Working Tax Credit Amount 2022 Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

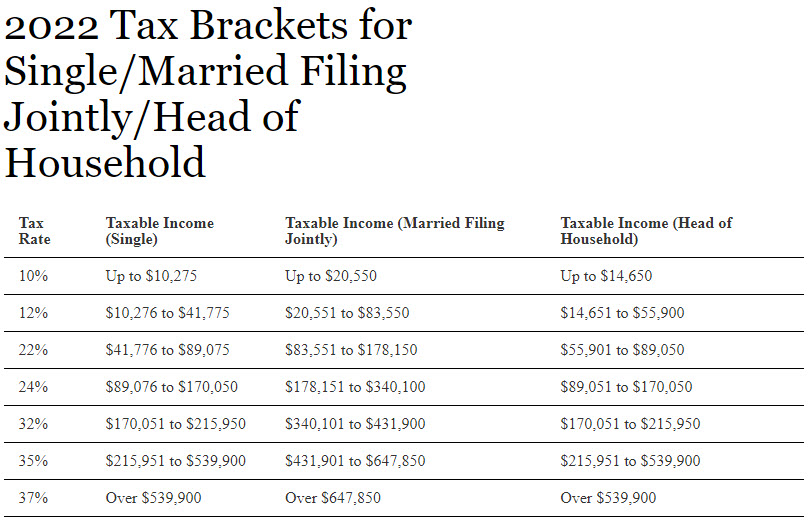

These regulations set the annual rates of Working Tax Credit and Child Tax Credit from 6 April 2022 and the weekly rate of Child Benefit and Guardian s Allowance from 11 April 2022 These Working Tax Credit rates for 2022 23 yearly amount shown These changes will come into effect on April 6 Working Tax Credit income threshold 2022 23 rate 6 770

Working Tax Credit Amount 2022

Working Tax Credit Amount 2022

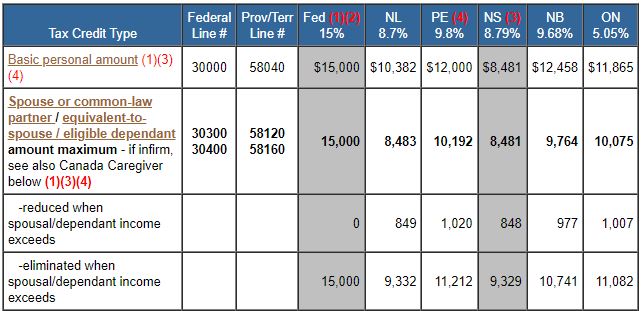

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

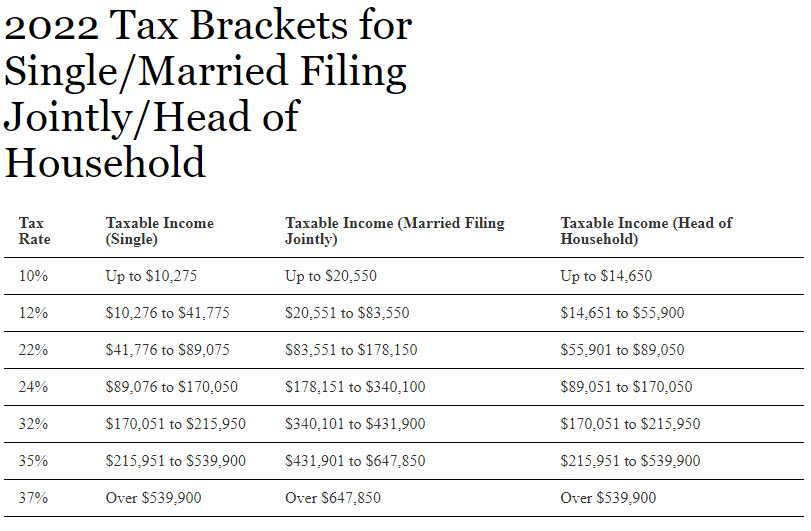

2022 Tax Changes Method CPA

https://methodcpa.com/wp-content/uploads/2022/09/2022-09-28_11-53-21-1.jpg

Income Tax Calculator BF Tax 2022

https://bf.icalculator.com/img/og/BF/81.png

Here are the details of the proposed new payment thresholds and rates for the 2022 23 financial year These changes came into effect on April 6 and were applied to benefit Working Tax Credit eligibility 2022 depends most on whether You are between 16 and 24 with a child or have a qualifying disability You are at least 25 either with or without any children You must be working a minimum number of hours

Working Tax Credit is money to help working people who are on a low income How much Working Tax Credit will I get It is complicated to work out how much Working Tax Credit you The maximum amount you may earn for the basic amount of Working Tax Credit is 2 005 yearly

Download Working Tax Credit Amount 2022

More picture related to Working Tax Credit Amount 2022

Annual Bonus Tax Calculator CA Tax 2022

https://nu-ca.icalculator.com/img/og/NU-CA/65.png

Income Tax Recruitment 2022 Released Salary Rs 2 18 200 Download

https://examsdaily.in/wp-content/uploads/2022/11/Income-Tax-Recruitment-2022-Released.jpg

Income Tax Calculator BW Tax 2022

https://bw.icalculator.com/img/og/BW/81.png

Working tax credit is a means tested benefit paid by HMRC to support people on a low income Find out how to claim working tax credit whether you re eligible to receive payments and how to calculate how much Working Tax Credit rates for 2022 23 yearly amount shown These changes will come into effect on April 6 Working Tax Credit income threshold 2022 23 rate 6 770 2021 22 rate 6 565 Basic

Before you make a claim you should check if you can get working tax credits You might need to claim Universal Credit instead The amount you ll get depends on your circumstances If you re Rates for Working Tax Credit Child Tax Credit tax credits income threshold and withdrawal rates Child Benefit and Guardian s Allowance for the 2024 to 2025 tax year are

Earned Income Tax Credit EITC Tax Refund Schedule For 2022 2023 Tax

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SORL1222001_780x440_mobile.jpeg

Annual Bonus Tax Calculator CO Tax 2022

https://co.icalculator.com/img/og/CO/65.png

https://www.gov.uk › working-tax-credit

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

https://www.legislation.gov.uk › uksi › pdfs

These regulations set the annual rates of Working Tax Credit and Child Tax Credit from 6 April 2022 and the weekly rate of Child Benefit and Guardian s Allowance from 11 April 2022 These

2022 Child Tax Credit Refundable Amount Latest News Update

Earned Income Tax Credit EITC Tax Refund Schedule For 2022 2023 Tax

Work Opportunity Tax Credit Available To Employers

Annual Bonus Tax Calculator CR Tax 2022

What Is Working Tax Credit The Business View

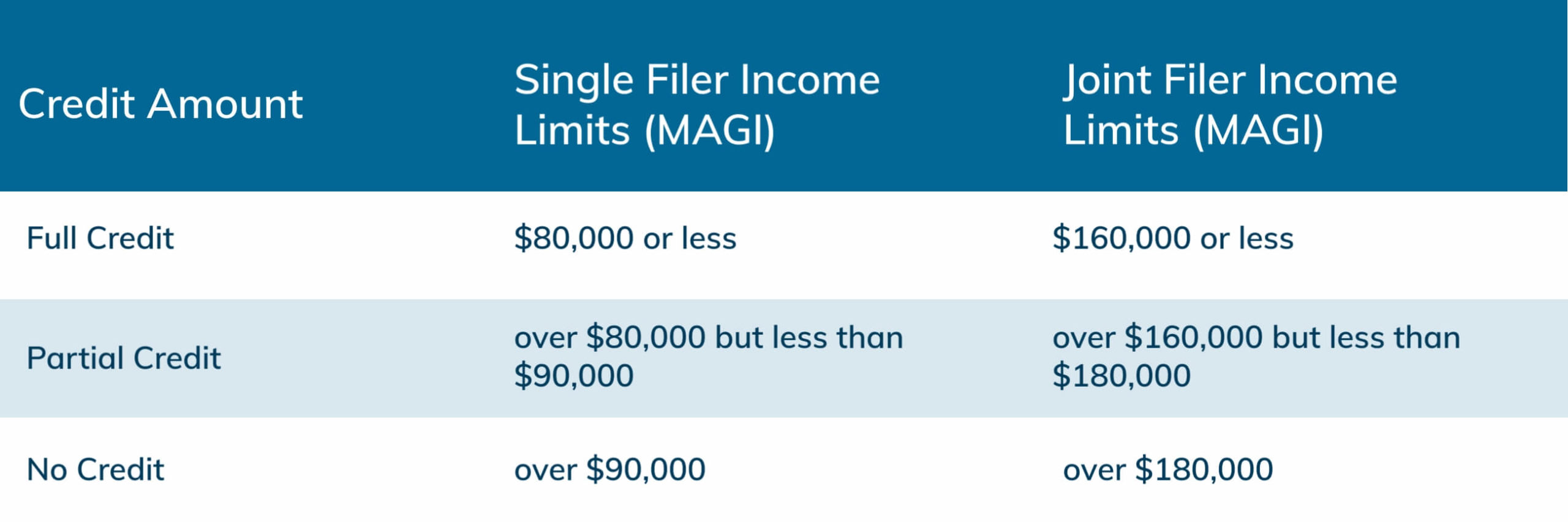

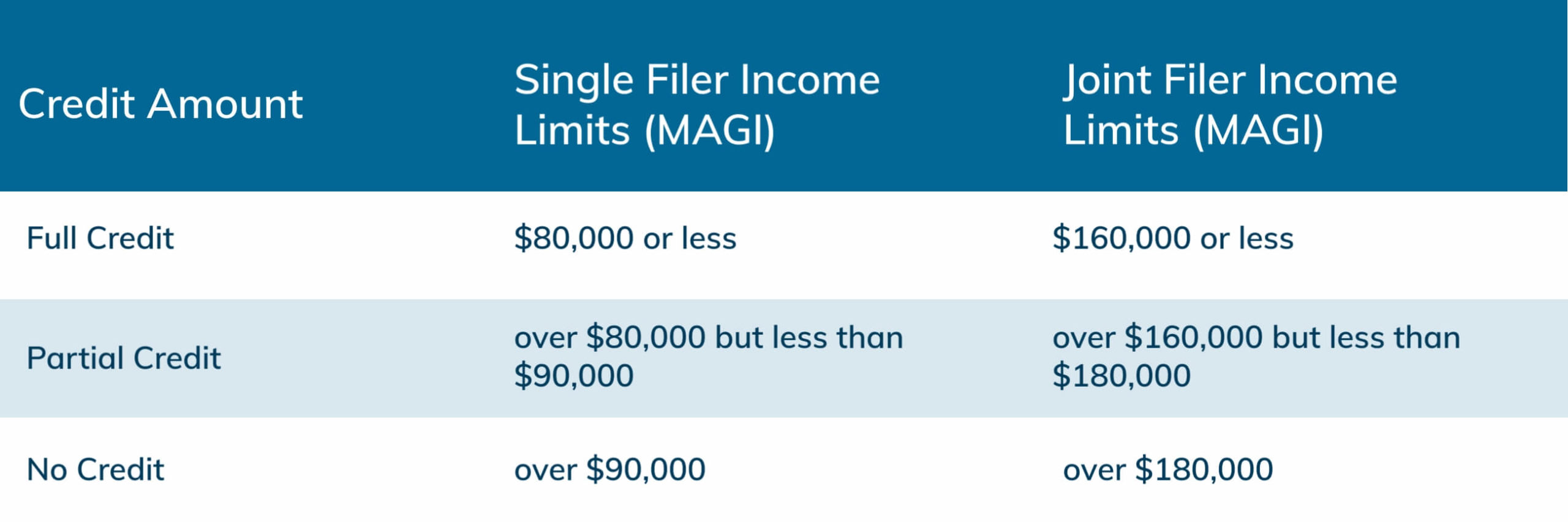

2022 Education Tax Credits Where s My Refund Tax News Information

2022 Education Tax Credits Where s My Refund Tax News Information

Annual Bonus Tax Calculator MW Tax 2022

Child Tax Credit 2023 Requirements Payment Schedule Credit Amount

What To Know When Filing Your 2022 Tax Return From JustAnswer Tax Experts

Working Tax Credit Amount 2022 - Working Tax Credit is money to help working people who are on a low income How much Working Tax Credit will I get It is complicated to work out how much Working Tax Credit you