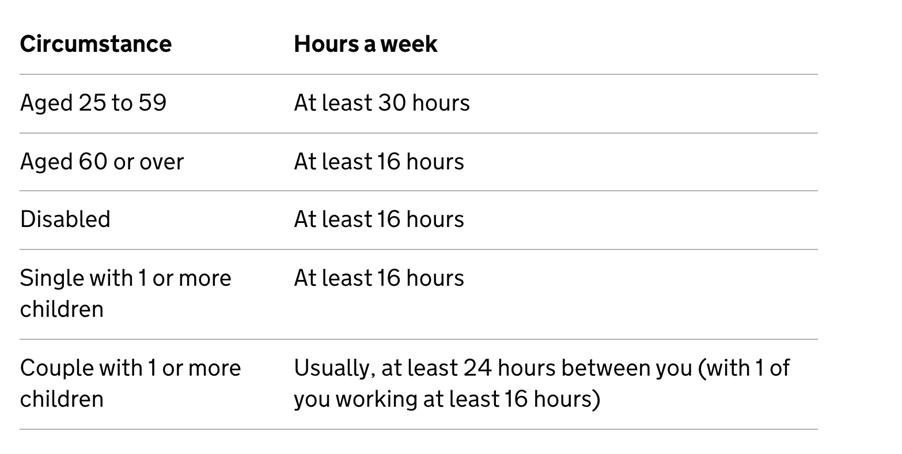

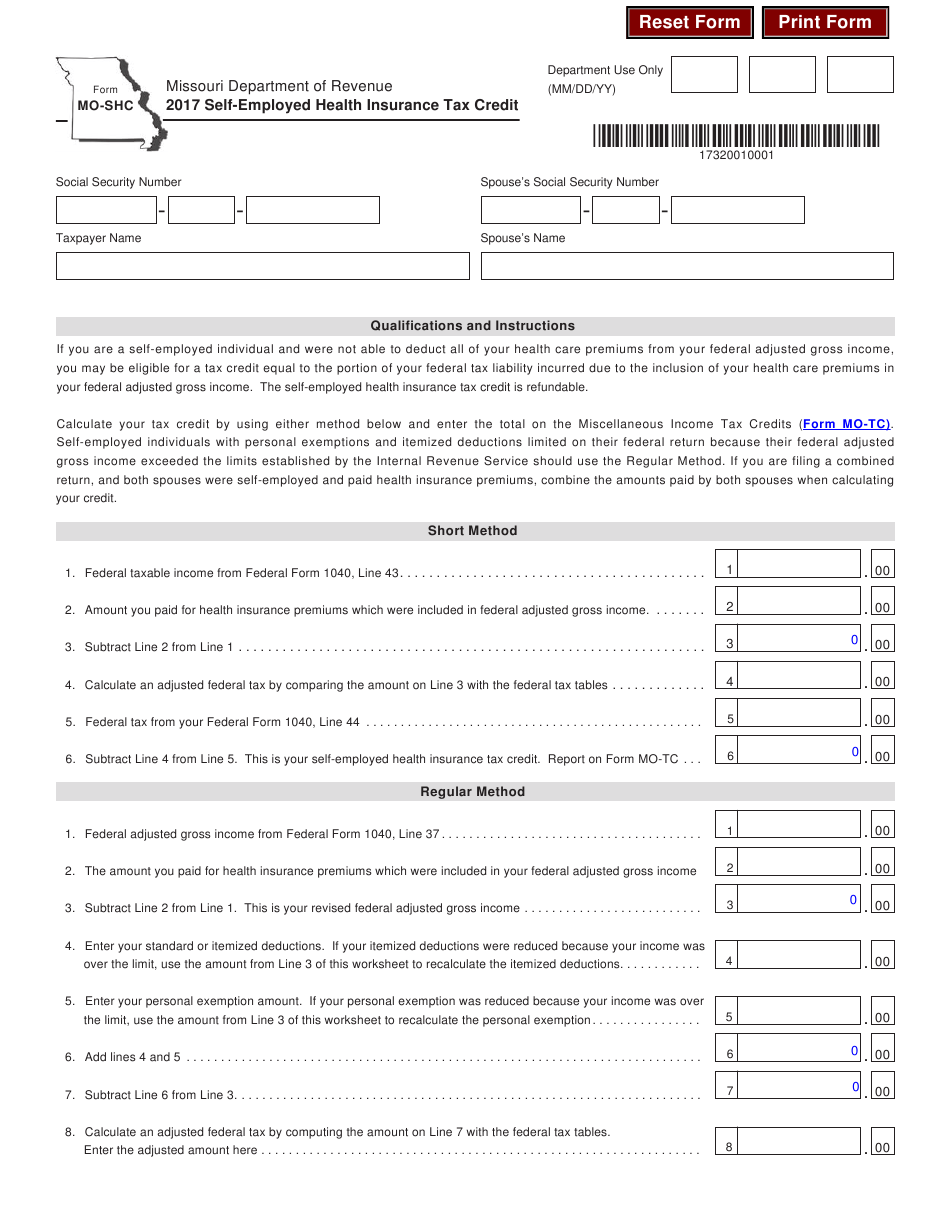

Working Tax Credit Eligibility Scotland Before you make a claim you should check if you can get working tax credits You might need to claim Universal Credit instead The amount you ll get depends on your circumstances If you re

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave You can only claim tax credits if you work at least 16 hours a week and are either use the tax credits disability helpsheet on GOV UK to check if you re eligible for the disability element

Working Tax Credit Eligibility Scotland

Working Tax Credit Eligibility Scotland

https://www.thinkastute.com/wp-content/uploads/2020/02/RD-Credits-Infographic-969x2048.jpg

GST Input Tax Credit Eligibility Ineligible ITC TAX ROBO

https://www.taxrobo.in/uploads/ac0ddf7777e5912679026e948dfb8c87.jpg

Working Tax Credits

https://ecohomenetwork.org/images/images/working-tax-credit.jpg

You can get extra tax credits to help with childcare costs for any children under 15 as long as your childcare provider is registered and approved Make sure your childcare provider is Am I eligible for Working Tax Credit You must work a certain number of hours a week to qualify You can qualify from age 16 if you fall into one of the last 3 categories if not in one of

For families currently receiving Child Tax Credit and Working Tax Credit here is an overview of entitlement Payments are based on current personal circumstances such as employment If you work and are on a low income there s support you could be entitled to to top up your earnings Discover what Working Tax Credit is and how to make a claim

Download Working Tax Credit Eligibility Scotland

More picture related to Working Tax Credit Eligibility Scotland

Child Tax Credit Eligibility Checker Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2021/04/child-tax-credit-eligibility-calculator.png

Working Tax Credit And Child Tax Credit Beavis Morgan Accountants

https://www.beavismorgan.com/wp-content/uploads/2022/02/Picture1.png

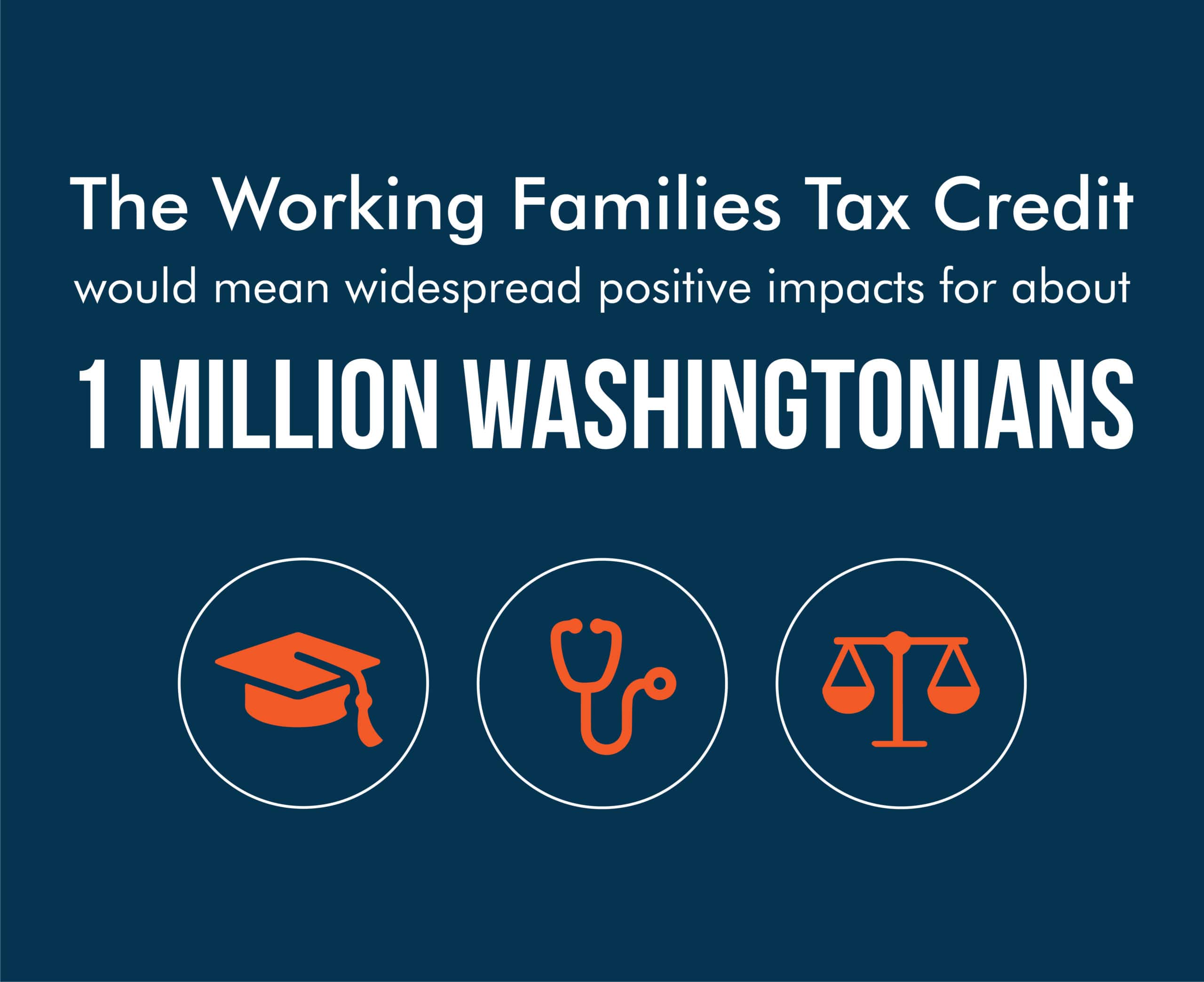

Infographic Washington State Working Families Tax Credit

https://workingfamiliescredit.wa.gov/sites/default/files/2022-10/WFTC Requirements Infographic- Spanish.jpg

WORKING Tax Credits are available for employees on a low income to top up their salaries How much you get depends on a number of factors including your age and how many hours you work Working tax credit is paid by HM Revenue Customs HMRC to support people who work and are on a low income It does not matter whether you are an employee or self employed To qualify for working tax credit you

You can t claim Working Tax Credit if you re getting Universal Credit Applies to England Wales Scotland and Northern Ireland Age rules You must be 16 or over but in some circumstances Find out if you re eligible for Working Tax Credit based on your age employment status and income level Apply today

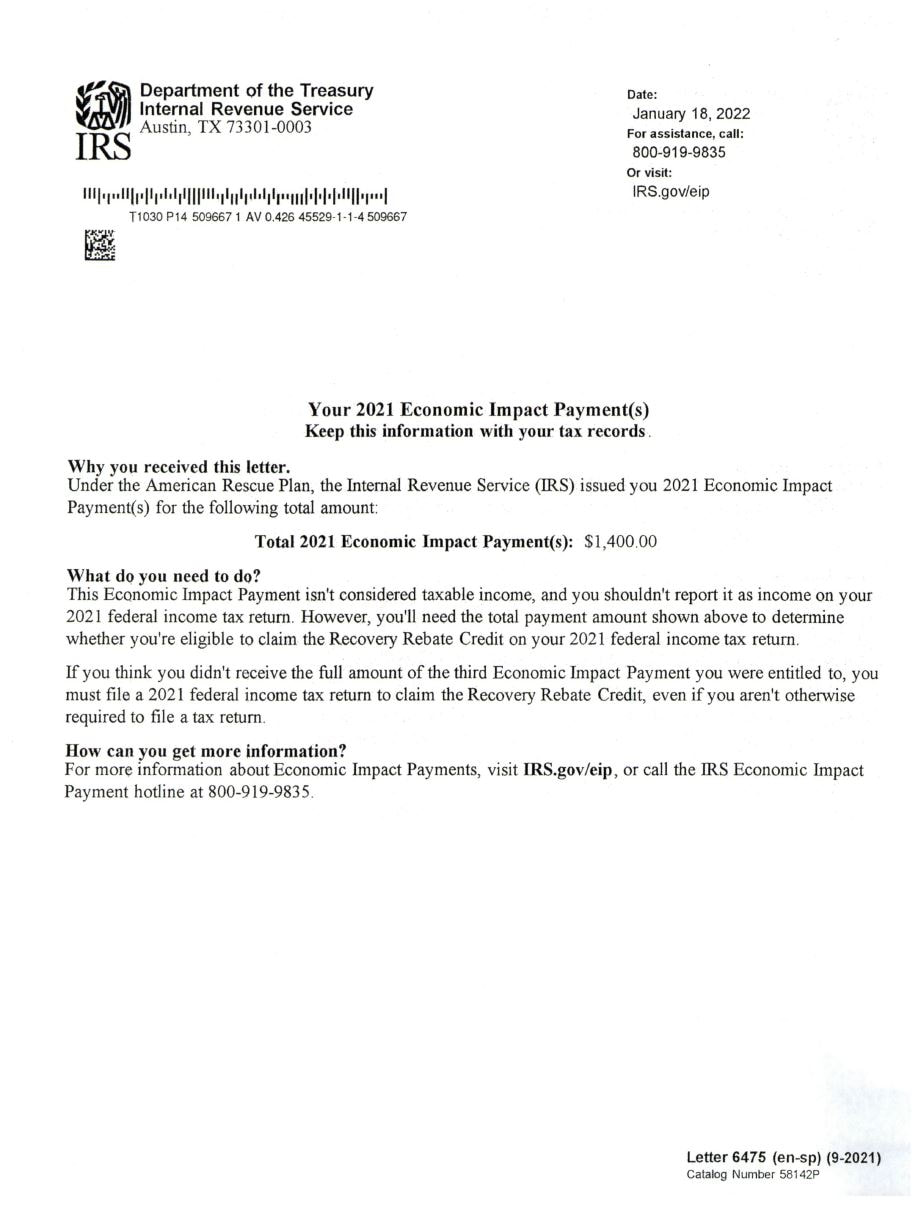

Tax Credit Letters Additional Information

https://www.masonrich.com/uploads/3/8/3/6/38361657/ltr-6475_orig.jpg

Working Tax Credit FAQs That You Wanted

https://www.coreadviz.co.uk/wp-content/uploads/2021/05/Working-Tax-Credit-CoreAdviz.png

https://www.citizensadvice.org.uk › scotland › ...

Before you make a claim you should check if you can get working tax credits You might need to claim Universal Credit instead The amount you ll get depends on your circumstances If you re

https://www.gov.uk › working-tax-credit › what-youll-get

Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credit Letters Additional Information

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

FAQ WA Tax Credit

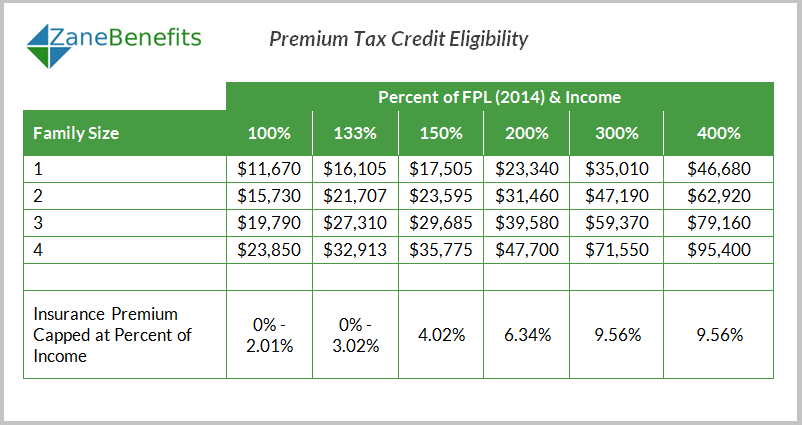

Premium Tax Credit Charts 2015

Working Tax Credits Self Employed Form Employment Form

Working Tax Credits Self Employed Form Employment Form

8 Points To Check Eligibility For Income Tax Return Filing

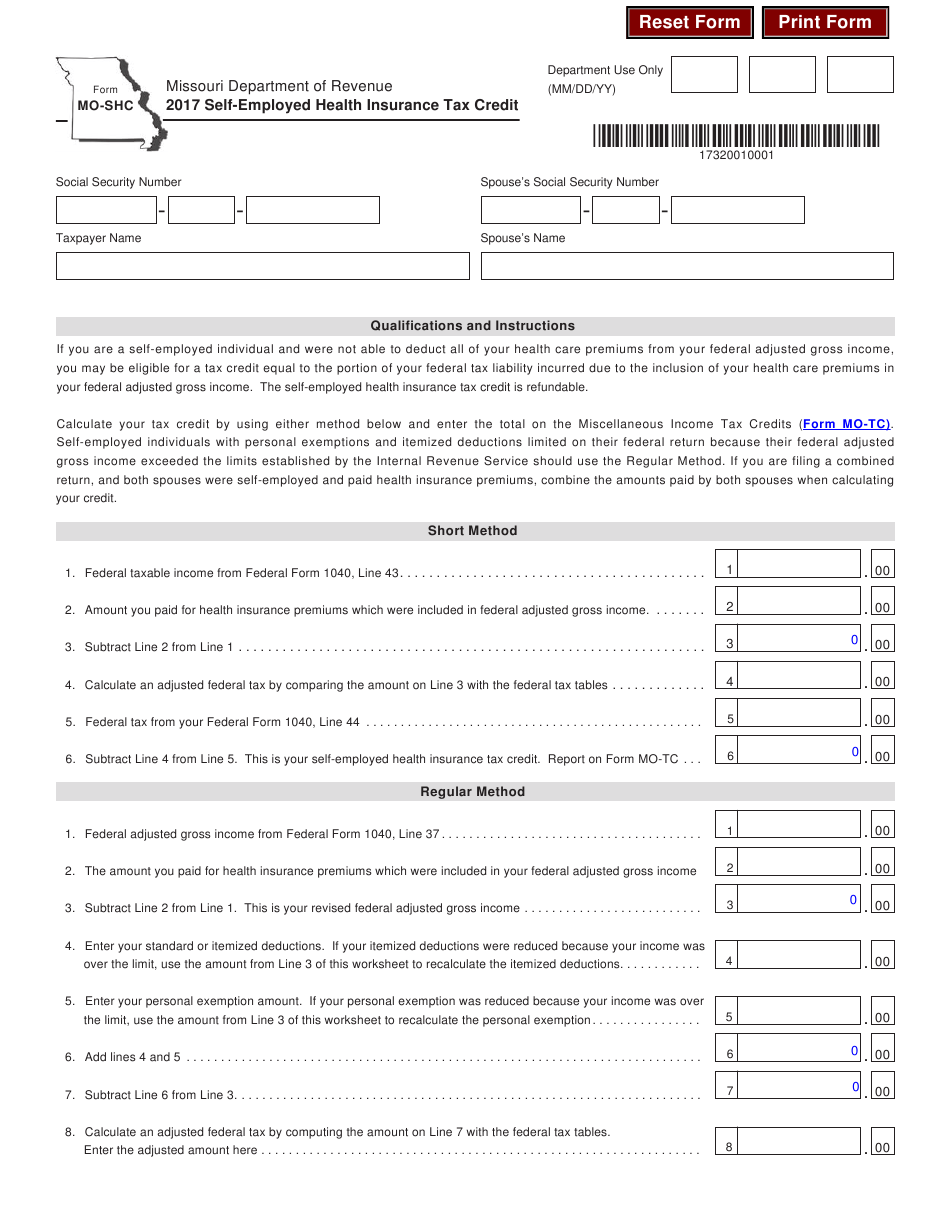

Earned Income Tax Credit EITC Eligibility

Working Families Tax Credit Budget And Policy Center

Working Tax Credit Eligibility Scotland - This advisory outlines the eligibility criteria for working tax credit and child tax credit As universal credit has supplanted tax credits new claims for the latter are no longer feasible