Why Does California Have A High Tax Rate For families of modest means California is not a high tax state California taxes are close to the national average for families in the bottom 80 percent of the income scale For the bottom 40 percent of families California

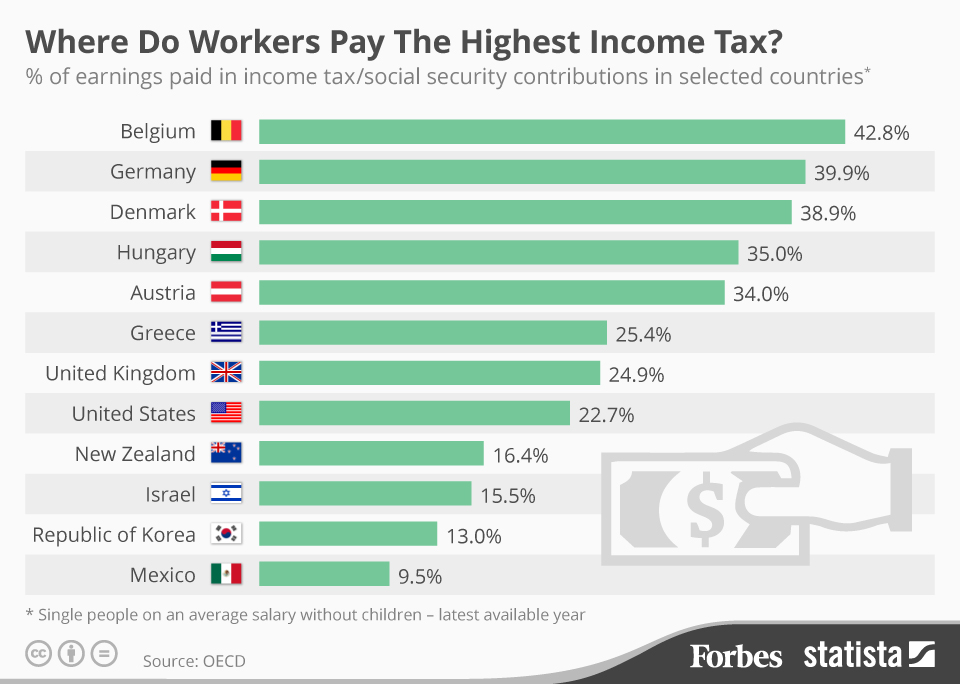

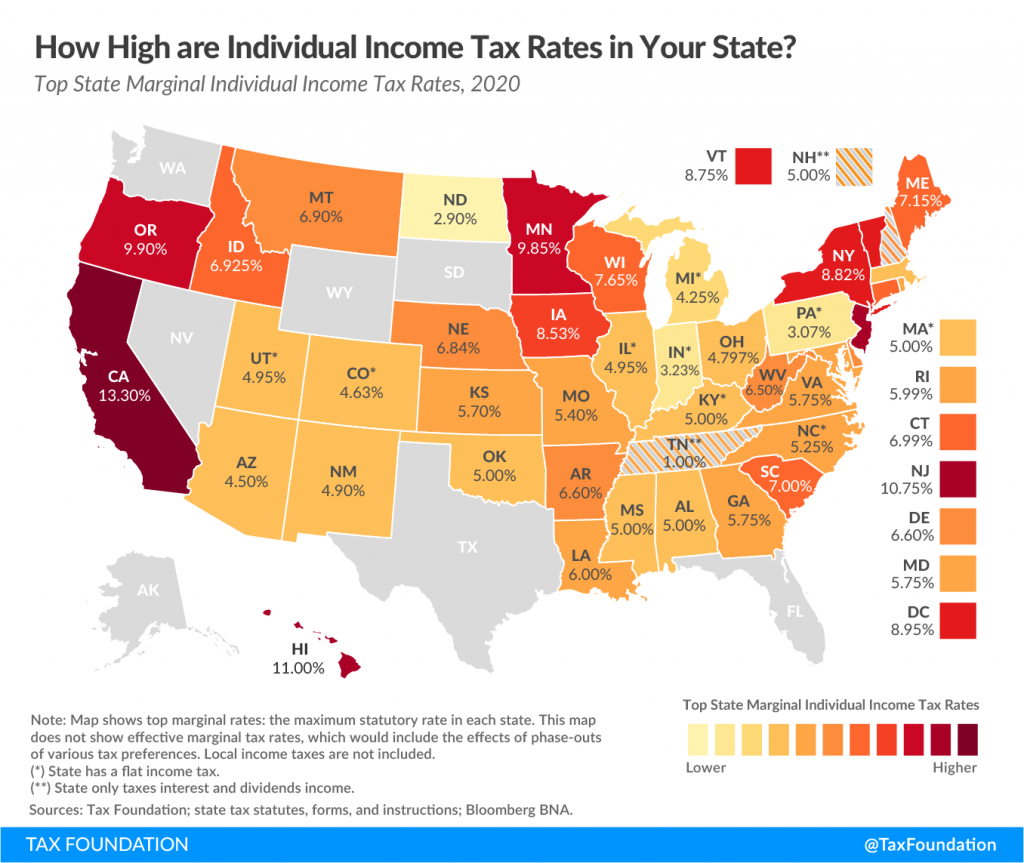

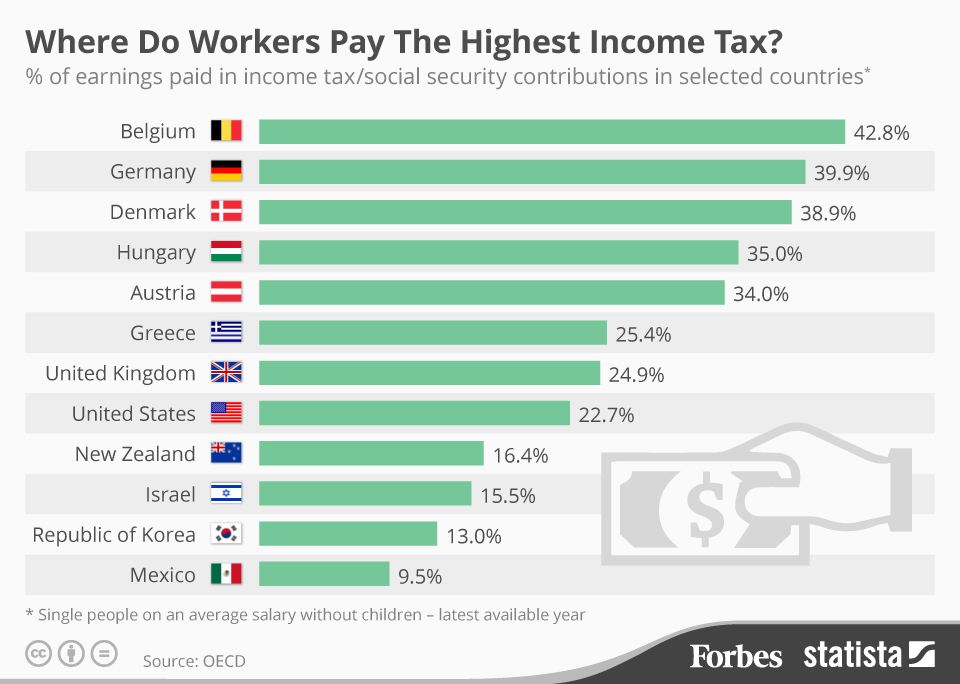

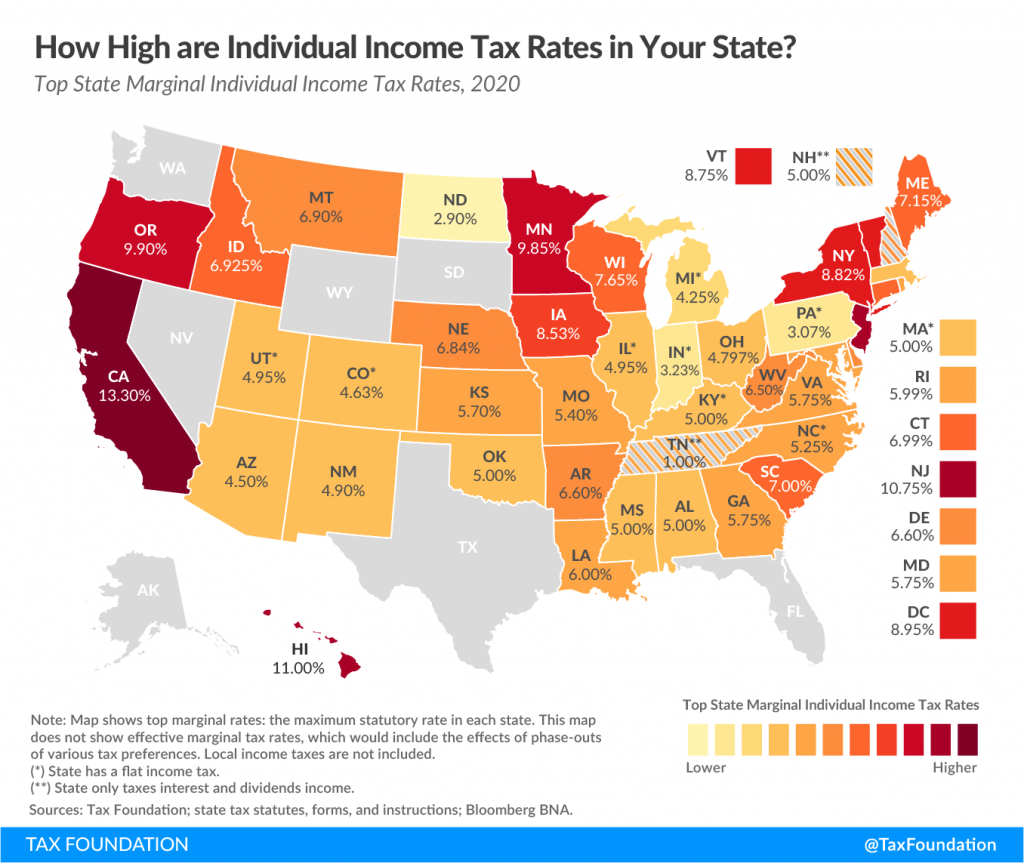

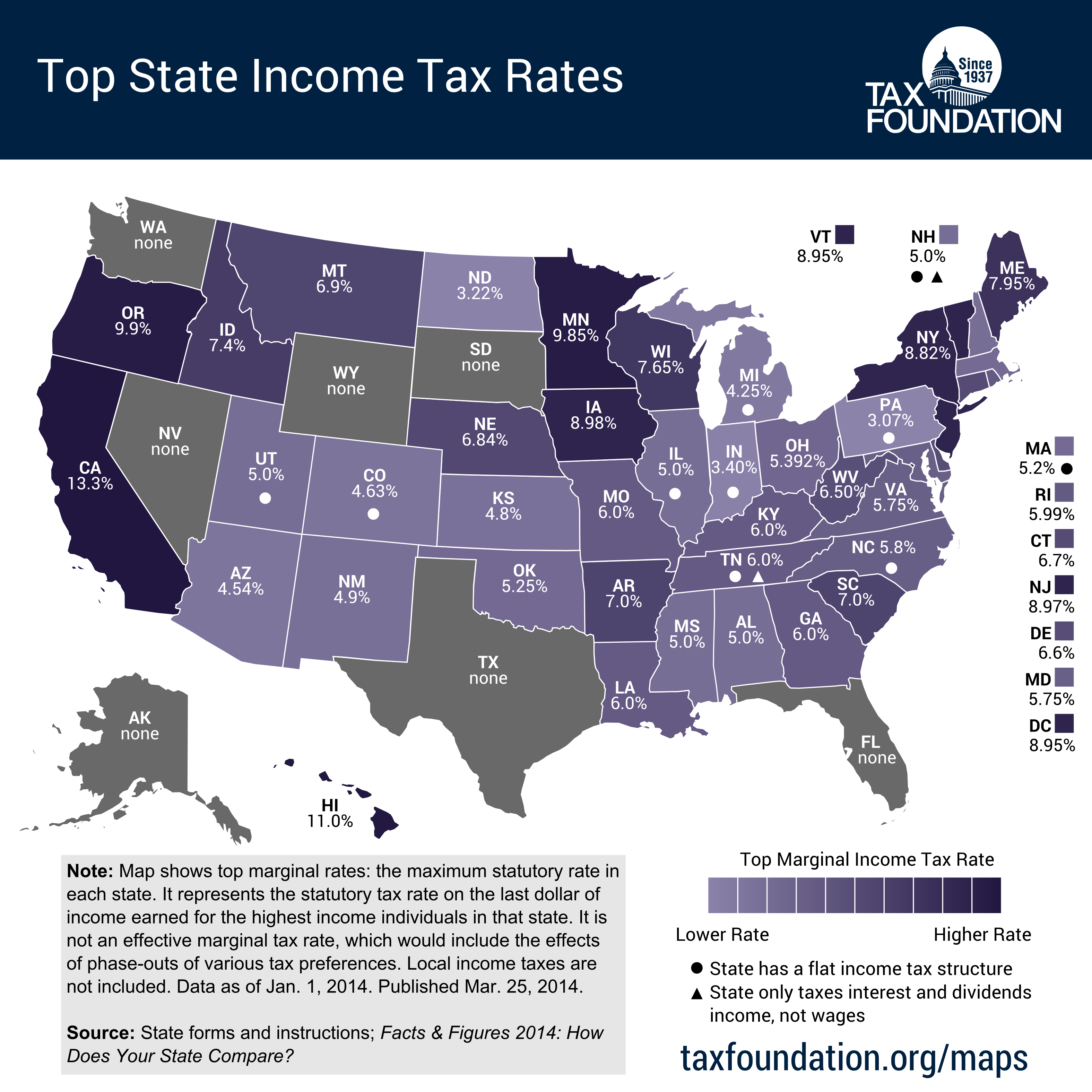

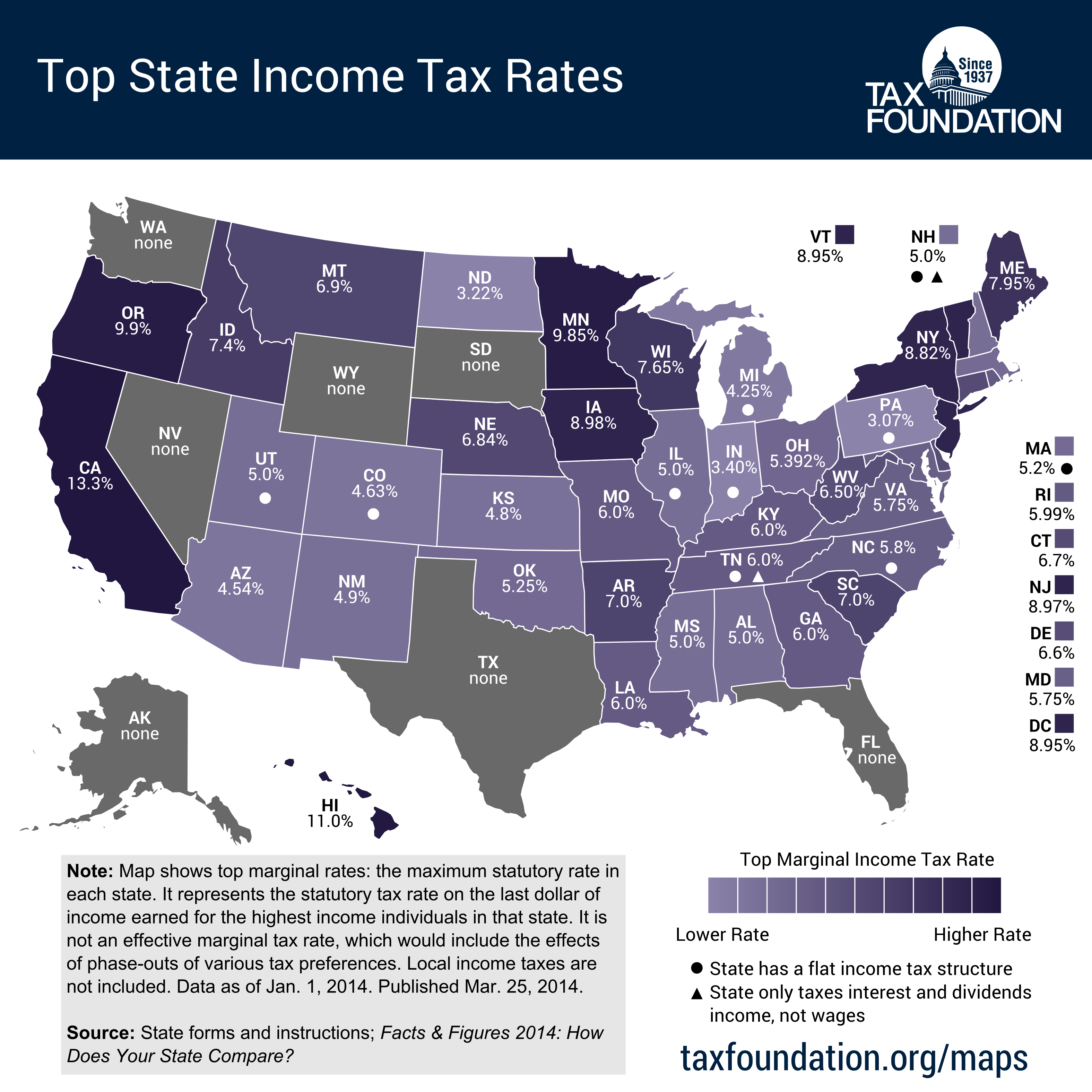

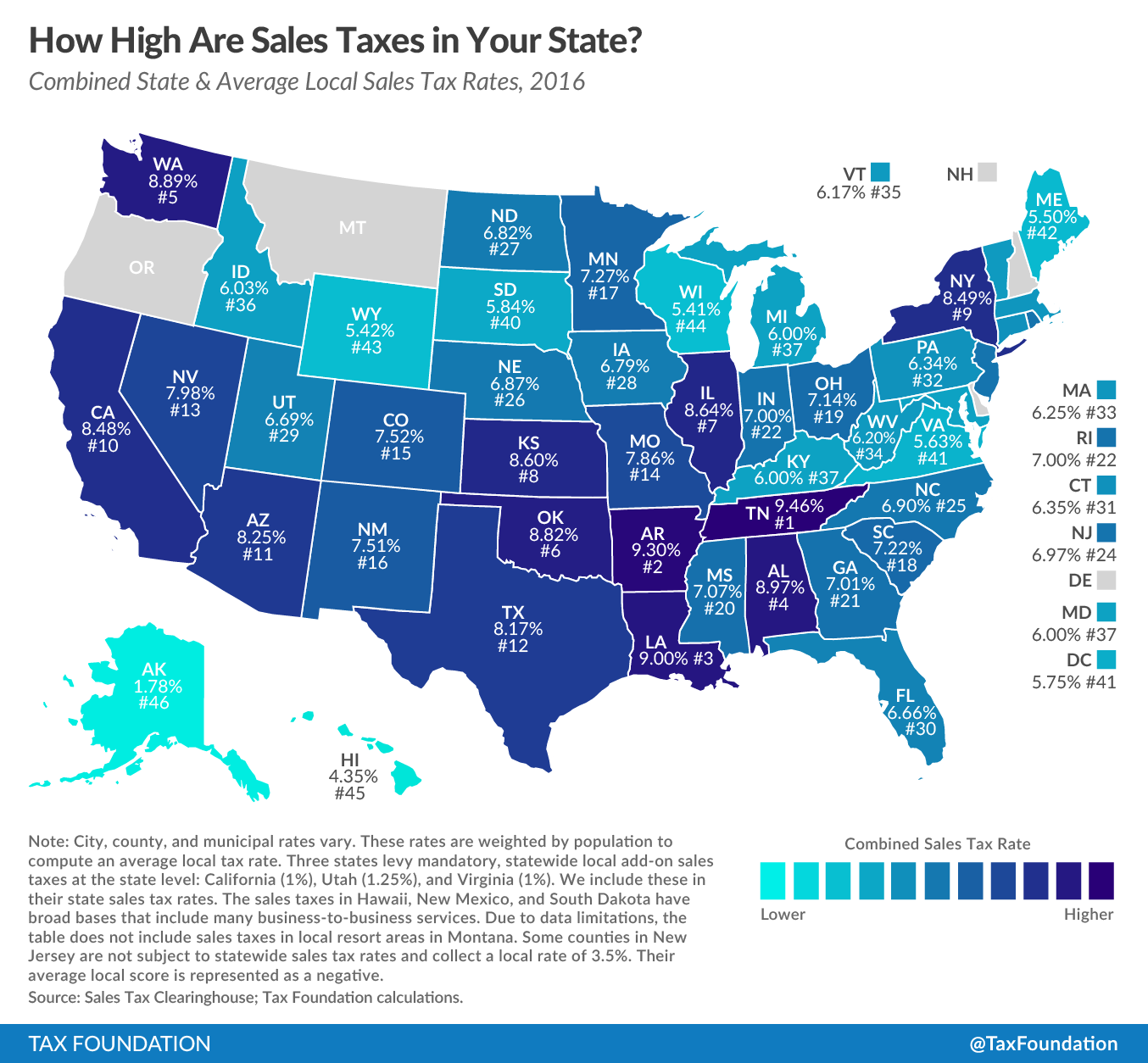

California has the highest state income tax with a rate of up to 13 3 California has graduated rate income taxes that range from 1 to a 13 3 tax rate on income of more At 7 25 California has the highest minimum statewide sales tax rate in the United States which can total up to 10 75 with local sales taxes included Sales and use taxes in California state and local are collected by the California Department of Tax and Fee Administration whereas income and franchise taxes are collected by the Franchise Tax Board

Why Does California Have A High Tax Rate

Why Does California Have A High Tax Rate

http://vlassisco.com.au/wp-content/uploads/2016/11/Info_G-Highest-Income-Tax.jpg

Tax Rates By State Map Printable Map Gambaran

https://thefinancebuff.com/wordpress/wp-content/uploads/2020/10/state-tax-map-1024x863.png

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

California ranks fairly high in overall taxation 10th highest both per capita and as a percentage of personal income based on the latest available California has the highest state income tax rate in the country California has graduated rate income taxes that range from 1 to a 13 3 tax rate on income of more than

California has 10 personal income tax rates ranging from 1 to 13 3 as of 2022 The highest rate of 13 3 begins at incomes of 1 million or more for single filers as of 2022 The 13 3 rate is referred to as the Many Californians owe little or no state income tax because the exemptions in California are fairly high But everyone pays the sales tax directly and indirectly When a state

Download Why Does California Have A High Tax Rate

More picture related to Why Does California Have A High Tax Rate

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

https://www.pennlive.com/resizer/p2gqH-9Cu-RsbFMDLy18ntSRMUc=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/capitol-notebook/photo/18540316-large.png

Fha Interest Rates Cheap Selling Save 41 Jlcatj gob mx

https://www.forex.academy/wp-content/uploads/2021/04/interest-rates.jpg

Why Does California Have So Many Wildfires There s A Scientific Reason

https://media.greenmatters.com/brand-img/GFswN2Vom/2160x1130/california-wildfires-1601489585986.jpg

Sure California is a high tax state But it s not the highest A new study from WalletHub which analyzes financial data says California is nowhere near the top of the state and local California has the nation s highest individual income tax rates and high sales tax burdens compared to the rest of the country In general the state has low property tax rates for residents who have owned a home for a long time

If you re short on time here s a quick answer High spending on public services and large income inequality drive the need for steep tax rates in California In this approximately 3000 word article we ll analyze the key California has the highest state sales tax rate 7 25 in the nation but taxes few services compared to other states It also has the 8th highest corporation tax rate 8 84 and

Benefits Employment Healthcare Kings County

https://www.countyofkings.com/home/showpublishedimage/6937/638004890891070000

The Tax System And Changing The Relationship With GRA News Room Guyana

https://newsroom.gy/wp-content/uploads/2016/06/tax-rate.jpg

https://itep.org › is-california-really-a-high-t…

For families of modest means California is not a high tax state California taxes are close to the national average for families in the bottom 80 percent of the income scale For the bottom 40 percent of families California

https://www.ncesc.com › geographic-faq › why-is-california-tax-so-high

California has the highest state income tax with a rate of up to 13 3 California has graduated rate income taxes that range from 1 to a 13 3 tax rate on income of more

Missed The Tax Return Deadline Do It By 30 April Before Further Charges

Benefits Employment Healthcare Kings County

Solved 5 The Conversion Strategy Exploits The Fact That Tax Rates

California Income Tax Rates RapidTax

County Budgets Where Does The Money Come From How Is It Spent

California Tops List Of 10 States With Highest Taxes

California Tops List Of 10 States With Highest Taxes

How High Are Sales Taxes In Your State Tax Foundation

What s Wrong With A 70 Tax Rate RedTea News

How To Redeem California Tax Income Return Warrants Personal Finance

Why Does California Have A High Tax Rate - California is not always a high tax state The lower one s income the lower the percentage they pay in taxes a new study finds