Wi Tax Credit For Child Verkko In Wisconsin this year s historic Child Tax Credit is estimated to benefit 651 000 families with 1 127 000 children 1 Thanks to the ARP the vast majority of families in

Verkko The Child Tax Credit CTC is available to families with a qualifying child Working families may be eligible for up to the maximum federal tax credit of 3 000 per Verkko The Wisconsin earned income credit is a special tax benefit for certain working families with at least one qualifying child The earned income credit is refundable This means

Wi Tax Credit For Child

Wi Tax Credit For Child

https://media.9news.com/assets/KUSA/images/6401c0ff-2eae-43ab-87f9-5318969aa0f5/6401c0ff-2eae-43ab-87f9-5318969aa0f5_1920x1080.jpg

2021 Child Tax Credit And Payments What Your Family Needs To Know

https://static.twentyoverten.com/5d5413591d304774fba39eb3/2EZZeQmAbBT/2021-Child-Tax-Credit-Examples.jpg

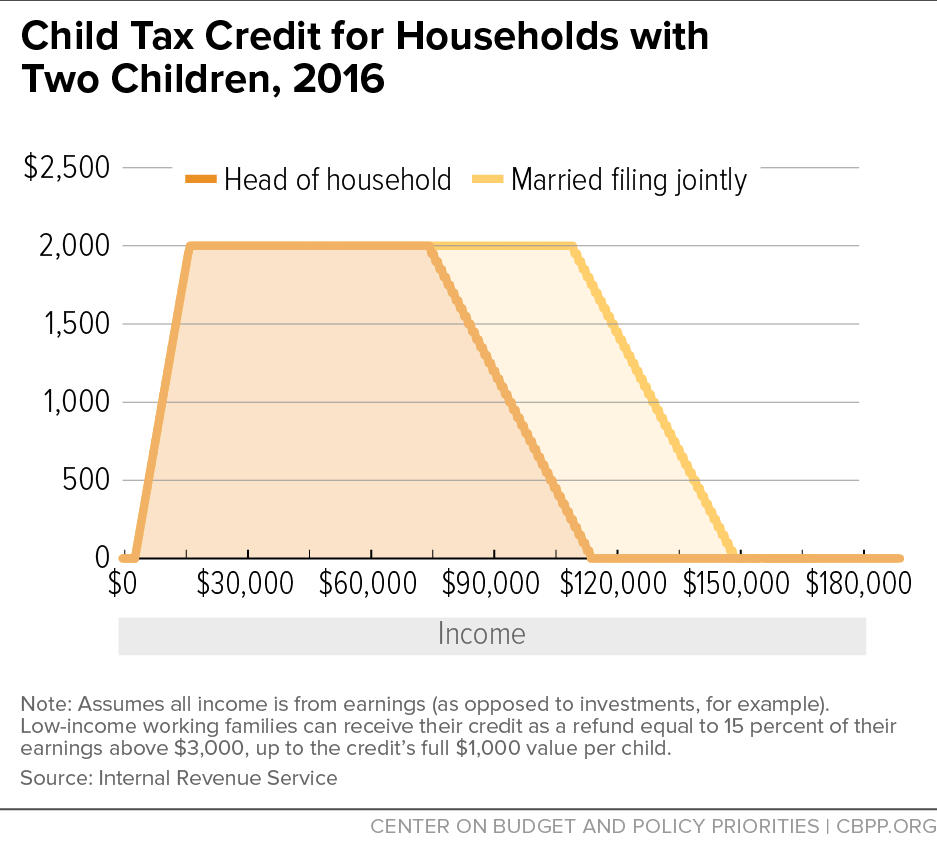

Child Tax Credit For Households With Two Children 2016 Center On

http://www.cbpp.org/sites/default/files/atoms/files/5-24-16tax-f2.png

Verkko WTB 214 Wisconsin Tax Bulletin July 2021 July 2021 Number 214 If you would like to receive notification when a new Wisconsin Tax Bulletin is available subscribe to the Verkko 23 helmik 2022 nbsp 0183 32 Under regular tax law the lowest income earning families are not eligible to receive the full tax refund The enhanced child tax credit guaranteed the full amount per child regardless of income

Verkko Wisconsin Shares Program BACKGROUND On March 11 2021 President Biden signed into law the American Rescue Plan Act of 2021 ARPA Section 9611 of the Verkko Additional Child and Dependent Care Tax Credit New for tax year 2022 this credit is for taxpayers claiming the Child and Dependent Care Tax Credit on their federal

Download Wi Tax Credit For Child

More picture related to Wi Tax Credit For Child

2023 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

What To Know About The New Monthly Child Tax Credit Payments

https://www.pgpf.org/sites/default/files/child-tax-credit-2021-chart.jpg

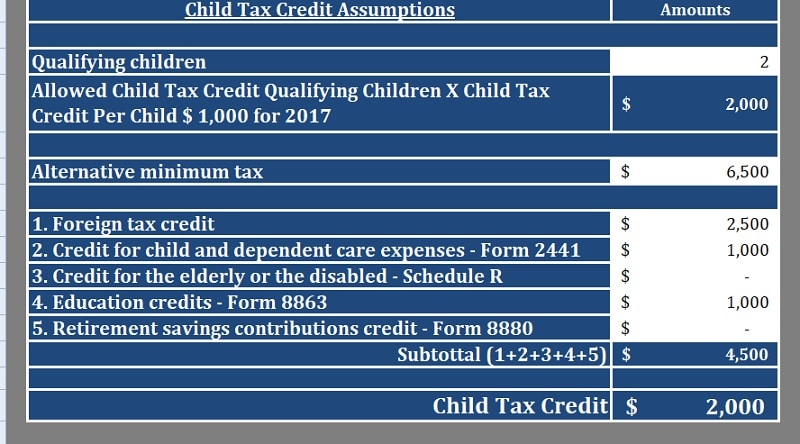

Download Child Tax Credit Calculator Excel Template ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/12/Child-Tax-Credit-Assumptions-CTCC.jpg

Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 People with kids under the age of 17 may be eligible to claim a tax credit of up to 2 000 per qualifying dependent For 2023 1 600 of the credit is potentially refundable We ll cover Verkko Wisconsin EIC The amount is a percentage of the federal amount totaling 4 with 1 qualifying child maximum credit 110 11 with 2 children maximum credit 635 or 34 with 3 or more children

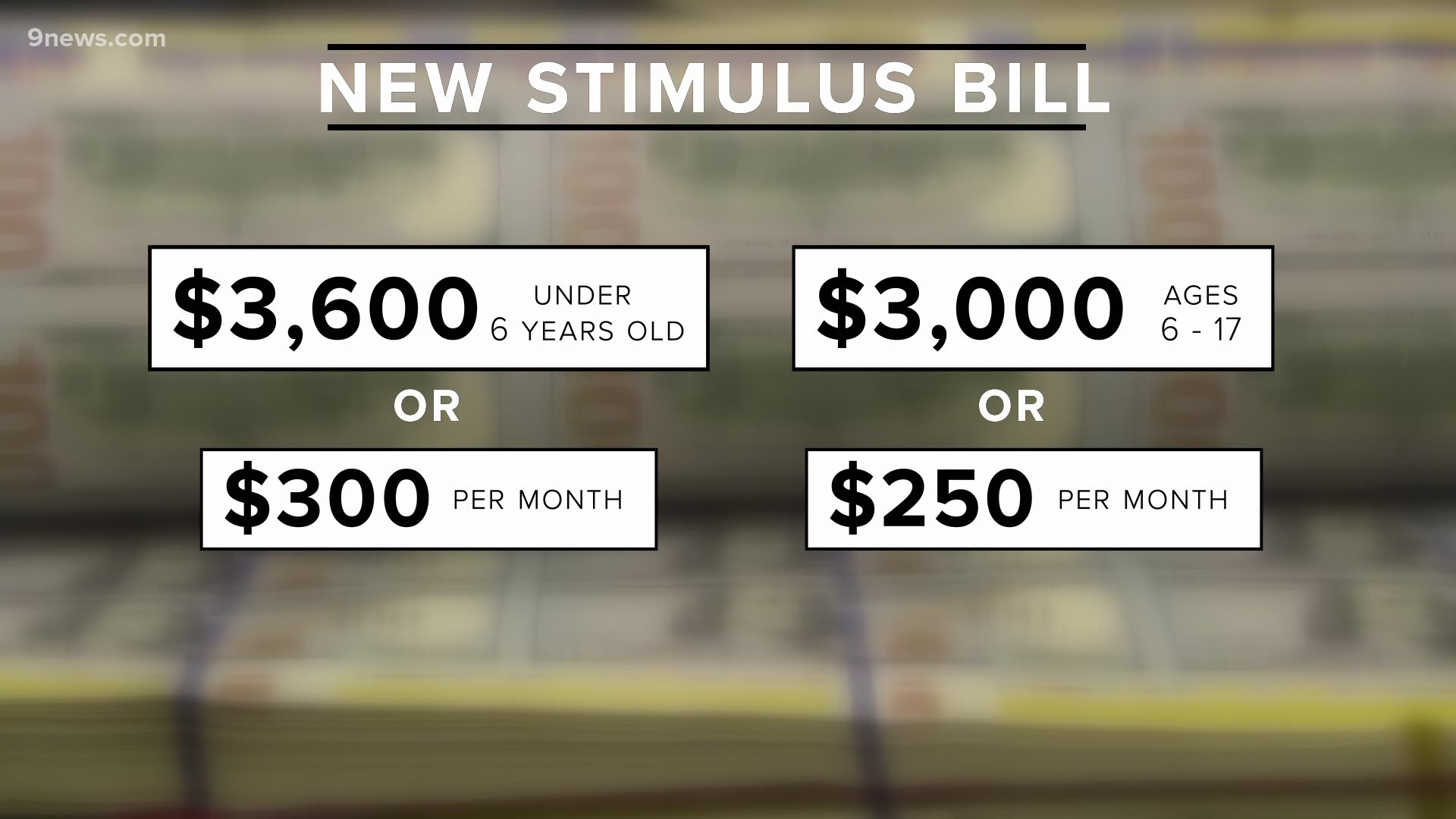

Verkko 4 of the federal EITC for workers with one qualifying child 11 of the federal EITC for workers with two qualifying children 34 of the federal EITC for workers with three Verkko 15 hein 228 k 2021 nbsp 0183 32 That will send families up to 250 a month for every child between 6 and 17 years old and up to 300 a month for kids under 6 For roughly 39 million

Child Tax Credit 2024 Changes Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/19/100019284/big.png

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/atoms/files/5-24-16tax-f1.png?itok=n314SgkK

https://www.whitehouse.gov/.../03/Wisconsin-Tax-Credit-…

Verkko In Wisconsin this year s historic Child Tax Credit is estimated to benefit 651 000 families with 1 127 000 children 1 Thanks to the ARP the vast majority of families in

https://dcf.wisconsin.gov/w2/parents/supportive-services/tax-credits

Verkko The Child Tax Credit CTC is available to families with a qualifying child Working families may be eligible for up to the maximum federal tax credit of 3 000 per

Form 8812 Additional Child Tax Credit Printable Pdf Download

Child Tax Credit 2024 Changes Fill Online Printable Fillable Blank

Child Care Tax Savings 2021 Curious And Calculated

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Child Tax Credit 2021 Monthly Payment Calculator Storage Unit Size

Child Tax Credit 2019 Chart What Is The Earned Income Tax Credit

Child Tax Credit 2019 Chart What Is The Earned Income Tax Credit

Child Tax Credit 2021 Chart Child Tax Credit 2020 2021 How To

Form 8812 Additional Child Tax Credit

Hoosiers Hopeful After IRS Announces Monthly Child Tax Credit Payments

Wi Tax Credit For Child - Verkko 21 helmik 2023 nbsp 0183 32 Child and dependent care tax credit Increasing Wisconsin s child and dependent care tax credit currently 50 of the federal credit to 100 of the