Why Are Treasury Bills Called Zero Coupon Bonds Examples of zero coupon bonds include US Treasury bills US savings bonds long term zero coupon bonds 1 and any type of coupon bond that has been stripped of its coupons Zero

What is a Zero Coupon Bond A zero coupon bond is a bond that pays no interest and trades at a discount to its face value It is also called a pure discount bond or deep discount bond U S Treasury bills are an example of a zero Most bonds make regular interest or coupon payments but not zero coupon bonds Zeros as they are sometimes called are bonds that pay no coupon or interest

Why Are Treasury Bills Called Zero Coupon Bonds

Why Are Treasury Bills Called Zero Coupon Bonds

https://kuvera.in/blog/wp-content/uploads/2022/07/TREASURY-BILLS-TYPES.png

Are Treasury Bonds Risky Only If You Plan To Re sell Before Maturity

https://www.gannett-cdn.com/-mm-/1dbe40553824c7eda5468e21f22b7da11dbd94e6/c=0-25-3499-2002/local/-/media/2018/04/24/USATODAY/USATODAY/636601746935291236-GettyImages-172740080.jpg?width=3200&height=1680&fit=crop

Deep Discount Bonds Vs Zero Coupon Bonds Explained

https://www.thefixedincome.com/blog/wp-content/uploads/2021/09/Blog-2.0-11-scaled.jpg

Zero coupon bonds are bonds that do not pay interest during the life of the bonds Instead investors buy zero coupon bonds at a deep discount from their face value which is the amount U S Treasury bills are short term government debt securities that have maturities of one year or less These instruments are considered zero coupon bonds as they are issued at a discount to their face value and do not

Zero coupon bonds are those bonds that do not pay any periodic interest during their tenure Instead they are sold at a discount to their face value and provide a return to the investor The U S Treasury initially opposed stripping of Treasuries into coupon only bonds known as annuities and maturity only bonds zeros because the zero coupon bonds could

Download Why Are Treasury Bills Called Zero Coupon Bonds

More picture related to Why Are Treasury Bills Called Zero Coupon Bonds

How To Buy Treasury Bills

https://www.usatoday.com/money/blueprint/images/uploads/2023/05/01011214/how-to-invest-in-treasury-bills-e1690866767542.jpg

What Are Treasury Bills T bills Definition Return Calculation

https://www.wallstreetmojo.com/wp-content/uploads/2019/04/Treasury-Bills-768x343.png

Treasury Bills YouTube

https://i.ytimg.com/vi/RS0kqXi4-9A/maxresdefault.jpg

Zero coupon bonds can help investors to avoid gift taxes but they also create phantom income tax issues Long term zero coupon bond investors gain the difference between Zero coupon bonds pay no interest and are issued at a discount to face value Investors profit by buying them below par and they receive the full face value at maturity

Treasury Zero Coupon Bonds are debt securities issued by the U S Department of the Treasury that do not provide periodic interest payments or coupons Instead these bonds Zero coupon notes and bonds are not issued by the U S Treasury Instead Treasury zeros are created by financial institutions and securities brokers and dealers

How The Treasury Market Predicts And Influence Interest Rates The New

https://static01.nyt.com/images/2022/11/01/business/00bond-explainer-still/00bond-explainer-still-videoSixteenByNine3000.jpg

Zero Coupon Bonds Explained With Examples Fervent Finance Courses

https://www.ferventlearning.com/wp-content/uploads/2020/12/articleImagery_AAABVM-ABF-12_6-2048x1152.jpg

https://en.wikipedia.org › wiki › Zero-coupon_bond

Examples of zero coupon bonds include US Treasury bills US savings bonds long term zero coupon bonds 1 and any type of coupon bond that has been stripped of its coupons Zero

https://corporatefinanceinstitute.com › resou…

What is a Zero Coupon Bond A zero coupon bond is a bond that pays no interest and trades at a discount to its face value It is also called a pure discount bond or deep discount bond U S Treasury bills are an example of a zero

How Are Treasury Bills T Bills Paid And Taxed Public

How The Treasury Market Predicts And Influence Interest Rates The New

CBN To Auction N58 5bn Treasury Bills This Week Businessamlive

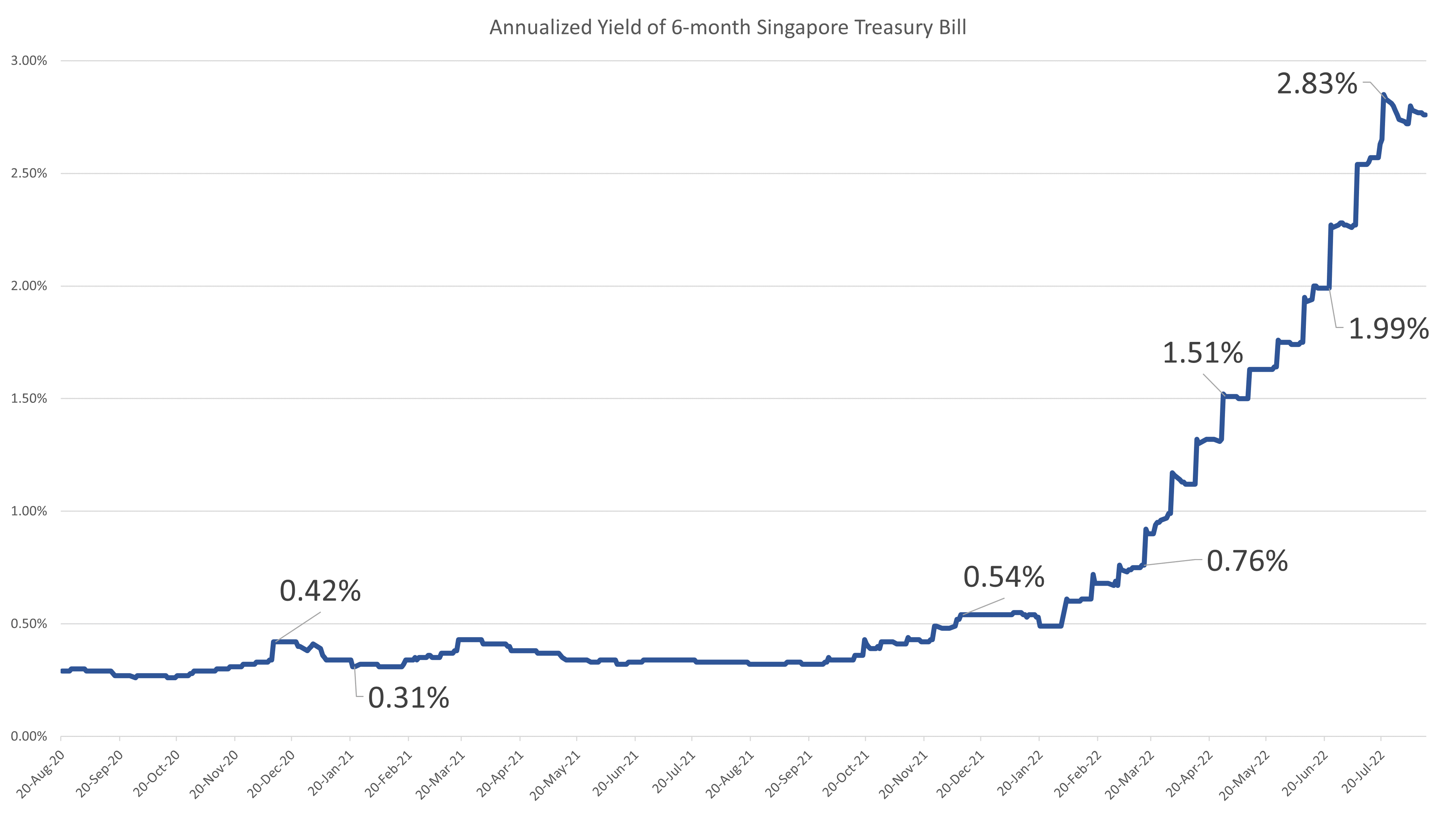

How To Buy Singapore 6 Month Treasury Bills T Bills Or 1 Year SGS

Treasury Yields Rise To New 4 year High As Inflation Concerns Drag On

Premium Bond Interest Rate Meaning

Premium Bond Interest Rate Meaning

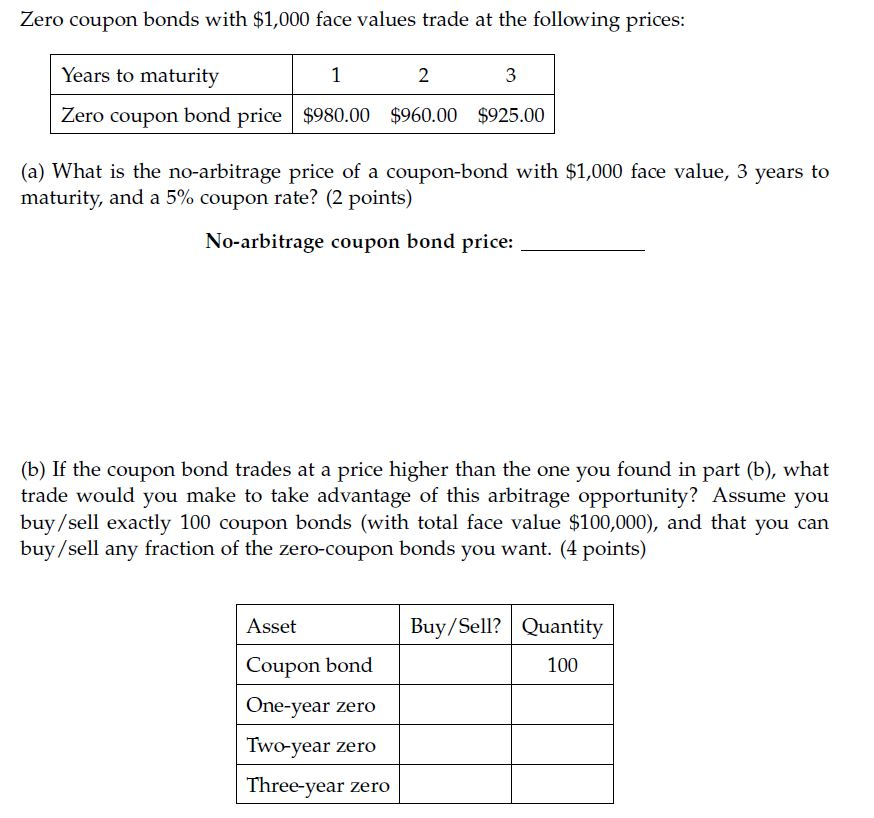

Solved Zero Coupon Bonds With 1 000 Face Values Trade At Chegg

What Is A Zero Coupon Bond Definition Features Advantages

Jennifer Lammer Inflation Protection

Why Are Treasury Bills Called Zero Coupon Bonds - Zero coupon bonds are those bonds that do not pay any periodic interest during their tenure Instead they are sold at a discount to their face value and provide a return to the investor