Who Qualifies For Rebate Verkko 12 maalisk 2021 nbsp 0183 32 Individuals who earn up to 75 000 in adjusted gross income heads of household with up to 112 500 and married couples who file jointly with up to 150 000 will get the full 1 400 per person

Verkko Eligibility criteria If you have children who are under 19 years of age If you turn 19 years of age before January 2024 If you are a new resident of Canada How much you can expect to receive Base year and payment period When your CAIP is paid When you should contact the CRA If the number of children in your care has changed Verkko 30 maalisk 2022 nbsp 0183 32 Parents who added a child to their family in 2021 may be eligible for a 1 400 payment Additionally families who added a dependent to their family in 2021 such as a parent niece or nephew or

Who Qualifies For Rebate

Who Qualifies For Rebate

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/61f95ecbe938df0d4bae19c2_Rebate-Pyramid.png

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Recovery Rebate Credit How To Apply And Who Qualifies YouTube

https://i.ytimg.com/vi/AeQXuigtZmw/maxresdefault.jpg

Verkko The General Assembly passed a law giving taxpayers with a tax liability a rebate of up to 200 for individual filers and up to 400 for joint filers You must file by November 1 2023 to be eligible for the rebate Verkko 1 jouluk 2023 nbsp 0183 32 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable

Verkko 15 elok 2023 nbsp 0183 32 Climate Action Incentive Payments In New Brunswick 90 per cent of direct proceeds from the federal fuel charge will be returned to residents through quarterly Climate Action Incentive CAI payments The other 10 per cent will be used to support small and medium sized businesses and Indigenous groups in New Brunswick Verkko 1 jouluk 2022 nbsp 0183 32 In order to qualify for any of the credit on your 2020 tax return you Must be a U S citizen or U S resident alien in 2020 Cannot have been a dependent of another taxpayer in 2020 Must have a Social Security number that is valid for employment before the 2020 tax return due date

Download Who Qualifies For Rebate

More picture related to Who Qualifies For Rebate

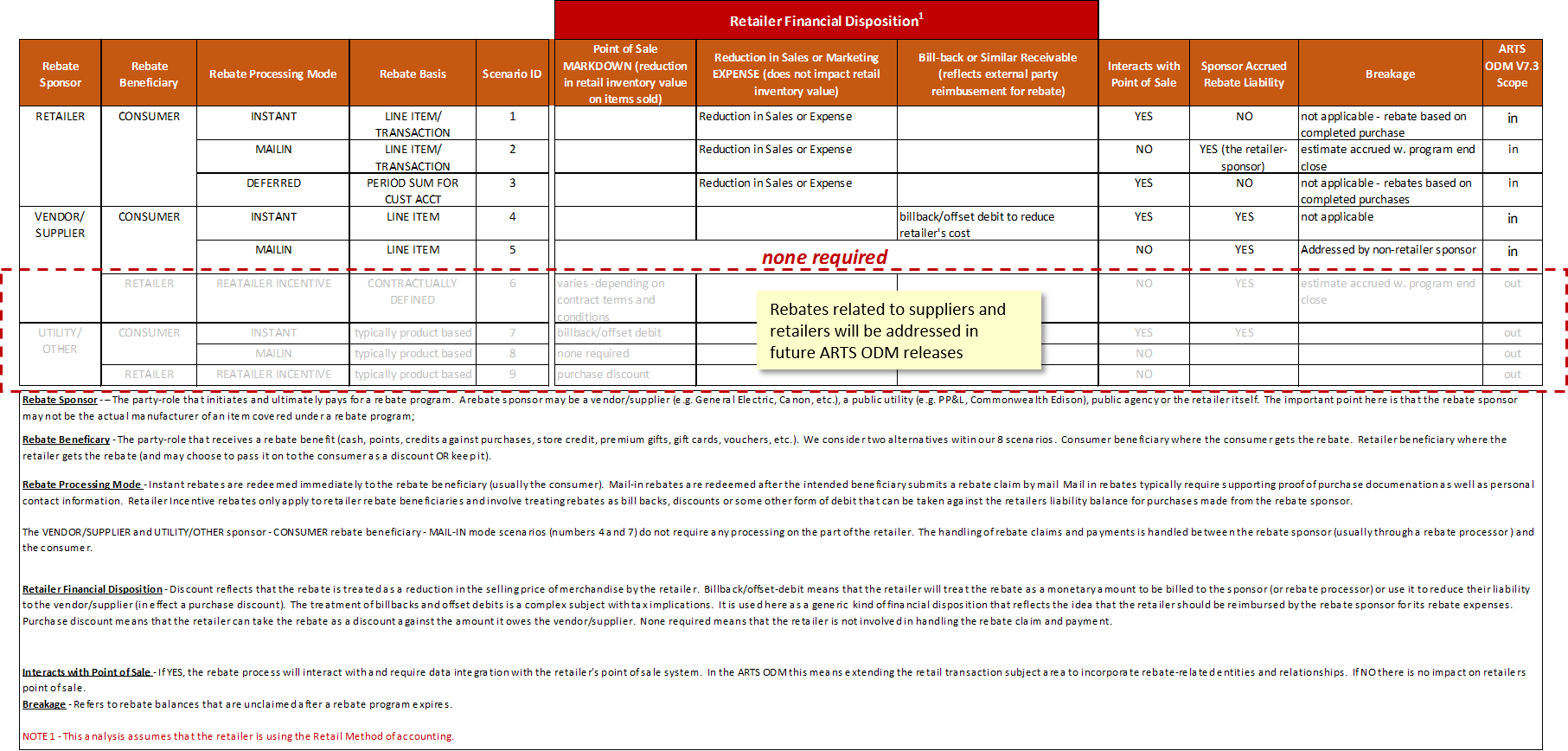

Understanding Customer Rebates

https://www.omg.org/retail-depository/arts-odm-73/arts_odm_v73_figure_0030_11.png

Rebate Sales Management Fulfillment Incentive Insights

https://incentiveinsights.com/wp-content/uploads/2019/05/rebateprogramguidemockup-1024x1024.png

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

Verkko 5 jouluk 2023 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return Verkko 13 huhtik 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

Verkko 8 helmik 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments were based on 2018 or 2019 tax year information Verkko 6 tuntia sitten nbsp 0183 32 Stimulus check update Homeowners in this state can apply for rebate Nine tax credits that could save Americans thousands of dollars Homeowners age 65 and older who make up to 150 000 can

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

Computation Of Rebate U s 87A FinancePost

https://financepost.in/wp-content/uploads/2019/04/rebate-1.png

https://www.cnbc.com/2021/03/12/1400-stimulus-checks-are-on-the-way...

Verkko 12 maalisk 2021 nbsp 0183 32 Individuals who earn up to 75 000 in adjusted gross income heads of household with up to 112 500 and married couples who file jointly with up to 150 000 will get the full 1 400 per person

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Verkko Eligibility criteria If you have children who are under 19 years of age If you turn 19 years of age before January 2024 If you are a new resident of Canada How much you can expect to receive Base year and payment period When your CAIP is paid When you should contact the CRA If the number of children in your care has changed

2022 Menards Rebate Forms RebateForMenards

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

Recovery Rebate Credit Who Qualifies For This Payment In 2022 Marca

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Property Tax Rebate Application Printable Pdf Download

Medicare Eligibility And Enrollment Hale Health Benefits

Medicare Eligibility And Enrollment Hale Health Benefits

Expired 15 Rebate From P G Freebies 4 Mom

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

XM Rebates 12 45 USD Daily And Direct PipRebate

Who Qualifies For Rebate - Verkko 15 elok 2023 nbsp 0183 32 Climate Action Incentive Payments In New Brunswick 90 per cent of direct proceeds from the federal fuel charge will be returned to residents through quarterly Climate Action Incentive CAI payments The other 10 per cent will be used to support small and medium sized businesses and Indigenous groups in New Brunswick