Wood Stove Tax Credit 2022 Form You claim the 30 tax credit on your federal income tax return form starting on the 2023 tax return that you will file in 2024 The credit is a reduction of the

Biomass Stoves Boilers Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal The credit rate for property placed in service in 2022 through 2032 is 30 Energy efficient home improvement credit The nonbusiness energy property credit is now the energy

Wood Stove Tax Credit 2022 Form

Wood Stove Tax Credit 2022 Form

https://cookstoves.net/wp-content/uploads/2022/01/wood_stove_tax_credit_increase_2022.jpg

Heated Up Guidance On The Wood Stove Tax Credit For 2022 And Changes

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjHdaPYEaMVfTnEuAM6tytbyHAb79Tl2YKyAhJNelumhkaKW3QVI0PIrg7Pjvp-z07B7aeOdVBwd9NreKnXPmuwrTyJ2kdAdRK5He16Rfm52rA2f83mWsYS_K2zSofAlJAuIcPpVWXtDv7qKzt3fr2bmJgzTV37nsSCMqiMDcTSGcs1-1v5t-kALg/w1200-h630-p-k-no-nu/30%25 Biomass heater TAx Credit p 1.jpg

Save The Biomass Stove Tax Credit

https://imagesoneclickpolitics.global.ssl.fastly.net/uploads/promoted_message/custom_campaign_image/6734/custom_campaign_image_Woodstove.jpg

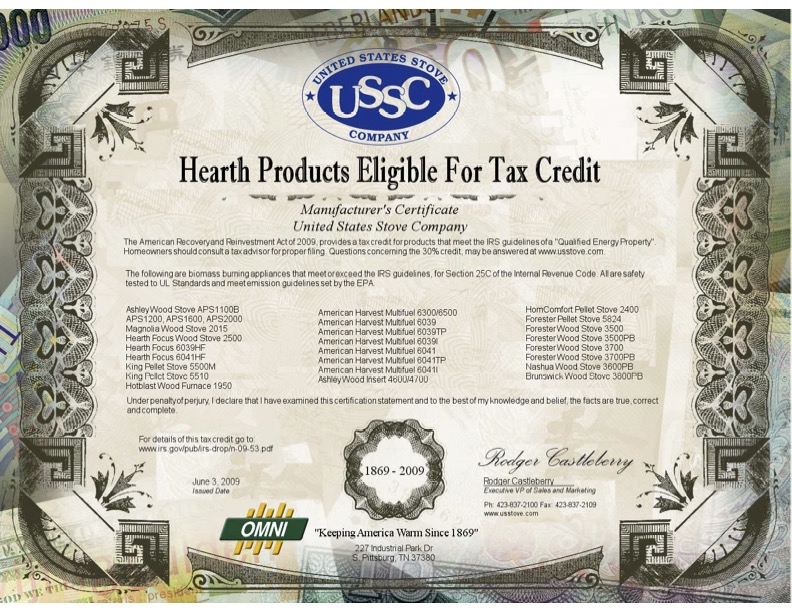

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped Anyone who relies on claimed efficiencies in marketing materials should do so at their own risk and be prepared to forgo the tax credit if the stove is labeled under 75

With the signing of the 2022 Inflation Reduction Act high efficiency wood stoves now qualify for a 30 tax credit under Section 25 C of the Internal Revenue Code This tax credit The U S Federal Government offered a tax credit to homeowners purchasing wood or pellet stoves that is at least 75 percent efficient

Download Wood Stove Tax Credit 2022 Form

More picture related to Wood Stove Tax Credit 2022 Form

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

https://i.ytimg.com/vi/meGOAnYEr4o/maxresdefault.jpg

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

https://images.auctionet.com/uploads/item_362394_85c4405734.JPG

Everything You Need To Know About Wood Stove Tax Credit In 2023 US

https://usfireplacestore.com/cdn/shop/articles/Wood_Stove.jpg?v=1673418539

Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and Applicable systems whether they are stoves purchased to heat space or larger whole home heating systems will now qualify for a renewable energy investment tax credit

This new tax credit allows eligible consumers to claim a 30 tax reduction based on the complete expenditure both the stove and its installation If you re on the Beginning in 2023 consumers buying highly efficient wood or pellet stoves will be able to claim a 30 tax credit capped at 2 000 annually The credit is for appliances installed

![]()

Wood Burning Stove Tax Credit

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1747,h_1200/https://www.fourdayfireplace.com/wp-content/uploads/2021/09/How-You-Can-Save-on-Taxes-With-a-Wood-Burning-Stove.jpeg

Non Profit Employee Retention Tax Credit 2022 Churches Schools

https://ampifire.com/video/images/stock-pexels-photo-8296981.jpeg

https://welovefire.com/stoves/the-2024-federal-25c...

You claim the 30 tax credit on your federal income tax return form starting on the 2023 tax return that you will file in 2024 The credit is a reduction of the

https://www.energystar.gov/about/federal-tax...

Biomass Stoves Boilers Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

Want A Wood Burning Stove Now Is A Great Time To Get One

Wood Burning Stove Tax Credit

2023 Woodstove Tax Credit 25C Energy Distribution Systems

Tax Credit Spavinaw Stove Company Gentry AR

Wood Stove Residential Energy Tax Credit From Hearthstone

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Tax Credit Wood And Pellet Stoves The Stove Center

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit

Wood Stove Tax Credit 2022 Form - In 2022 taxpayers will need to fill out IRS Form 5695 to get the new increased tax credit for installations in 2021 Taxpayers will not need an updated Form