Wi Child Tax Rebate Taxable Web The Wisconsin child sales tax rebate is not included in a claimant s 2018 Wisconsin taxable income If the rebate is included in federal adjusted gross income the claimant

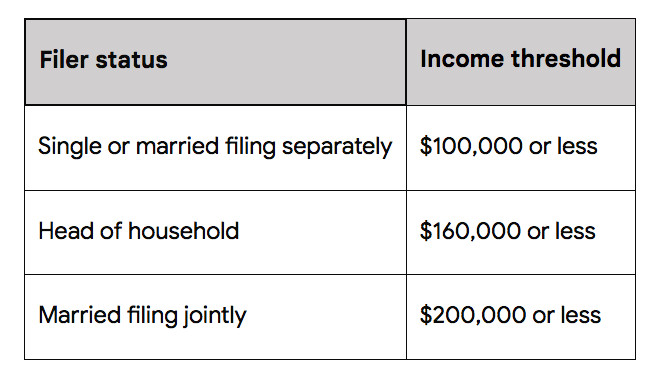

Web 3 avr 2022 nbsp 0183 32 1 Who s Eligible Families whose adjusted gross income was at 150 000 or below for married couples or 75 000 for single filer parents are eligible for the credit 2 Web 3 juin 2019 nbsp 0183 32 You do not list the WI Child Sales Tax Rebate on your tax return The Wisconsin child sales tax rebate is not included in Wisconsin taxable income If the

Wi Child Tax Rebate Taxable

Wi Child Tax Rebate Taxable

http://www.screwedkenoshastyle.com/Income/2001-1040.gif

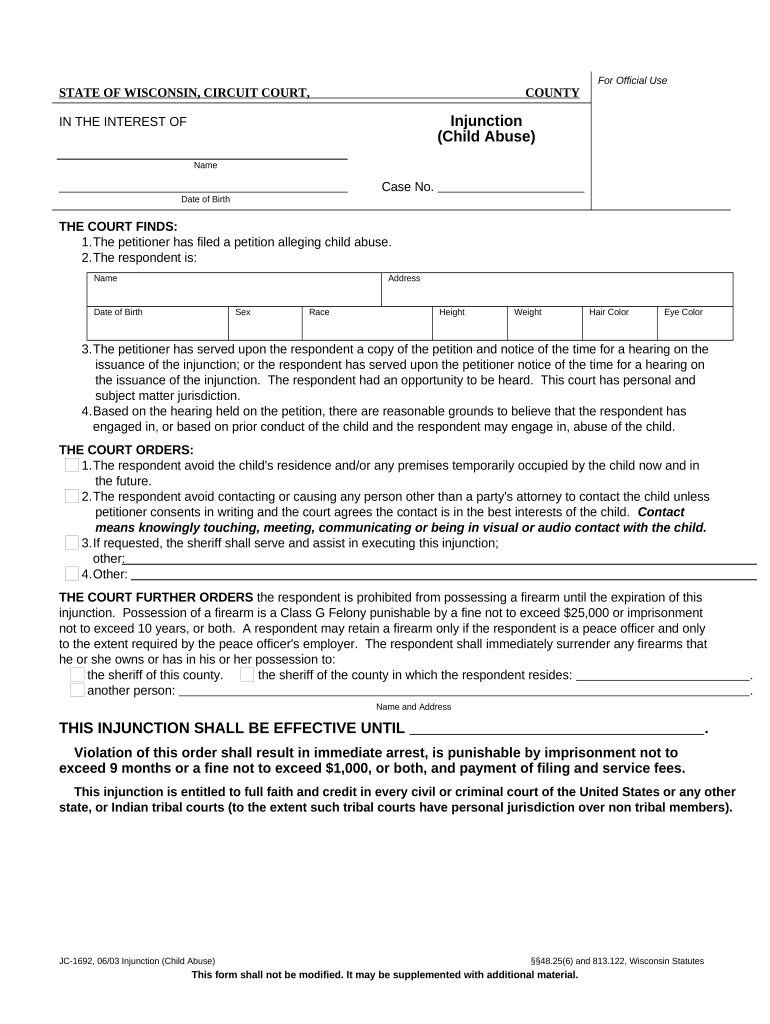

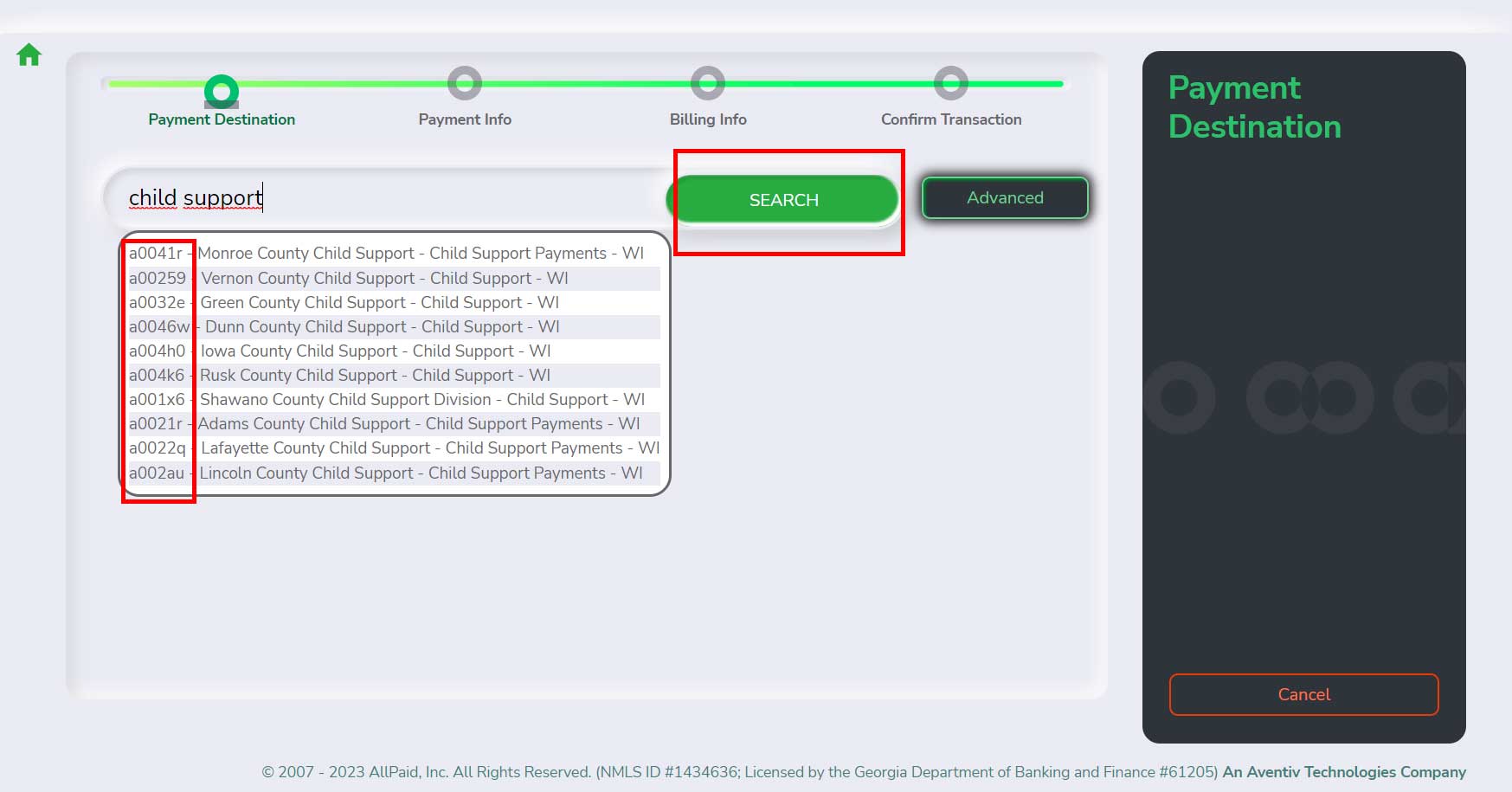

Wi Child Abuse Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/497/431/497431095/large.png

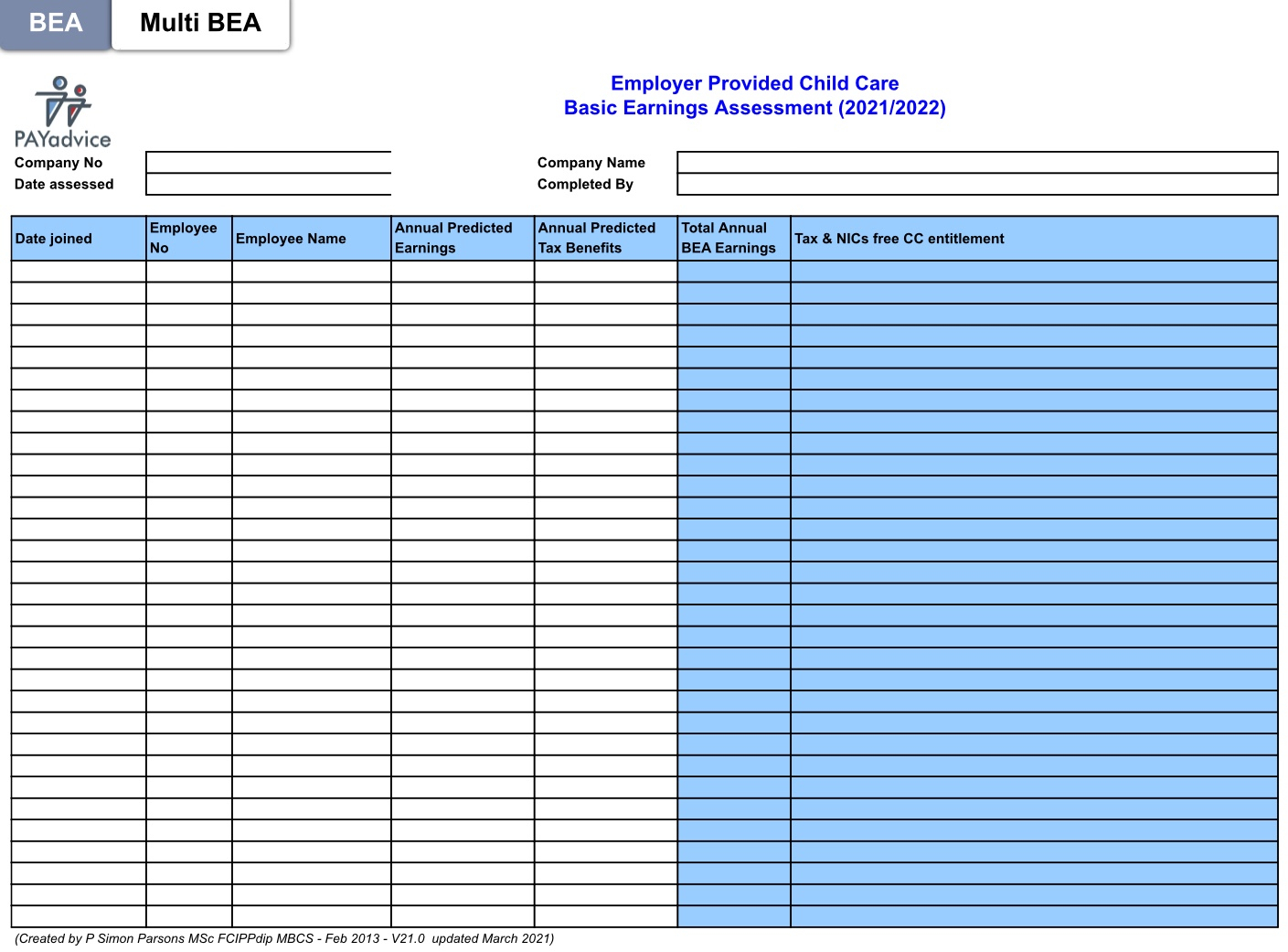

Child Care Tax Rebate 2022 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/child-care-vouchers-2021-2022-basic-earnings-assessment-calculator.jpg

Web 3 avr 2022 nbsp 0183 32 Many Wisconsin parents who got child tax credit payments in 2021 may get smaller refunds from the federal government in 2022 a financial expert said Web Information about The Earned Income Tax Credit EITC which may lower the taxes you owe and refund you up to 6 935 at tax time 2022 Tax Credits Get the Credit you

Web Additional Child and Dependent Care Tax Credit New for tax year 2022 this credit is for taxpayers claiming the Child and Dependent Care Tax Credit on their federal return Web In 2018 Wisconsin enacted a one time Child Tax Rebate worth 100 per child Families can apply here https childtaxrebate wi gov CHILD AND DEPENDENT CARE TAX

Download Wi Child Tax Rebate Taxable

More picture related to Wi Child Tax Rebate Taxable

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

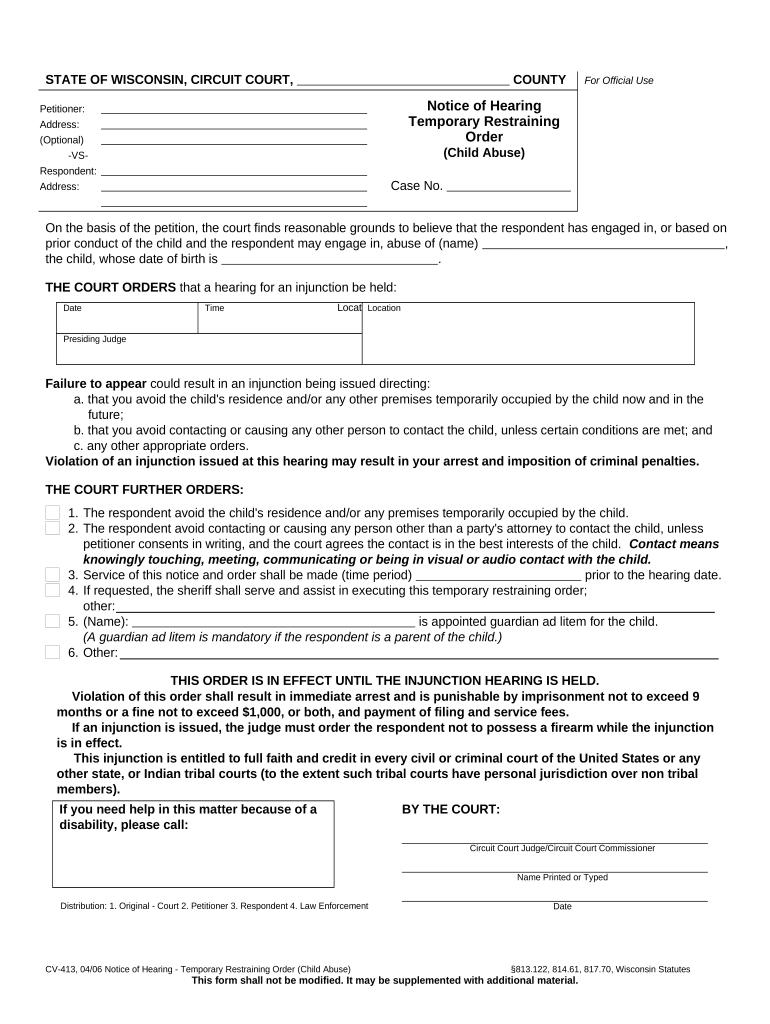

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022-768x644.png

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

https://thevillage.org/wp-content/uploads/2022/07/ChildTaxRebate-002_web.jpg

Web The Child Tax Credit CTC is available to families with a qualifying child Working families may be eligible for up to the maximum federal tax credit of 3 000 per dependent child Web 15 juil 2021 nbsp 0183 32 Typically the child tax credit is distributed annually as a deduction for how much a family owes on its income taxes Prior to this year s changes the deduction was up to 2 000 per dependent

Web 20 juin 2018 nbsp 0183 32 With just less than two weeks remaining in the filing period the Wisconsin Department of Revenue DOR is urging eligible claimants to file for their 100 per child Web 15 mai 2018 nbsp 0183 32 1 Signing up The state Department of Revenue began accepting applications Tuesday at https childtaxrebate wi gov Parents without internet access can call 608

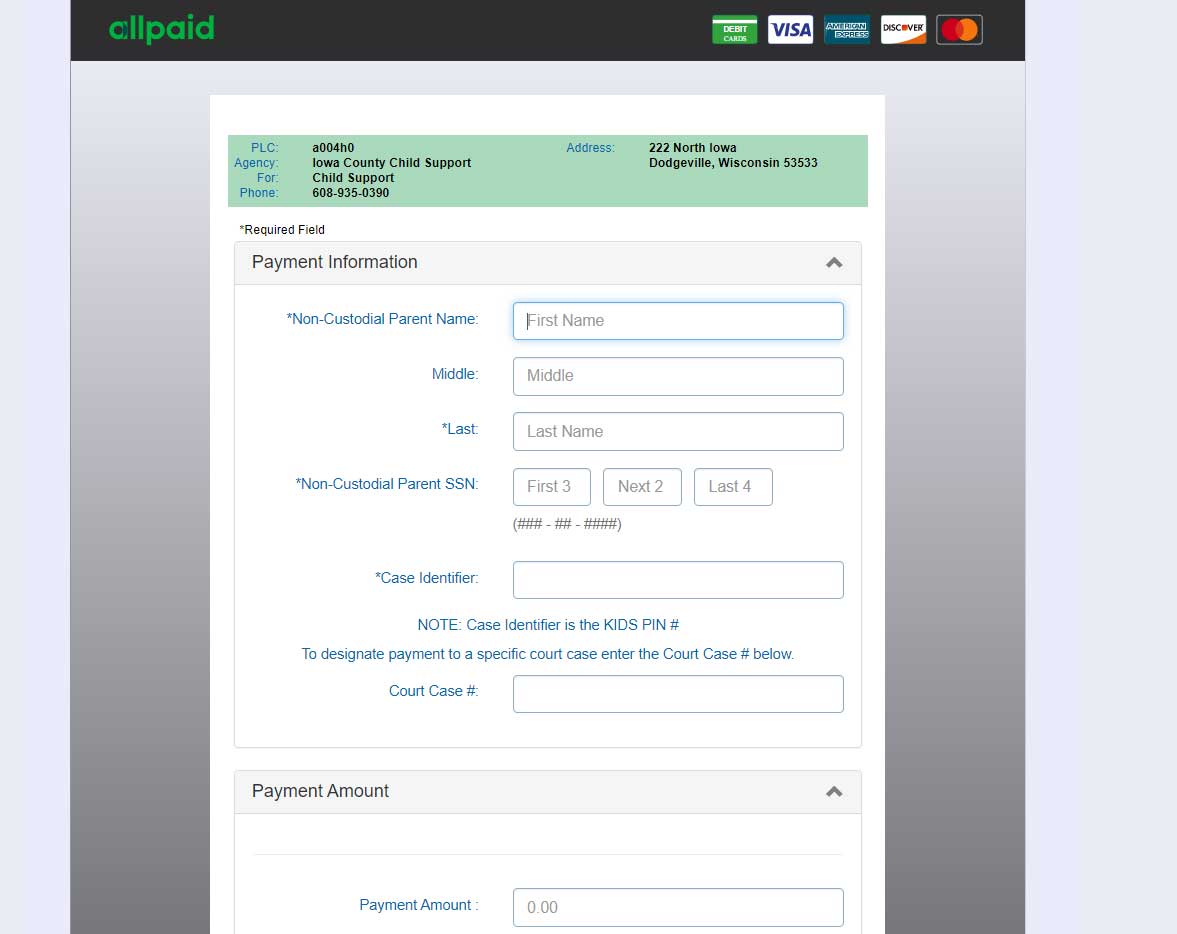

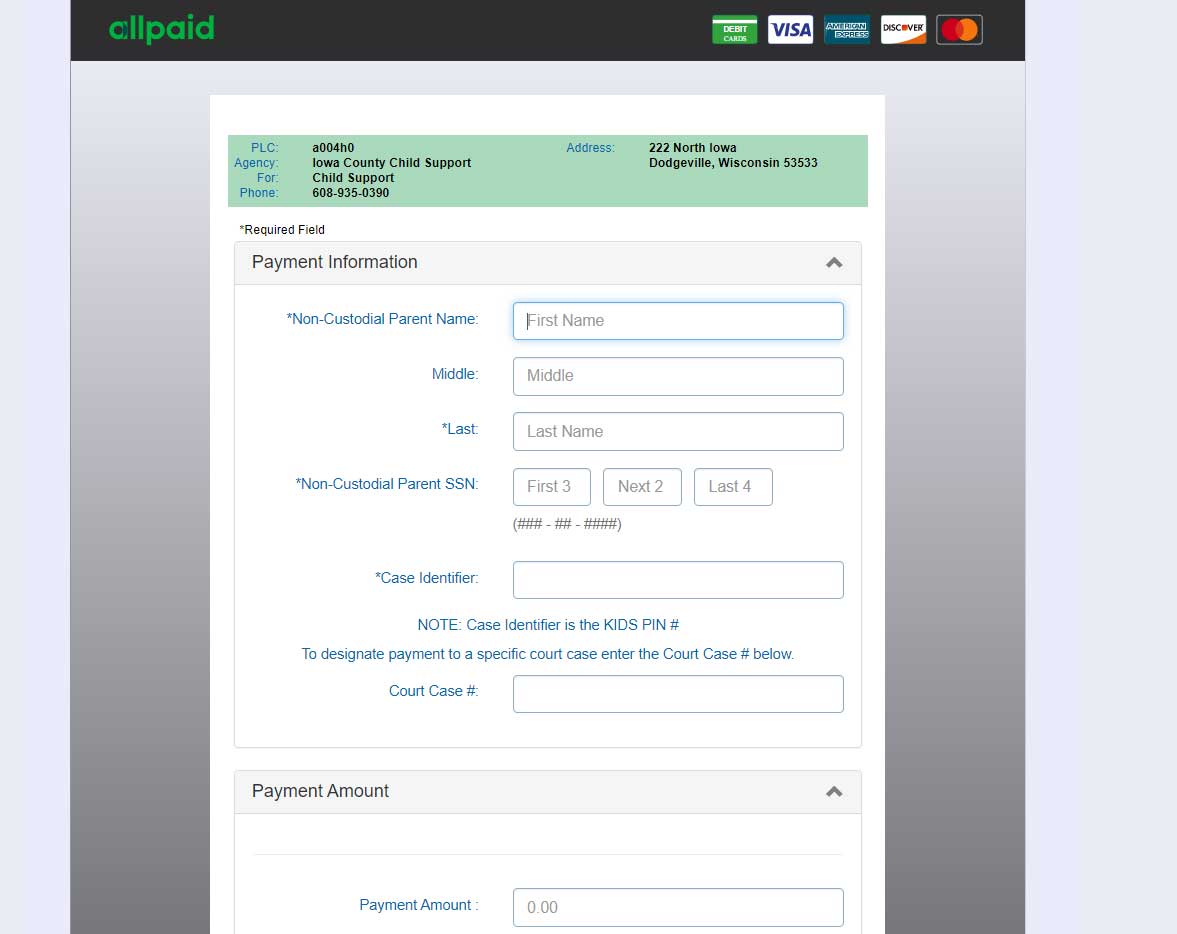

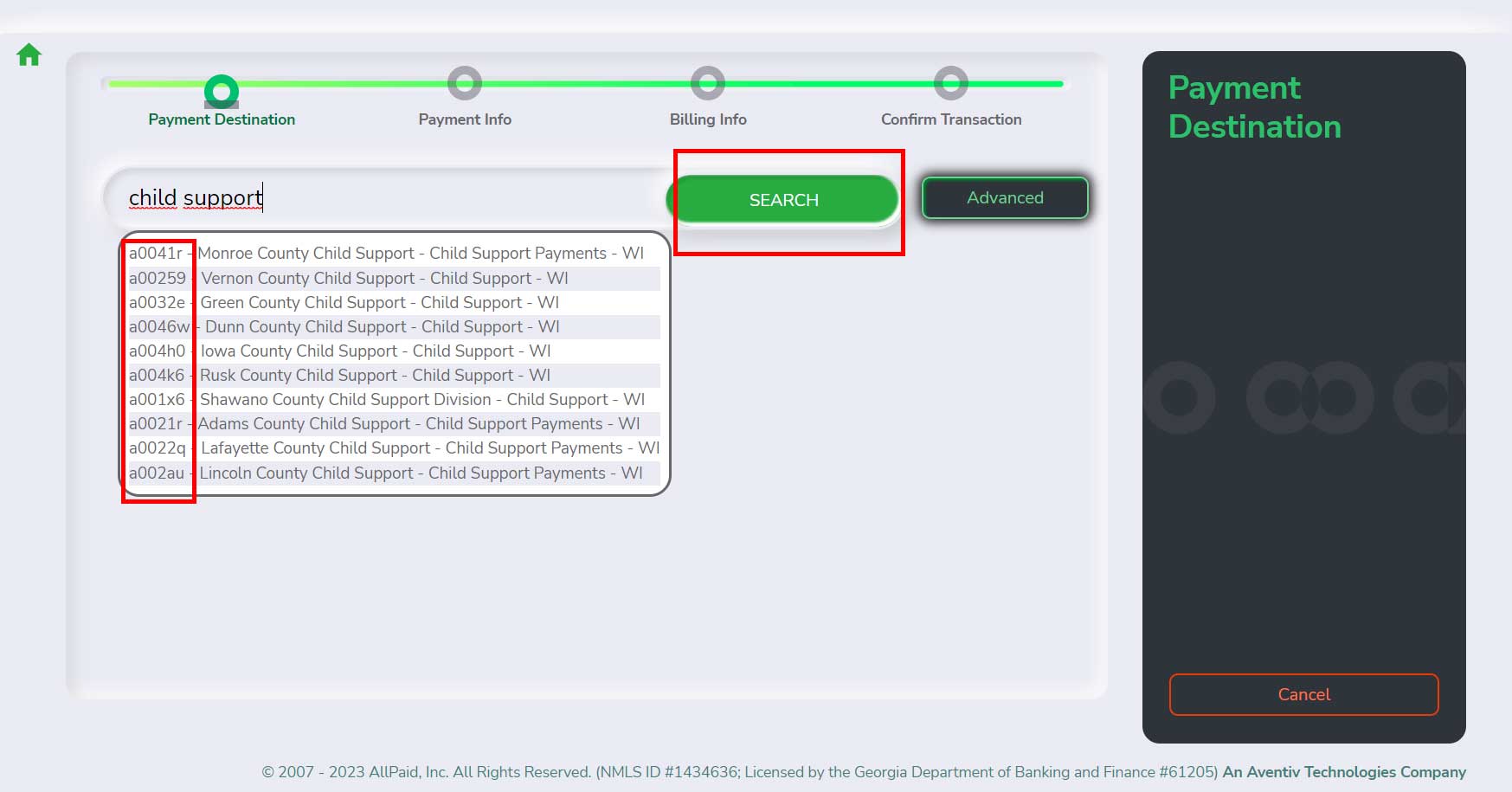

How To Make Child Support Wi Gov Payments Online 2023

https://childsupportgov.com/wp-content/uploads/2023/03/Wi-Child-Support-Payment-Online-Allpaid.jpg

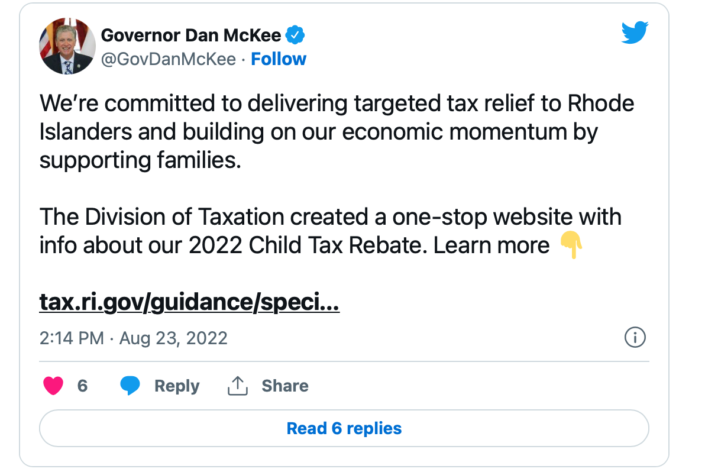

Online Portal To Help Rhode Islanders With Child Tax Rebate

https://oceanstatecurrent.com/wp-content/uploads/2022/08/Screen-Shot-2022-08-30-at-9.46.51-AM-705x472.png

https://www.revenue.wi.gov/Pages/TaxPro/2018/2018-Wisconsin-Tax-Up…

Web The Wisconsin child sales tax rebate is not included in a claimant s 2018 Wisconsin taxable income If the rebate is included in federal adjusted gross income the claimant

https://news.yahoo.com/2022-tax-refund-child-tax-160529061.html

Web 3 avr 2022 nbsp 0183 32 1 Who s Eligible Families whose adjusted gross income was at 150 000 or below for married couples or 75 000 for single filer parents are eligible for the credit 2

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

How To Make Child Support Wi Gov Payments Online 2023

Wisc Child Tax Rebate Deadline KDWA 1460 AM

/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg)

VIDEO State Holds Webinar To Teach People How To Register For Child

200 000 CT Households Have Applied For The Child Tax Credit Rebate

How To Make Child Support Wi Gov Payments Online 2023

How To Make Child Support Wi Gov Payments Online 2023

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried

Wi Child Abuse Form Fill Out And Sign Printable PDF Template SignNow

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Wi Child Tax Rebate Taxable - Web In 2018 Wisconsin enacted a one time Child Tax Rebate worth 100 per child Families can apply here https childtaxrebate wi gov CHILD AND DEPENDENT CARE TAX