Wood Stove Tax Credit Irs In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

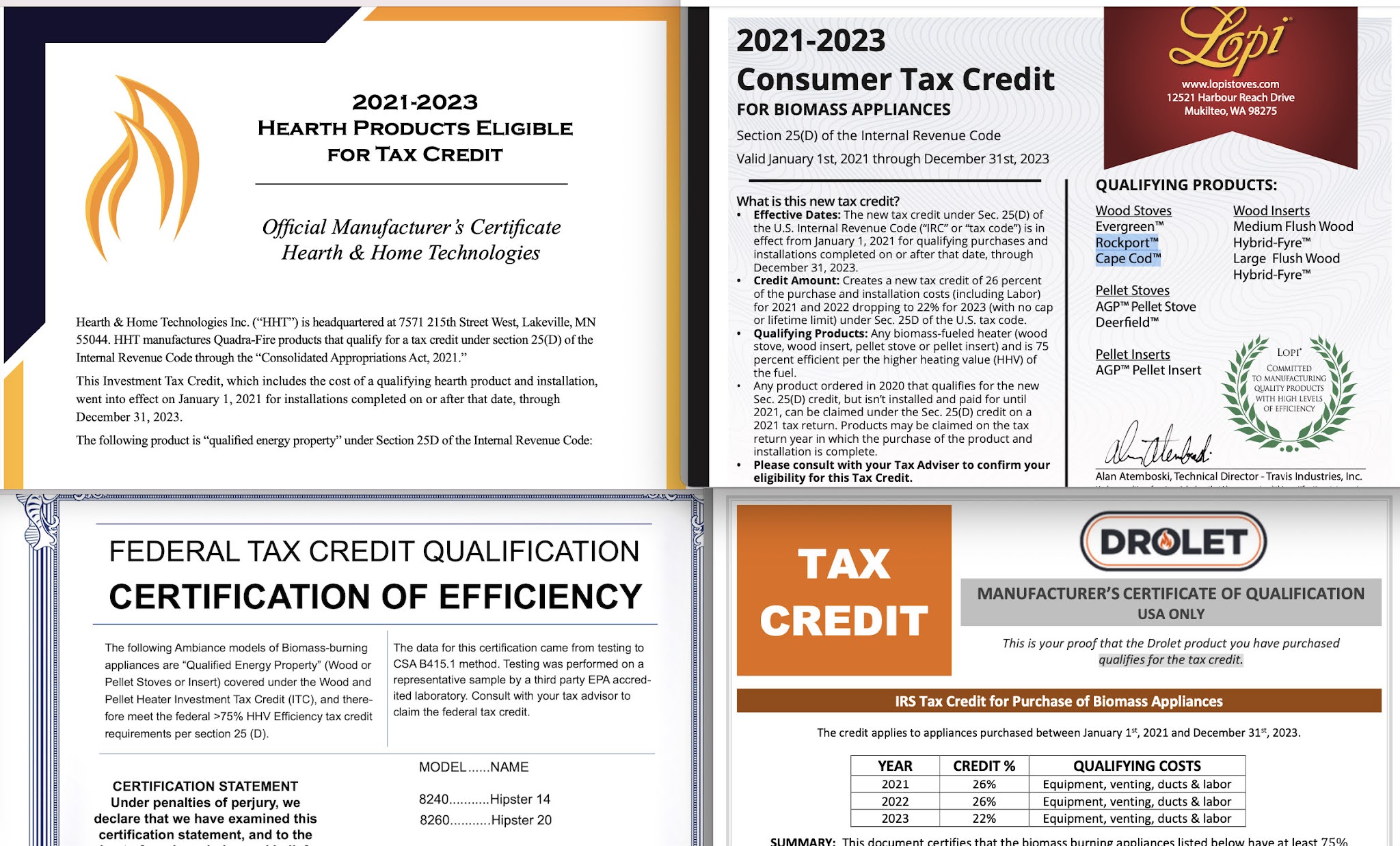

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Biomass Stoves Boilers Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

Wood Stove Tax Credit Irs

Wood Stove Tax Credit Irs

https://i.ytimg.com/vi/Hwidq9meTLw/maxresdefault.jpg

![]()

Wood Burning Stove Tax Credit

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1747,h_1200/https://www.fourdayfireplace.com/wp-content/uploads/2021/09/How-You-Can-Save-on-Taxes-With-a-Wood-Burning-Stove.jpeg

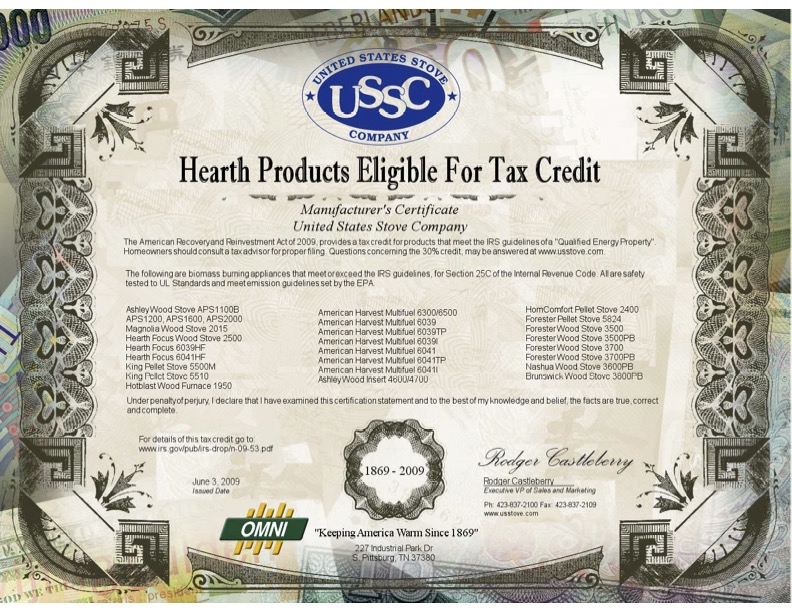

Tax Credit Spavinaw Stove Company Gentry AR

https://irp.cdn-website.com/486121ac/dms3rep/multi/Screen+Shot+2021-09-29+at+11.37.54+AM.png

What makes a wood stove eligible for the huge 26 tax credit The stove must meet the 2020 EPA standards The stove must have a minimum efficiency of 75 HHV The Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

Medium Size Wood Stove Qualifying for Tax Credit sold at a We Love Fire Partner Store 2999 Chimney System 1800 Hearth Pad 400 Installation 1000 Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit that is

Download Wood Stove Tax Credit Irs

More picture related to Wood Stove Tax Credit Irs

Tax Credit Wood And Pellet Stoves The Stove Center

https://cdn.shopify.com/s/files/1/0111/6880/9018/articles/Tax_Credit_2021_800x.jpg?v=1625851065

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

https://i.pinimg.com/736x/fd/5e/67/fd5e67705632b92ada33c3d4b1333220.jpg

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

https://images.auctionet.com/uploads/item_362394_85c4405734.JPG

January 2023 Update In December 2022 the IRS issued its new Guidance and FAQs for the new 25 C tax credit effective for installations January 1 2023 and December 31 Tax Credit Duration Amount From January 1 2023 to December 31 2032 homeowners can get a tax credit of 30 on both the purchase and installation of

Energy Saving Tips Home Upgrades From solar panels to stove tops you can get money back whether you re replacing an old appliance or installing new technology The money Congress removed biomass stoves from section 25 C which had provided a 300 tax credit up until Dec 31 to prevent a double benefit or double dipping under

Tax Credit For Wood And Pellet Heaters 2022 Update Cookstove Community

https://cookstoves.net/wp-content/uploads/2022/01/wood_stove_tax_credit_increase_2022.jpg

Stove Packages Wood And Pellet Stove Tax Credit

https://oregonwoodstovetaxcredit.com/wp-content/uploads/2022/10/Tax-Credit-Wood-Stove-Package.jpg

https://www.irs.gov/newsroom/energy-incentives-for...

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit

Tax Credit For Wood And Pellet Heaters 2022 Update Cookstove Community

What Is The Biomass Stove Tax Credit Mountain Hearth Patio

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit

300 Tax Credit For Qualifying Wood Stoves Charlotte NC Owens

300 Tax Credit For Qualifying Wood Stoves Charlotte NC Owens

Everything You Need To Know About Wood Stove Tax Credit In 2023 US

How To Claim Your Biomass Tax Credit For Your New Wood And Pellet Stove

2023 Woodstove Tax Credit 25C Energy Distribution Systems

Wood Stove Tax Credit Irs - Medium Size Wood Stove Qualifying for Tax Credit sold at a We Love Fire Partner Store 2999 Chimney System 1800 Hearth Pad 400 Installation 1000