Homeowners Tax Rebate 2024 When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Homeowners Tax Rebate 2024

Homeowners Tax Rebate 2024

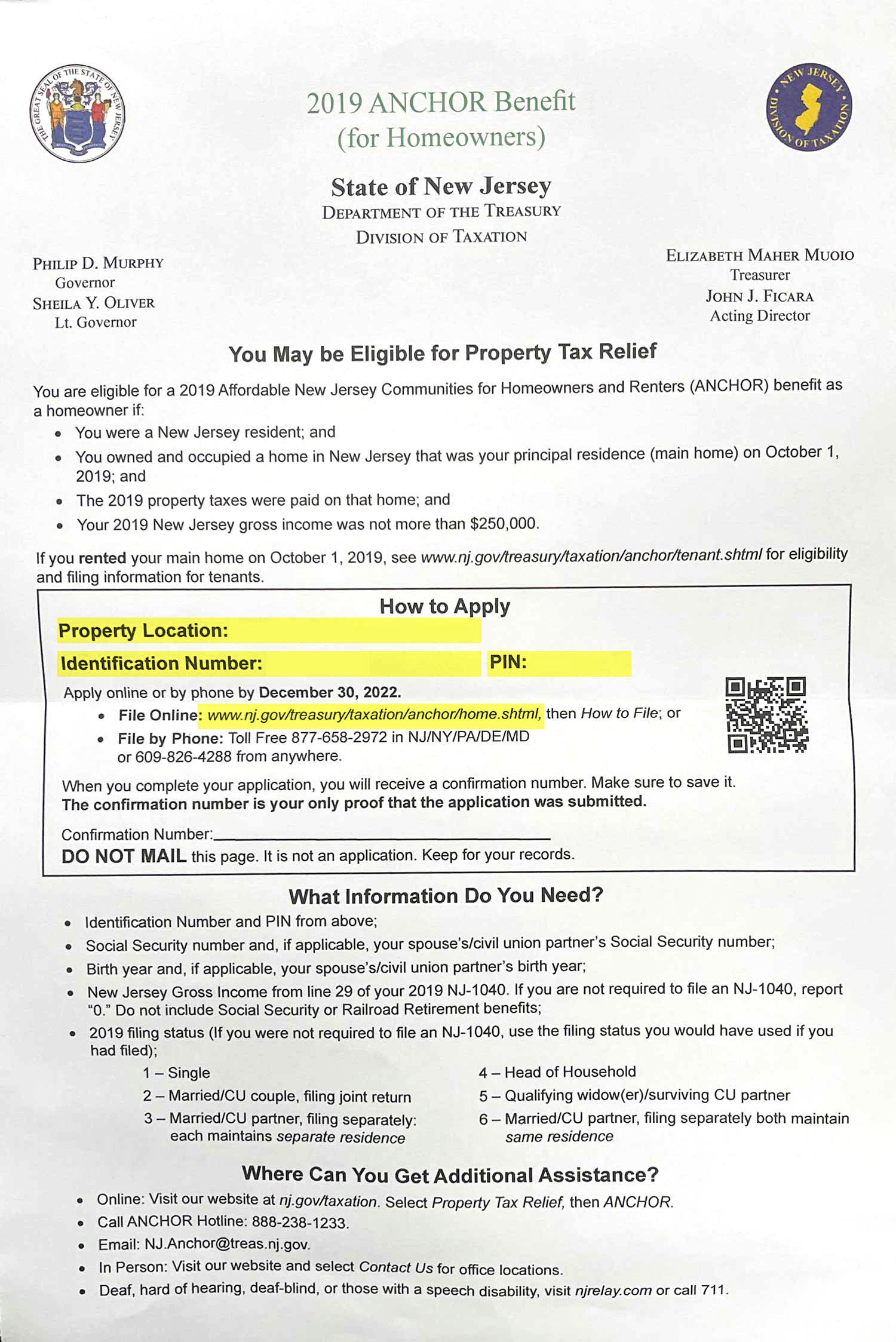

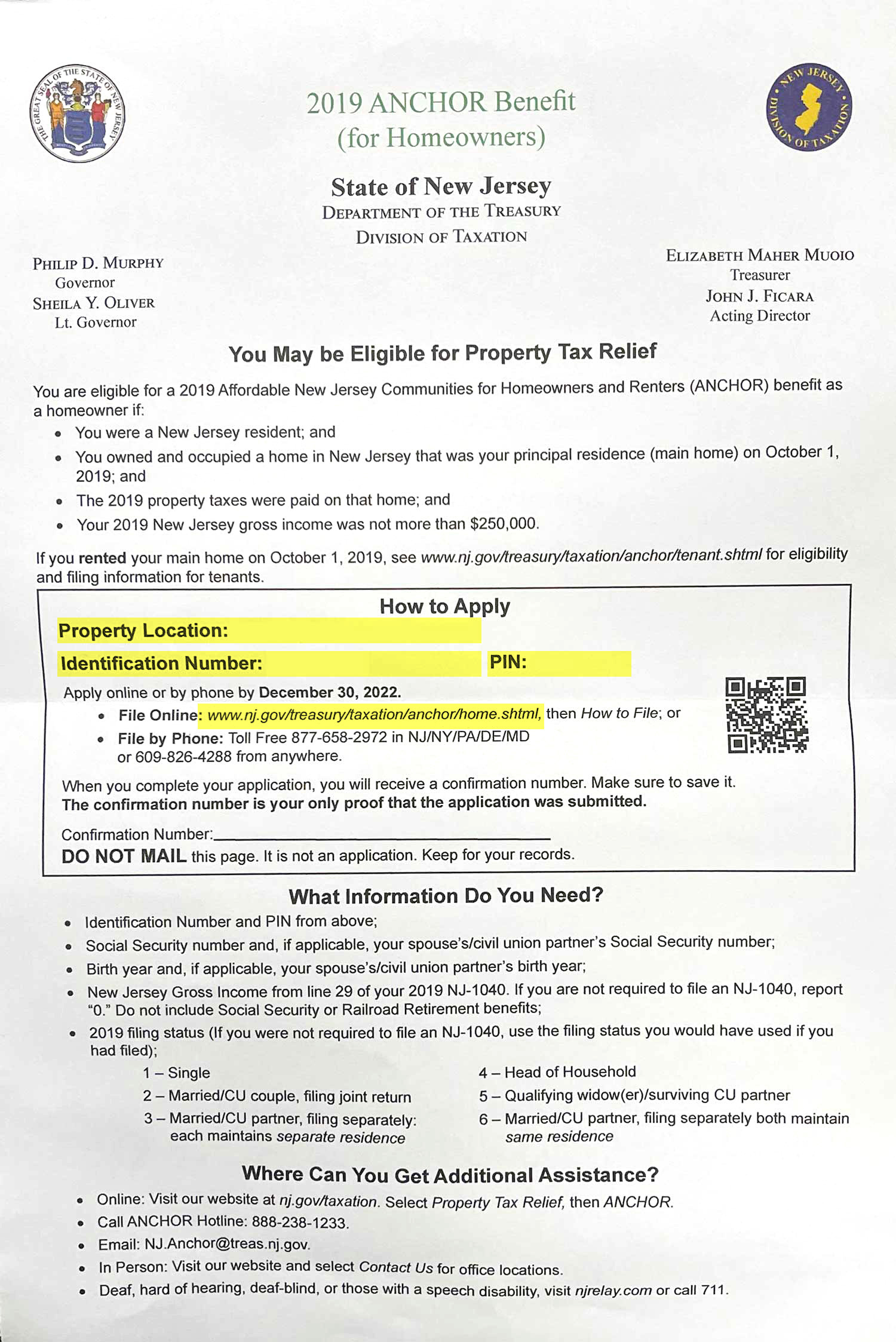

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding Households looking for assistance today may be eligible for other federal programs including tax credits or the Weatherization Assistance Program Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30

Download Homeowners Tax Rebate 2024

More picture related to Homeowners Tax Rebate 2024

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022 Property Credit was set to expire in 2024 However the When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

Most older homeowners would see their property tax bills cut in half with a maximum benefit of 6 500 The agreement still must be approved as part of a proposed 53 billion budget which is due Here s how big the 15 000 First Time Home Buyer Tax Credit would get for buyers over the next 5 years assuming a 5 annual rate of inflation 2023 Maximum tax credit of 17 850 2024 Maximum tax credit of 18 745 2025 Maximum tax credit of 19 680 2026 Maximum tax credit of 20 665

Eligibility For Homeowners Tax Rebate YouTube

https://i.ytimg.com/vi/ZqmfXWRY6TA/maxresdefault.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

https://www.cnet.com/personal-finance/taxes/all-the-tax-breaks-homeowners-can-take-for-a-maximum-tax-refund-in-2024/

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married filing

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

Eligibility For Homeowners Tax Rebate YouTube

8 Must know Homeowners Tax Breaks For 2021 Including A COVID Rebate HLC Team At Cornerstone

More Pa Seniors Would Qualify For The Property Tax Rent Rebate Program Under New Proposal

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Property Tax Rebate Pennsylvania LatestRebate

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

Homeowners Tax Rebate 2024 - Homeowners will see their 2024 property tax bill reduced 43 70 per 100 000 of home value Updated November 30 2023 at 4 15 PM EST This article has been updated with the commissioners vote