York Pa Tax Rebate Program Web Expansion to Property Tax Rent Rebate Program Changes Coming in 2024 Governor Josh Shapiro delivered on a promise he made to older Pennsylvanians when he signed

Web 3 juil 2023 nbsp 0183 32 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners renters and people Web The deadline to apply for the 2022 Property Tax Rent Rebate is June 30 2023 The Department of Revenue will pay property tax and rent rebate claims filed on behalf of

York Pa Tax Rebate Program

York Pa Tax Rebate Program

https://i0.wp.com/gantnews.com/wp-content/uploads/2023/05/vqdbs7zn0dm9fp9tpw6972kypg.jpeg?fit=1920%2C1440&ssl=1

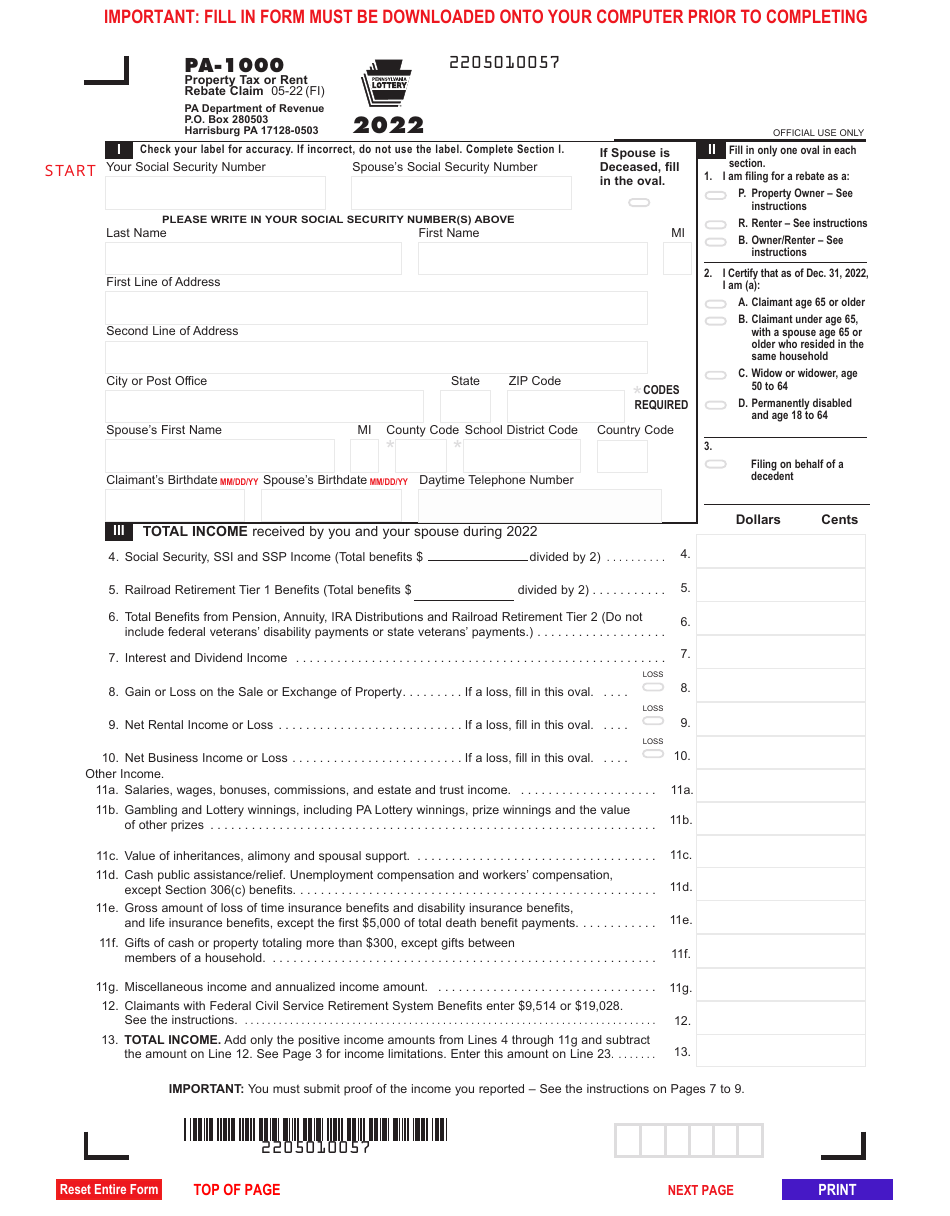

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

https://data.templateroller.com/pdf_docs_html/2587/25879/2587963/page_1_thumb_950.png

York Air Conditioner Rebates AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/york-air-conditioner-rebates.png?fit=680%2C357&ssl=1

Web 27 sept 2022 nbsp 0183 32 Learn how to take advantage of Pennsylvania s property tax rebate and rent rebate program and a special one time bonus approved this year Web Property Tax Rent Rebate Program claimants now have the option to submit program applications online with the Department of Revenue s myPATH system This is the first

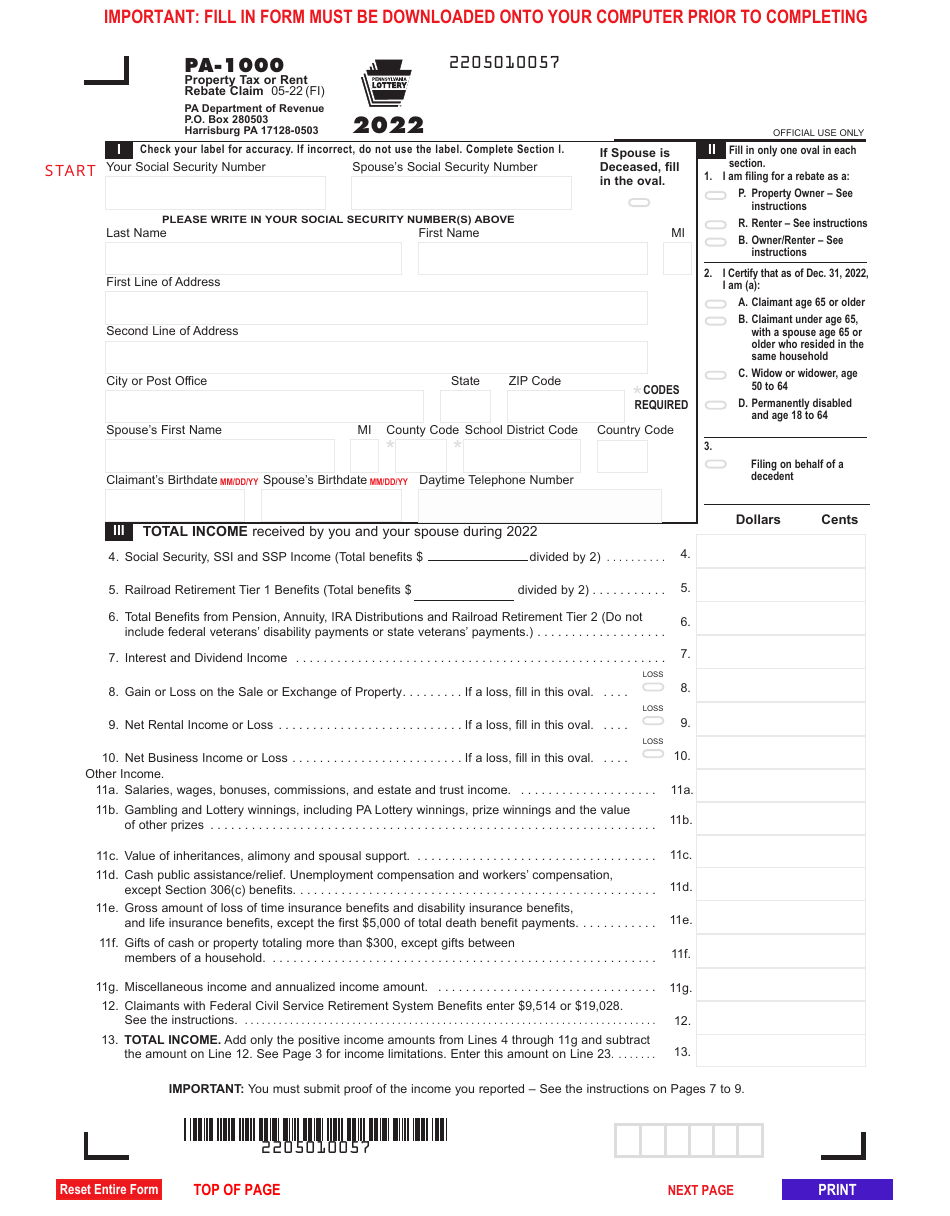

Web 19 janv 2023 nbsp 0183 32 The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older Web 30 juin 2023 nbsp 0183 32 A Pennsylvania program providing rebates on property tax or rent paid the previous year by income eligible seniors and people with disabilities AM I

Download York Pa Tax Rebate Program

More picture related to York Pa Tax Rebate Program

Muth Encourages Eligible Residents To Apply For Extended Property Tax

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Fill Free Fillable Forms For The State Of Pennsylvania

https://var.fill.io/uploads/pdfs/html/a378fb8d-2005-45e3-bbce-dd3883a89208/1616677076_thm.png

PA Officials Call For Boosting Property Tax Rent Rebate Program

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-officials-call-for-boosting-property-tax-rent-rebate-program.jpg?resize=1024%2C683&ssl=1

Web Make a Payment Where s My Income Tax Refund Property Tax Rent Rebate Status Pennsylvania Department of Revenue gt Forms and Publications gt Forms for Individuals Web 2 ao 251 t 2022 nbsp 0183 32 Homeowners with eligible income under 8 000 would receive a 455 bonus 8 001 to 15 000 an extra 350 15 001 to 18 000 an extra 210 and 18 001 to 35 000 an extra 175

Web Home amp Utilities Property Tax or Rent Rebate You may be eligible for a PA property tax or rent rebate if you or your spouse are 65 years or you are a widow er age 50 or Web 7 ao 251 t 2023 nbsp 0183 32 HARRISBURG Thousands more older and disabled Pennsylvanians will qualify for help from a landmark state property tax rebate program after Democratic

NYS Assembly Passes Bill To Revert STAR Tax Rebates WHAM

https://13wham.com/resources/media2/16x9/full/1015/center/80/a58f3662-c124-411b-8f84-6c1a87572751-large16x9_100316STARwebsite1.JPG

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web Expansion to Property Tax Rent Rebate Program Changes Coming in 2024 Governor Josh Shapiro delivered on a promise he made to older Pennsylvanians when he signed

https://www.media.pa.gov/Pages/Revenue-Details.aspx?newsid=402

Web 3 juil 2023 nbsp 0183 32 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners renters and people

More Pa Seniors Would Qualify For The Property Tax Rent Rebate

NYS Assembly Passes Bill To Revert STAR Tax Rebates WHAM

PA Property Tax Rebate Program Deadline Approaching Glenside Local

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

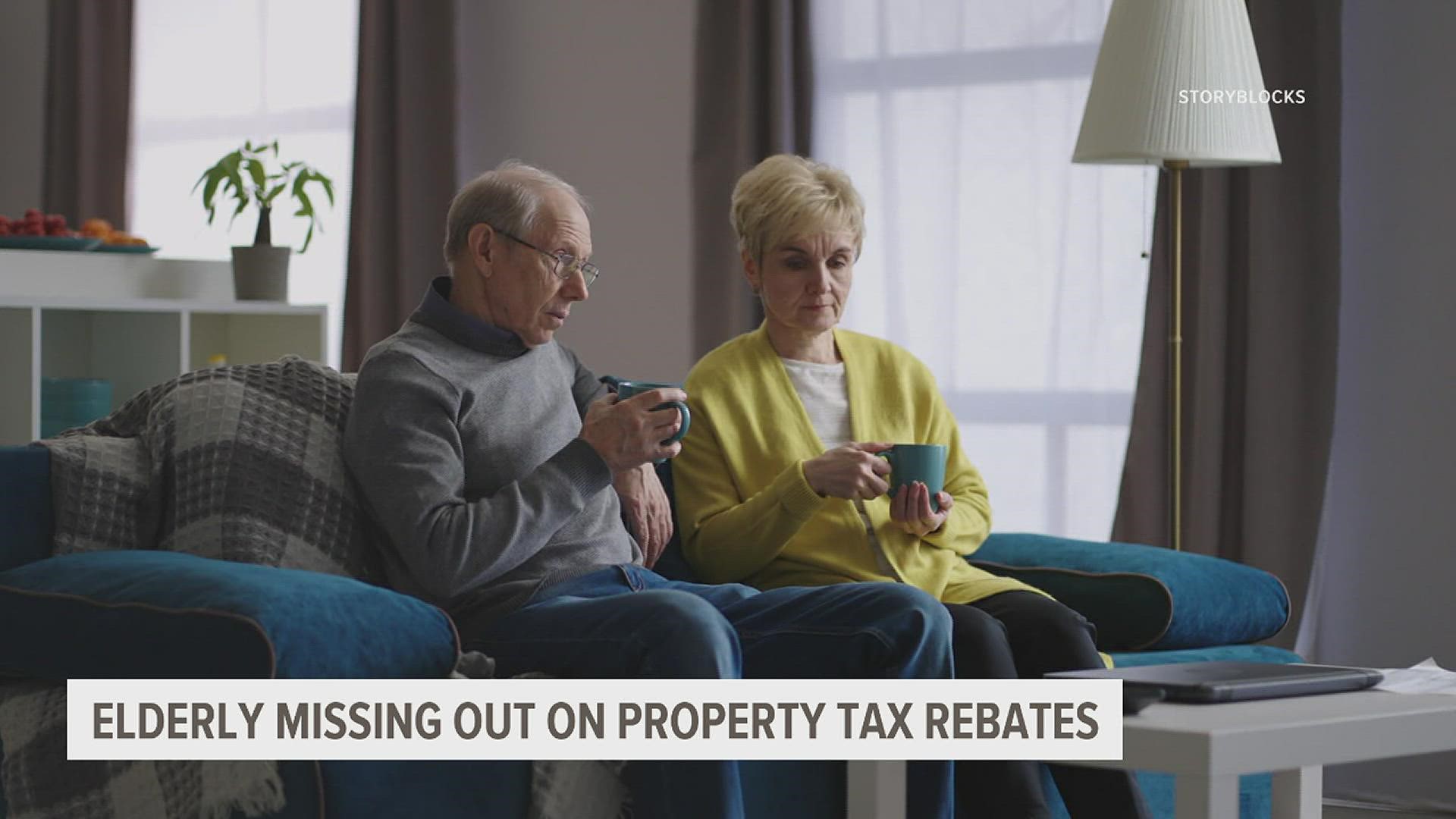

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Property Tax Rent Rebate Program Maximizing Savings And Support For

Property Tax Rent Rebate Program Maximizing Savings And Support For

PA Property Tax Rent Rebate Applications Now Available

Older Disabled Residents Can File For Property Tax Rent Rebate Program

PA Rent Rebate Program Unlocking Financial Relief For Pennsylvania

York Pa Tax Rebate Program - Web 19 janv 2023 nbsp 0183 32 The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older