Work From Home Tax Credit 2023 Line The tax rules for 2023 have changed Here s how to claim your expenses The temporary flat rate method for claiming work from home expenses introduced during the pandemic has been

Claiming other employment expenses on line 22900 for example motor vehicle expenses as well as home work space in the home office supplies and In a news release dated 21 December 2023 the Canada Revenue Agency CRA provided an update on the process for claiming home office expenses for the

Work From Home Tax Credit 2023 Line

Work From Home Tax Credit 2023 Line

https://wowa.ca/static/img/opengraph/work-from-home-tax-credit.png

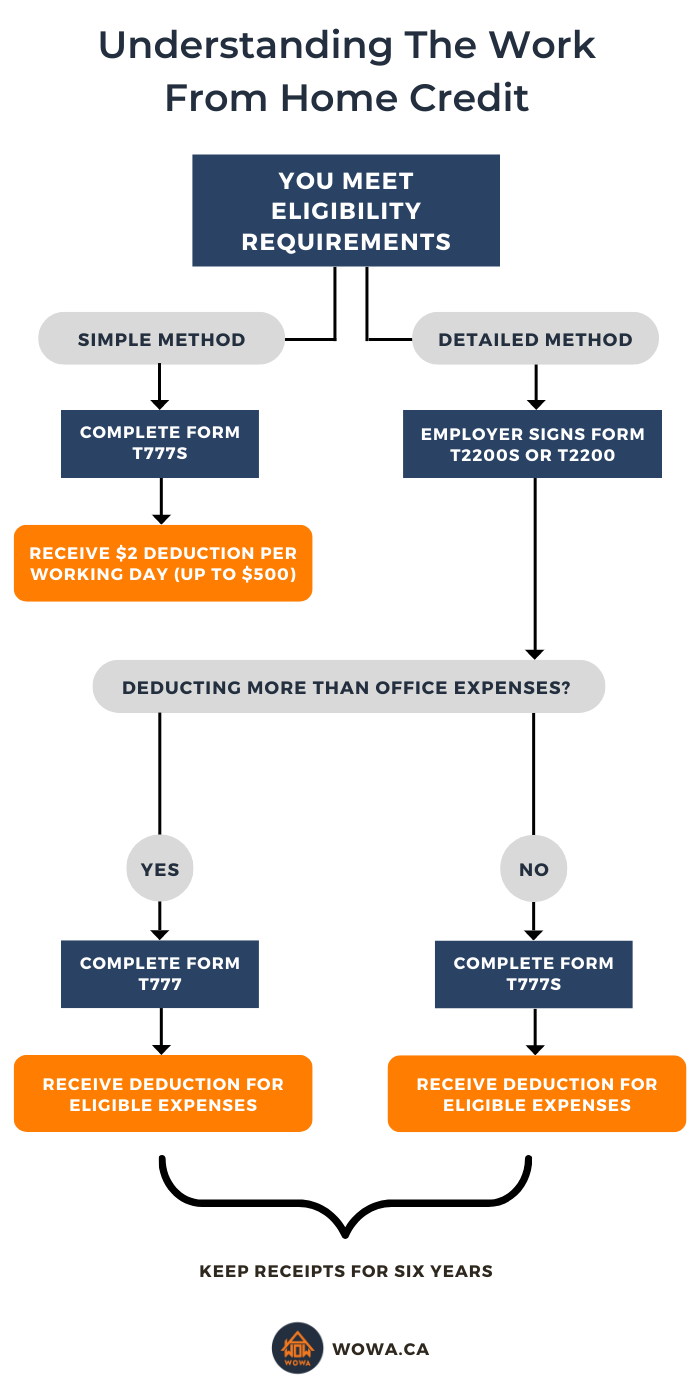

Work From Home Tax Credit Guide WOWA ca

https://wowa.ca/_next/image?url=%2Fstatic%2Fimg%2Fwork-from-home-tax-credit%2Fwfh-flow.png&w=1080&q=90

Who Can Claim Work From Home Tax Deductions 2023

https://cdn.autonomous.ai/static/upload/images/new_post/who-claim-work-from-home-tax-deductions-4298-1648788197177.jpg

The guidance indicates that for 2023 the CRA has adopted a broad interpretation of situations in which an employee is required to work from home which is one of the If you work from home or follow a hybrid model there are some changes in how to claim home office expenses when filing your tax return that you should know about Dilshad Burman explains

You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office The CRA has issued an updated T2200 for 2023 a completed and signed copy of which employees need to obtain from their employer to claim employment expenses under the detailed method

Download Work From Home Tax Credit 2023 Line

More picture related to Work From Home Tax Credit 2023 Line

Working From Home Tax Deductions Etax

https://www.etax.com.au/wp-content/uploads/2023/04/working-from-home-tax-deductions.jpg

Working From Home This Tax Credit Could Apply To You CUPE Local 786

https://cupe786.ca/wp-content/uploads/2021/02/work-from-home-tax-credit.png

Everything About The Work From Home Tax Deduction

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5fff0445fc482eb821062bc3_man-working-from-home.jpg

Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year I m filing my taxes for home office expenses in 2023 using Ufile I work from home 3 days a week 24 hours and I use 30 of the house for my work area I don t understand how I should fill out Perc

Work space in the home expenses Enter the total amount you paid for an expense for the period s you worked from home Enter 0 if you are not claiming the expense What can you claim for working from home in 2023 The Canada Revenue Agency CRA introduced a temporary flat rate home office expense deduction for the

Working From Home Tax Relief E Working And Home Workers Tax Relief

https://greallyaccountants.ie/wp-content/uploads/2020/11/work_from_home_tax_relief.jpg

There s A New Tax Deduction Available For Canadians Working From Home

https://offloadmedia.feverup.com/secrettoronto.co/wp-content/uploads/2020/12/17073741/New-Work-From-Home-Tax-Credit.jpg

https://www.thestar.com/business/persona…

The tax rules for 2023 have changed Here s how to claim your expenses The temporary flat rate method for claiming work from home expenses introduced during the pandemic has been

https://www.canada.ca/en/revenue-agency/services...

Claiming other employment expenses on line 22900 for example motor vehicle expenses as well as home work space in the home office supplies and

Here s How To Save Money On Your Taxes In Canada If You Work From Home

Working From Home Tax Relief E Working And Home Workers Tax Relief

Work From Home Tax Deductions Whats The Issue TaxMedics

Work from home Tax Implications What Employers And Employees Need To

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/UUTSLHBYWFP3HKJXNGL3I3UBPU.jpg)

Work from home Tax Credit Claims Expected To Cost Ottawa 260 million

2020 TAX TIPs Work From Home Tax Credit Flat Rate Method Or

2020 TAX TIPs Work From Home Tax Credit Flat Rate Method Or

New Jersey To End Temporary Work From Home Tax Rules WilkinGuttenplan

Work from home Tax Deductions Top Of Mind As ATO Cracks Down TaxTank

Does Canada Have A Work From Home Tax Credit NerdWallet

Work From Home Tax Credit 2023 Line - For 2023 if an employee has voluntarily entered into a formal telework arrangement with their employer the employee is considered to have been required to work from home