Work Clothes Tax Credit 3 years ago Updated Follow You can deduct the cost and upkeep of work clothes and uniforms if you mustwear them as a condition of your employment and the clothes are not suitable for everyday wear As an exception clothing that is considered a marketing cost can be considered

Cleaning repairing or replacing a uniform or specialist clothing for example overalls or safety boots Claim relief for a uniform or specialist clothing You can claim tax relief for a Determining if work tools and uniforms as well as works clothes are tax deductible depends on a couple of factors In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply

Work Clothes Tax Credit

Work Clothes Tax Credit

http://shuriken.com/wp-content/uploads/2017/08/02-What-You-Need-To-Know-Before-Claiming-A-Tax-Deduction-For-Your-Work-Clothing-FB-Featured-Image.png

Clothes Rent Meals What Is Tax Deductible Humphries Associates

https://humphriespeople.co.nz/wp-content/uploads/2023/02/Ho3uaezKr7Adf5PAK7oa4-waldemar-brandt-Db4d6MRIXJc-unsplash-open.jpg

Quantity Limited Promotion Leather Boho Skirt Flower Embroidery Midi

https://i.etsystatic.com/22166848/r/il/a02c1c/2973666523/il_794xN.2973666523_gty4.jpg

Most employees cannot claim employment expenses You cannot deduct the cost of travel to and from work or other expenses such as most tools and clothing You have to keep records for each year you claim expenses For more information see Keeping records Find out more about claiming tax relief for uniforms work clothing and tools There are different rules for expenses if you re self employed Check if you can claim a flat rate expense You

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense Are work clothes tax deductible If you spend money on clothes for work you may or may not be able to claim them as a business expense depending on a number of factors These include your work status and

Download Work Clothes Tax Credit

More picture related to Work Clothes Tax Credit

How To Claim A Tax Deduction For Work Clothes Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/83/153/469549093.jpg

Are Work Clothes Tax deductible For Self employed EMS

https://enterprisemadesimple.co.uk/wp-content/uploads/2021/04/Blog-Post-template-2021-10-28T151356.197-1024x576.png

Clothes Rent Meals What Is Tax Deductible Hunter Withers

https://images.squarespace-cdn.com/content/v1/6376a4320f05ce50eec2ffc3/1679007100911-37UCOSF7XXHL6F5C42XO/unsplash-image-ojZ4wJNUM5w.jpg?format=1000w

If work in construction and are required to purchase your own hard hat that is tax deductible If you work in a hospital environment and must buy your own scrubs those are deductible as well If you re a performer and buy your own costumes they count too This also applies to accessories Taxes Here s how to claim work expenses when filing your taxes You can claim work expenses if you re a freelancer or business owner but W 2 employees are limited in what they can claim

ANSWER Under general tax principles the value of employer provided clothing is a taxable benefit unless the clothing qualifies for an exclusion You would enter your uniform work clothes in TurboTax under Federal Taxes Deductions and Credits I ll choose what I work on or jump to full list scroll down to Employment Expenses Job related expenses start revisit update Use the TurboTax guide to help you enter these expense Enter your occupation information

Tax Deduction For Work Clothing Uniform

https://topaccountants.com.au/images/adv/blogs/Blog-3.png

Upward Assumption Jet Peluche Cuore Rally Metal Seller

https://palmigiochi.it/pub/media/catalog/product/cache/4cf32b0ac309688615fa4fc4377ba540/8/1/812b8kkt74l._ac_sl1500_.jpg

https://tmi.ukko.fi/hc/en-us/articles/4403570724753

3 years ago Updated Follow You can deduct the cost and upkeep of work clothes and uniforms if you mustwear them as a condition of your employment and the clothes are not suitable for everyday wear As an exception clothing that is considered a marketing cost can be considered

https://www.gov.uk/tax-relief-for-employees/...

Cleaning repairing or replacing a uniform or specialist clothing for example overalls or safety boots Claim relief for a uniform or specialist clothing You can claim tax relief for a

Donation Value Guide 2019 Spreadsheet Unique Goodwill Donation

Tax Deduction For Work Clothing Uniform

Clothes Rent Meals What Is Tax Deductible Corbeau Accounting

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

26 Self Employed Seamstress Free Sewing Pattern

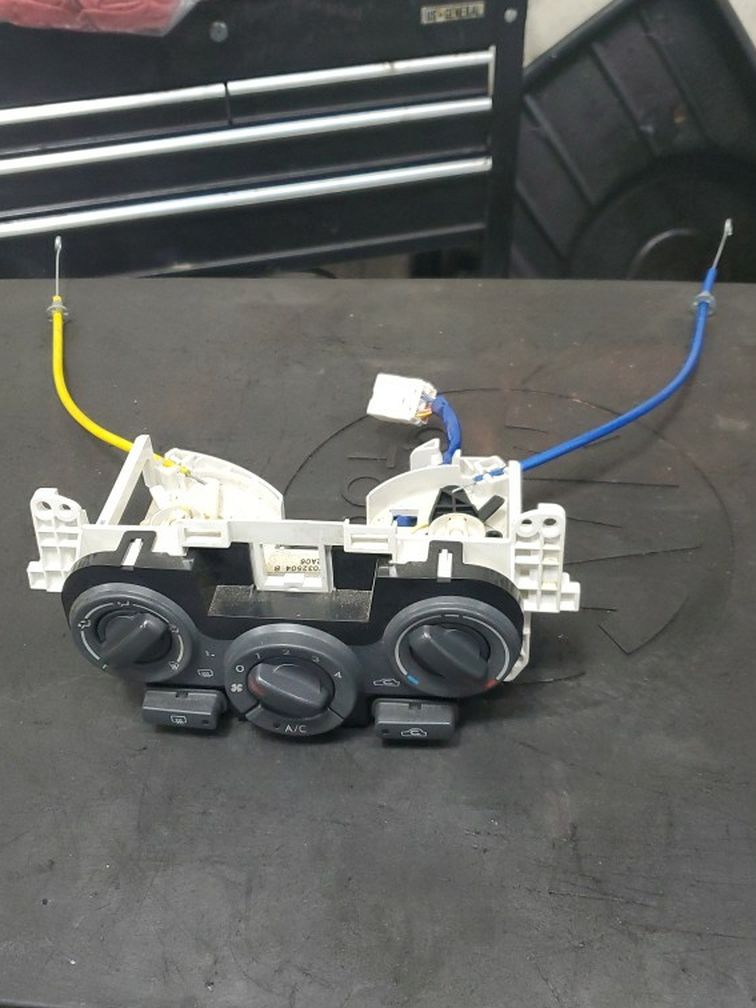

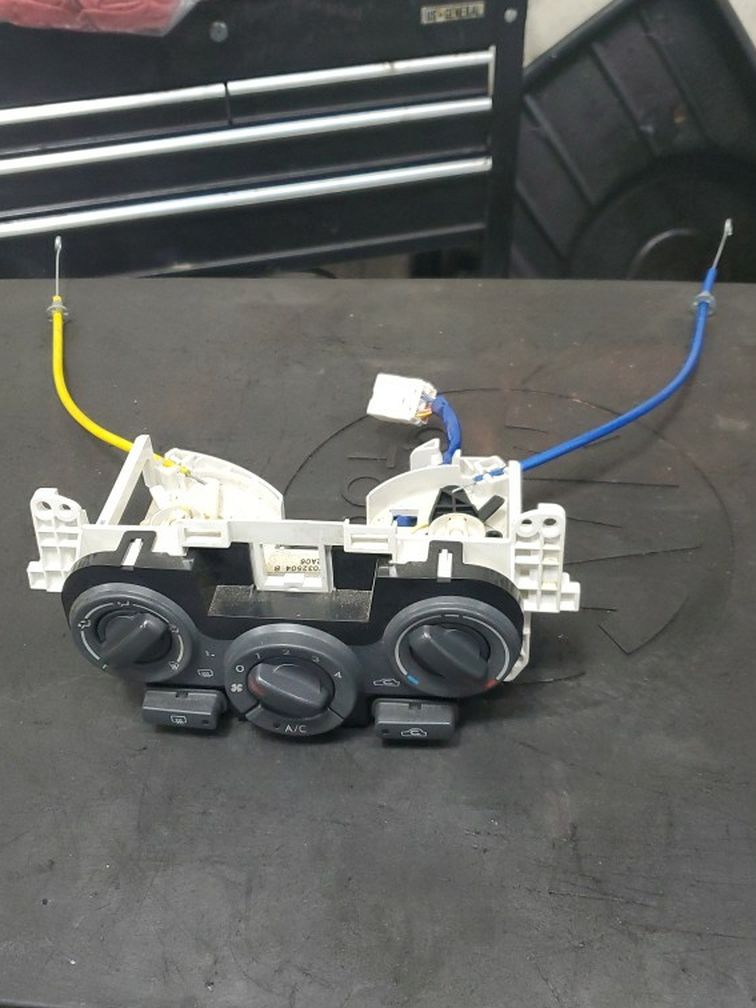

Hight Quality Guaranteed Heater Chassis Control By For Sale Kent And

Hight Quality Guaranteed Heater Chassis Control By For Sale Kent And

Cheap Online Shop Silver DG Earrings In Clip on Earrings Clip on

Printable Clothing Donation Form Printable Forms Free Online

26 Self Employed Seamstress Free Sewing Pattern

Work Clothes Tax Credit - Most employees cannot claim employment expenses You cannot deduct the cost of travel to and from work or other expenses such as most tools and clothing You have to keep records for each year you claim expenses For more information see Keeping records