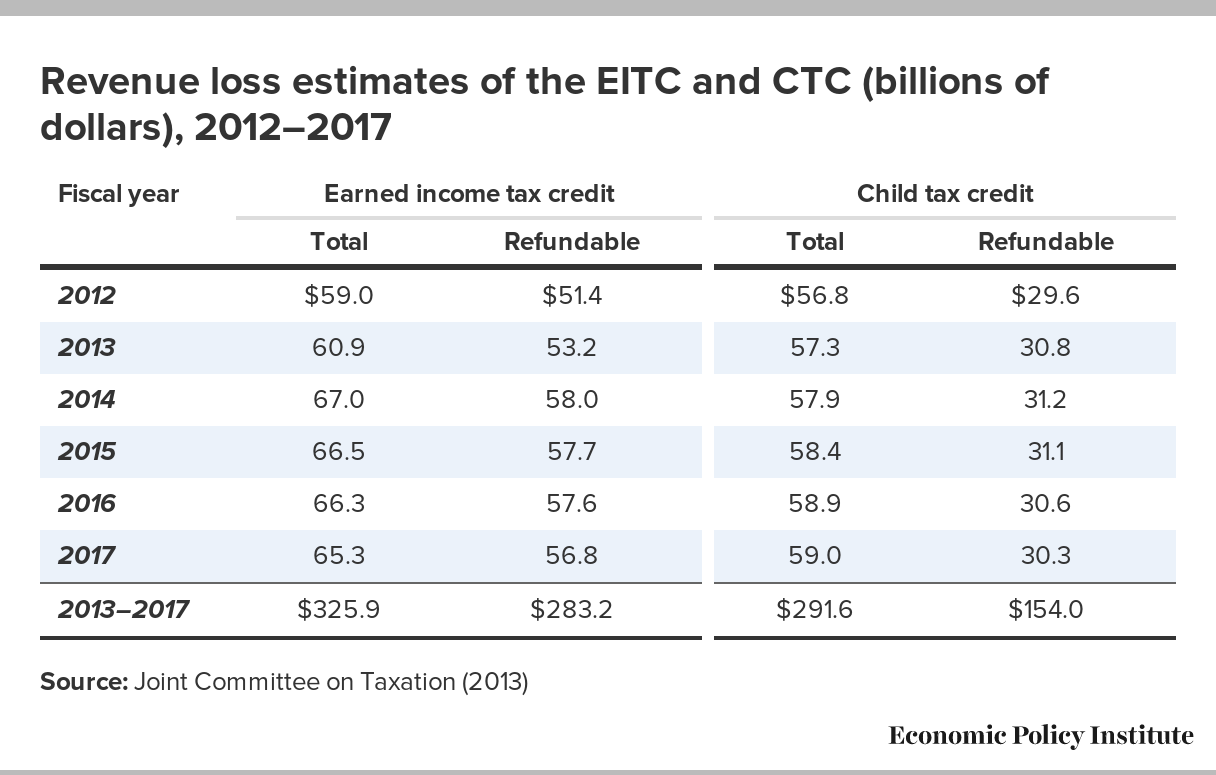

Earned Income Tax Credit City Of Detroit

https://detroitmi.gov/sites/detroitmi.localhost/files/2019-01/ETIC-Chart.jpg

Permanent Application For Property Tax Credit Exemptions

https://image.slidesharecdn.com/1297720/95/permanent-application-for-property-tax-creditexemptions-1-728.jpg?cb=1239854389

Verkko 9 syysk 2022 nbsp 0183 32 Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL 1040 filing under 200 000 for individual filers and under 400 000 for those who Verkko The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

Verkko 2022 Schedule ICR IL 1040 Instructions The Illinois Property Tax Credit is not allowed if the taxpayer s adjusted gross income for the taxable year exceeds 500 000 for returns with a federal filing status of married filing jointly or 250 000 for all other returns The K 12 Education Expense Credit is not allowed if the taxpayer s Verkko 8 elok 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 and 2021 and your adjusted gross income on the 2021 Form IL 1040 must be under 250 000 for single filers and 500 000 for joint filers

Download Who Qualifies For Property Tax Credit In Illinois

More picture related to Who Qualifies For Property Tax Credit In Illinois

Who Qualifies For A Premium Tax Credit YouTube

https://i.ytimg.com/vi/yxVB69iU1eY/maxresdefault.jpg

Credit Checks Consumer Business

https://dcba.lacounty.gov/wp-content/uploads/2017/10/CreditChecks.jpg

Who Qualifies For The Low Income Housing Tax Credit Program

https://www.complianceprime.com/blog/wp-content/uploads/2021/11/Who-Qualifies-for-the-Low-Income-Housing-Tax-Credit-Program.jpg

Verkko The property tax credit is not available to taxpayer s with a federal AGI over 500 000 for married filing joint filing status 250 000 for all other filing status The property tax credit is available to residents who paid taxes on their main home that was located in Illinois for the time you owned and lived in the home Verkko You may figure a credit for the Illinois property taxes you paid in 2022 on your principal residence not a vacation home or rental property for the time you owned and lived at the property during 2022 if that residence was in Illinois Nonresidents of Illinois may not take this credit

Verkko 17 lokak 2022 nbsp 0183 32 An estimated 6 million residents are eligible for refunds of up to 300 Millions of Illinois residents are eligible for an income tax rebate property tax rebate or both thanks to Gov J B Verkko 20 toukok 2022 nbsp 0183 32 Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including

Who Qualifies For Business Credit Cards YouTube

https://i.ytimg.com/vi/PKi4fkIJtec/maxresdefault.jpg

![]()

Everything You Need To Know About Texas Medicaid

https://cdn.shortpixel.ai/client/to_webp,q_lossless,ret_img,w_1200,h_1800/https://www.medicareplanfinder.com/wp-content/uploads/2019/05/Texas-SNAP-Medicare-Plan-Finder.jpg

https://www.nbcchicago.com/news/local/you-may-qualify-for-an-illin…

Verkko 29 syysk 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have

https://www.nbcchicago.com/news/local/illinois-property-tax-rebat…

Verkko 11 elok 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly If filing alone your

Medicare Eligibility And Enrollment Hale Health Benefits

Who Qualifies For Business Credit Cards YouTube

Who Qualifies For A Business Credit Card The Points Guy

The Earned Income Tax Credit And The Child Tax Credit History Purpose

Who Qualifies For Biden s 15 000 First Time Home Buyer Tax Credit

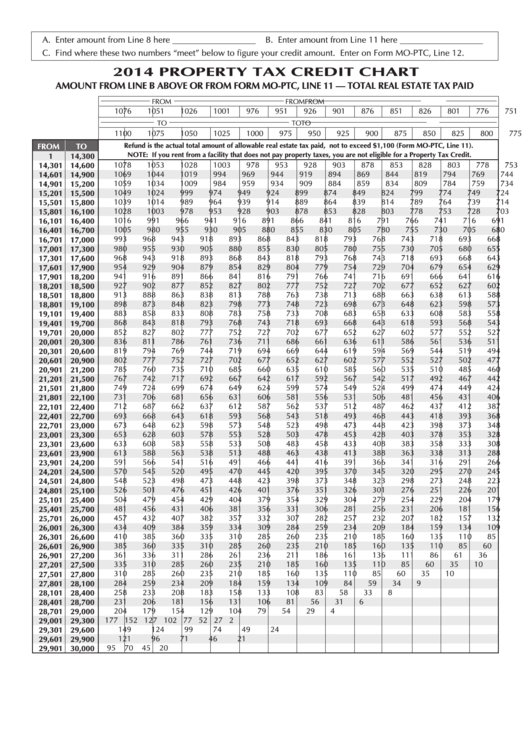

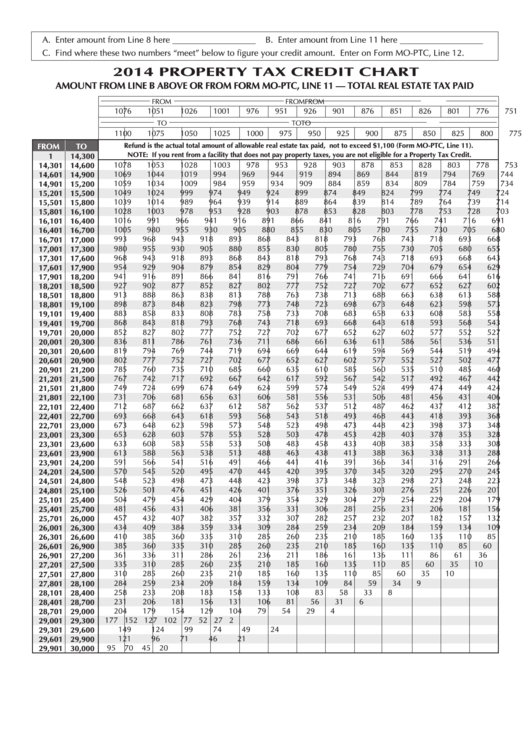

Form Mo Ptc Property Tax Credit Chart 2014 Printable Pdf Download

Form Mo Ptc Property Tax Credit Chart 2014 Printable Pdf Download

ADU Grant Program CCS Inc Construction Consulting Services

Who Qualifies For WIC Riverside University Health System

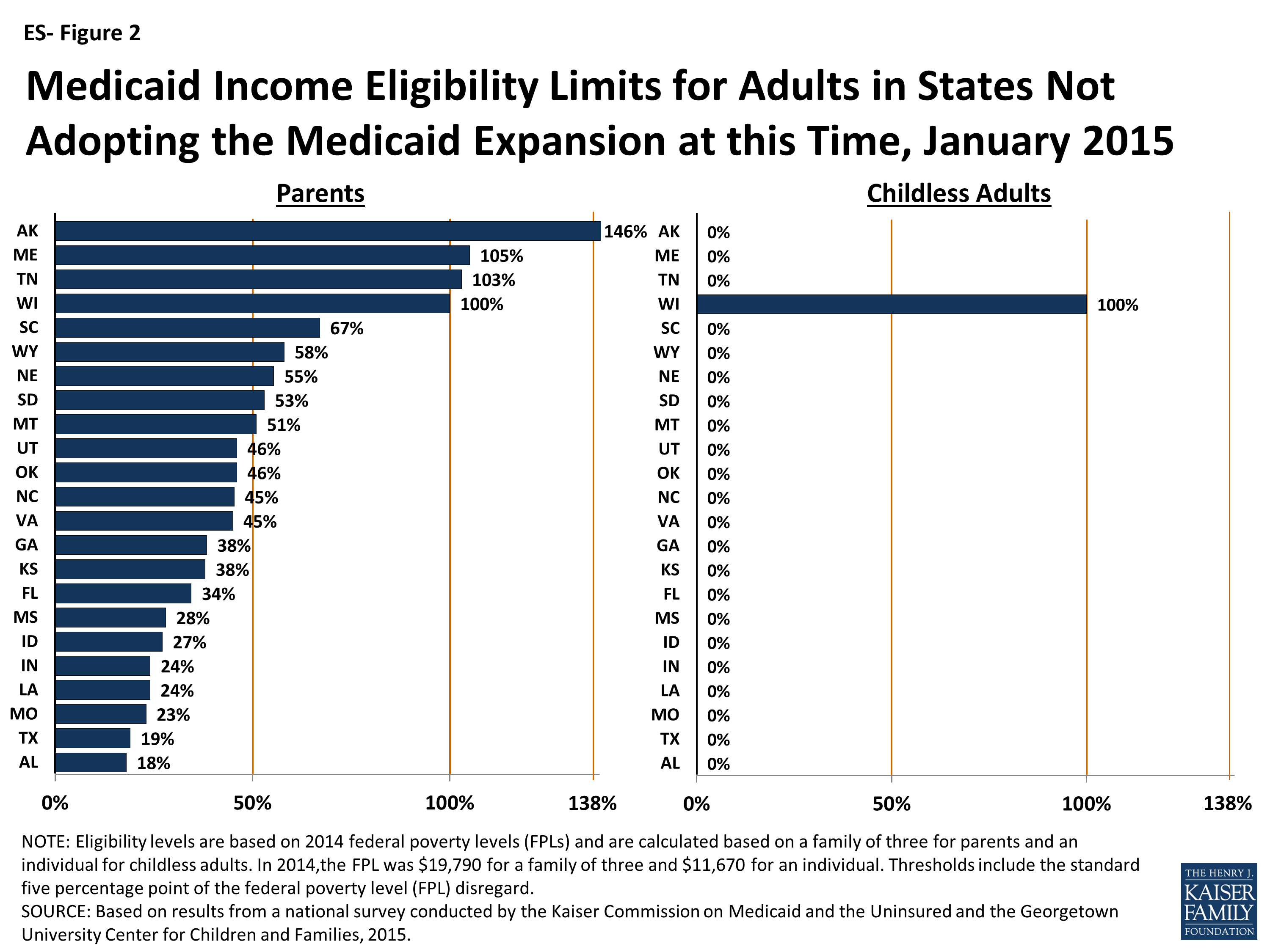

Modern Era Medicaid Findings From A 50 State Survey Of Eligibility

Who Qualifies For Property Tax Credit In Illinois - Verkko You may figure a credit for Illinois property you sold during the current tax year by combining all the preceding year s property tax paid in the current tax year as well as a portion of the current year s tax paid based on the time you owned and lived at the property during the current year