Withholding Tax Italy Calculator Easy to use salary calculator for computing your net income in Italy after Income Tax and Social Security contributions have been deducted

Corporate Withholding taxes A 26 base standard withholding tax WHT rate applies on the yields on loans and securities bonds shares etc paid by Italian IRPEF Calculator calculate your net pay from a gross amount Self Employed Reckoner gross up calculator Find the gross amount you need to ask to

Withholding Tax Italy Calculator

Withholding Tax Italy Calculator

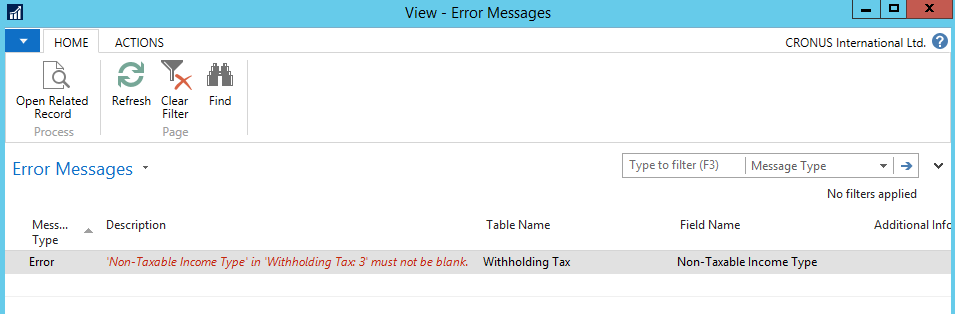

https://learn.microsoft.com/en-us/dynamics/s-e/images/viewerrorsmessagesimage.png

Italy Spanish Funds Exempt From Withholding Tax KPMG United States

https://assets.kpmg/is/image/kpmg/rome-piazza-navona-pavement-cafes-restaurants:cq5dam.web.1200.630

Important Tax Benefits To Know Before Renovating In Italy

https://www.italyirl.com/wp-content/uploads/2023/03/TaxBenefits.jpg

Calculate your income tax in Italy and salary deduction in Italy to calculate and compare salary after tax for income in Italy in the 2024 tax year Personal income tax rates and calculation Latest update 23 01 2024 Personal income tax applies to an individual s total income Gross tax is calculated by

The Italian income tax calculator is designed to serve a wide range of individual taxpayers in Italy Whether you are a salaried employee a freelancer or a small business owner Use our Italy Payroll Calculator for the 2024 tax year to effortlessly calculate your net salary income tax social security contributions and other deductions Accurate and

Download Withholding Tax Italy Calculator

More picture related to Withholding Tax Italy Calculator

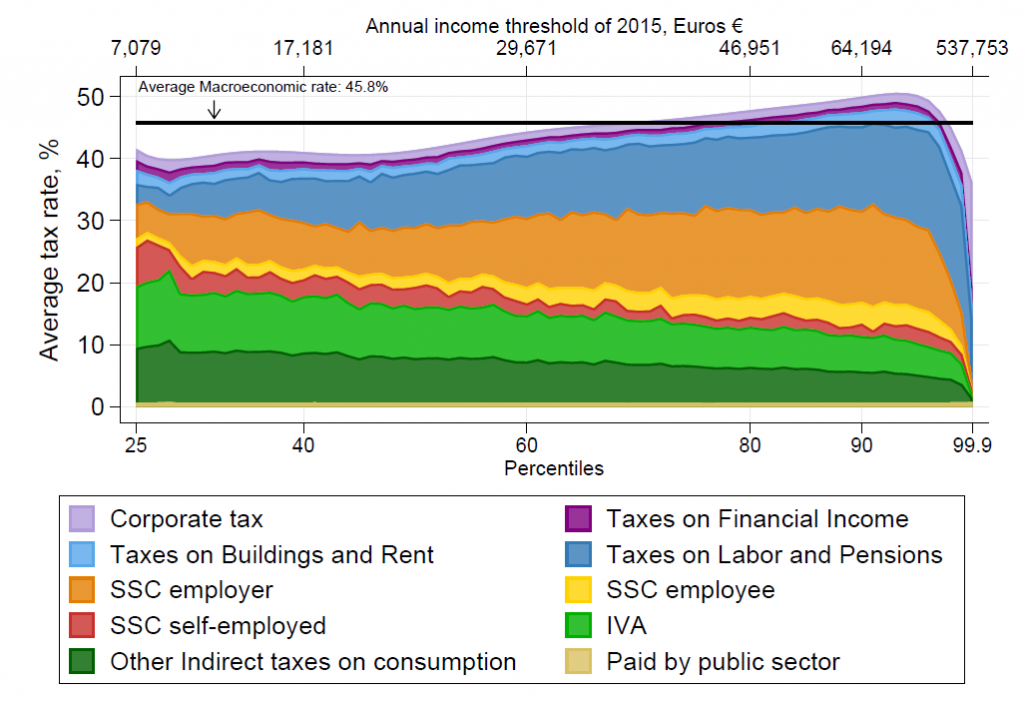

Income Inequality In Italy And Tax Policy Implications WID World

https://wid.world/wp-content/uploads/2022/02/TaxRateIncomePercentile_NT-1024x708.png

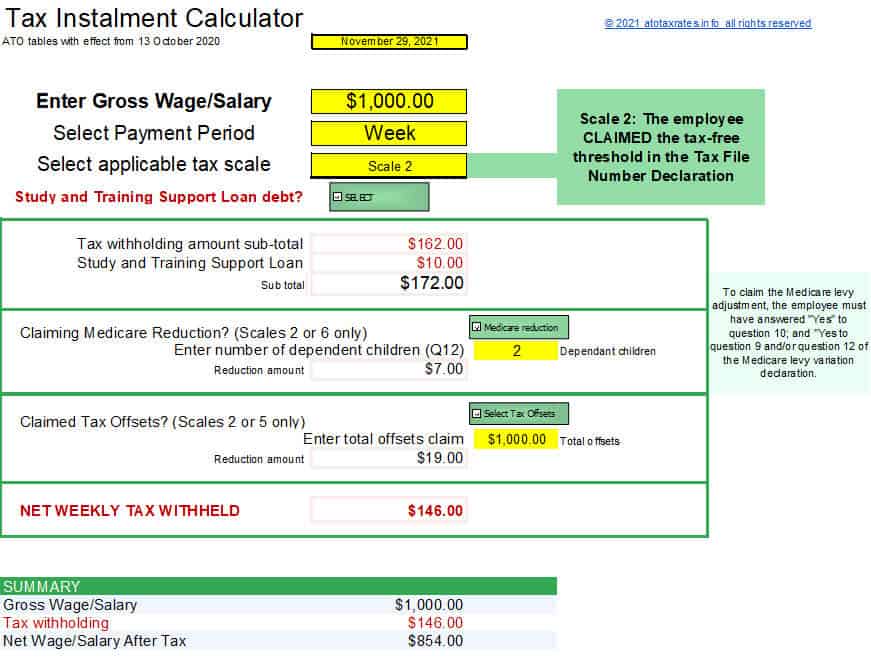

ATO Tax Tables 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/tidw2022a.jpg

Tax Withholding Calculator 2020 MarieBryanni

https://m.foolcdn.com/media/affiliates/images/PayrollTaxes-01-IRSWithholdingTable_7CWWk0h.width-750.png

Find out your net salary and get a detailed tax breakdown including income tax social security contributions and health insurance with our Italy Salary Calculator Individual Income determination Last reviewed 28 February 2024 Taxable income is generally subject to progressive tax rates see the Taxes on

In Italy withholding agents employers or principals withhold tax on the amounts they pay to employees and workers who receive an income as employees The main income tax levied on individuals is the personal income tax PIT also known as the Impostasui redditi delle persone fisiche IRPEF In Italy the

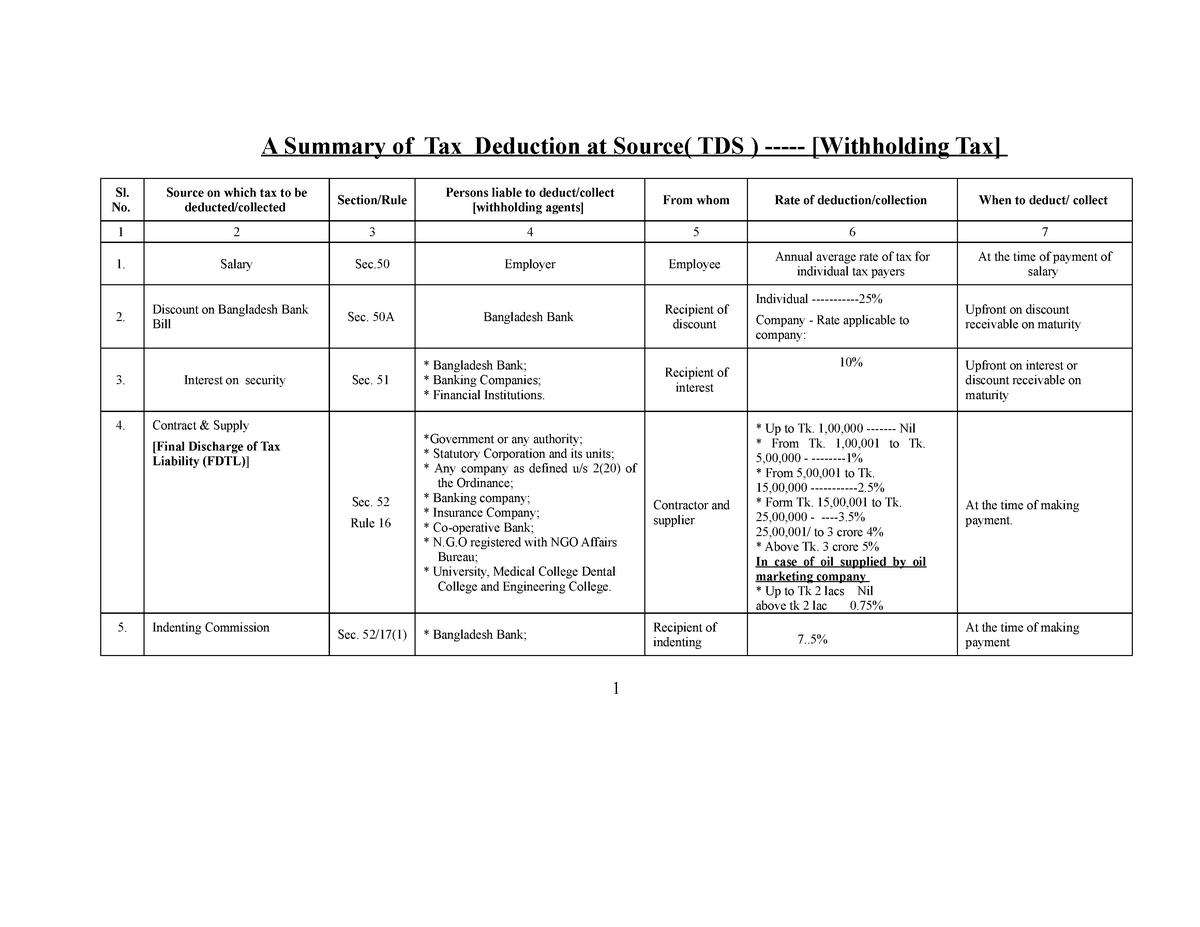

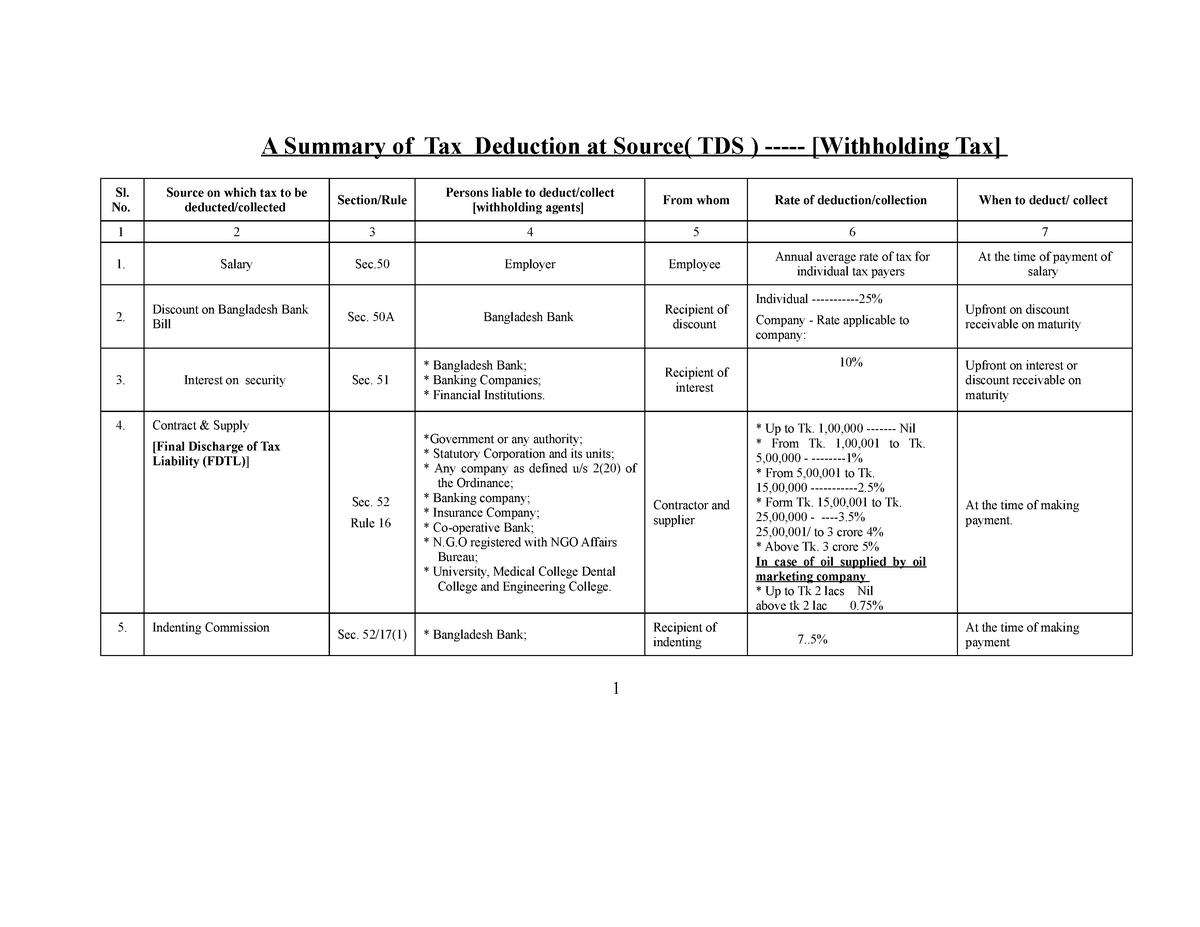

Withholding Tax A Summary Of Tax Deduction At Source TDS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7fcfb9cf94cf853aa3234b5c51abd0bf/thumb_1200_927.png

2022 Ga Tax Withholding Form WithholdingForm

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/08/tax-calculator-atotaxrates-info.jpg

https://salaryaftertax.com/it

Easy to use salary calculator for computing your net income in Italy after Income Tax and Social Security contributions have been deducted

https://taxsummaries.pwc.com/Italy/Corporate/Withholding-taxes

Corporate Withholding taxes A 26 base standard withholding tax WHT rate applies on the yields on loans and securities bonds shares etc paid by Italian

Europe Personal Income Tax Rates Birojs BBP

Withholding Tax A Summary Of Tax Deduction At Source TDS

Annual Federal Withholding Calculator KerstinKeisha

Irs Tax Withholding Estimator Calculator Tax Withholding Estimator 2021

W 4p Calculator Of Tax Withheld Tax Withholding Estimator 2021

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

Italy Taxes Italy Income Tax Italy Currency 2020

File Casio Fx 991ES Calculator New jpg Wikipedia

2023 Payroll Withholding Calculator LesleyMehek

Withholding Tax Italy Calculator - Ritenuta d Acconto also known as withholding tax is a mechanism implemented by the Italian government to collect taxes from various sources of income