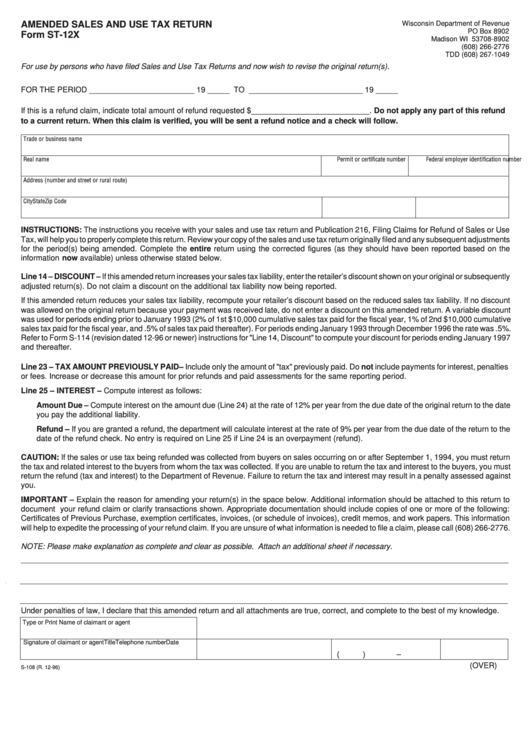

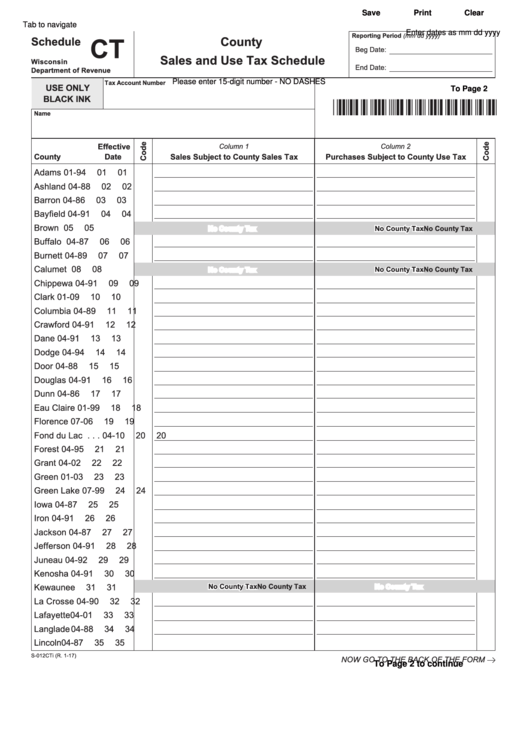

Wi Sales And Use Tax Rebates Web Seller s Claim for Refund for refund of tax reported on your Sales and Use Tax Return Amend Sales and Use Tax Return electronically using My Tax Account If you have

Web 20 f 233 vr 2021 nbsp 0183 32 As a result a remote seller is only required to collect and remit sales or use tax if its gross sales into Wisconsin exceed 100 000 in the previous or current year Web This publication explains who may file a claim for re fund of Wisconsin state county and stadium sales or use tax It also includes information relating to forms time limitations

Wi Sales And Use Tax Rebates

Wi Sales And Use Tax Rebates

https://data.formsbank.com/pdf_docs_html/308/3080/308090/page_1_thumb_big.png

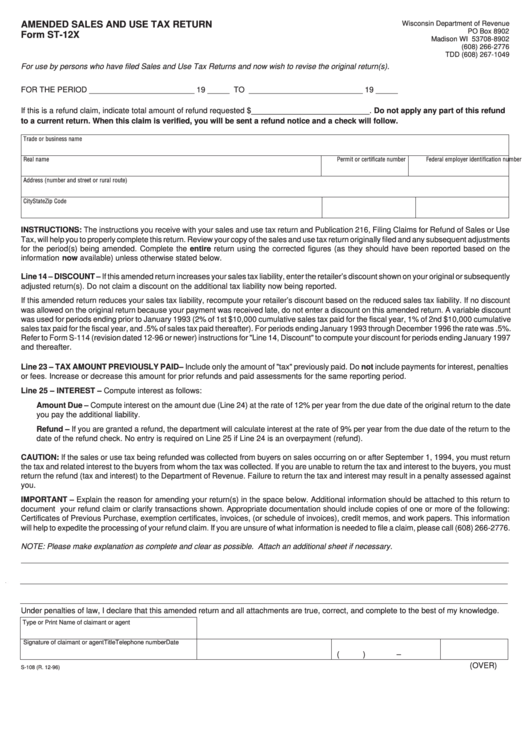

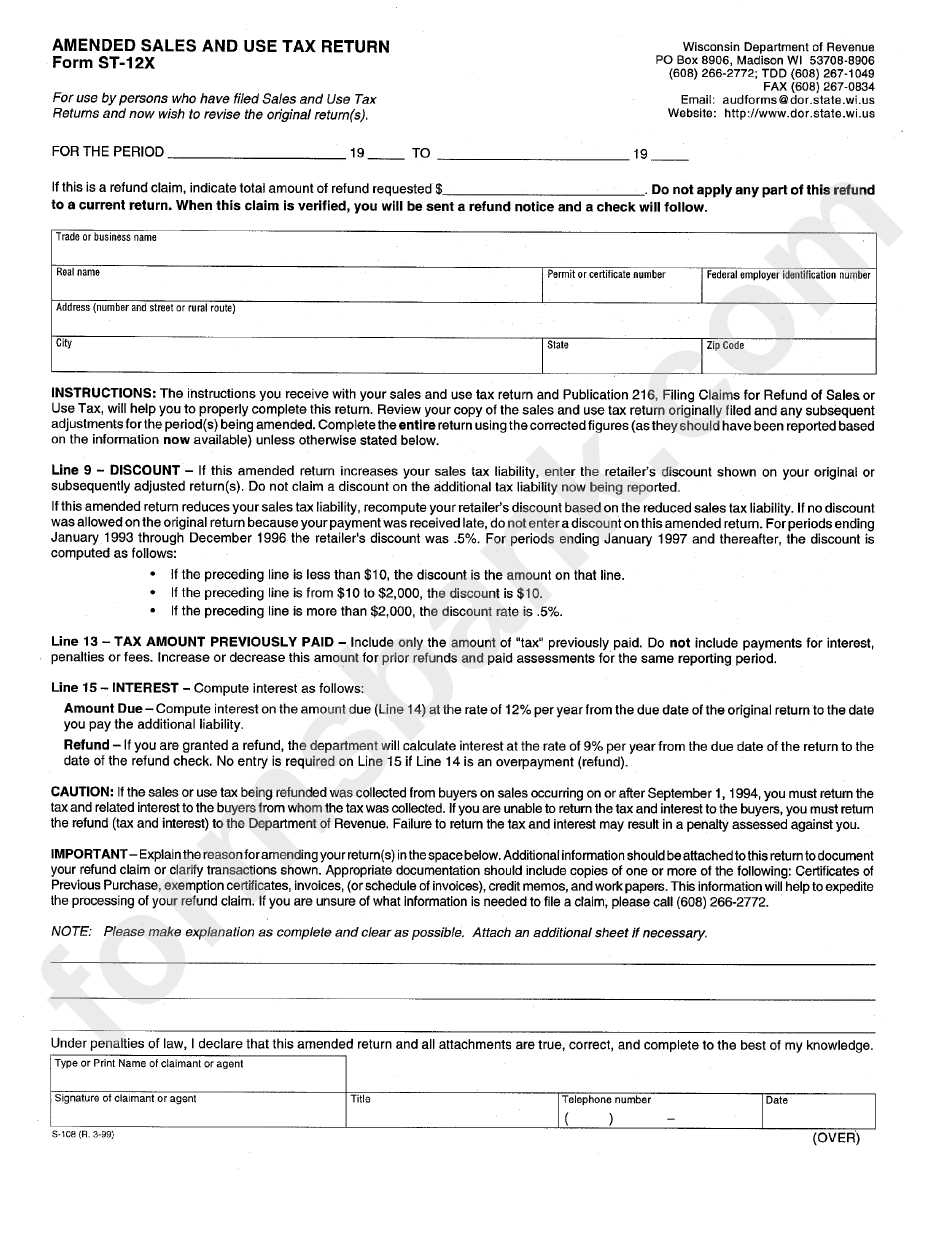

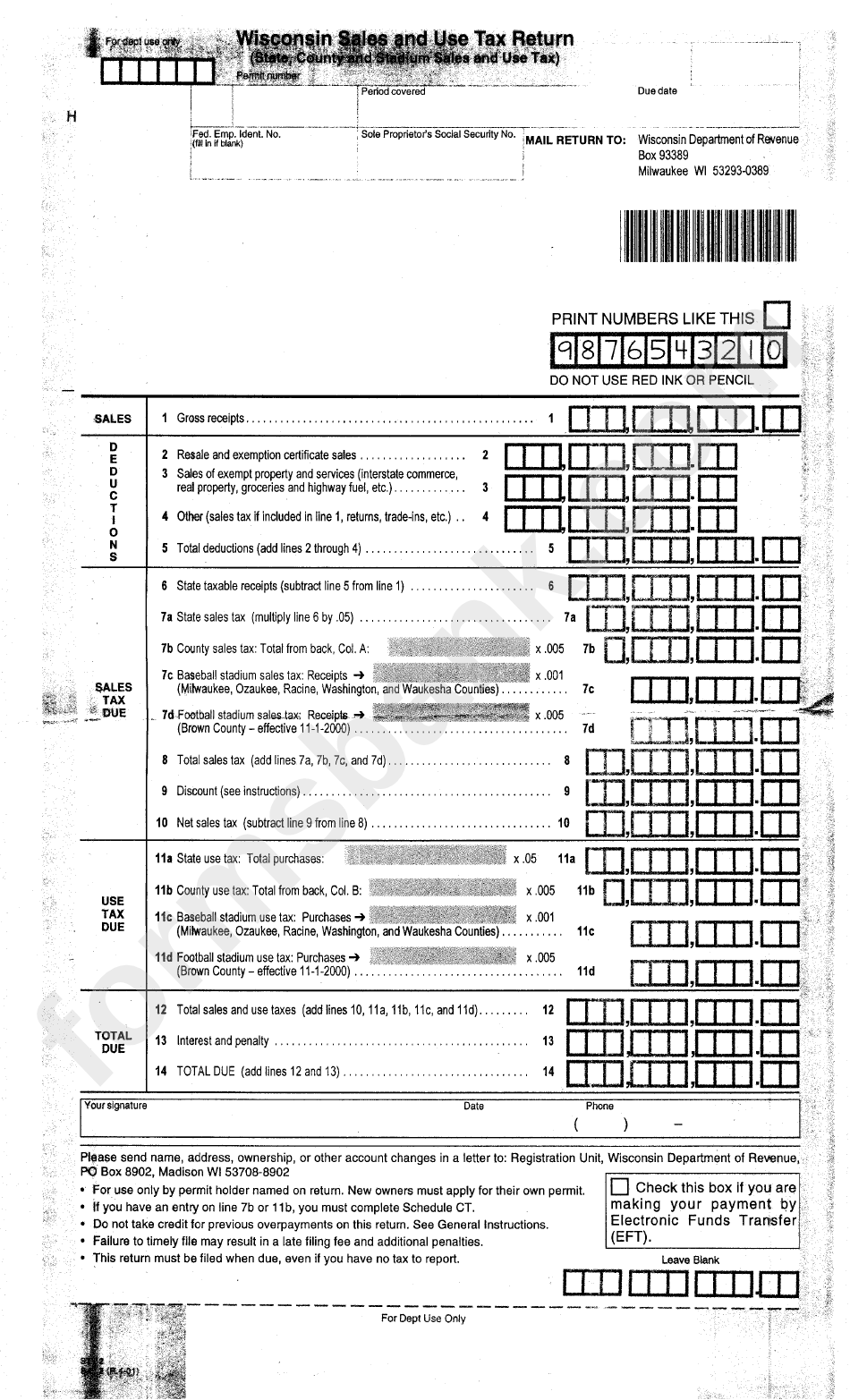

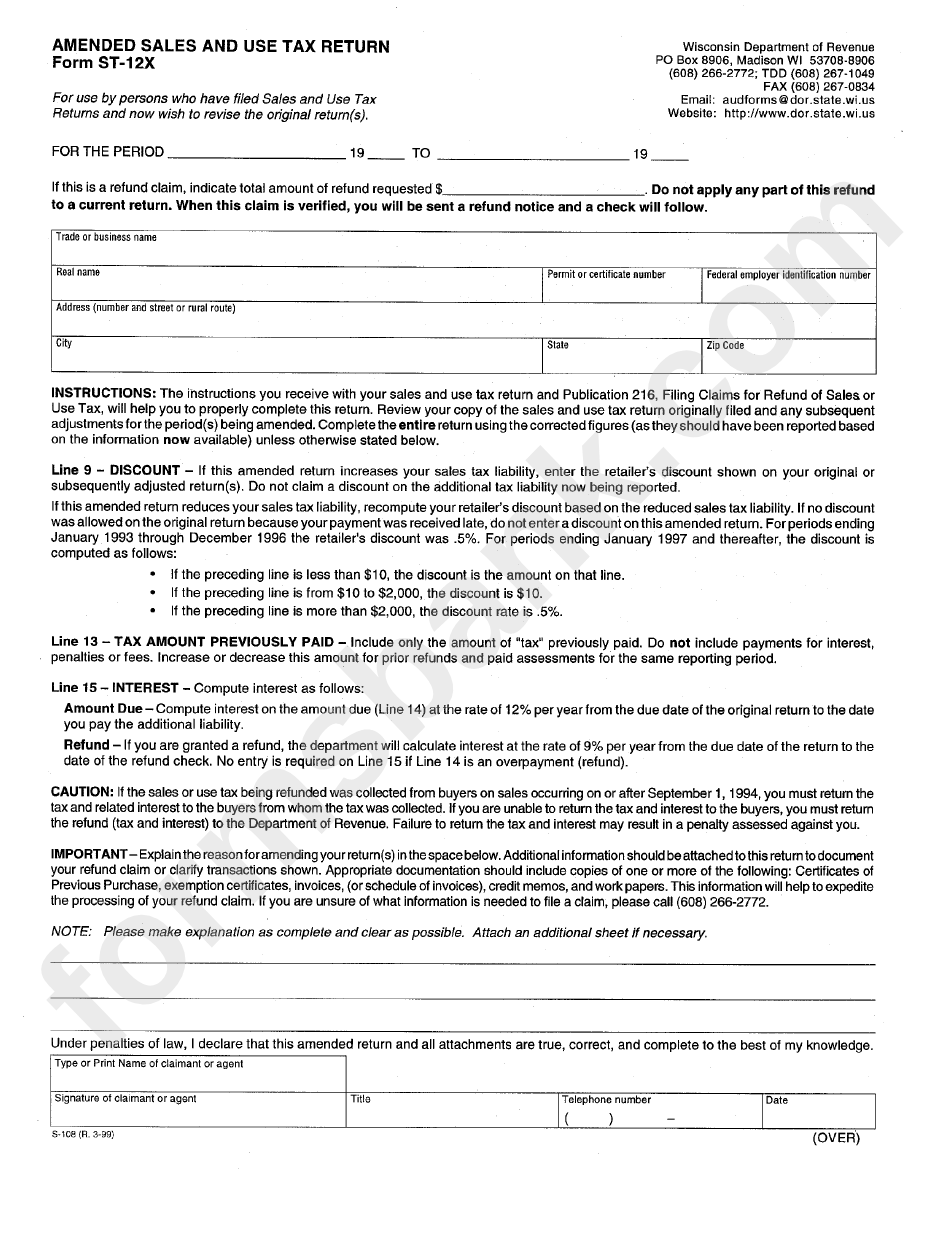

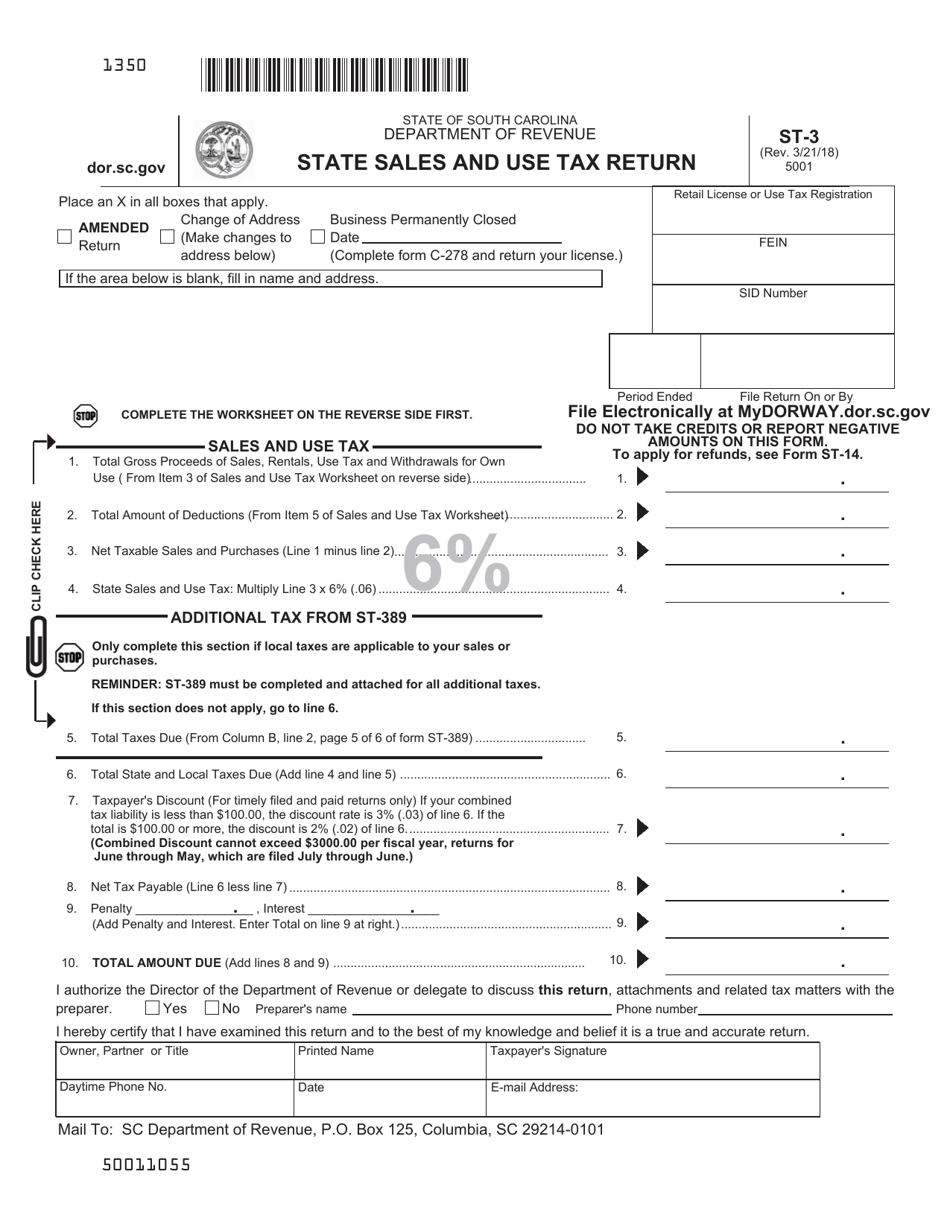

Form St 12x Amended Sales And Use Tax Return Wisconsin Printable

https://data.formsbank.com/pdf_docs_html/265/2658/265844/page_1_bg.png

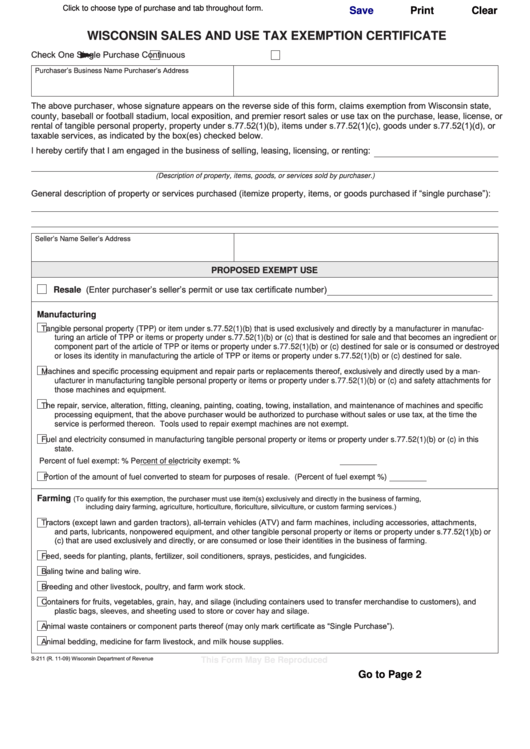

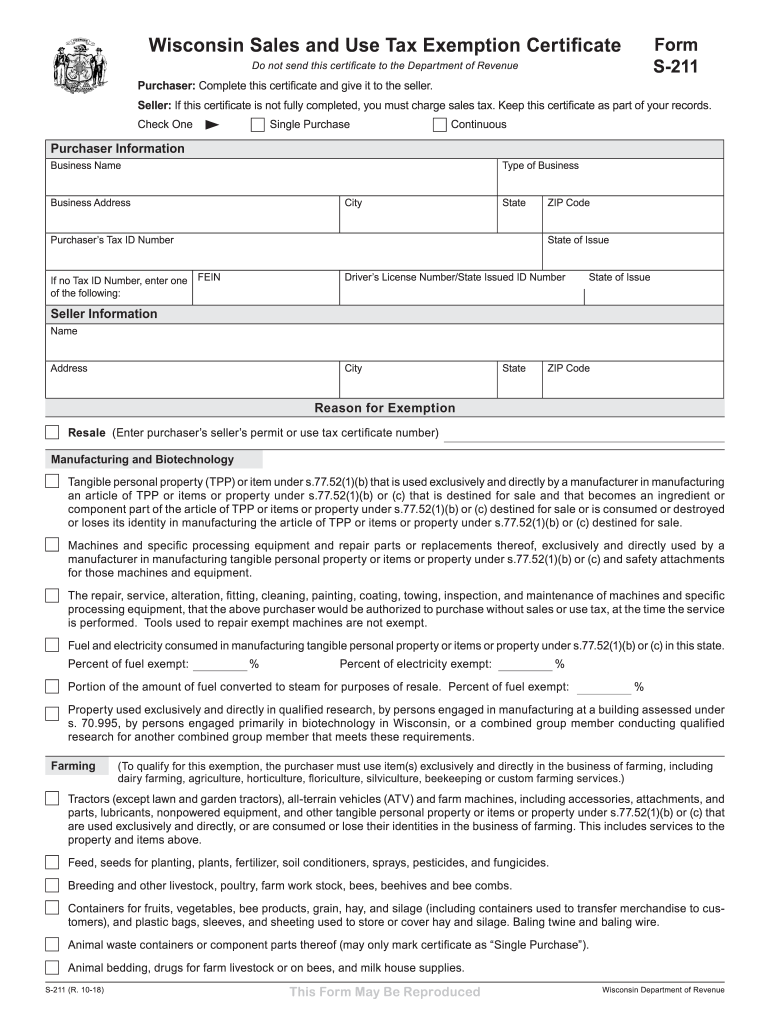

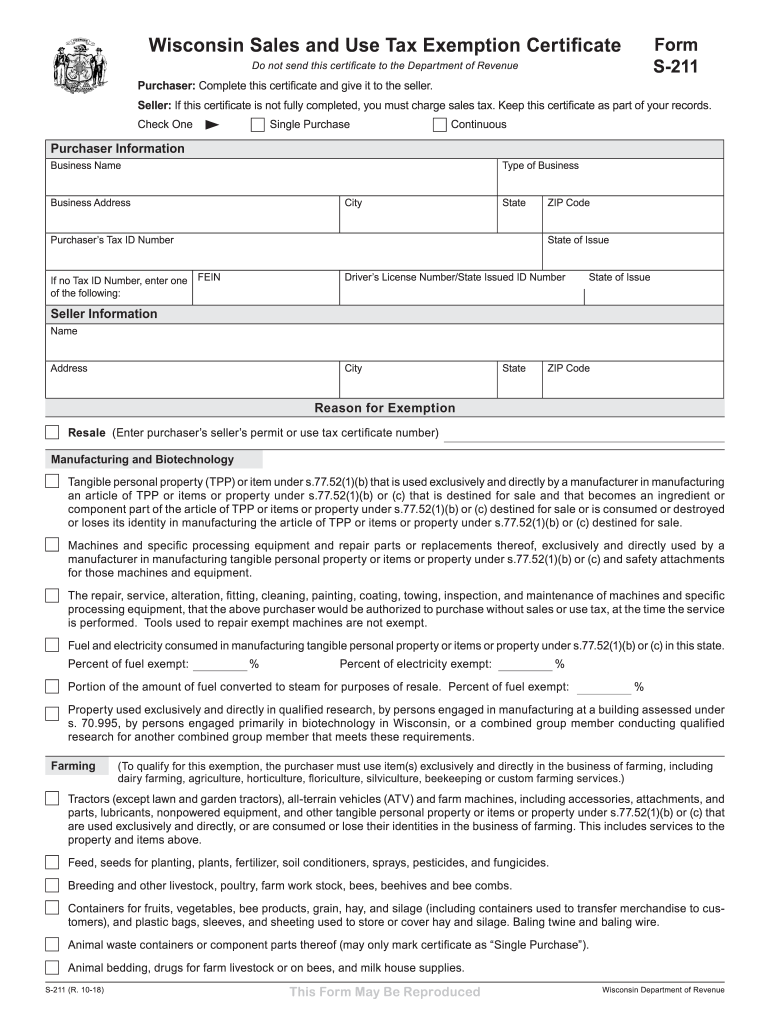

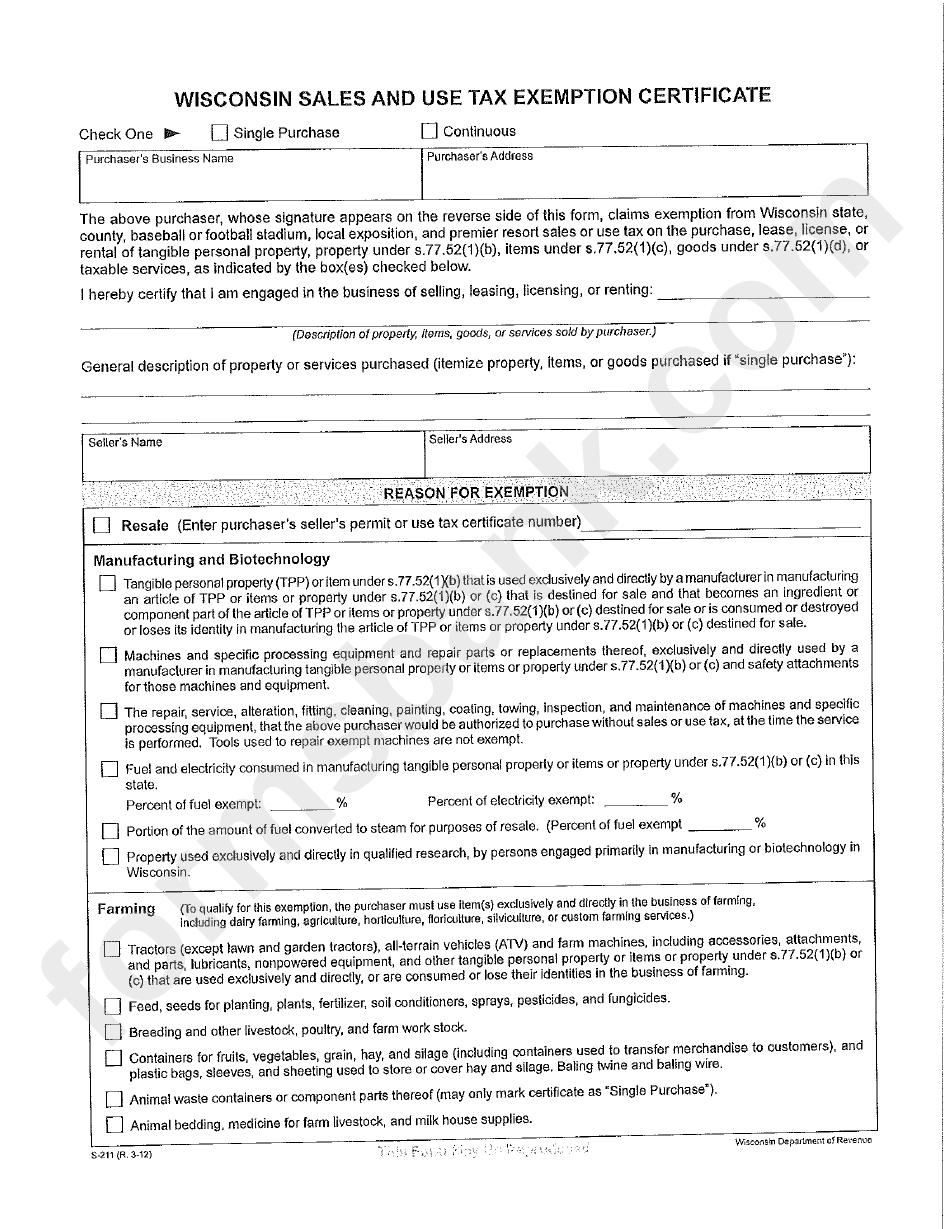

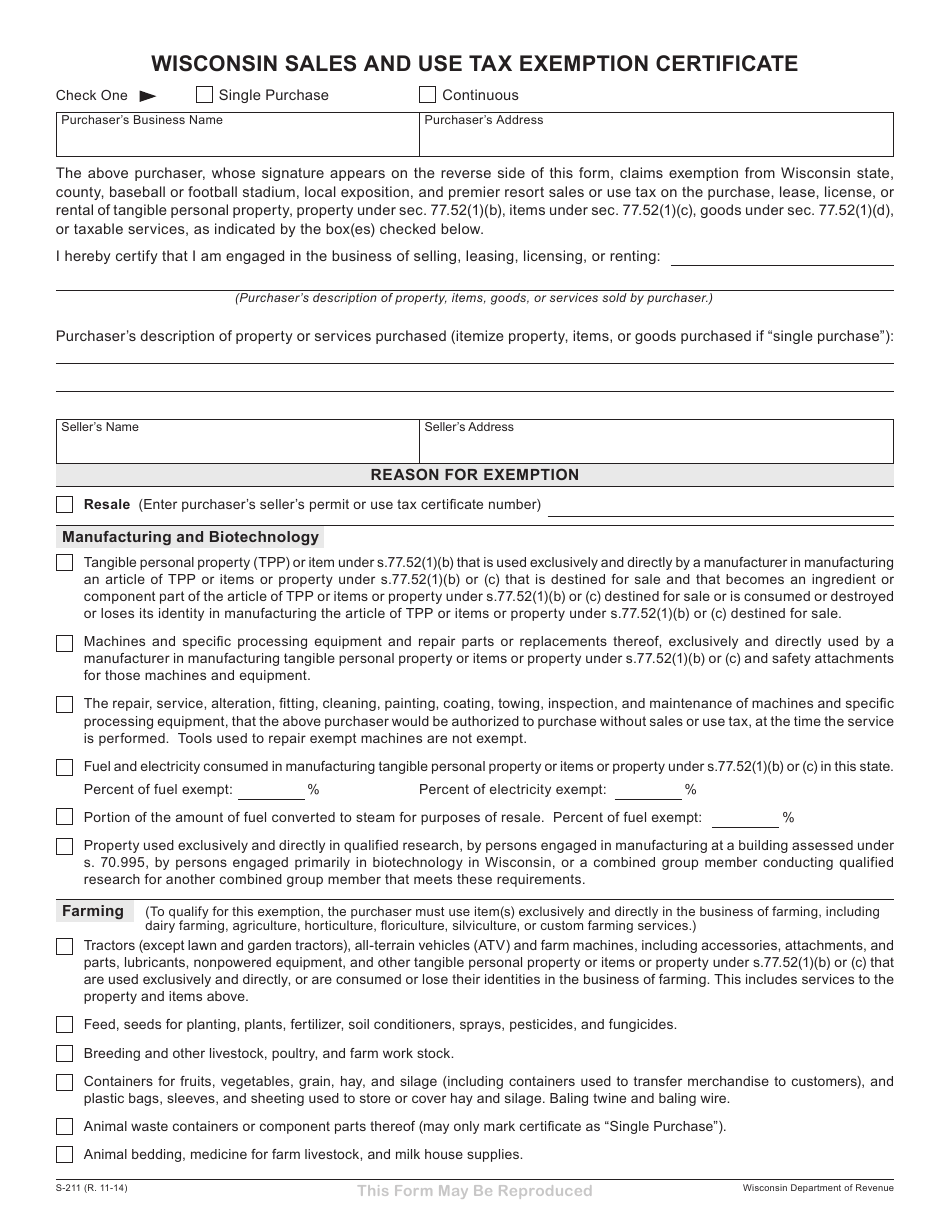

Fillable July 2009 S211 Wisconsin Sales And Use Tax Exemption Printable

https://data.formsbank.com/pdf_docs_html/107/1079/107992/page_1_thumb_big.png

Web 28 sept 2022 nbsp 0183 32 Report fraud Wisconsin has a variety of tax deductions exclusions exemptions and credits available to Wisconsin businesses Our Interactive Tax Incentive Web County Sales and Use Tax Find Wisconsin State and County Sales Tax Rate Difference Between Sales Tax and Use Tax Digital Goods Disaster Relief Payments Disregarded

Web The state use tax rate is 5 and if the item purchased is used stored or consumed in a county that imposes county tax you must also pay an additional 0 5 county tax See Web Sales tax is imposed on retailers who make taxable retail sales licenses leases or rentals of the following products in Wisconsin unless an exemption applies Tangible personal

Download Wi Sales And Use Tax Rebates

More picture related to Wi Sales And Use Tax Rebates

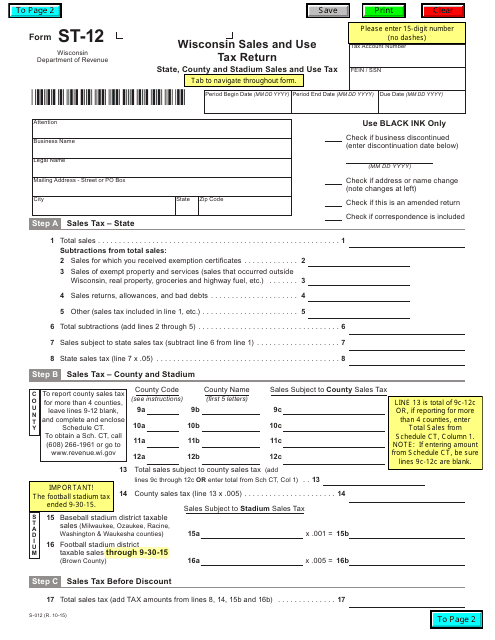

St 12 Fillable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1731/17315/1731527/form-st-12-wisconsin-sales-and-use-tax-return-wisconsin_big.png

Sales And Use Tax Return Form St John The Baptist Parish Printable

https://data.formsbank.com/pdf_docs_html/265/2655/265581/page_1_bg.png

Wisconsin Tax Exemption Form

https://i2.wp.com/data.formsbank.com/pdf_docs_html/139/1390/139070/page_1_thumb_big.png

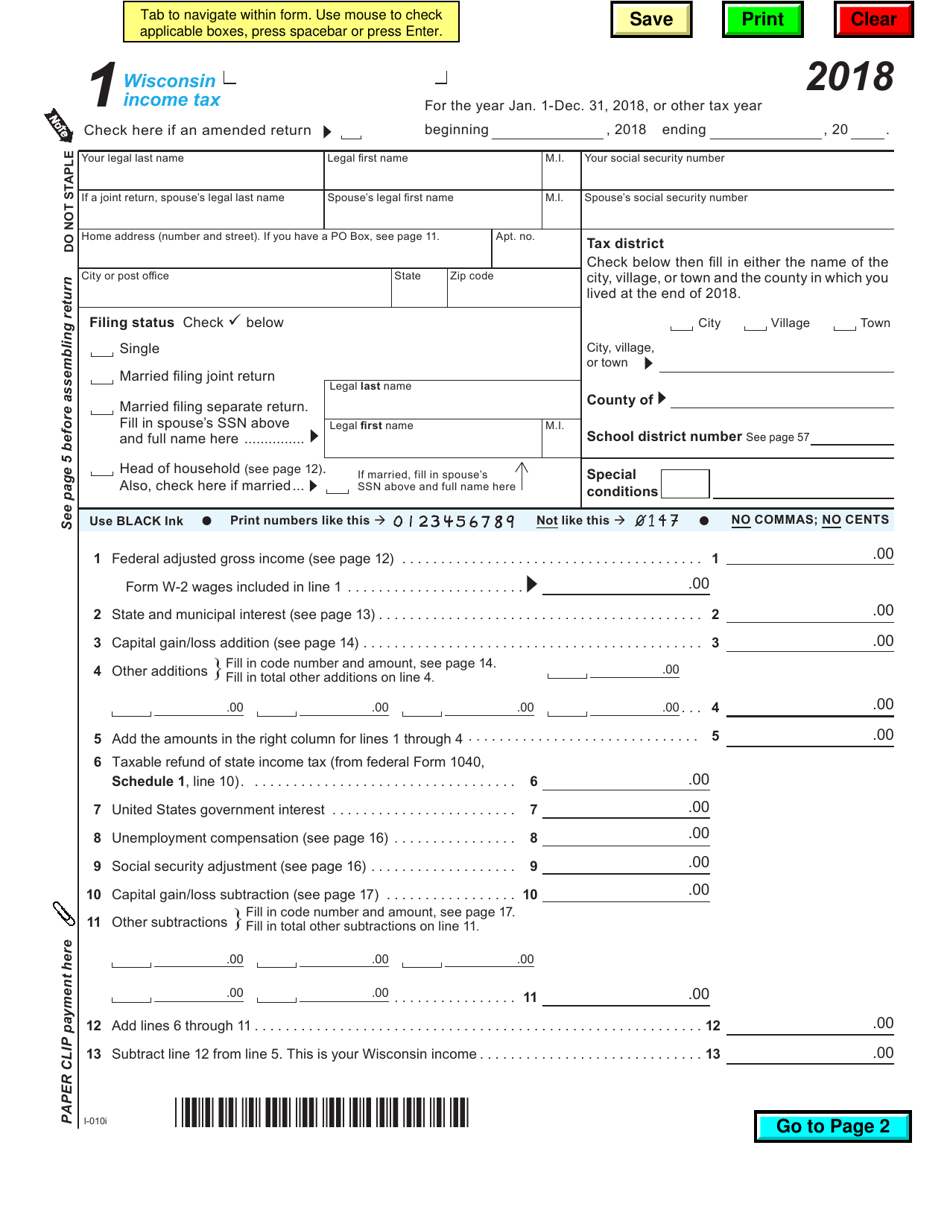

Web 1 janv 2021 nbsp 0183 32 Sales Telefile Telefile Sales and Use Tax returns Sales and Use Tax dorsales Sign up now to be provided with electronic communication from DOR on Web Sales and Use Tax Information Includes information regarding 5 state sales and use tax 0 5 county sales and use tax 0 1 baseball stadium sales and use tax

Web The seller should be familiar with the various exemption requirements and the instructions for using this certificate For more information about exemptions see Form S 211 S Web Wisconsin imposes a 5 tax on the sale or use of most tangible personal property and on selected services The tax is imposed on retailers for the privilege of selling leasing or

Wisconsin Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/463/853/463853672/large.png

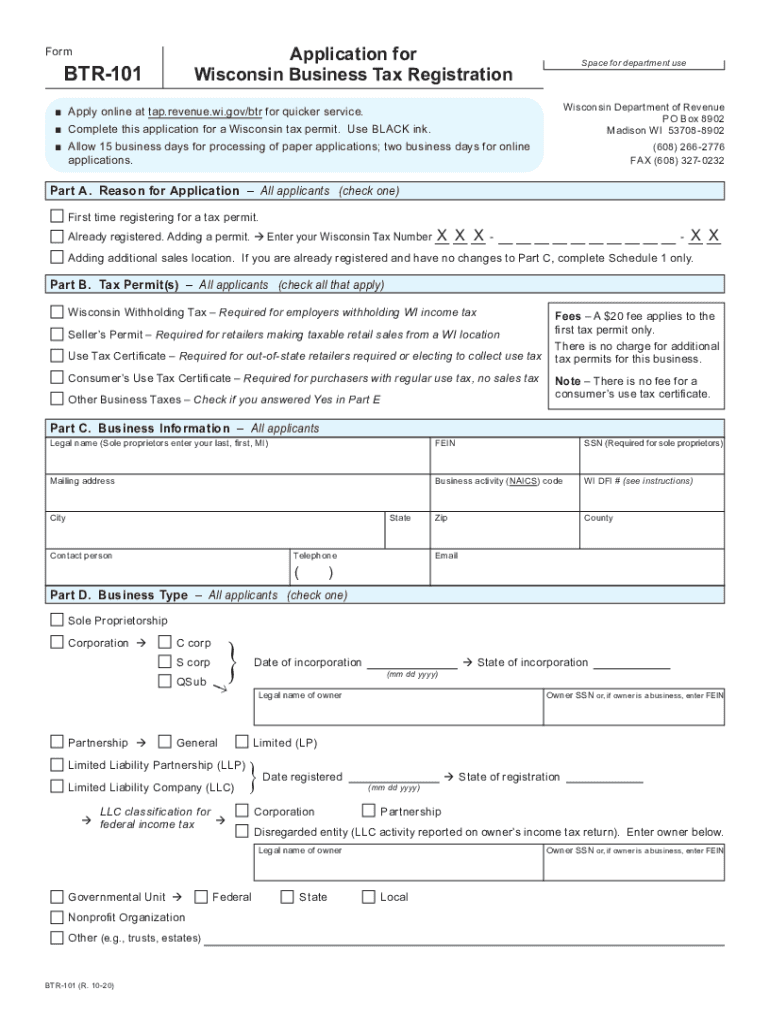

Wisconsin Form Btr 101 Fillable Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/536/40/536040017/large.png

https://www.revenue.wi.gov/Pages/FAQS/pcs-sales.aspx

Web Seller s Claim for Refund for refund of tax reported on your Sales and Use Tax Return Amend Sales and Use Tax Return electronically using My Tax Account If you have

https://www.revenue.wi.gov/Pages/faqs/pcs-topics.aspx

Web 20 f 233 vr 2021 nbsp 0183 32 As a result a remote seller is only required to collect and remit sales or use tax if its gross sales into Wisconsin exceed 100 000 in the previous or current year

W9 Tax Exemption Certificate Sun Prairie WI Official Website

Wisconsin Tax Exempt Form Fill Out Sign Online DocHub

Wi Sales Tax Exemption Form Kneelpost

Form S 211 Fill Out Sign Online And Download Printable PDF

Wi Sales And Use Tax Exemption Certificate

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

Sales And Use Tax Return Form St John The Baptist Parish Printable

St 12 Fillable Form Printable Forms Free Online

Fillable Wisconsin Form 1 Printable Forms Free Online

Wi Sales And Use Tax Rebates - Web 28 sept 2022 nbsp 0183 32 Report fraud Wisconsin has a variety of tax deductions exclusions exemptions and credits available to Wisconsin businesses Our Interactive Tax Incentive