Who Qualifies For Property Tax Exemption You can supplement your 2023 pre collected tax amount with an additional prepayment How to request and make an additional prepayment You may sell your permanent home exempt from tax provided that both of the following conditions are met You have owned the house or apartment for at least 2 years You have or one of your

Veterans qualify for property tax exemptions deductions or credits in many states If you re a veteran check what benefits are available to you You ve earned it If You Have a Disability People living with disabilities may not have to pay the full burden of their property taxes You may be eligible for a property tax exemption if you re a U S military veteran or an active service member

Who Qualifies For Property Tax Exemption

Who Qualifies For Property Tax Exemption

https://i.ytimg.com/vi/PrtEbWzrJjc/maxresdefault.jpg

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

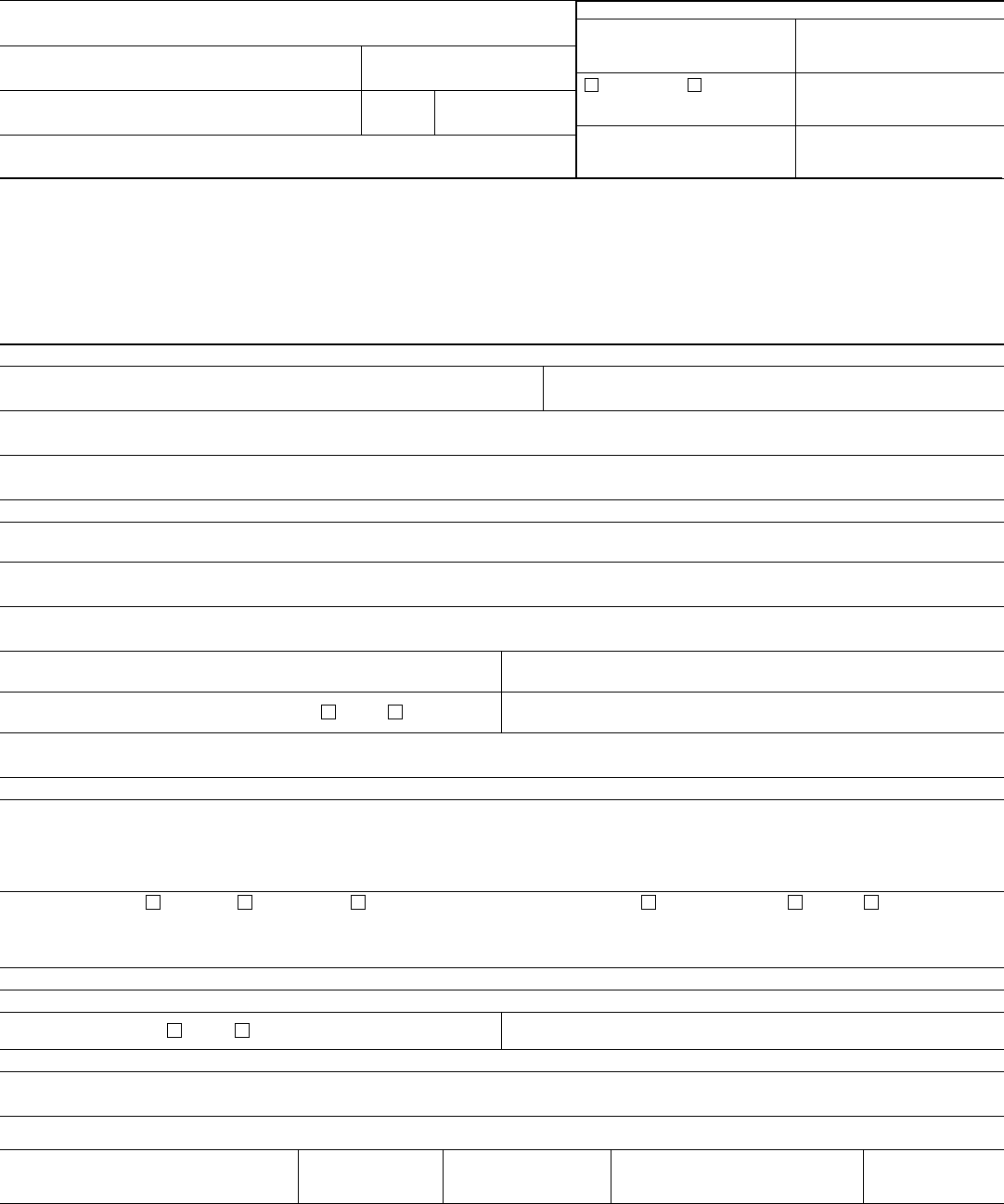

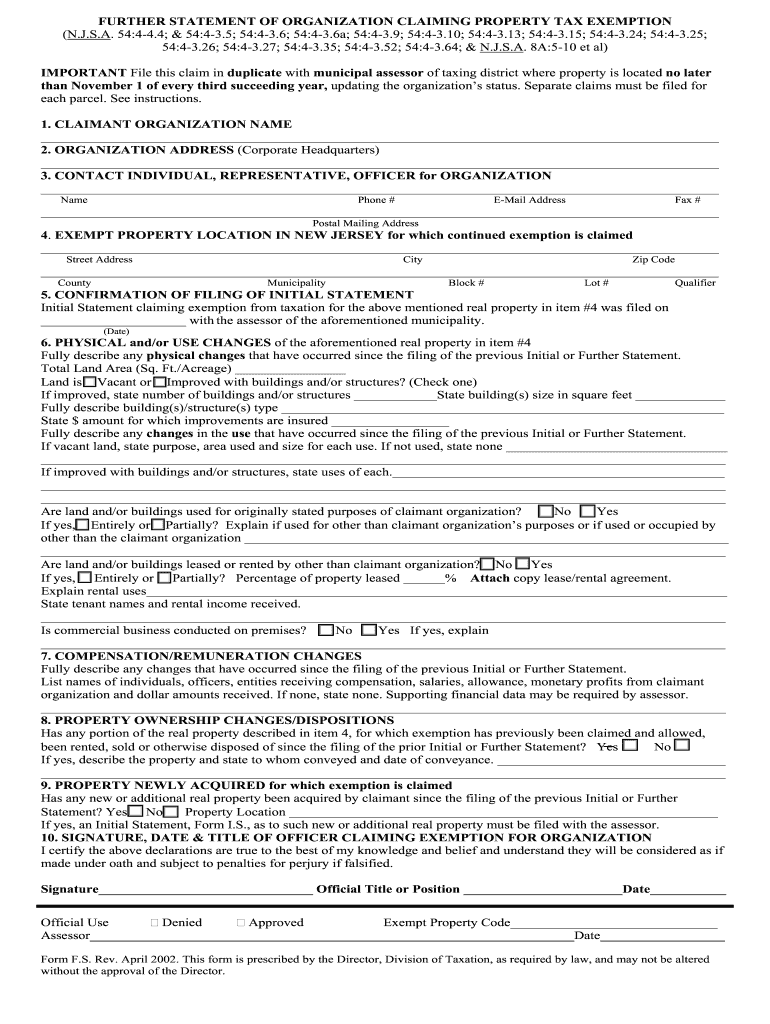

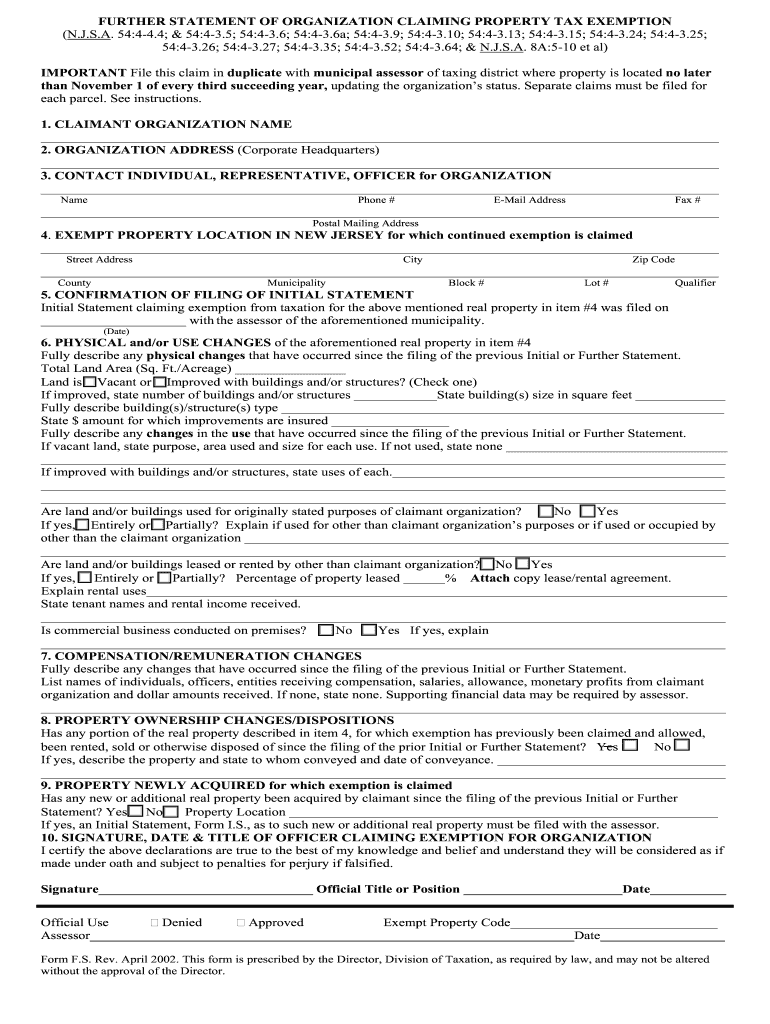

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Municipality xed e ects tax exempted housing company dwelling transaction are on average 1 more expensive than transactions without the transfer tax exemption This would seem to suggest that part of the bene ts of the tax exemption accrue to the sellers However section 5 4 discusses why the assumptions necessary for this interpretation may Disabled veterans 100 exemption Some veterans who meet the strict eligibility criteria may qualify for a 100 exemption from property tax Church 100 exemption Some properties owned by religious groups for worship and other religious activities may qualify for a 100 exemption

THE GOVERNMENT of Prime Minister Petteri Orpo NCP on Thursday unveiled a proposal to scrap the transfer tax exemption granted to first time home buyers in order to partly pay for a wider lowering of the tax rates First time home buyers who meet certain criteria such as being 18 39 years old and acquiring at least a 50 per cent stake The county or local tax assessor is vital in the property tax exemption process This official is responsible for reviewing exemption applications and determining whether a property qualifies for tax relief based on its assessed value and the homeowner s eligibility They may also advise on required documentation and deadlines

Download Who Qualifies For Property Tax Exemption

More picture related to Who Qualifies For Property Tax Exemption

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Letter To Gov Newsom For Property Tax Relief

http://static1.squarespace.com/static/556bae9be4b0d7e06eea69f0/556bb579e4b0723f18d99bf7/5e77e054b0412f11a91cfd79/1585980650452/Joel+with+Property+Tax+Bill.png?format=1500w

Co To Jest Homestead Property Tax Exemption Karolina Moscicki

https://karolinasellsflorida.com/wp-content/uploads/2022/01/HomesteadNieruchomosci-1024x576.jpg

Colorado exempts 50 of the first 200 000 of the actual value of your home for seniors and disabled veterans There are age income and residency restrictions so it s smart to read the fine print A homestead exemption aimed at seniors may only defer property taxes until the home is sold And don t assume exemptions for seniors kick in at 65 Real Property Tax kiinteist vero fastighetsskatt A real estate tax is levied on properties located in Finland The actual rates are established by the municipalities which are the recipients of the revenue from this tax The tax is imposed on the value of the property Tax rates vary in different municipalities ranging from 0 41 to 6

The local property tax rate known as a millage or mill rate is applied to your property s assessed value to determine how much tax you owe This determines your tax liability The tax collector factors in any exemptions you qualify for before defining your total property tax liability A property tax exemption allows a taxpayer to waive In fact the state county or city agency that collects your property taxes usually doesn t tell you that you qualify for an exemption Instead you yourself have to figure out whether you re

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

Property Tax Exemptions The Romanski Group

http://www.lifeinlafayette.com/wp-content/uploads/2019/11/Property-tax-exemptions.jpg

https://www.vero.fi/en/individuals/housing/selling_your_home

You can supplement your 2023 pre collected tax amount with an additional prepayment How to request and make an additional prepayment You may sell your permanent home exempt from tax provided that both of the following conditions are met You have owned the house or apartment for at least 2 years You have or one of your

https://smartasset.com/taxes/do-you-qualify-for-property-tax-exemptions

Veterans qualify for property tax exemptions deductions or credits in many states If you re a veteran check what benefits are available to you You ve earned it If You Have a Disability People living with disabilities may not have to pay the full burden of their property taxes

Tax Exemption Form For Veterans ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Application For Real And Personal Property Tax Exemption 087 Edit

New Income Thresholds For Property Tax Reduction Programs Auburn Reporter

Claiming Property Form Fill Out And Sign Printable PDF Template SignNow

Claiming Property Form Fill Out And Sign Printable PDF Template SignNow

How To Pay Less Property Taxes Benefit From The Homestead Exemption

Property Tax Exemptions Do You Qualify

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Who Qualifies For Property Tax Exemption - THE GOVERNMENT of Prime Minister Petteri Orpo NCP on Thursday unveiled a proposal to scrap the transfer tax exemption granted to first time home buyers in order to partly pay for a wider lowering of the tax rates First time home buyers who meet certain criteria such as being 18 39 years old and acquiring at least a 50 per cent stake