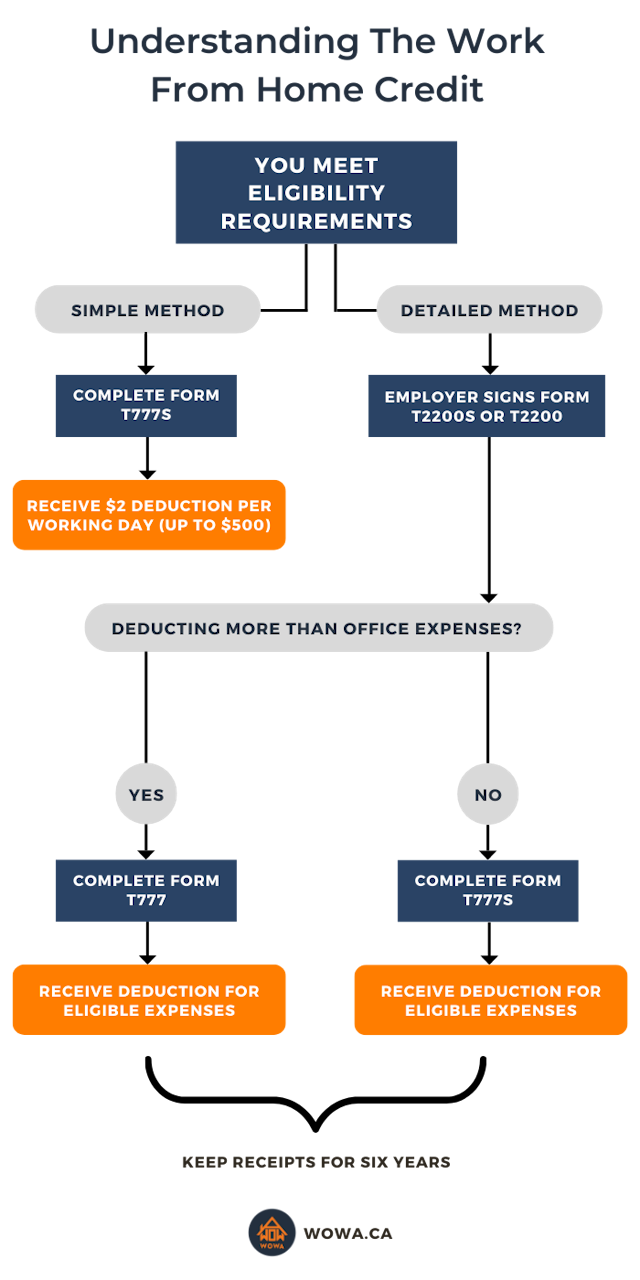

Work From Home Tax Credit 2023 Form For 2023 if an employee has voluntarily entered into a formal telework arrangement with their employer the employee is considered to have been required to

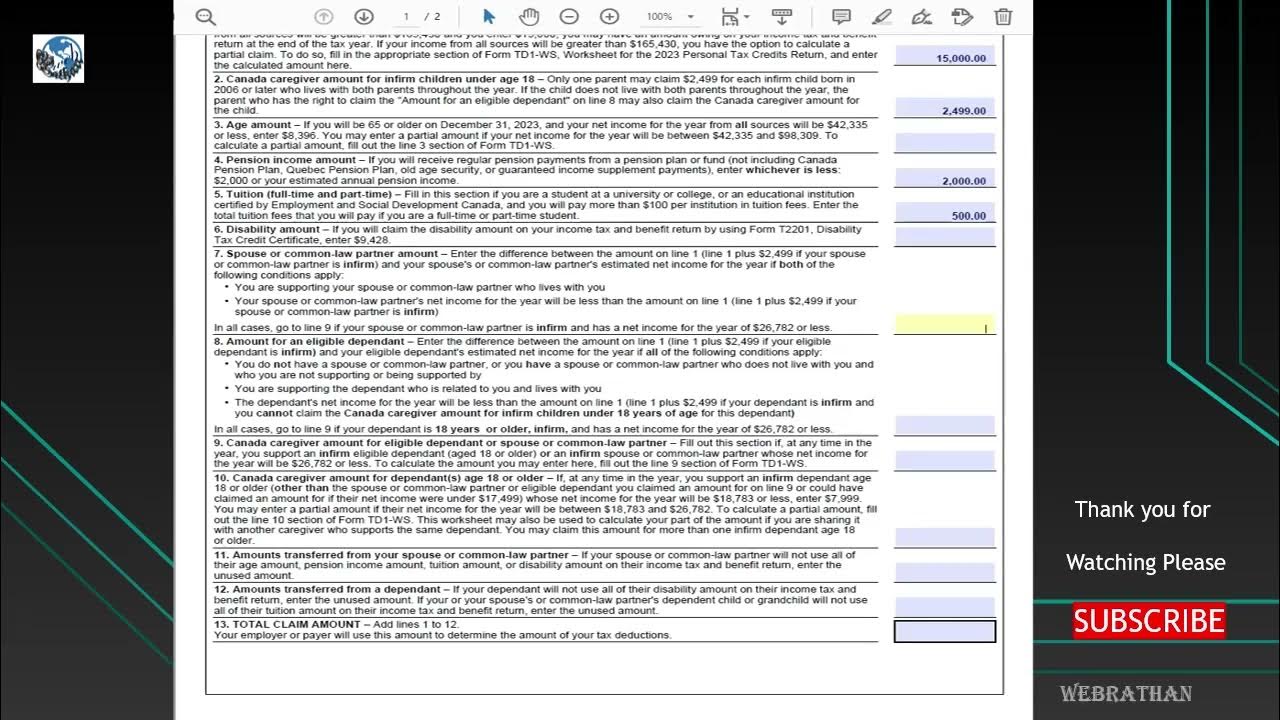

The CRA discontinued the flat rate method of claiming work from home expenses for the 2023 tax year Introduced in 2020 the temporary flat rate method Filing a 2023 tax year return or 2019 or prior year tax return Form T777S for 2020 2021 and 2022 only Use Option 2 Detailed method on Form T777S to

Work From Home Tax Credit 2023 Form

Work From Home Tax Credit 2023 Form

https://media.blogto.com/articles/2023228-work-from-home-tax-credit.jpg?w=2048&cmd=resize_then_crop&height=1365&quality=70

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses-S.jpg

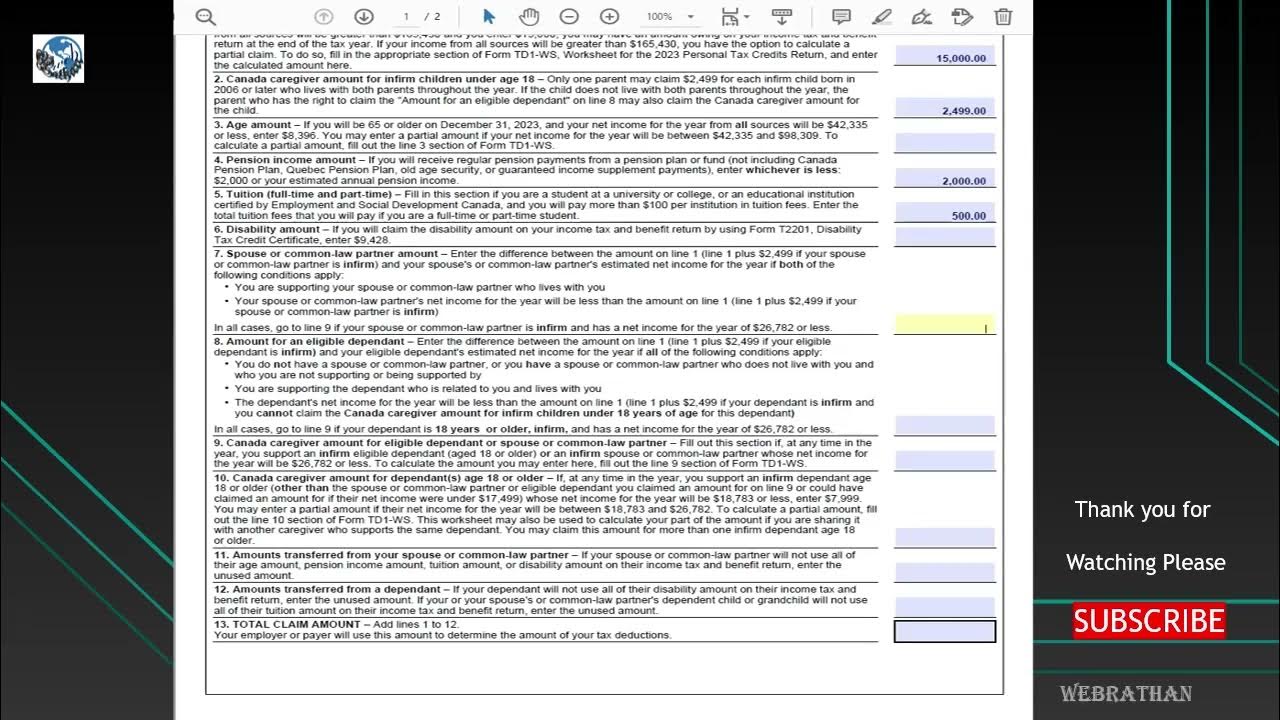

Introducing The 2023 Tax Return

https://www.etax.com.au/wp-content/uploads/2022/12/2023-tax-return-is-coming.jpg

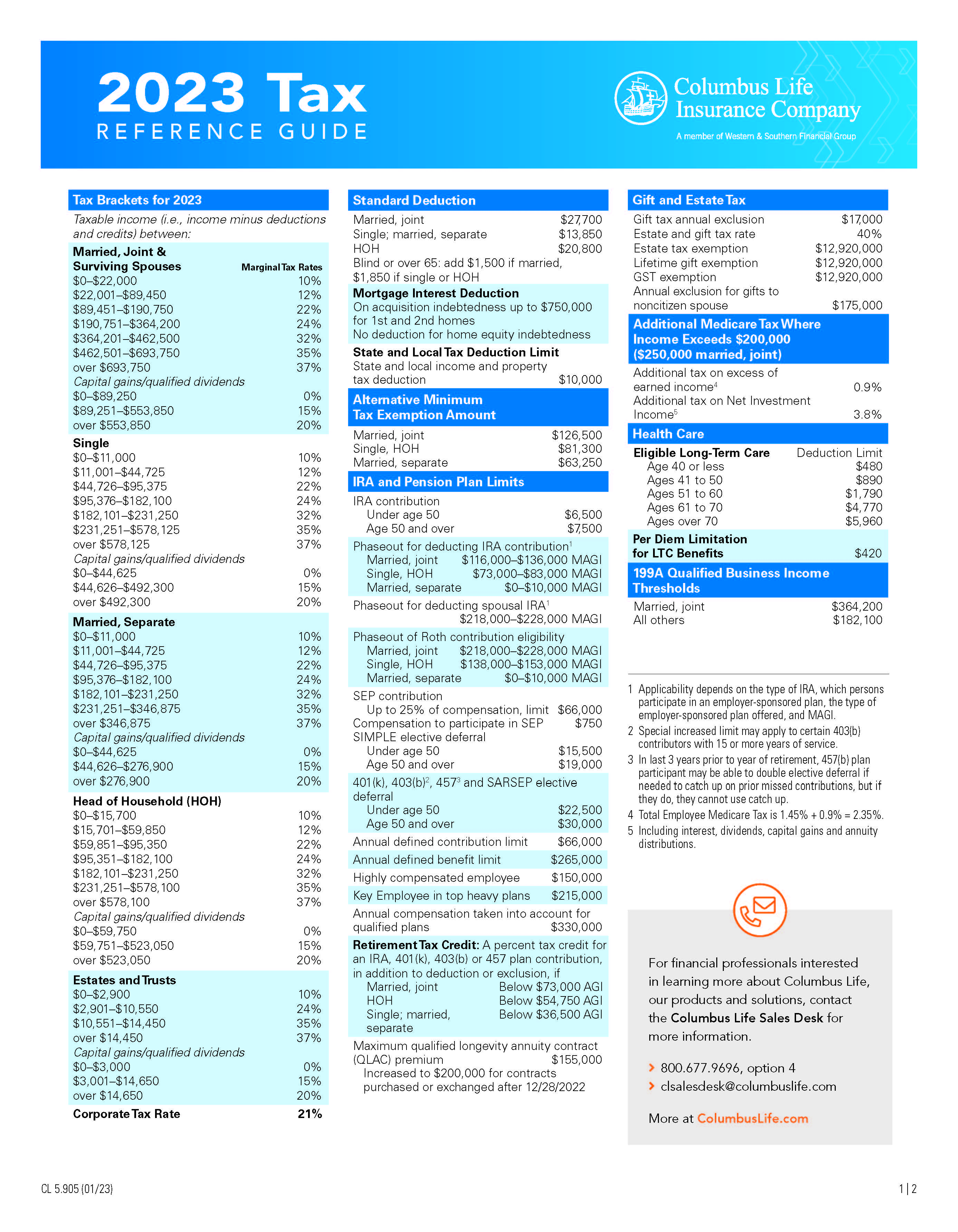

Sign into myAccount From the PAYE Services card select review your tax Select the 2023 Income Tax year and then select submit In Tax Credits and Relief There are two ways to calculate the home office deduction the simplified option and the regular method according to the IRS The simplified option uses a

You will need to fill the new T777 s Statement of Employment Expenses for Working at Home Due to COVID 19 form to claim the deduction What expenses can I Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year

Download Work From Home Tax Credit 2023 Form

More picture related to Work From Home Tax Credit 2023 Form

Pin On Money Career

https://i.pinimg.com/originals/ee/c5/b7/eec5b7fd3c5a9724311261ebd5e2a242.png

Working From Home Tax Deductions In 2022 Wattle Accountants

https://www.wattleaccountants.com.au/wp-content/uploads/2022/05/Social-Media-01-2-scaled.jpg

Startek Recruitment 2023 Work From Home Jobs Bulk Hiring 2023

https://www.berojgarshala.com/wp-content/uploads/2023/09/Startek-Recruitment-2023-Work-From-Home-Jobs-Bulk-Hiring-2023-MAUSAM-NAGPAL-BEROJGARSHALA-min-1024x576.jpg

Posted March 4 2024 6 29 pm Last Updated March 5 2024 12 09 pm If you work from home or follow a hybrid model and divide your time between your home and workplace To be able to make a claim for 2023 you ll need to get a signed copy of CRA form T2200 Declaration of Conditions of Employment from your employer The T2200

Learn how to claim home office expenses for 2023 if you work primarily from home and have a completed Form T2200 Find out the eligible expenses the Home Office Tax Deduction 2023 2024 Rules Who Qualifies The home office deduction is a tax break for self employed people who use part of their home for

Changes To Working From Home Tax Deductions For The 2023 Tax Year

https://static.wixstatic.com/media/934398_cd73839c9da44f28b17e98959303c93c~mv2.png/v1/fill/w_821,h_838,al_c,q_90,enc_auto/934398_cd73839c9da44f28b17e98959303c93c~mv2.png

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

https://magentafp.com/wp-content/uploads/2022/05/Your-Guide-to-202223-Tax-Allowances-and-Limits-Twitter-Post-1080x675.png

https://www.canada.ca/en/revenue-agency/services/...

For 2023 if an employee has voluntarily entered into a formal telework arrangement with their employer the employee is considered to have been required to

https://www.thestar.com/business/personal-finance/...

The CRA discontinued the flat rate method of claiming work from home expenses for the 2023 tax year Introduced in 2020 the temporary flat rate method

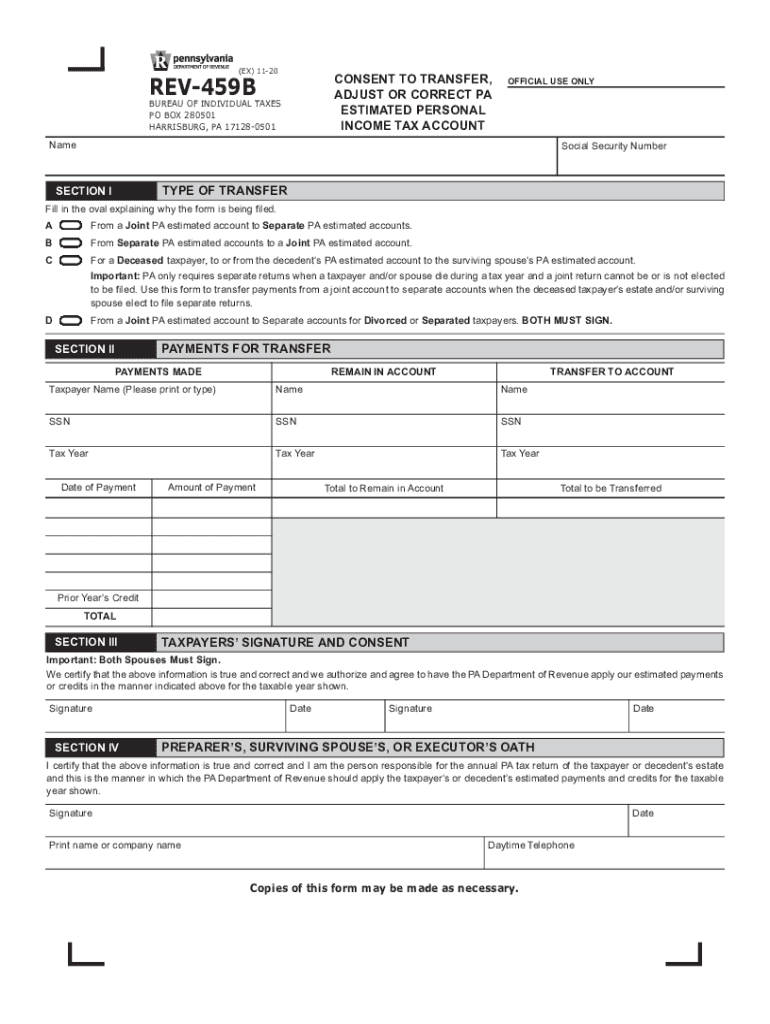

2023 Pa Tax Form Printable Forms Free Online

Changes To Working From Home Tax Deductions For The 2023 Tax Year

Work From Home Tax Credit Guide WOWA ca

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes

Don t Forget To Claim Working From Home Tax Relief RSM UK

2023 Ontario Tax Form Printable Forms Free Online

2023 Ontario Tax Form Printable Forms Free Online

2024 Tax Summary Maddi Christean

Due Diligence Checklist For Buying A Business

Fillable Online How The Working From Home Tax Rules Can Help With Your

Work From Home Tax Credit 2023 Form - Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year