Will Redundancy Payment Affect Tax Credits You must report that you have lost your job and declare any redundancy pay you get if you re getting tax credits Universal Credit other benefits Debt budgeting and money advice

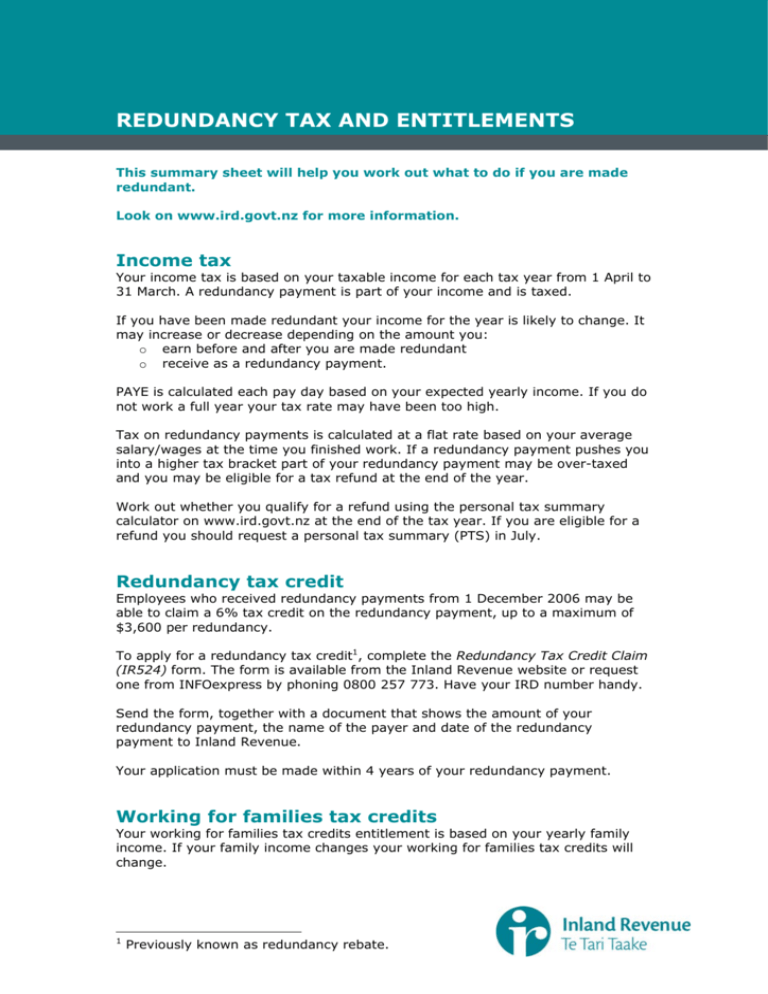

The first 30 000 of any redundancy payment you receive is disregarded by Tax Credits For most people getting a redundancy payment will not affect your entitlement If you ve recently lost your job or been made redundant you might be able to claim back some of the tax you paid while you were working This is known as getting a tax refund or tax rebate

Will Redundancy Payment Affect Tax Credits

Will Redundancy Payment Affect Tax Credits

https://assurancehr.com.au/wp-content/uploads/2022/04/Redundancy-concept.jpg

What Is Redundancy Payment Redundancy Claims UK

https://www.redundancyclaim.co.uk/images/inline/1024x576/faqs/article-12-banner.jpg

How Will Redundancy Affect You Corporate Finance Detective

https://corporate.financedetective.com.au/wp-content/uploads/sites/2/2016/01/shutterstock_4330825-624x433.jpg

Working Tax Credit will continue for 4 weeks after you finish work unless you apply for Universal Credit For most people tax credits have been replaced by Universal Credit This means that you may not be able to make a new claim for tax credits when you get a Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

The first 30 000 of any redundancy pay is tax free This amount includes any non cash benefits that form part of your redundancy package such as a company car or computer When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each year

Download Will Redundancy Payment Affect Tax Credits

More picture related to Will Redundancy Payment Affect Tax Credits

How Is A Redundancy Payment Taxed Wingate Financial Planning

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

How Much Are You Entitled As Redundancy Pay Know Your Eligibility In UK

https://cdn.papershift.com/20221019210850/redundancy-pay-for-the-employees-in-UK-and-its-legal-obligations-explained-by-Papershift.jpeg

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

If you are an existing tax credits claimant you must inform HMRC if you are made redundant and stop working enough hours to qualify for working tax credit You may qualify for a four week run on of working tax credit Your total redundancy pay both statutory and contractual may be tax free up to a maximum amount of 30 000 Given statutory redundancy pay is capped at 19 290 you won t pay any tax if you just receive the legal minimum

Whether it s statutory or contractual redundancy pay the first 30 000 you receive is tax free and no national insurance contributions are deducted either Do check you don t find yourself paying these as some smaller companies without a human resources department might not know the rules For any redundancy pay over 30 000 your employer will usually take the tax at your normal tax rate If your employer pays you your final pay after you leave your job they ll take the tax from your redundancy pay at the basic rate of 20

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

https://www.gov.uk/guidance/redundancy-help...

You must report that you have lost your job and declare any redundancy pay you get if you re getting tax credits Universal Credit other benefits Debt budgeting and money advice

https://workingfamilies.org.uk/articles/benefits...

The first 30 000 of any redundancy payment you receive is disregarded by Tax Credits For most people getting a redundancy payment will not affect your entitlement

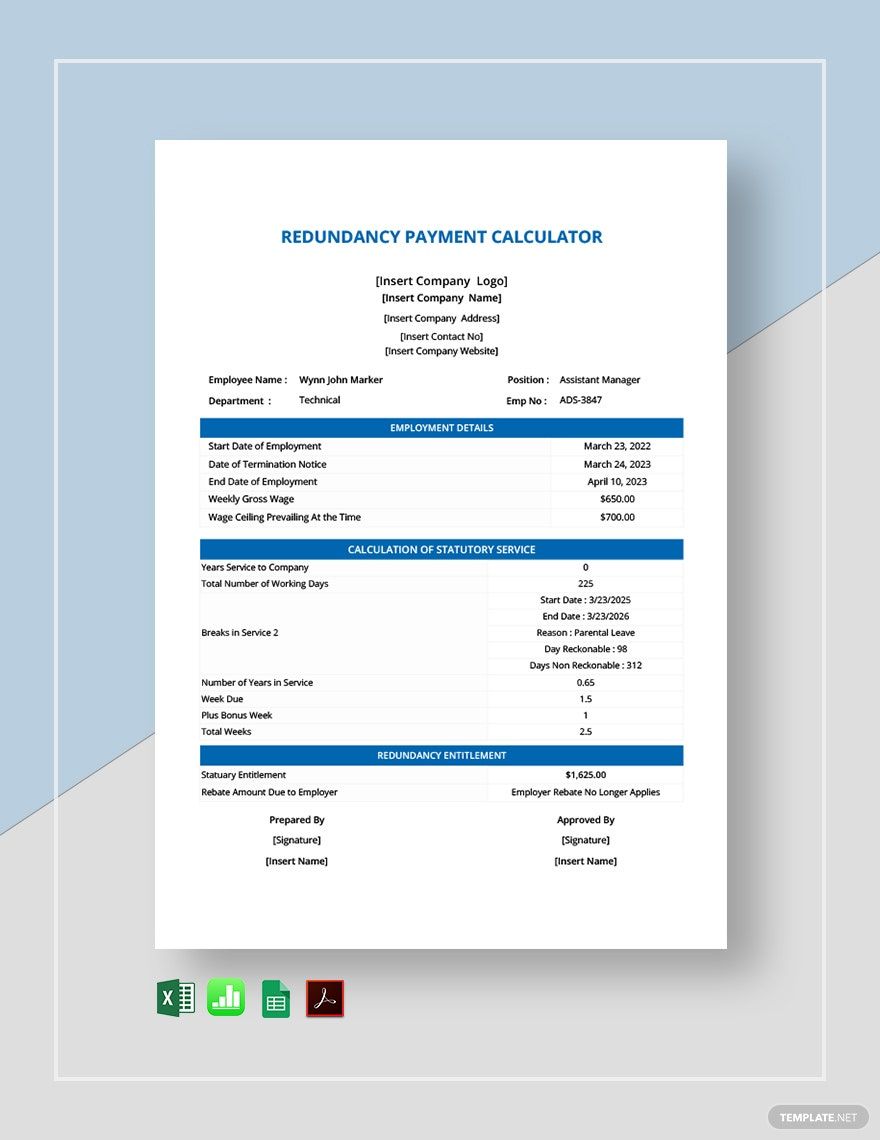

Redundancy Payment Calculator Template In Google Docs Excel Google

HOW REDUNDANCY PAYMENTS ARE TAXED

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

What Is Late Payment How Does A Late Payment Affect Your Credit

Most Important Factors That Affect Your Tax Credits

A Guide To Statutory Redundancy Payments Cashfloat

A Guide To Statutory Redundancy Payments Cashfloat

Royal Mail Voluntary Redundancy Calculator CALCULATORUK HJW

What Tax Do I Pay On Redundancy Payments CruseBurke

The Redundancy Payments Service

Will Redundancy Payment Affect Tax Credits - Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be taxed in the same way as regular income