Working At Home Tax Deductions Verkko 6 toukok 2020 nbsp 0183 32 An employee working from home for less than half of the year can claim 450 euros In this case the sum is below 750 euros so there is no provision for

Verkko 18 jouluk 2023 nbsp 0183 32 Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses Verkko 21 jouluk 2023 nbsp 0183 32 So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work

Working At Home Tax Deductions

Working At Home Tax Deductions

https://www.morrows.com.au/wp-content/uploads/2020/07/Tax-Tips-for-Employees-–-Working-from-Home-Tax-Deductions.jpg

Working From Home Tax Deductions Who Is Eligible And How To Apply

https://homewerker.com/wp-content/uploads/2020/07/Working-from-home-tax-deductions-Who-is-eligible-and-how-to-apply-scaled.jpg

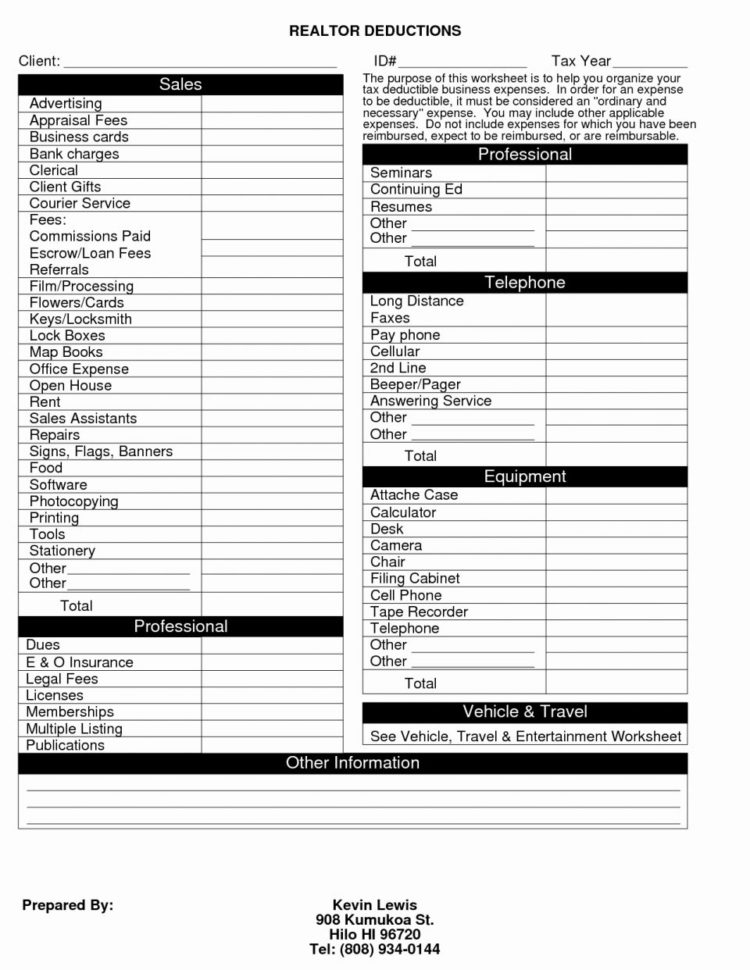

Tax Deductions For Contract Workers Freelancers And Home Business

https://i.pinimg.com/originals/b1/46/73/b14673837d3f99a152b082d60a59c0f4.jpg

Verkko 19 lokak 2023 nbsp 0183 32 Can you claim work from home tax deductions Who can claim 2023 tax deductions when working from home Tax Tip Verkko Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively apply to

Verkko 12 syysk 2023 nbsp 0183 32 When is working from home considered tax deductible Working from home What am I allowed to write off How to write off your rent or mortgage Example 1 simplified expenses Verkko 6 elok 2020 nbsp 0183 32 The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return With more people working from home than ever

Download Working At Home Tax Deductions

More picture related to Working At Home Tax Deductions

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

Excel Tax Worksheet

https://db-excel.com/wp-content/uploads/2019/01/tax-preparation-excel-spreadsheet-in-small-business-tax-preparation-worksheet-2017-deductions-2018-750x970.jpg

Working From Home Tax Deductions Explained Today Show Australia YouTube

https://i.ytimg.com/vi/JocGDj7oJYg/maxresdefault.jpg

Verkko 8 helmik 2023 nbsp 0183 32 The rule of thumb is that if you re a W 2 employee you re not eligible for a work from home tax deduction This wasn t always the case though The Tax Verkko 28 marrask 2023 nbsp 0183 32 Working from home comes with various benefits such as no commute and a casual dress code It can also offer potentially valuable tax

Verkko 20 marrask 2023 nbsp 0183 32 According to H amp R Block CEO there is a wide range of expenses you can claim when working from home including Home equipment such as a printer Verkko You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Working From Home Tax Deductions Potts Company

https://www.pottscpa.com/wp-content/uploads/2020/09/working-from-home-tax-deductions-cover.jpg

https://yle.fi/a/3-11337523

Verkko 6 toukok 2020 nbsp 0183 32 An employee working from home for less than half of the year can claim 450 euros In this case the sum is below 750 euros so there is no provision for

https://smartasset.com/taxes/work-from-home-tax-deductions

Verkko 18 jouluk 2023 nbsp 0183 32 Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses

List Of Tax Deductions Here s What You Can Deduct

Tax Credits Save You More Than Deductions Here Are The Best Ones

10 Most Common Small Business Tax Deductions Infographic

6 Working From Home Deductions You Can Claim BOX Advisory Services

Work From Home Tax Deductions Forrest Private Wealth

Working From Home Tax Deductions 2020 Quill Group Tax Accountants

Working From Home Tax Deductions 2020 Quill Group Tax Accountants

Business Checklist Business Advice Business Finance Business

5 Tax Deductions Small Business Owners Need To Know

Income Tax Deductions For The FY 2019 20 ComparePolicy

Working At Home Tax Deductions - Verkko 22 helmik 2023 nbsp 0183 32 Although there has been an increase in employees working at home since coronavirus under tax reform employees can no longer take federal tax