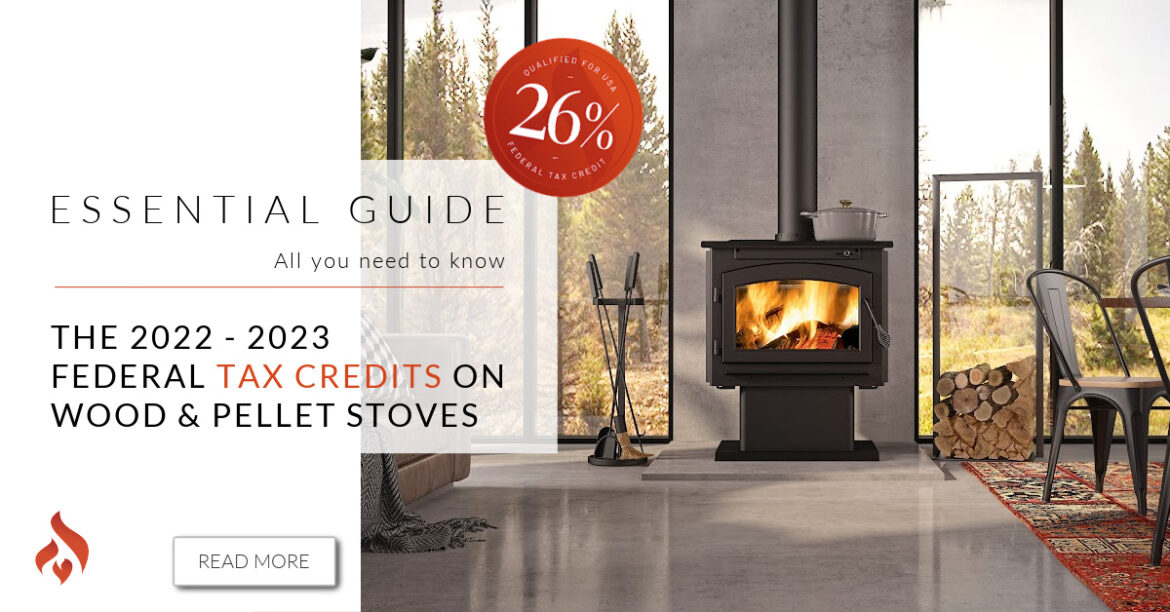

Wood Stove Tax Credit 2022 Irs A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is

Wood Stove Tax Credit 2022 Irs

Wood Stove Tax Credit 2022 Irs

https://cookstoves.net/wp-content/uploads/2022/01/wood_stove_tax_credit_increase_2022.jpg

Save The Biomass Stove Tax Credit

https://imagesoneclickpolitics.global.ssl.fastly.net/uploads/promoted_message/custom_campaign_image/6734/custom_campaign_image_Woodstove.jpg

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

https://i.ytimg.com/vi/meGOAnYEr4o/maxresdefault.jpg

With the signing of the 2022 Inflation Reduction Act high efficiency wood stoves now qualify for a 30 tax credit under Section 25 C of the Internal Revenue Code This tax credit is Beginning in 2021 if you purchase and install a wood or pellet stove or larger residential biomass heating system with a Thermal Efficiency Rating of at least

THE FEDERAL 25C TAX CREDIT ON WOOD AND PELLET STOVES CAN SAVE YOU UP TO 2000 How so With the August 16 2022 signing of the Inflation Guidance on the wood stove tax credit for 2022 and changes for 2023 Aug 2022 update The Inflation Reduction Act now signed into law will change the tax credit

Download Wood Stove Tax Credit 2022 Irs

More picture related to Wood Stove Tax Credit 2022 Irs

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

https://images.auctionet.com/uploads/item_362394_85c4405734.JPG

Everything You Need To Know About Wood Stove Tax Credit In 2023 US

https://usfireplacestore.com/cdn/shop/articles/Wood_Stove.jpg?v=1673418539

Want A Wood Burning Stove Now Is A Great Time To Get One

https://www.fourdayfireplace.com/wp-content/uploads/2022/07/Wood-Burning-Stove.jpg

The Inflation Reduction Act signed last year on August 16th 2022 includes a provision for the Investment Tax Credit ITC for wood or pellet stoves purchases Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

Tax Credit Duration Amount From January 1 2023 to December 31 2032 homeowners can get a tax credit of 30 on both the purchase and installation of Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

![]()

Wood Burning Stove Tax Credit

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1747,h_1200/https://www.fourdayfireplace.com/wp-content/uploads/2021/09/How-You-Can-Save-on-Taxes-With-a-Wood-Burning-Stove.jpeg

2023 Woodstove Tax Credit 25C Energy Distribution Systems

https://energydist.com/wp-content/uploads/2022/02/evergreen_wood_insert-600x419.jpg

https://woodstove.com/tax-credit-initiatives

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Wood Stove Residential Energy Tax Credit From Hearthstone

Wood Burning Stove Tax Credit

Tax Credit Spavinaw Stove Company Gentry AR

Tax Credit Wood And Pellet Stoves The Stove Center

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

Everything You Need To Know About Wood Stove Tax Credit In 2023 In 2023

Everything You Need To Know About Wood Stove Tax Credit In 2023 In 2023

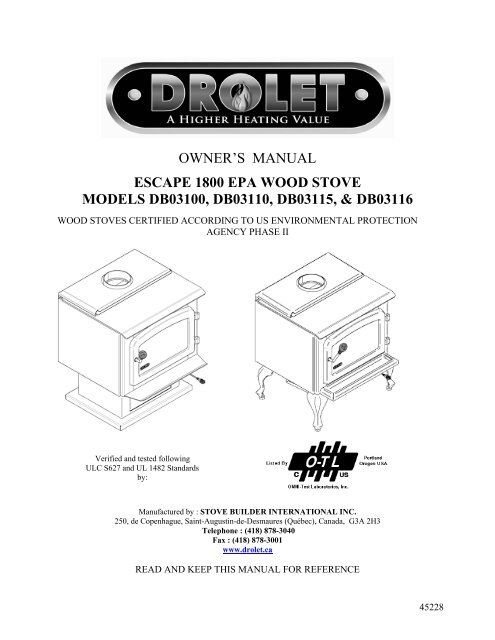

OWNER S MANUAL ESCAPE 1800 EPA WOOD STOVE Drolet

New Tax Credits For 2021 Hearth Forums Home

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

Wood Stove Tax Credit 2022 Irs - In 2022 taxpayers will need to fill out IRS Form 5695 to get the new increased tax credit for installations in 2021 Taxpayers will not need an updated Form