Wisconsin Child Tax Credit Rebate Status Web 3 avr 2022 nbsp 0183 32 MILWAUKEE WI Parents across America including in Wisconsin may

Web The current subtraction for child and dependent care expenses is no longer available for Web 3 avr 2022 nbsp 0183 32 Many Wisconsin parents who got child tax credit payments in 2021 may

Wisconsin Child Tax Credit Rebate Status

/cloudfront-us-east-1.images.arcpublishing.com/gray/WD3F6SWAPRMQPAIIILH7MU4KYM.png)

Wisconsin Child Tax Credit Rebate Status

https://gray-wmtv-prod.cdn.arcpublishing.com/resizer/L4mGjvZBM1pqH53KwhUMLPLcqtw=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/WD3F6SWAPRMQPAIIILH7MU4KYM.png

Analysts Wisconsin Child Tax Rebate Helps But Permanent Reform Better

https://bloximages.newyork1.vip.townnews.com/thecentersquare.com/content/tncms/assets/v3/editorial/e/9b/e9beed78-2230-11e8-af69-0f5e167008c2/5aa02825f1498.image.jpg?resize=1200%2C800

Wisconsin Child Tax Rebate Proving To Be Popular WXPR

https://npr.brightspotcdn.com/dims4/default/eb020f0/2147483647/strip/true/crop/275x144+0+19/resize/1200x630!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Flegacy%2Fsites%2Fwxpr%2Ffiles%2F201805%2Fmoney_moo.jpg

Web You can check the status of your payments with the IRS For Child Tax Credit monthly Web Child Care Tax Credits Information for Parents Wisconsin Department of Children

Web 1 mars 2022 nbsp 0183 32 The repayment protection will be completely phased out when that parent s Web 28 janv 2022 nbsp 0183 32 The plan also includes doubling the state s child care tax credit and a new tax credit for the expenses borne by family caregivers for elderly or disabled people Combined the tax credits would be valued

Download Wisconsin Child Tax Credit Rebate Status

More picture related to Wisconsin Child Tax Credit Rebate Status

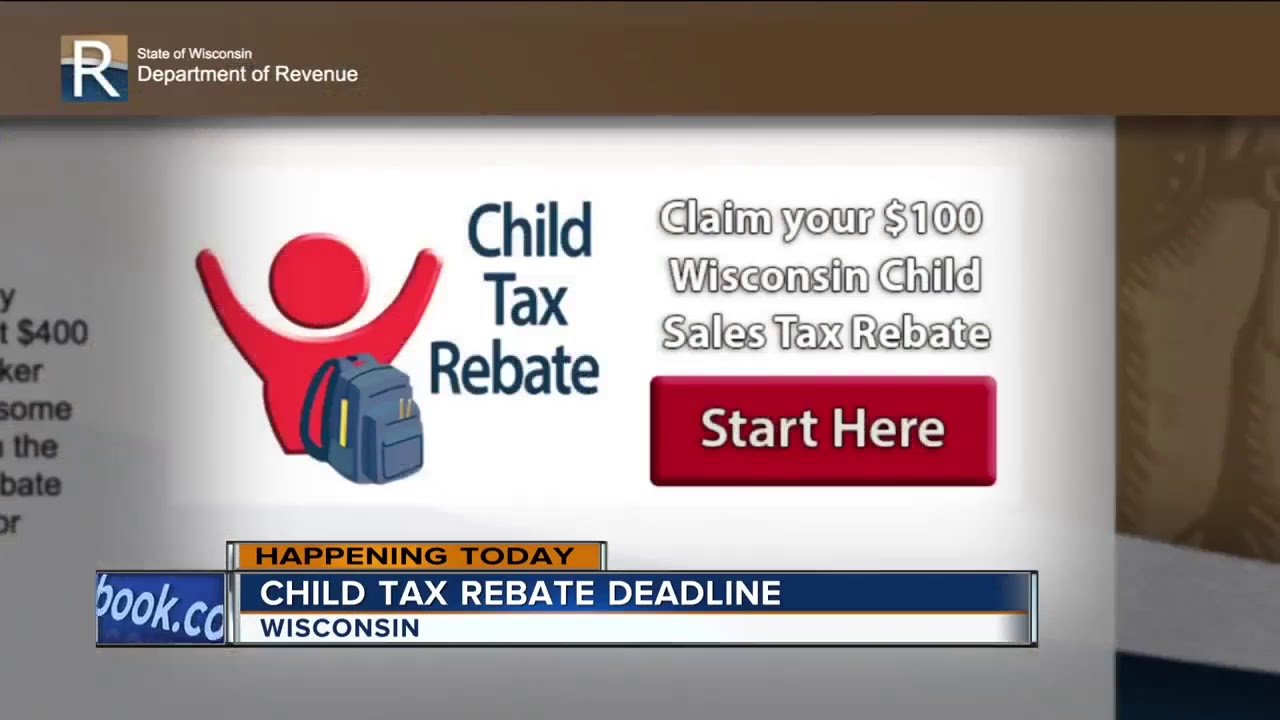

Wisconsin Parents Want Your 100 Child Tax Rebate Today Is The LAST

https://i.ytimg.com/vi/f1FHUxMqmdM/maxresdefault.jpg

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Loading

https://fox47.com/resources/media2/16x9/full/1024/center/80/cb7c2645-4974-4715-af8a-bc8432e275ac-large16x9_Taxestaxforms.jpg

Web Section 9611 of the ARPA increased the federal Child tax credit for families with children Web The Child Tax Credit CTC is available to families with a qualifying child Working

Web New in 2022 Additional Child and Dependent Care Tax Credit A new credit is Web 14 mai 2018 nbsp 0183 32 Tuesday Wisconsin residents with children under the age of 18 can apply

Meet A Wisconsin Mom Waiting On Nearly 6 000 The IRS Owes From Her

https://s.yimg.com/ny/api/res/1.2/hFLRYmMZH4bQNarhkuo08w--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD05MDA-/https://media.zenfs.com/en/insider_articles_922/6add54dc292dcae72ae4ec962782e6d1

Still Haven t Received My Tax Refund 2022 TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/amended-refund-completed-still-havent-received-it-it-says-completed.jpeg

/cloudfront-us-east-1.images.arcpublishing.com/gray/WD3F6SWAPRMQPAIIILH7MU4KYM.png?w=186)

https://news.yahoo.com/2022-tax-refund-child-tax-160529061.html

Web 3 avr 2022 nbsp 0183 32 MILWAUKEE WI Parents across America including in Wisconsin may

https://www.revenue.wi.gov/WisconsinTaxBulletin/214-07-2…

Web The current subtraction for child and dependent care expenses is no longer available for

2018 Guide To Wisconsin Home Solar Incentives Rebates And Tax Credits

Meet A Wisconsin Mom Waiting On Nearly 6 000 The IRS Owes From Her

Child Tax Credit 2019 What Is The Child Tax Credit CTC Tax

Wisconsin Residents Claim Your 100 Sales Tax Credit NOW

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

IRS Sent Out Over 1 Billion In Child Tax Credit Payments To The Wrong

IRS Sent Out Over 1 Billion In Child Tax Credit Payments To The Wrong

Wisconsin Child Tax Credit Available Project Captures Oral Histories

10 2019 Child Tax Credit Worksheet

/cloudfront-us-east-1.images.arcpublishing.com/gray/POPXNPLVGVH6RB6S2K5SW2CPRE.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

Wisconsin Child Tax Credit Rebate Status - Web 28 janv 2022 nbsp 0183 32 The plan also includes doubling the state s child care tax credit and a new tax credit for the expenses borne by family caregivers for elderly or disabled people Combined the tax credits would be valued