Wisconsin Tax Rebate 2024 Electronic filing for Wisconsin individual income tax returns and homestead credit claims will be available on January 29 2024 when the IRS begins accepting electronically filed returns Links to electronic forms will not be active until filing opens Individual Income Tax News Subscribe to E News Calendar

January 26 2024 FOR IMMEDIATE RELEASE CONTACT Patty Mayers 608 266 2300 DORCommunications wisconsin gov Individual income tax season begins January 29 Wisconsin DOR launches free WisTax e filing system joins IRS Free File program MADISON The individual income tax filing season begins on Monday January 29 2024 and the Wisconsin Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

Wisconsin Tax Rebate 2024

Wisconsin Tax Rebate 2024

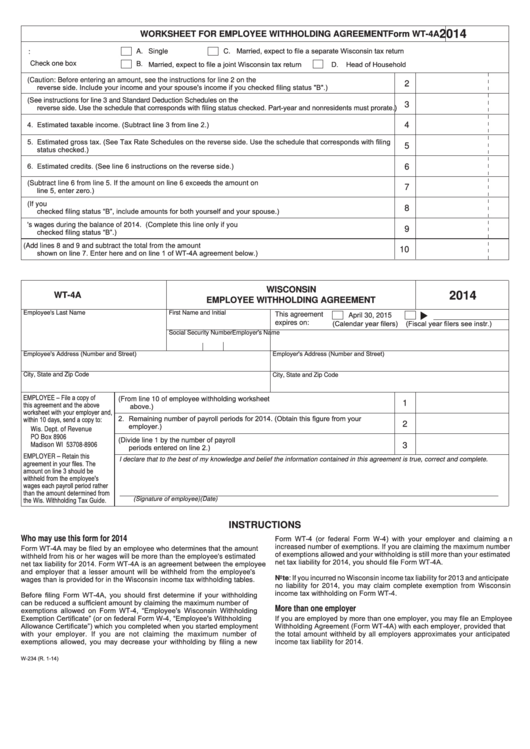

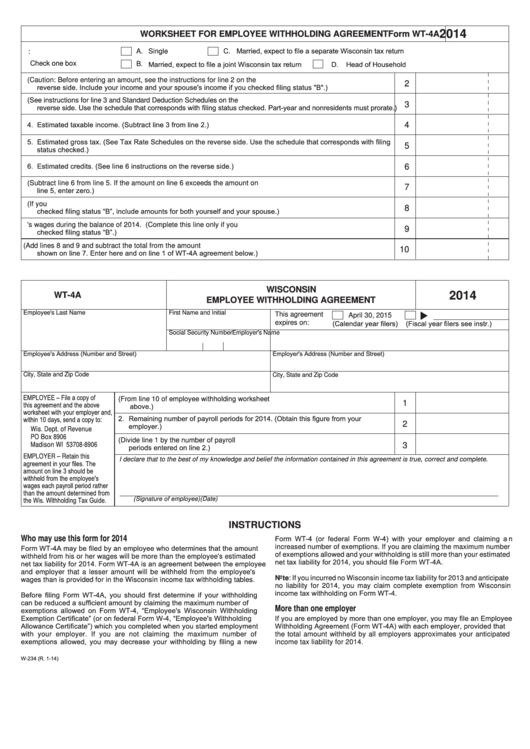

https://www.employeeform.net/wp-content/uploads/2023/01/form-wt-4a-wisconsin-employee-withholding-agreement-printable-pdf-download.png

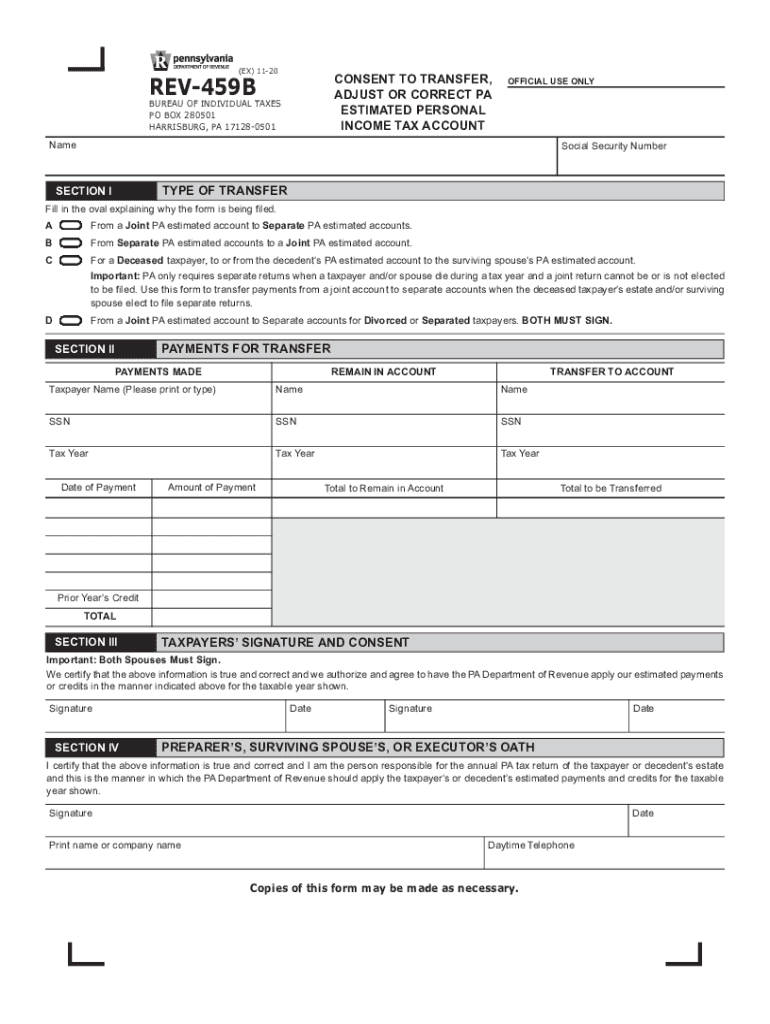

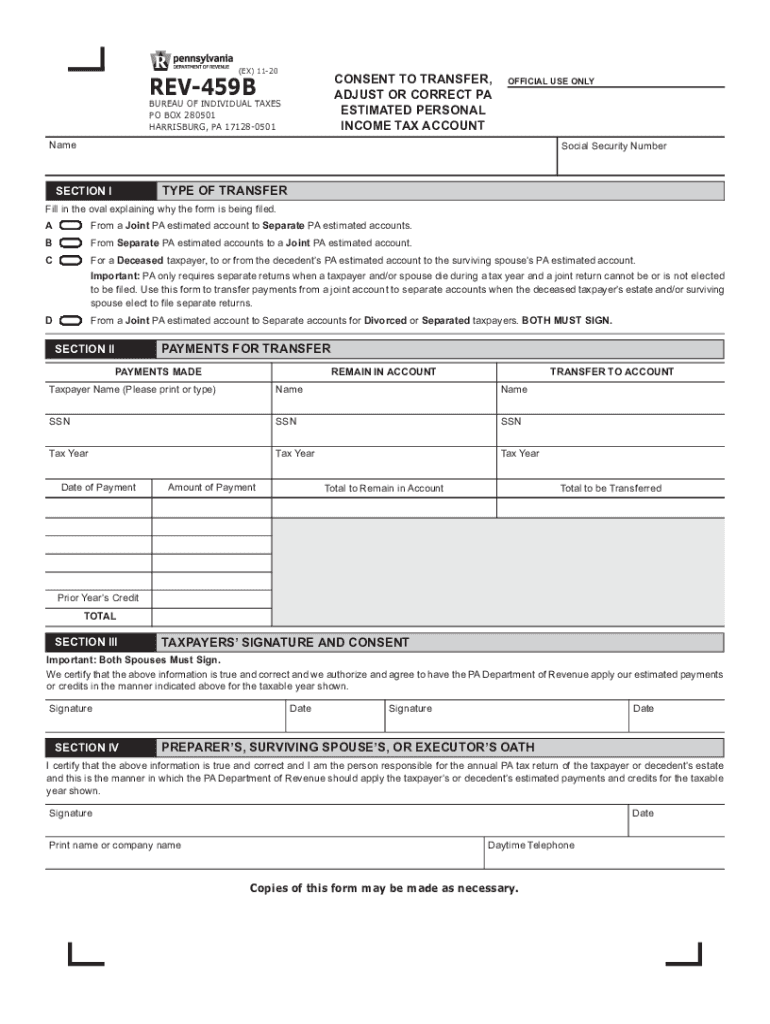

2023 Pa Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/563/640/563640699/large.png

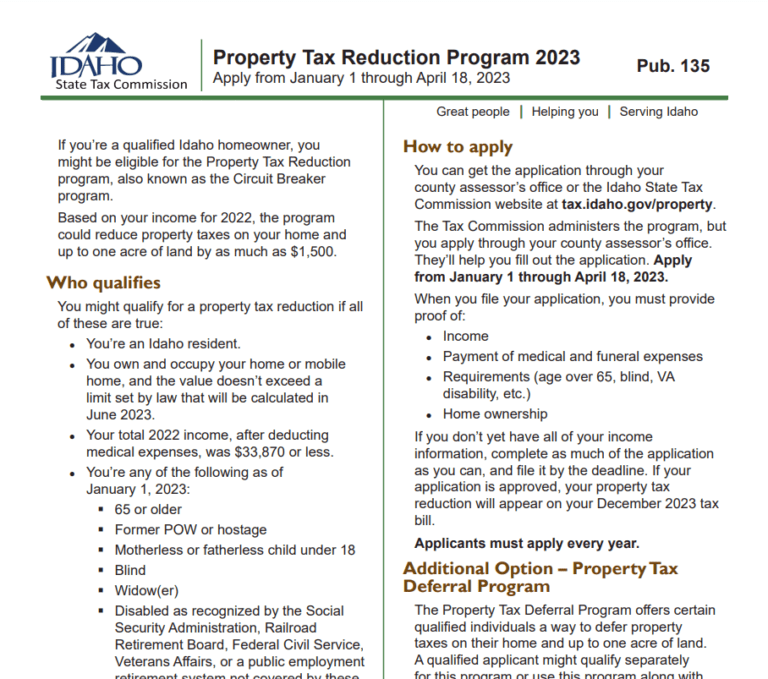

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your spouse if married have earned income during the year You or your spouse if married are disabled Get more information on Homestead Credit qualifications Watch our About the Wisconsin Homestead Credit video

Income tax 3 5 percent to 7 65 percent Wisconsin has four state income tax brackets ranging from 3 5 percent to 7 65 percent Most people are taxed at the second highest rate and pay a top income tax rate of 5 3 percent Property tax 1 61 percent of a home s assessed value average Right now single filers who make between 14 320 and 28 640 and married joint filers who make between 19 090 to 38 190 fall in the second bracket That means they face a 4 4 tax rate Singles

Download Wisconsin Tax Rebate 2024

More picture related to Wisconsin Tax Rebate 2024

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

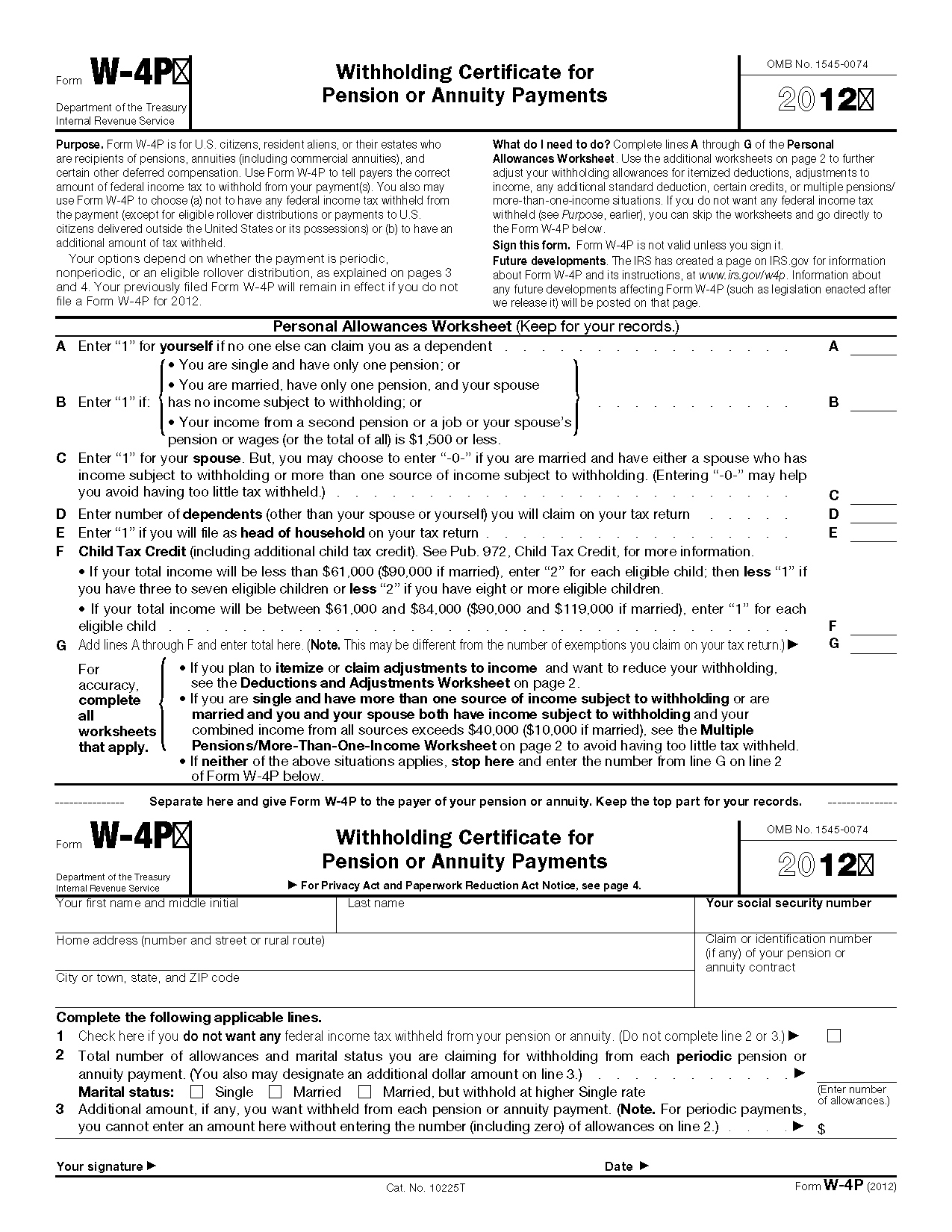

Wisconsin State Tax Forms Printable Printable Forms Free Online

https://w4formsprintable.com/wp-content/uploads/2021/07/wisconsin-w-4-form-printable-w4-2020-form-printable.jpg

Wisconsin Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/434/242/434242948/large.png

You can check the status of your Wisconsin tax refund on the Wisconsin Department of Revenue website by email via this form or by telephone 608 266 8100 in Madison 414 227 4907 in Milwaukee The federal federal allowance for Over 65 years of age Single Filer in 2024 is 1 550 00 Federal Married Joint Filer Tax Tables The federal standard deduction for a Married Joint Filer in 2024 is 29 200 00 The federal federal allowance for Over 65 years of age Married Joint Filer in 2024 is 1 550 00

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts There are 1371 days left until Tax Day on April 16th 2020 The IRS will start accepting eFiled tax returns in January 2020 you can start your online tax return today for free with TurboTax Compare the state income tax rates in Wisconsin with the income tax rates in 4 Wisconsin Tax Deductions

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

https://www.revenue.wi.gov/Pages/WisTax/home.aspx

Electronic filing for Wisconsin individual income tax returns and homestead credit claims will be available on January 29 2024 when the IRS begins accepting electronically filed returns Links to electronic forms will not be active until filing opens Individual Income Tax News Subscribe to E News Calendar

https://www.revenue.wi.gov/Pages/News/2024/2024TaxSeasonOpen.pdf

January 26 2024 FOR IMMEDIATE RELEASE CONTACT Patty Mayers 608 266 2300 DORCommunications wisconsin gov Individual income tax season begins January 29 Wisconsin DOR launches free WisTax e filing system joins IRS Free File program MADISON The individual income tax filing season begins on Monday January 29 2024 and the Wisconsin

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

Income Tax Rebate Under Section 87A

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

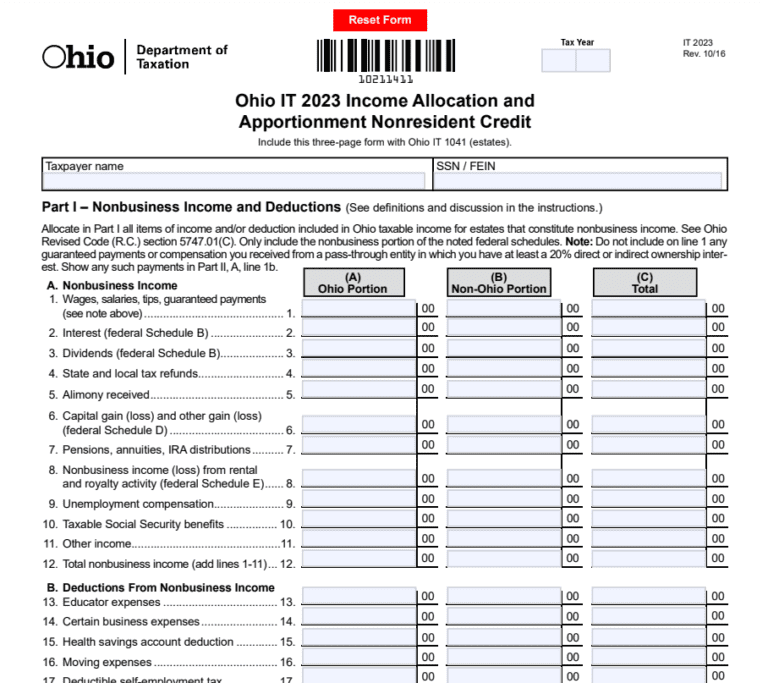

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Wisconsin Tax Rebate 2024 - In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your spouse if married have earned income during the year You or your spouse if married are disabled Get more information on Homestead Credit qualifications Watch our About the Wisconsin Homestead Credit video