1098 Form Tax Rebate Web You are required to report reimbursements of overpaid interest aggregating 600 or more to a payer of record on Form 1098 You are not required to report reimbursements of

Web Report the total reimbursement even if it is for overpayments made in more than 1 year To be reportable the reimbursement must be a refund or credit of mortgage interest Web 16 d 233 c 2022 nbsp 0183 32 Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report

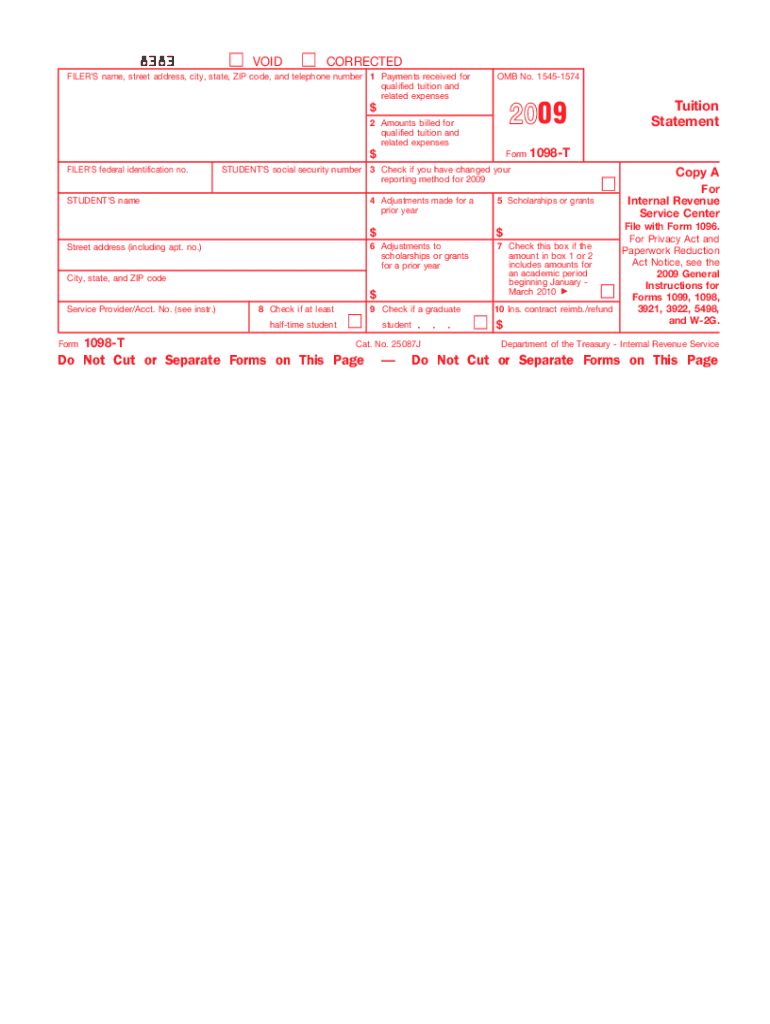

1098 Form Tax Rebate

1098 Form Tax Rebate

https://www.utsa.edu/financialaffairs/services/financial-services/images/2019_1098t.png

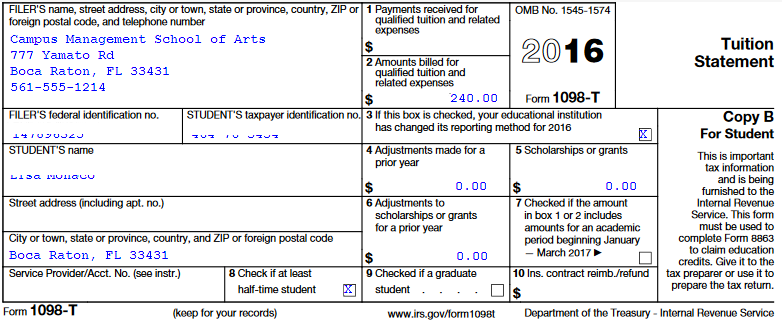

View 1098T

https://help.campusmanagement.com/PRT/22.3/Student/Content/Resources/Images/1098t.png

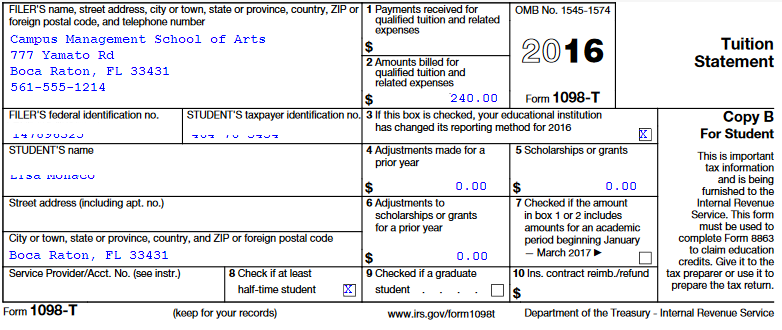

1098 2016 Public Documents 1099 Pro Wiki

https://wiki.1099pro.com/download/attachments/12615890/20161098.JPG?version=1&modificationDate=1461256855740&api=v2

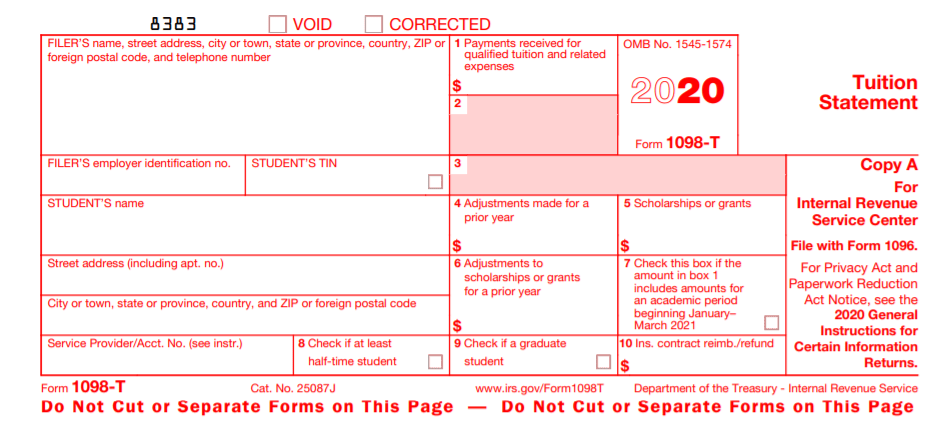

Web Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is Web 1 d 233 c 2022 nbsp 0183 32 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders

Web The optional method allows you to deduct the mortgage interest and state and local real property taxes reported on Form 1098 Mortgage Interest Statement but only up to the Web 11 juin 2023 nbsp 0183 32 Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage related expenses paid on a mortgage during the tax year These expenses can be

Download 1098 Form Tax Rebate

More picture related to 1098 Form Tax Rebate

1098 Form 2015 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/6/963/6963924/large.png

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

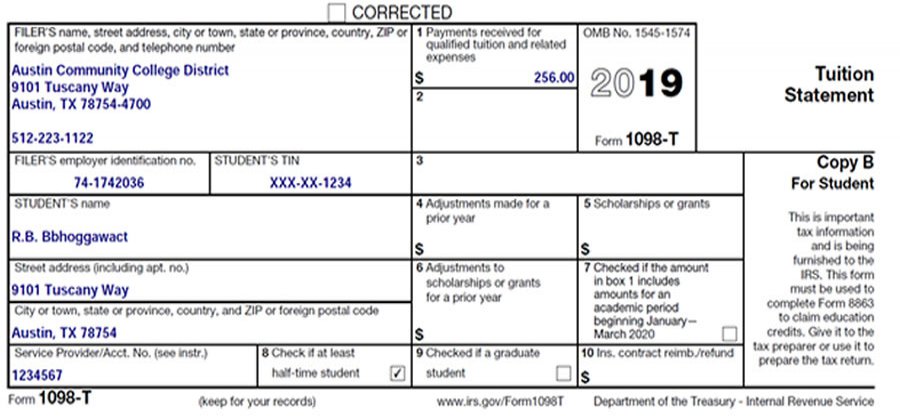

How To Get My 1098 T Form From School School Walls

https://www.austincc.edu/sites/default/files/resize/1098T_2019-900x420.jpg

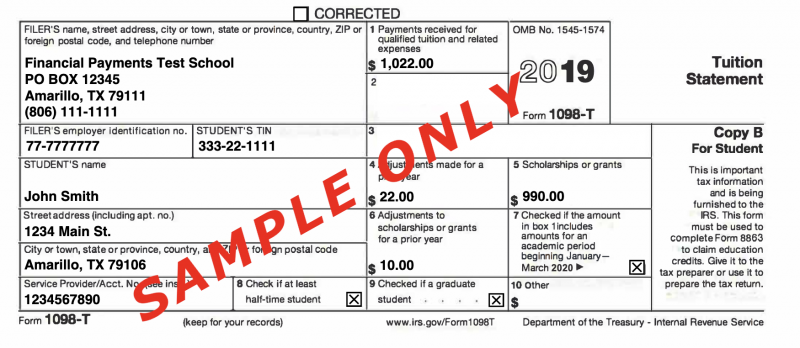

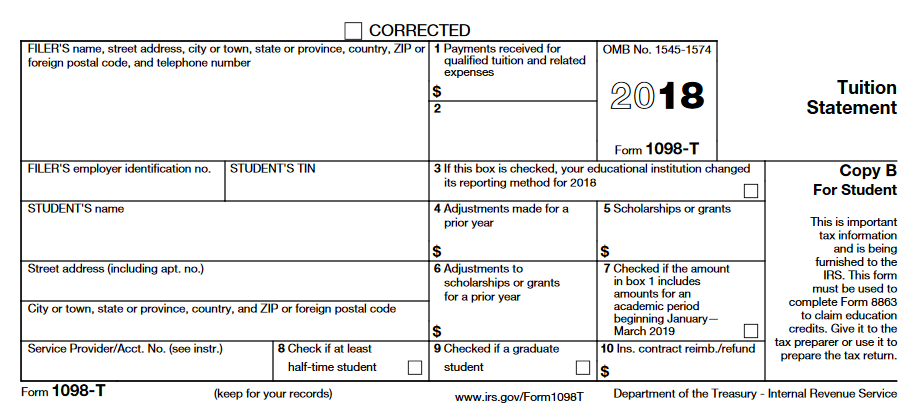

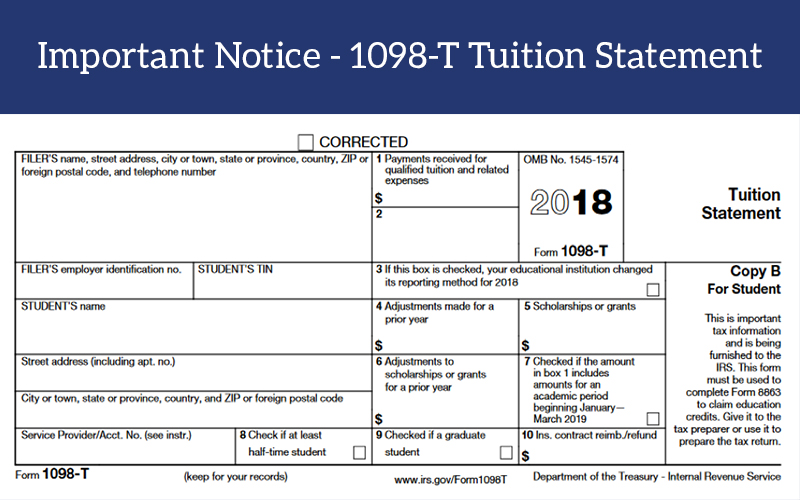

Web Home Money and tax Income Tax Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need Web Generally an eligible educational institution such as a college or university must send Form 1098 T or acceptable substitute to each enrolled student by January 31 2023 An institution will report payments

Web 1 f 233 vr 2022 nbsp 0183 32 Form 1098 T also allows you to deduct up to 4 000 for qualified higher education expenses As with any tax deduction that can lower your AGI and potentially Web 30 juin 2023 nbsp 0183 32 Request copies of key documents Taxpayers who are missing Forms W 2 1098 1099 or 5498 for the years 2019 2020 or 2021 can request copies from their

What Is A 1098 T Form Used For Full Guide For College Students The

https://www.handytaxguy.com/wp-content/uploads/2018/12/1098-T-Tuition-Statement-Image.png

1098 T Form Nipodcup

https://www.pdffiller.com/preview/100/41/100041178/large.png

https://www.irs.gov/pub/irs-pdf/i1098.pdf

Web You are required to report reimbursements of overpaid interest aggregating 600 or more to a payer of record on Form 1098 You are not required to report reimbursements of

https://www.irs.gov/instructions/i1098

Web Report the total reimbursement even if it is for overpayments made in more than 1 year To be reportable the reimbursement must be a refund or credit of mortgage interest

1098T Forms For Education Expenses IRS Copy A ZBPforms

What Is A 1098 T Form Used For Full Guide For College Students The

2019 Updates 1098 T Forms

1098 T Tuition Statement Finance And Administration Oregon State

Students Can Now Access 1098T Form Online On The College Website

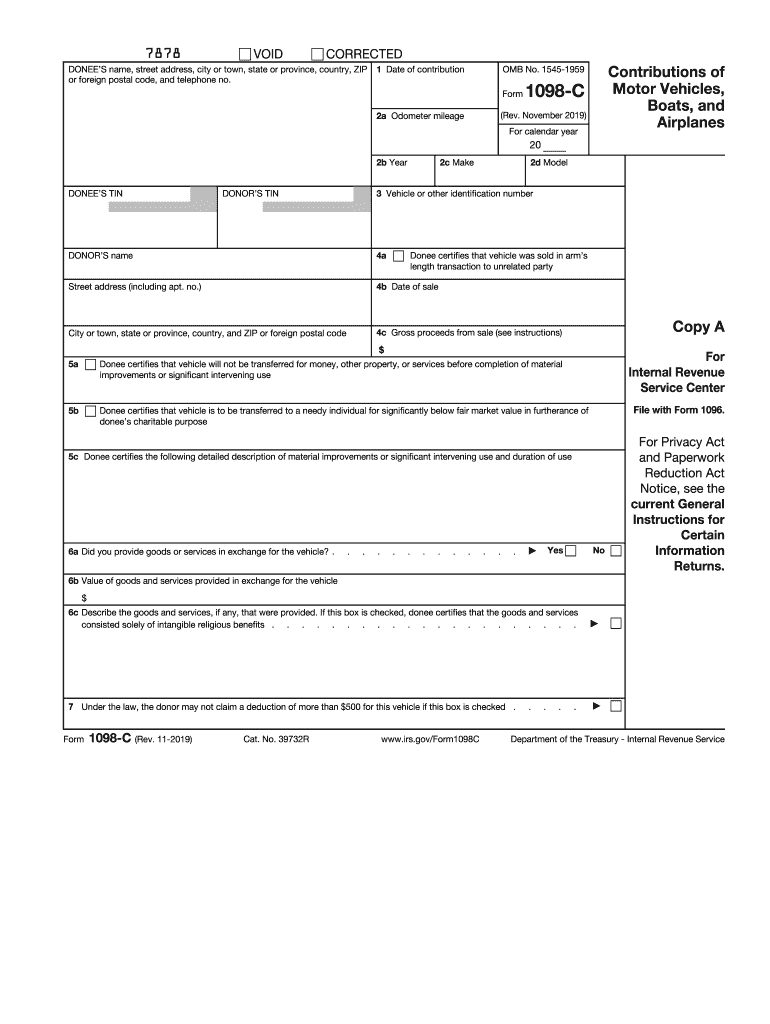

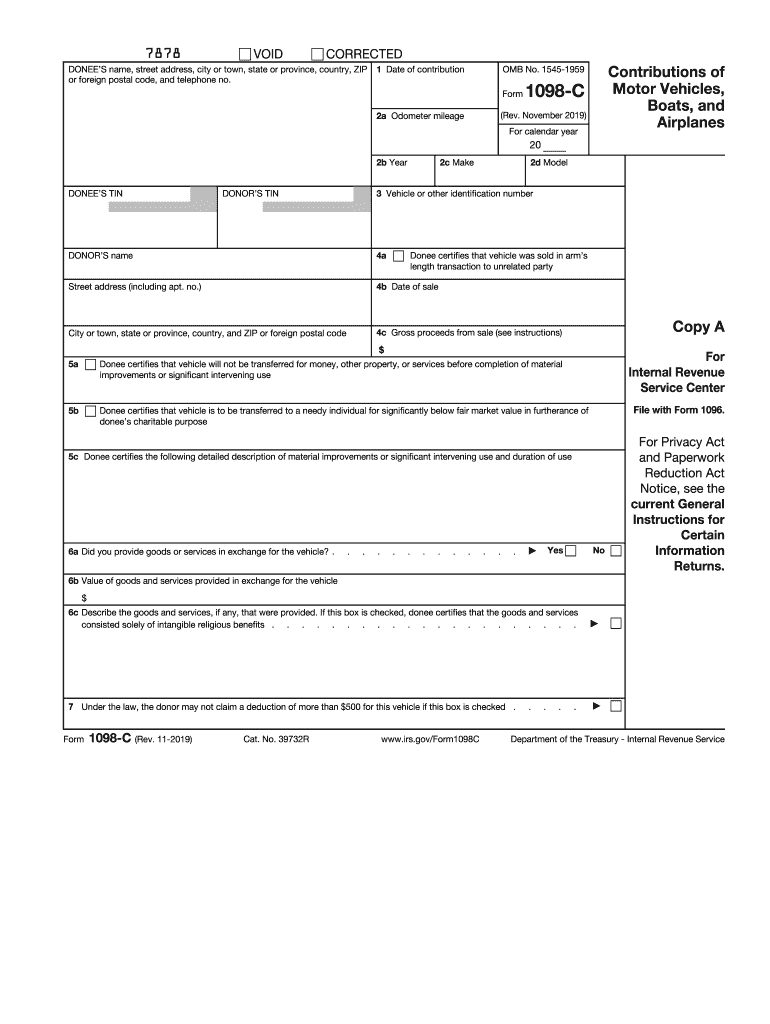

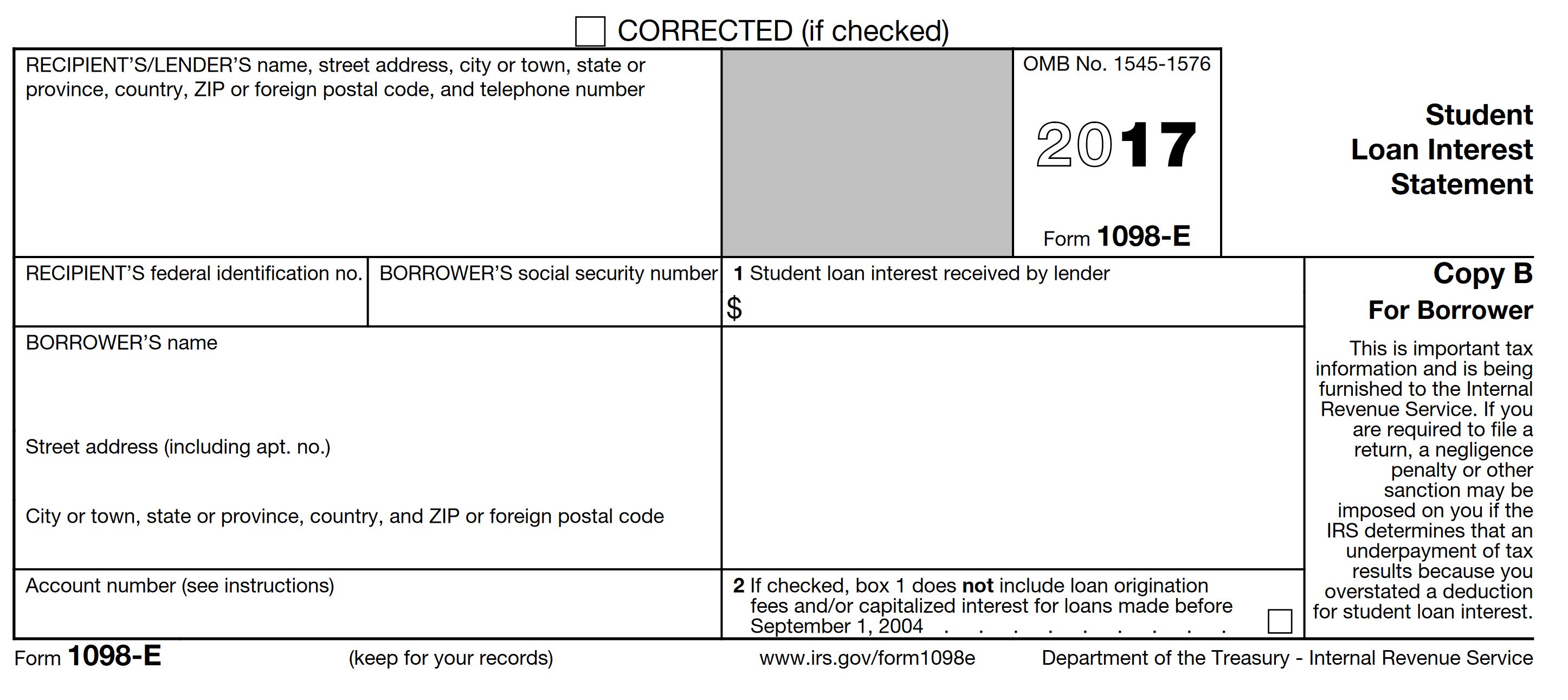

Fillable 2017 C Fill Out Sign Online DocHub

Fillable 2017 C Fill Out Sign Online DocHub

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax

Form 1098t Printable Printable Forms Free Online

Form 1098 T Information Student Portal

1098 Form Tax Rebate - Web 1 d 233 c 2022 nbsp 0183 32 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders