Wv Vehicle Tax Credit Tax policy experts said with the exception of West Virginians who own more than two cars and several additional vehicles like motorcycles and campers it is likely that the majority of people will receive somewhere between 100 and

Beginning January 1 2024 taxpayers are eligible to claim a Motor Vehicle Property Tax Adjustment Credit The first opportunity to claim this credit will be on a 2024 WV income tax return filed in 2025 for all timely paid property taxes for eligible vehicles due in 2024 Beginning January 1 2024 taxpayers are eligible to claim a Motor Vehicle Property Tax Adjustment Credit The first opportunity to claim this credit will be on a 2024 WV

Wv Vehicle Tax Credit

Wv Vehicle Tax Credit

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

https://static01.nyt.com/images/2023/04/17/multimedia/17ev-credits-1-vbpt/17ev-credits-1-vbpt-videoSixteenByNine3000.jpg

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

On Wednesday West Virginia Governor Jim Justice signed House Bill 125 into law That law will provide a tax credit back to those that have paid taxes on their vehicles All West Virginians who own a vehicle will receive a full dollar to dollar refund for personal property taxes Beginning in 2024 taxpayers are eligible to claim a Motor Vehicle Property Tax Adjustment Credit The first opportunity to claim this credit will be on a 2024 WV income tax return filed in 2025 You must file your assessment form and pay your property taxes on time

Starting on the first of January next year all West Virginia taxpayers will be eligible to claim a Motor Vehicle Property Tax Adjustment Credit But if you pay all of your motor vehicle taxes West Virginia taxpayers will now be able to get a refund on their 2023 motor vehicle property tax with less confusion after Gov Jim Justice signed an adjustment into law on Wednesday

Download Wv Vehicle Tax Credit

More picture related to Wv Vehicle Tax Credit

WV Logo

https://logodix.com/logo/9730.png

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

https://www.gannett-cdn.com/-mm-/322f5d74305547090bc274f56107e40846bee274/c=0-154-3000-1849/local/-/media/2017/12/18/DetroitFreeP/DetroitFreePress/636492030183827062-IMG-2017-Chevrolet-Bolt-2-1-1-.JPG?width=3200&height=1680&fit=crop

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Any taxpayers who do not owe West Virginia income taxes and are not required to file a West Virginia income tax return will be able to file a claim for rebate in early 2025 of their motor vehicle property taxes paid without having to file a full return West Virginians are starting to receive their statements of personal property taxes due on vehicles boats and RVs But this year the tax department says just pay the first half for now Beginning on January 1 2024 taxpayers are eligible to claim a Motor Vehicle Property Tax Adjustment Credit

Each year all West Virginians who own a vehicle would receive a tax credit equal to the amount of tax paid on their vehicles Pass through entities and corporations would also be eligible to receive the credit It applies retroactively to January 1 2022 View the bill here Any taxpayers that do not owe West Virginia income taxes and are not required to file a state income tax return will be able to file a claim for rebate in early 2025 of their motor vehicle property taxes paid without having to file a full return

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://mountainstatespotlight.org/2022/12/20/wv...

Tax policy experts said with the exception of West Virginians who own more than two cars and several additional vehicles like motorcycles and campers it is likely that the majority of people will receive somewhere between 100 and

https://tax.wv.gov/Individuals/Pages/Personal...

Beginning January 1 2024 taxpayers are eligible to claim a Motor Vehicle Property Tax Adjustment Credit The first opportunity to claim this credit will be on a 2024 WV income tax return filed in 2025 for all timely paid property taxes for eligible vehicles due in 2024

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Prepare And File Form 2290 E File Tax 2290

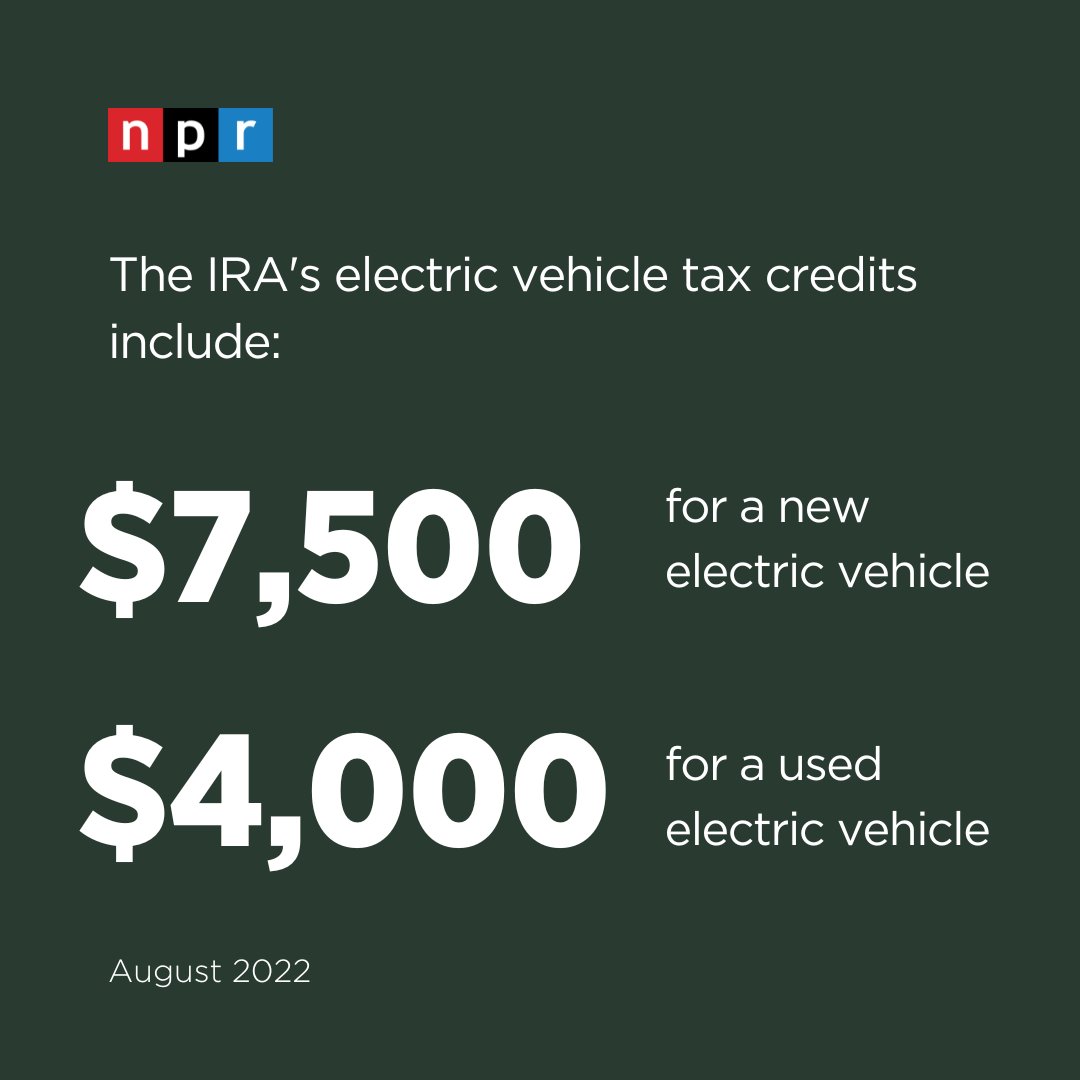

Spike On Twitter Ok Credits For Used EVs Is Exciting

VEHICLE TAX RELATED UPDATES 2023 KERALA

Individual Tax WEC CPA Blog

Individual Tax WEC CPA Blog

Legacy Tax Service Mobile AL

Where Could Interest And Tax Rates Be Headed Mercer Advisors

New Vehicle Tax Rates Come Into Force Today GOV UK

Wv Vehicle Tax Credit - Starting on the first of January next year all West Virginia taxpayers will be eligible to claim a Motor Vehicle Property Tax Adjustment Credit But if you pay all of your motor vehicle taxes