Why Do You Need Spouse S Income On My Tax Return So we ve taken the time to explain why Within your Income Tax Return you must make a legal declaration whether you had a spouse during the year where you answer yes to this question then

Social Security income can be paid to spouses of eligible applicants with a reduced benefit amount Spousal Social Security The effect of making the election When making the election to include your child s income on your tax return the amounts of qualifying income for 2023 at 1 250

Why Do You Need Spouse S Income On My Tax Return

Why Do You Need Spouse S Income On My Tax Return

https://imggarden.gardnerquadsquad.com/do_i_have_to_include_my_dependent_childs_income_on_tax_return.png

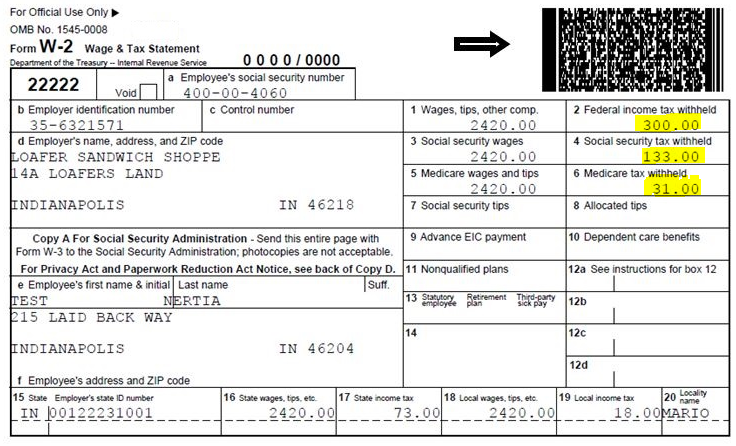

Should I Include A Dependent s Income On My Tax Return TurboTax Tax

https://digitalasset.intuit.com/content/dam/intuit/cg/en_us/turbotax/tax-tips/images/general/should-i-include-a-dependents-income-on-my-tax-return_-1.jpg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

It s not necessary for married couples to declare their spouse s income when filing separately unless they live in a community property state What is married filing separately Married filing separately is one of five tax filing statuses available to taxpayers Under the married filing separately status each spouse files their own

When one spouse earns substantially more than the other combining the incomes on a joint return may pull some of the higher earner s income into a lower Even if you file taxes jointly Social Security does not count both spouses incomes against one spouse s earnings limit It s only interested in how much you

Download Why Do You Need Spouse S Income On My Tax Return

More picture related to Why Do You Need Spouse S Income On My Tax Return

How To Find Out If You Owe Irs Informationwave17

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/Form_1040_2021.61dc944778e68.png

Most notable is the income test If the person has any additional income but it s below 25 000 benefits won t be taxed If they earn between 25 000 and 34 000 50 of the survivor benefit is This form of spousal support is specifically designated to benefit any biological or adopted children of the ex spouse It cannot be required to pay for stepchildren unless the ex spouse adopted

First make sure you entered them under Personal Info and you are filing a Joint return And when Turbo Tax says YOU on a Joint return it means either of you The ATO needs your spouse s or ex spouse s information because it lets them know whether they have to charge you more or less at tax time If you have a

2020 Form 1040 With Line 22 Outlined

https://studentaid.gov/sites/default/files/2020-taxes-paid.PNG

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

https://1044form.com/wp-content/uploads/2020/08/completing-form-1040-the-face-of-your-tax-return-us-2-2048x1199.png

https://www.coopersaccountants.com.au/why …

So we ve taken the time to explain why Within your Income Tax Return you must make a legal declaration whether you had a spouse during the year where you answer yes to this question then

https://www.investopedia.com/ask/answers/…

Social Security income can be paid to spouses of eligible applicants with a reduced benefit amount Spousal Social Security

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

2020 Form 1040 With Line 22 Outlined

Find Your WHY 2 Easy Ways To Discover Your Life s Purpose

Kentucky Employee State Withholding Form 2022 Employeeform Net

Home based Business Deductions Automated BusinessPerks LessTaxes

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

How To Fill Out Your Tax Return Like A Pro The New York Times

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Why Do I Have To Provide My Spouse s Income Details In My Tax Return

Why Do You Need Spouse S Income On My Tax Return - The ATO uses your spouse s income to determine a number of things that may benefit you This includes entitlement to a private health insurance rebate