Why Do I Pay Oasdi Tax And Medicare If you work past age 65 you can often keep your health insurance But what about enrolling in Medicare Can you do both Should you See 5 Medicare pitfalls to avoid

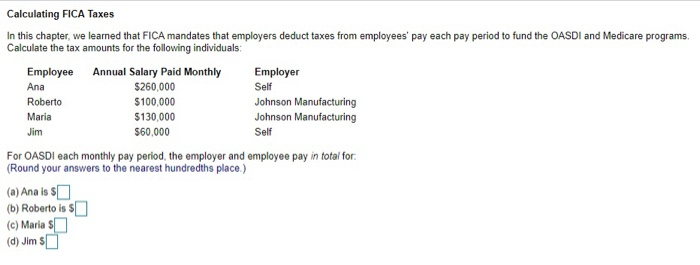

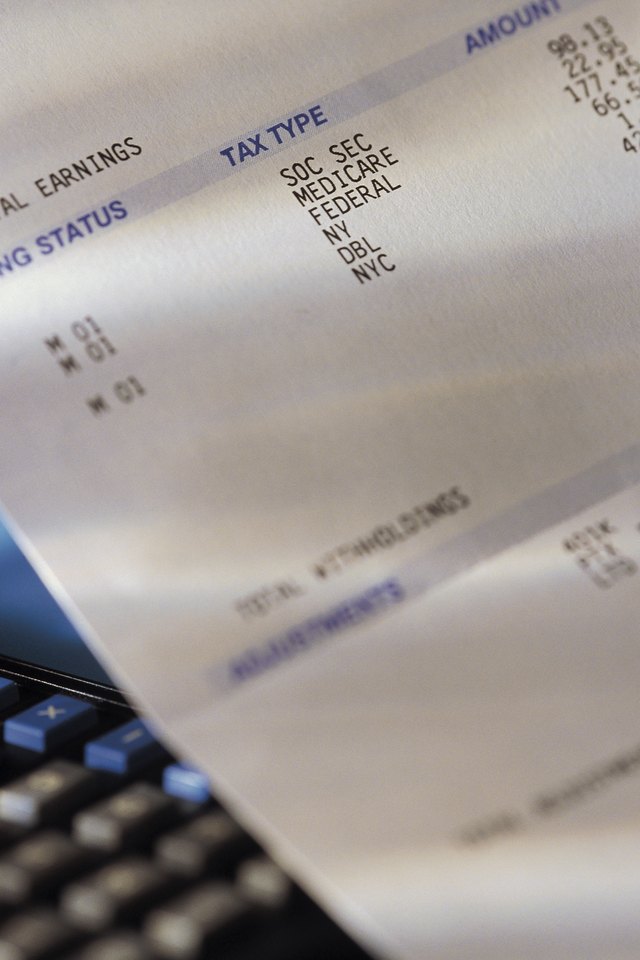

The OASDI program more commonly known as Social Security is one of two taxes that make up the Federal Insurance and Contributions Act FICA The other is a FICA is a payroll tax that goes toward funding Social Security and Medicare Employees and employers split the total cost Updated May 8 2024 1 min read Written by Tina Orem

Why Do I Pay Oasdi Tax And Medicare

Why Do I Pay Oasdi Tax And Medicare

https://old.tonyflorida.com/wp-content/uploads/2022/09/fed-oasdi-ee.jpg

Federal Employees And Social Security Myths Versus Reality Government

https://governmentworkerfi.com/wp-content/uploads/2020/11/Federal-Employees-and-Social-Security-Myths-Versus-Reality-Pin.jpg

What OASDI Tax Is And Why You Should Care The Motley Fool

https://g.foolcdn.com/editorial/images/439678/tax-gettyimages-507839992.jpg

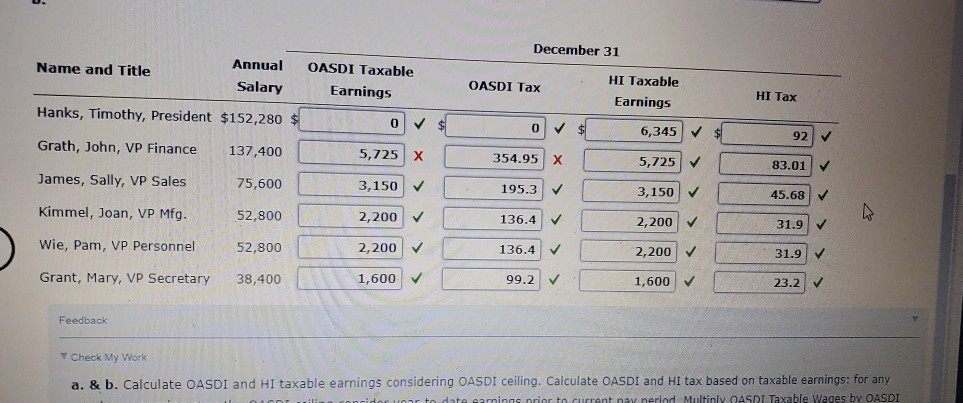

Employers of covered workers also pay Social Security tax over and above the wages they pay Medicare tax is not part of the OASDI tax although it is sometimes lumped together with 29 rows Tax rates for each Social Security trust fund Maximum taxable earnings Social Security s Old Age Survivors and Disability Insurance OASDI program and Medicare s

OASDI and Medicare are separate and OASDI taxes do not fund Medicare A separate 2 9 tax funds Medicare People sometimes refer to both the Medicare tax and OASDI taxes collectively as Federal Insurance Taxes under the Federal Insurance Contributions Act FICA are composed of the old age survivors and disability insurance taxes also known as Social Security taxes and

Download Why Do I Pay Oasdi Tax And Medicare

More picture related to Why Do I Pay Oasdi Tax And Medicare

What Is OASDI Tax

https://taxsaversonline.com/wp-content/uploads/2022/07/What-Is-The-OASDI-Tax-Being-Used-To-Pay-For.jpg

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Solved Calculate Payroll K Mello Company Has Three Employees a

https://www.coursehero.com/qa/attachment/34807877/

OASDI also known as the Social Security tax is an acronym for the Old Age Survivors and Disability Insurance program which provides monthly benefits to qualified While the standard Medicare tax rate applies to most individuals high income earners may be subject to Medicare surtaxes including the Additional Medicare Tax and Net

The taxable income limit is 168 600 for the 2024 tax year and 160 200 for 2023 Incidentally there is no limit to the Medicare tax which is currently levied at a rate of 1 45 There s no wage base limit for Medicare tax All covered wages are subject to Medicare tax If in 2020 you make more than 200 000 Medicare gets an extra 0 9 on those

What Is Fed OASDI EE Tax On My Paycheck Old Blog Posts

https://old.tonyflorida.com/wp-content/uploads/2022/09/federal-oasdi-paycheck-768x425.png

OASDI Tax How Contributions Differ For Employers The Self Employed

https://images.ctfassets.net/mnc2gcng0j8q/i000PqZF2UePju7vbQZUt/990f1efc85a46343135495f210ef8b7f/1099-MISC-Tax-Rules-Breaking-Down-the-Form.png?w=2400&

https://www.fidelity.com/learning-center/personal...

If you work past age 65 you can often keep your health insurance But what about enrolling in Medicare Can you do both Should you See 5 Medicare pitfalls to avoid

https://www.nerdwallet.com/article/taxes/oasdi-tax

The OASDI program more commonly known as Social Security is one of two taxes that make up the Federal Insurance and Contributions Act FICA The other is a

How To Calculate Oasdi And Medicare Taxes

What Is Fed OASDI EE Tax On My Paycheck Old Blog Posts

Oasdi Taxable Wages Calculator HaticeJadyn

What Is The OASDI Deduction On A Paycheck Sapling

Do You Know How Your OASDI And Medicare Taxes Are Impacted After

What Is OASDI Tax On My Paycheck Why You And Your Employer Pay This

What Is OASDI Tax On My Paycheck Why You And Your Employer Pay This

What Is OASDI Tax Definition And Types Of Social Security Tax

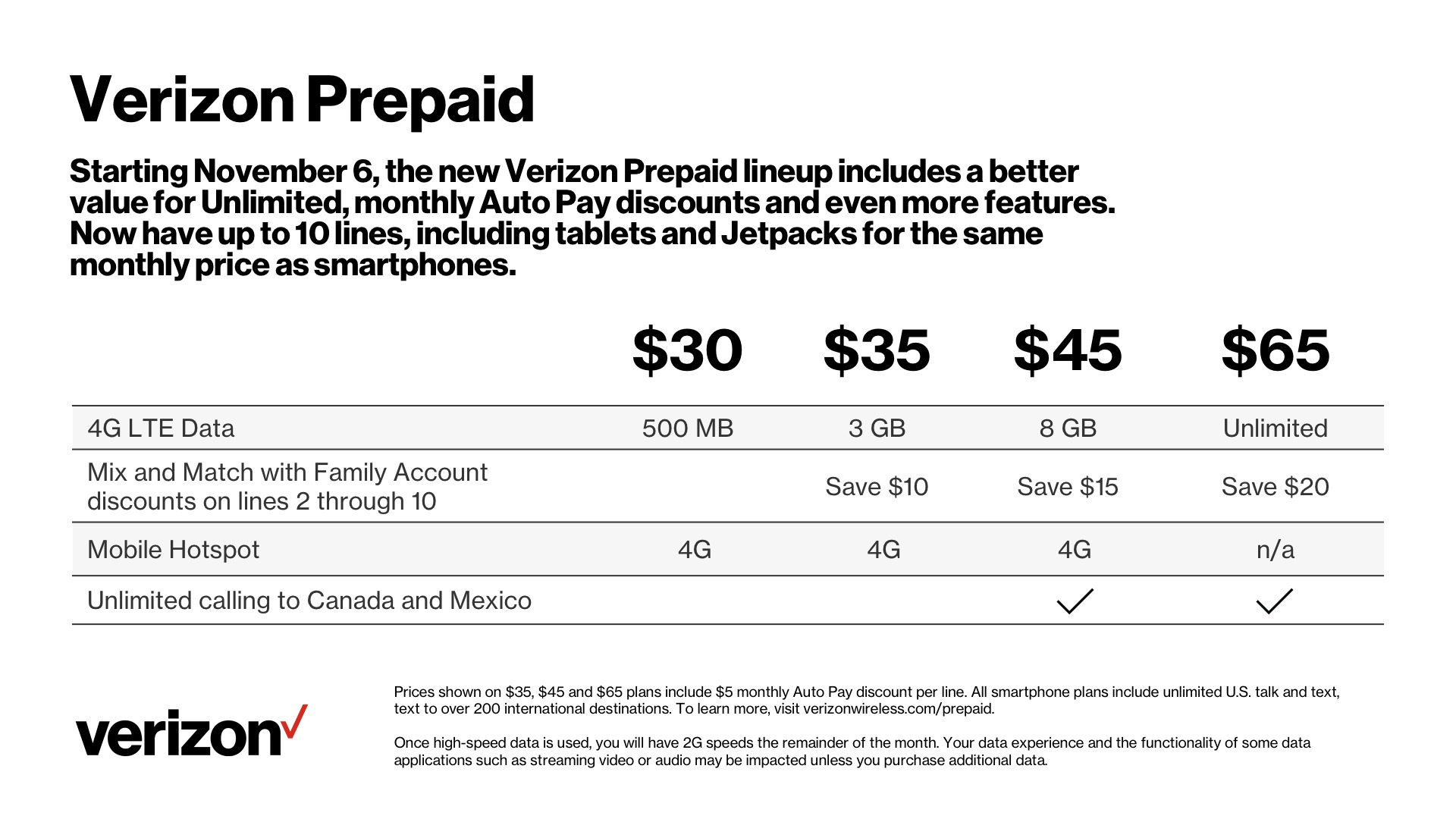

Prepaid Bill Pay Verizon

What Is The Employee Medicare Tax

Why Do I Pay Oasdi Tax And Medicare - 29 rows Tax rates for each Social Security trust fund Maximum taxable earnings Social Security s Old Age Survivors and Disability Insurance OASDI program and Medicare s