Withholding Tax Italy Luxembourg Tax is withheld at the rate of 26 from gross dividends paid to non residents For residents of an EU EEA country which is included in Italy s white list see Sec 13 5 in Italy

The following taxes are withheld on payments made The WHT due on dividends paid to residents of a treaty country cannot exceed the non treaty rate Tax is withheld at the rate of 15 from gross dividends distributed to non residents

Withholding Tax Italy Luxembourg

Withholding Tax Italy Luxembourg

http://upload.wikimedia.org/wikipedia/commons/e/ea/Luxembourg_Grund_from_Verlorenkost_01.jpg

File Palais Du Luxembourg Hiver JPG Wikimedia Commons

https://upload.wikimedia.org/wikipedia/commons/1/16/Palais_du_Luxembourg_hiver.JPG

.jpg)

File Palais Du Luxembourg 2010 jpg Wikimedia Commons

https://upload.wikimedia.org/wikipedia/commons/a/af/Palais_du_Luxembourg_(2010).jpg

On 7 February 2022 the Italian Provincial Tax Court of Pescara currently renamed Court of Justice of first instance according to the recent reform of the tax process issued a In addition to corporate income tax IRES local income tax is levied at the level of Italian corporations ie IRAP IRAP is levied on the net value of the production

b When a resident of Luxembourg receives income which in accordance with the provisions of Articles 10 11 and 12 are taxable in Italy Luxembourg grants on the tax of The new Protocol introduces a withholding tax of 15 on the gross amount of interest paid whereas the prior rate had provided for no withholding tax on interest only

Download Withholding Tax Italy Luxembourg

More picture related to Withholding Tax Italy Luxembourg

What Are FICA Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/07/getty_what_are_fica_taxes.jpeg.jpg

Italy Spanish Funds Exempt From Withholding Tax KPMG United States

https://assets.kpmg/is/image/kpmg/rome-piazza-navona-pavement-cafes-restaurants:cq5dam.web.1200.630

Luxembourg Tourist Information Facts Location

http://famouswonders.com/wp-content/uploads/2009/09/Alzette-River-in-Luxembourg.jpg

On 7 February 2022 the Pescara Tax Court of First Instance ruled that a Luxembourg SICAV is comparable to an Italian investment fund and therefore is entitled to the Withholding tax Luxembourg Dividends royalties interest rents etc Dividends paid to a non resident company generally are subject to withholding tax at 15

Key points The Law provides a very favorable set of provisions for foreign undertakings for collective investment UCIs in Italian resident companies with a Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by

Important Tax Benefits To Know Before Renovating In Italy

https://www.italyirl.com/wp-content/uploads/2023/03/TaxBenefits.jpg

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

https://www.orbitax.com/taxhub/withholdingtaxrates/...

Tax is withheld at the rate of 26 from gross dividends paid to non residents For residents of an EU EEA country which is included in Italy s white list see Sec 13 5 in Italy

https://taxsummaries.pwc.com/luxembourg/corporate/withholding-taxes

The following taxes are withheld on payments made The WHT due on dividends paid to residents of a treaty country cannot exceed the non treaty rate

Italy Budget Law 2021 A New Withholding Tax Exemption On Dividends And

Important Tax Benefits To Know Before Renovating In Italy

The Luxembourg Reserved Alternative Investment Fund RAIF Updated

Luxembourg Limits Deduction Of Certain Payments Made To Countries On

Income Tax 2022 Understand How And Where The DIRF Withholding Tax Is

Luxembourg Agrees To Help Fight Tax Cheats

Luxembourg Agrees To Help Fight Tax Cheats

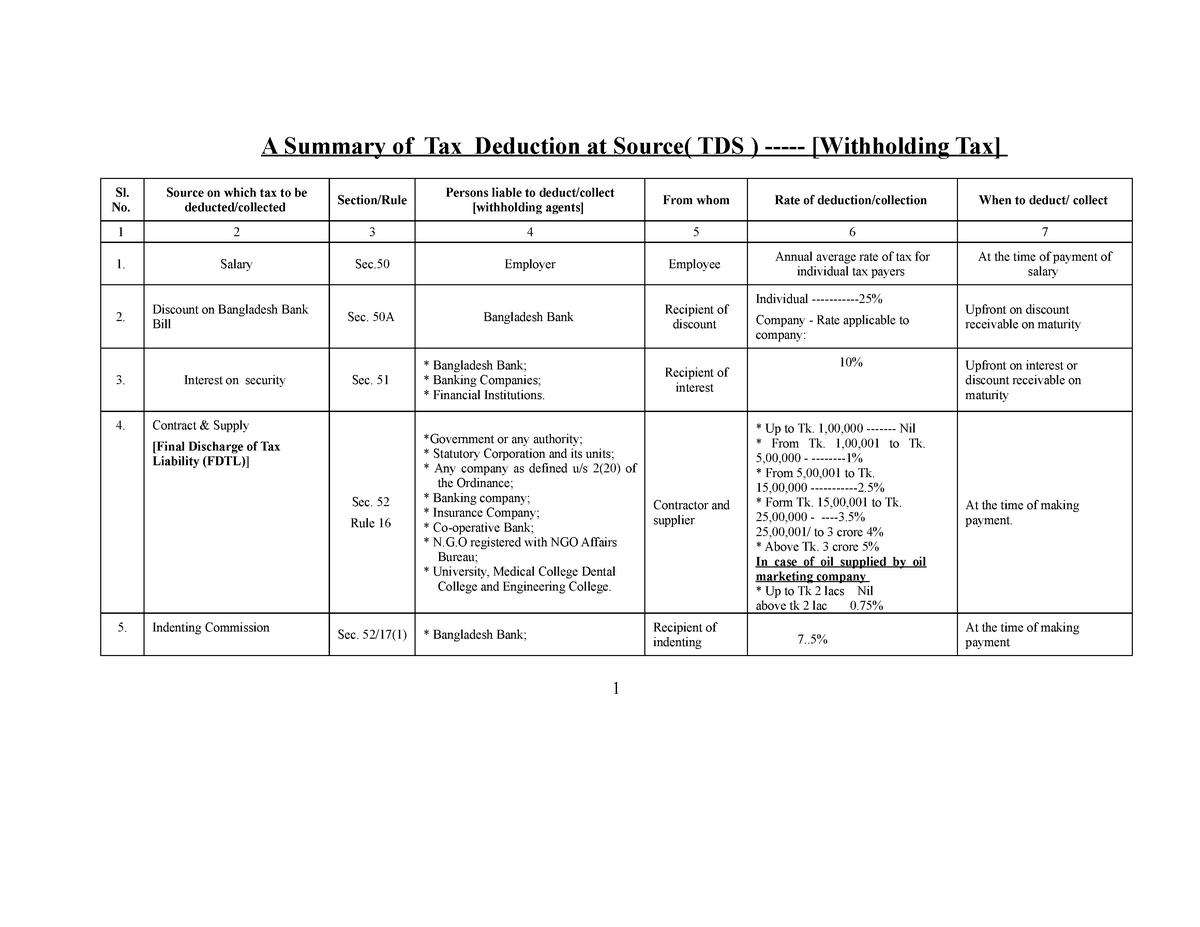

Withholding Tax A Summary Of Tax Deduction At Source TDS

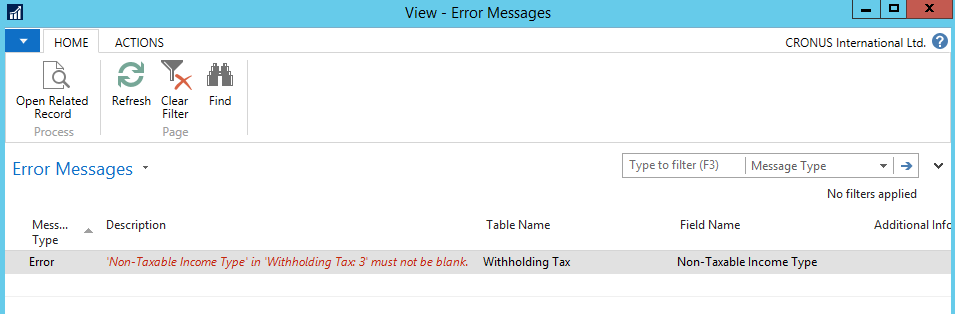

Microsoft Dynamics NAV 2016 Non Taxable Income Type Handling In

How To Apply The Withholding Tax On Wages Timenews

Withholding Tax Italy Luxembourg - On 7 February 2022 the Italian Provincial Tax Court of Pescara currently renamed Court of Justice of first instance according to the recent reform of the tax process issued a