Why Does Student Loan Count As Income Do Student Loans Count as Income If you re in a hurry and want a short answer no student loans themselves are not taxable This is because student loans are essentially loans that one is expected to pay back to the lender with interest So since it s not an earned income they shouldn t trigger a higher tax bill

Fortunately the short answer is no In most cases your student loans won t increase your tax bill but they can impact your taxes in other ways Let s take a deeper look at how student loans as well as scholarships In a nutshell the answer is no student loans are debt and do not count as income Fellowships and other forms of financial grants however may be counted as income depending on how the funds are spent And

Why Does Student Loan Count As Income

Why Does Student Loan Count As Income

http://www.accumulatingmoney.com/wp-content/uploads/2019/02/studentloanforgiveness.png

Does Student Loan Debt Affect Getting A Mortgage Yes Because It

https://i.pinimg.com/originals/d4/82/ed/d482ed2ad1805abc710ed8a4eb4eec2a.jpg

Do Student Loans Count As Income Check Out Here

http://awajis.com/wp-content/uploads/2020/04/Do-Student-Loans-Count-As-Income_.png

In fact not only do your student loans not count as income they could actually help reduce your taxable income However student loan forgiveness meaning when the federal government cancels your loans does count as taxable income and can result in a large tax bill March 6 2020 Many students borrow money or accept grants and scholarships to help pay for higher education Luckily you don t report student loans grants and scholarships as income on

They typically cannot however claim student loan funds as income on their loan or apartment application Similarly you don t need to claim student loan money as income on your tax return Although student loans can be used as a source of income while you are in school they are ultimately a debt obligation that you will have to repay in March 3 2022 8 min read Generally debt of any kind that must be paid back doesn t count as income on your taxes including student loans However if some or all your student

Download Why Does Student Loan Count As Income

More picture related to Why Does Student Loan Count As Income

Student Loans How Can You Reduce Your Total Loan Cost Marca

https://phantom-marca.unidadeditorial.es/e3ae09fad4671029fff000aa005b5f70/resize/1320/f/jpg/assets/multimedia/imagenes/2023/02/28/16775751269529.png

STUDENT LOAN DEBT

http://www.advisorsmagazine.com/images/2019/07/20/chartdebt2.jpg

Student Loan Repayment Income Based Plans

https://www.fingerlakes1.com/wp-content/uploads/2022/01/student-loan-debt.jpg

Tax benefits and deductions for students Student aid that does NOT count as income The IRS doesn t see any loan that you must repay as income such as credit card debt personal loans and mortgages and student loans Financial aid used to cover education expenses also typically isn t taxed Do Student Loans Count as Taxable Income If you need to take out federal or private student loans to pay for your school rest assured that this is not considered taxable income You won t need to pay income taxes on it in the United States

Student loans do not count as income The short answer to the question of whether your student loan is considered income is no In the eyes of the IRS these loans do not count towards your annual income And the reason why is pretty straightforward unlike actual income your loans must be paid back plus interest The answer to that question is no student loans are not considered income Since you ll be paying your loans back with interest you don t have to worry about paying taxes on the amount In

Account Suspended Student Loan Debt Student Loans Best Student Loans

https://i.pinimg.com/originals/6a/19/de/6a19de8f425df290ef065cc9301e5b92.png

How Do Student Loans Work Multiply My Money

https://multiplymymoney.com/wp-content/uploads/2019/07/Illustration-Of-Infographic-Of-Student-Loan-Concept-1024x768.jpg

https://pressbooks.cuny.edu/learners/part/do...

Do Student Loans Count as Income If you re in a hurry and want a short answer no student loans themselves are not taxable This is because student loans are essentially loans that one is expected to pay back to the lender with interest So since it s not an earned income they shouldn t trigger a higher tax bill

https://www.rockethq.com/learn/personal-finances/...

Fortunately the short answer is no In most cases your student loans won t increase your tax bill but they can impact your taxes in other ways Let s take a deeper look at how student loans as well as scholarships

Why The Fixed Bond to Income Ratio FOIR Can Affect Your Loan Application

Account Suspended Student Loan Debt Student Loans Best Student Loans

How Do Student Loans Work

Major Update On Federal Student Loan Payments Student Loan Payment

Do Student Loans Count As Income For Taxes LendEDU

Joe Biden s Plan To Forgive Student Loan Debt Explained Maori Art

Joe Biden s Plan To Forgive Student Loan Debt Explained Maori Art

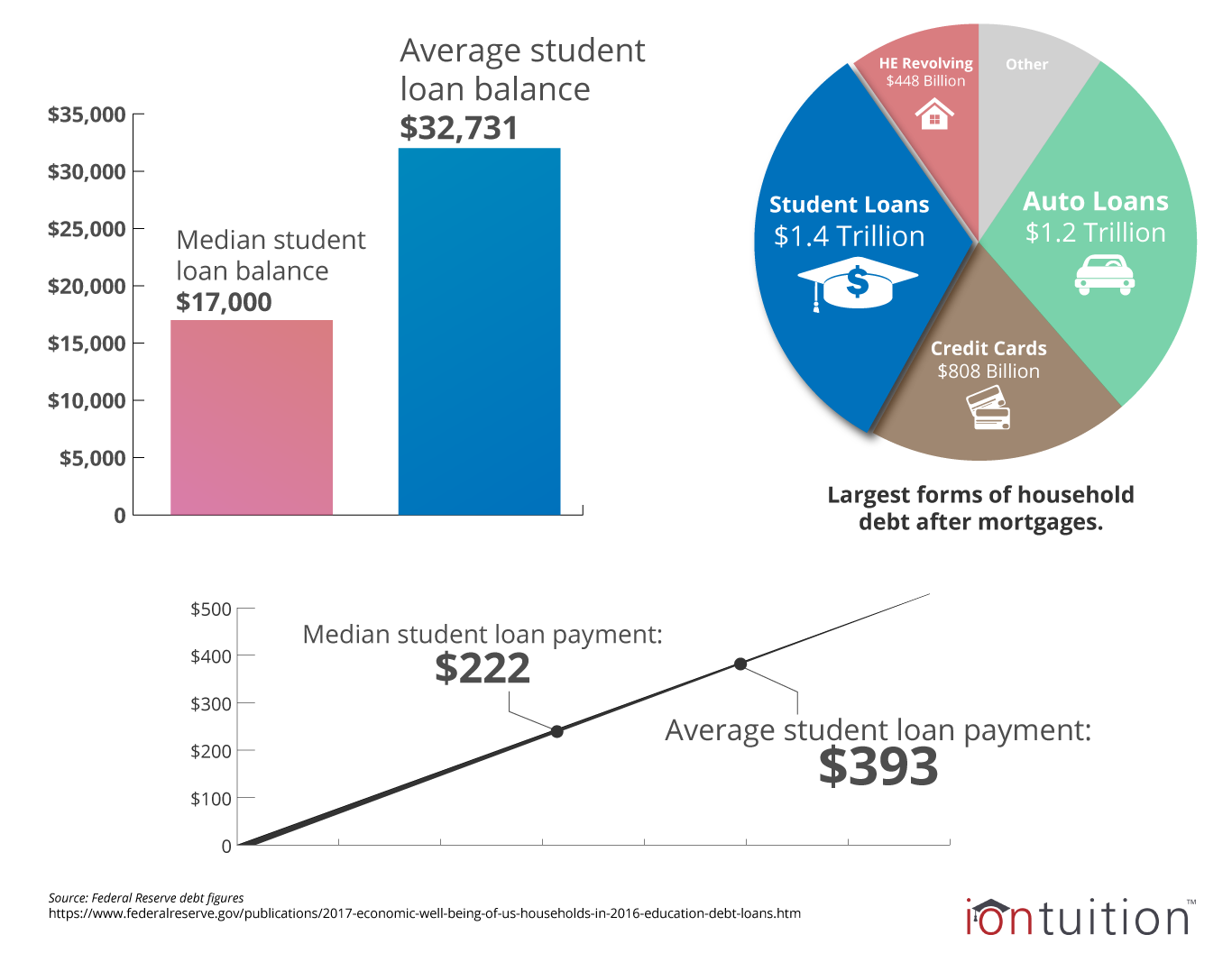

How Does Your Student Debt Compare To National Averages IonTuition

How Do Student Loans Work And What Types Are Available Plain Finances

It s Official Student Loan Rates Will Double Monday Credit

Why Does Student Loan Count As Income - March 6 2020 Many students borrow money or accept grants and scholarships to help pay for higher education Luckily you don t report student loans grants and scholarships as income on