Will Social Security Tax Be Refunded Do You Get Social Security and Medicare Tax Back Explore the nuances of reclaiming Social Security and Medicare taxes including exceptions and refund processes for

No you don t get the Social Security or Medicare taxes refunded Those are owed starting from the first dollar you earn The standard deduction of 12 950 only applies to income for federal Yes you can get a refund when too much Social Security tax is withheld from you The procedure depends on whether the excess withholdings were caused by multiple employers exceeding

Will Social Security Tax Be Refunded

Will Social Security Tax Be Refunded

https://img.money.com/2023/07/News-Missouri-Nixes-Social-Security-Tax.jpg?quality=85

Proposed Law Would Increase The Social Security Taxable Wage Base

https://www.clevelandgroup.net/wp-content/uploads/2022/07/SS-Blog.jpg

WHAT TO KNOW Social Security Tax Refunds In 2023 WHY TO FILE YouTube

https://i.ytimg.com/vi/p4vDWdgVhEM/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYUyBNKGUwDw==&rs=AOn4CLCOFPjDjqGvlpYHPzRlH6OEwkExAg

A 2024 report from the bipartisan Committee for a Responsible Federal Budget CRFB warns that eliminating taxes on Social Security benefits would dramatically worsen the program s You might overpay Social Security and Medicare taxes for a number of reasons Some workers are exempt from paying these taxes The government will give the money back to you if this happens either as a refund

Kevin Thompson a finance expert and the founder and CEO of 9i Capital Group told Newsweek Since Social Security is a significant part of mandatory spending and the Nearly everyone who earns income from work has to pay Social Security payroll taxes As much as most people would like not to have to have these taxes withheld from their paychecks there

Download Will Social Security Tax Be Refunded

More picture related to Will Social Security Tax Be Refunded

States That May Cut Taxes On Social Security Income SSI Texas

https://texasbreaking.com/wp-content/uploads/2023/02/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

Social Security Tax Unfair And Impractical

https://s.hdnux.com/photos/17/75/51/4184660/8/rawImage.jpg

Deferred Social Security Tax Payments Due By Jan 3 2022 CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/12/social_secruity_admin_1_.61ca6c0f9a855.png

If you work for an employer you and your employer each pay a 6 2 Social Security tax on up to 160 200 of your earnings Each must also pay a 1 45 Medicare tax on all earnings If And a 2015 Social Security Administration analysis projected over 56 percent of beneficiary families will be subject to income tax on their Social Security benefits by 2050

Congressman Thomas Massie R KY reintroduced legislation last week that would eliminate income taxes on Social Security benefits According to a press statement from When you file your taxes any excess Social Security tax paid is credited back to you either by increasing your federal tax refund or decreasing the amount you owe

Social Security GuangGurpage

https://static01.nyt.com/images/2022/10/16/business/16Strategies-illo/16Strategies-illo-superJumbo.jpg

Social Security Basics MCF

https://static.twentyoverten.com/5a2960f547c4357916a4f2d5/JTO5xN96HB/Social-Security-infographic.jpeg

https://accountinginsights.org › do-you-get-social...

Do You Get Social Security and Medicare Tax Back Explore the nuances of reclaiming Social Security and Medicare taxes including exceptions and refund processes for

https://www.reddit.com › tax › comments › do_i...

No you don t get the Social Security or Medicare taxes refunded Those are owed starting from the first dollar you earn The standard deduction of 12 950 only applies to income for federal

Social Security Income Penalties Are Refunded To You When You Reach

Social Security GuangGurpage

What Is Social Security Tax And How Much Is It TheStreet

Tax 3361 Individual Income Taxes Tax Return Project Chegg

Collection Of 2020 Social Security Tax Deferral 157th Air Refueling

Social Security Who Is Exempt From Paying SS Tax Lifestyle UG

Social Security Who Is Exempt From Paying SS Tax Lifestyle UG

Social Security Tax What Employers Need To Know

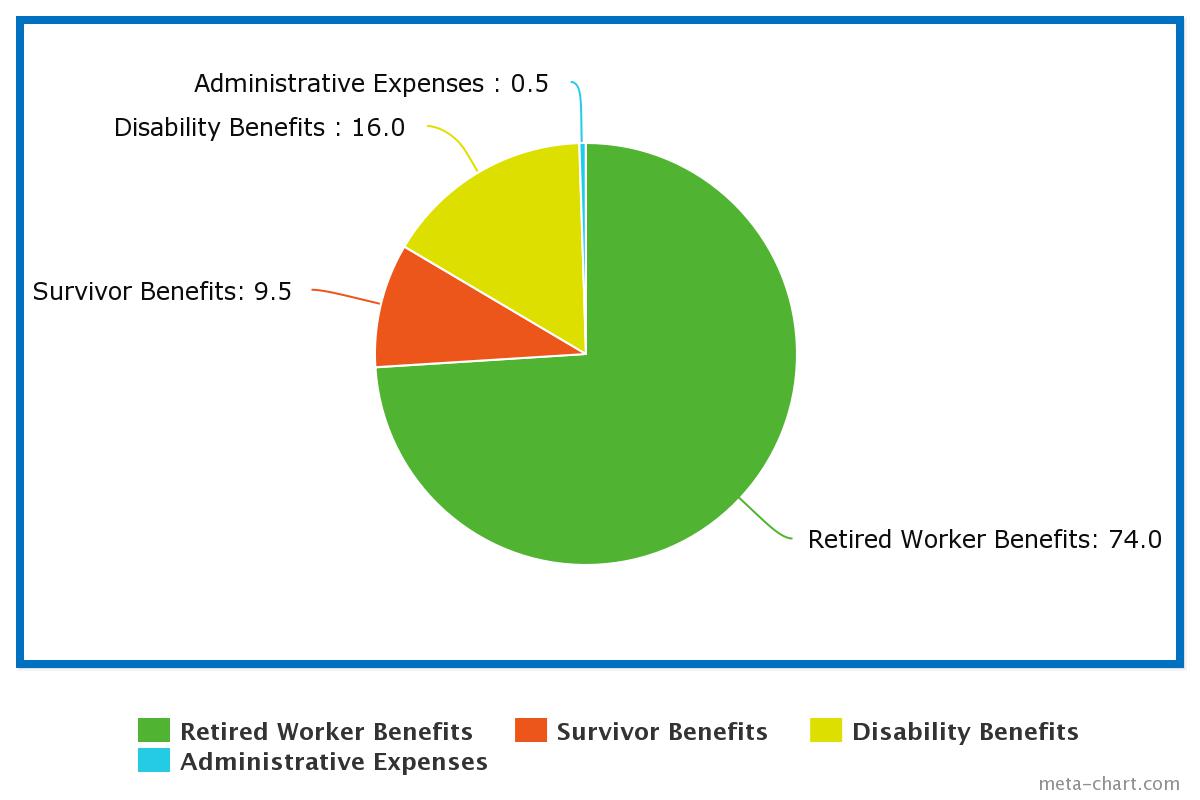

Where Do Your Social Security Tax Dollars Go Open Retirement Open

Social Security Tax How To Reduce Or Eliminate Tax On Social Security

Will Social Security Tax Be Refunded - While Social Security benefits typically aren t taxed if they re the sole income source there are still avenues for tax refunds through refundable credits and deductions