Zakat Tax Rebate Malaysia Web 4 avr 2023 nbsp 0183 32 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint

Web 27 mars 2023 nbsp 0183 32 1 Apa beza zakat pendapatan dan cukai pendapatan 2 Dengar kata kalau bayar zakat pendapatan boleh dapat 100 rebat cukai pendapatan Betul ke ni 3 2 Web Tax Rebate RM a Zakat Fitrah Subject to the maximum of tax charged b Fees Levy on Foreign Workers Not applicable starting Year of Assessment 2011 Subject to the

Zakat Tax Rebate Malaysia

Zakat Tax Rebate Malaysia

https://i1.rgstatic.net/publication/359042687_Factors_Determining_Zakat_Rebate_Preferences_in_Malaysia_Zakat_as_Tax_Deduction/links/63804359c2cb154d29247214/largepreview.png

PDF Impact Of Zakat Payment Offset System On Income Tax Collection In

https://www.researchgate.net/profile/Annuar-Nassir/publication/313749422/figure/tbl3/AS:667073982234635@1536054239472/Statistics-on-Zakat-Collection-Claimed-as-Income-Tax-Rebate_Q640.jpg

PDF Impact Of Zakat Payment Offset System On Income Tax Collection In

https://www.researchgate.net/profile/Annuar-Nassir/publication/313749422/figure/fig1/AS:599702101827585@1519991531859/Zakat-Collection-Graph-from-year-2005-to-2014_Q640.jpg

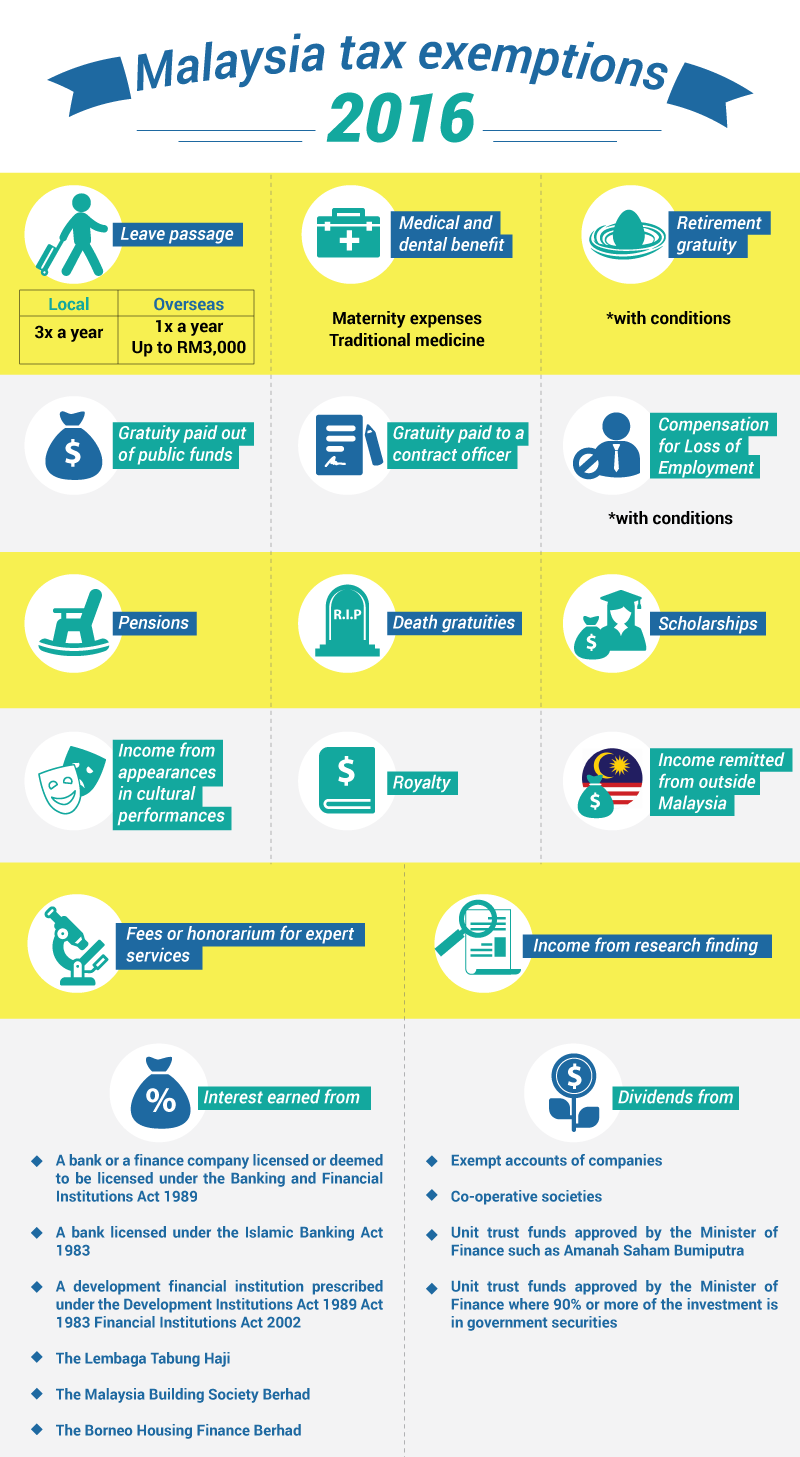

Web Malaysia is one of the Islamic countries that integrate zakat in the tax system Muslim individual taxpayers can minimize tax payment by claiming zakat paid as a tax rebate Web TYPE OF REBATE LIMIT SELF RM400 WIFE HUSBAND ZAKAT FITRAH Paid by the holder of an Employment Pass Visit Pass temporary employment or Work Pass

Web Zakat payers will receive 100 tax rebates from the Inland Revenue Board of Malaysia LHDN 2 5 Business Tax Rebate Zakat payers will receive a 2 5 tax rebate from Web 1 mars 2022 nbsp 0183 32 Zakat income tax rebate in Malaysia Tax rebates are also given to Muslims that pay Zakat The rebate amount will be based on how much you paid during the tax year It is referred to as the had kifayah

Download Zakat Tax Rebate Malaysia

More picture related to Zakat Tax Rebate Malaysia

Table 5 From Factors Determining Zakat Rebate Preferences In Malaysia

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/4693c87c035c28f11dbc6bb537b7ad3e19115744/7-Table5-1.png

PDF Impact Of Zakat Payment Offset System On Income Tax Collection In

https://www.researchgate.net/profile/Annuar-Nassir/publication/313749422/figure/tbl4/AS:667073982255111@1536054239491/Average-Zakat-Contribution-by-Malay-Muslims-in-Malaysia-by-years_Q640.jpg

Zakat In Income Tax Filing MUIS

https://www.zakat.sg/wp-content/uploads/2023/04/Zakat-in-Income-Tax-Filing-2023-2.png

Web Benefits of Paying Zakat 100 Individual Tax Rebate Zakat payers will receive 100 tax rebates from the Inland Revenue Board of Malaysia LHDN 2 5 Business Tax Web 21 janv 2016 nbsp 0183 32 Rebate is a deduction from tax payable If zakat paid is less than tax payable then the balance must be paid to IRB However if zakat paid is more than tax payable then the difference cannot be claimed

Web 12 ao 251 t 2021 nbsp 0183 32 Malaysia is one of the Islamic countries that integrate zakat in the tax system Muslim individual taxpayers can minimize tax payment by claiming zakat paid Web Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner 8 000 Restricted 3 Purchase of basic supporting equipment

Zakat In Income Tax Filing MUIS

https://www.zakat.sg/wp-content/uploads/2023/04/Zakat-in-Income-Tax-Filing-2023-1.png

Tax Rebate 2017 Malaysia Income Tax Rebate U s 87A For F Y 2017 18

https://www.imoney.my/articles/wp-content/uploads/2016/03/Mini-infogs-Income-tax-guide-2016_3-1.png

https://www.imoney.my/.../income-tax-guide-malaysia/what-is-tax-rebate

Web 4 avr 2023 nbsp 0183 32 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint

https://loanstreet.com.my/ms/pusat-pembelajaran/zakat-dan-cukai-pendap…

Web 27 mars 2023 nbsp 0183 32 1 Apa beza zakat pendapatan dan cukai pendapatan 2 Dengar kata kalau bayar zakat pendapatan boleh dapat 100 rebat cukai pendapatan Betul ke ni 3 2

Business Zakat Calculation In Malaysia CasonanceHammond

Zakat In Income Tax Filing MUIS

Business Zakat Calculation In Malaysia CaydenropMoyer

Cross Tabulation Of Maal Zakat Payers And Tax Deduction Preference

Personal Tax Relief Malaysia 2020 Alexandra Ross

EdisiViral Kadar Zakat Fitrah 2020 Semua Negeri Di Malaysia

EdisiViral Kadar Zakat Fitrah 2020 Semua Negeri Di Malaysia

Zakat Tax And Customs Authority Booth Portfolio

Income Tax Deduction Malaysia Joseph Randall

Zakat Tax And Customs Authority On LinkedIn

Zakat Tax Rebate Malaysia - Web 11 juil 2019 nbsp 0183 32 Malaysia Download chapter PDF Introduction Zakat and taxation are two distinct concepts that need to be comprehensively understood and appreciated by the