2 Year Tax Exemption Rebate Web 5 avr 2022 nbsp 0183 32 Taxe fonci 232 re 2022 une exon 233 ration temporaire de 2 ans pour certains propri 233 taires Ainsi certains propri 233 taires b 233 n 233 ficient d une exon 233 ration temporaire de la

Web If an issuer elects to pay penalty in lieu of rebate under the 2 year exception however the issuer must apply those penalty provisions b Rules applicable for all spending Web L exon 233 ration de la taxe fonci 232 re sera 224 ce moment l 224 de 3 ans 224 partir de l ann 233 e suivant celle du paiement du montant total des d 233 penses d 233 quipement 5 ans pour les

2 Year Tax Exemption Rebate

2 Year Tax Exemption Rebate

https://economictimes.indiatimes.com/img/60155156/Master.jpg

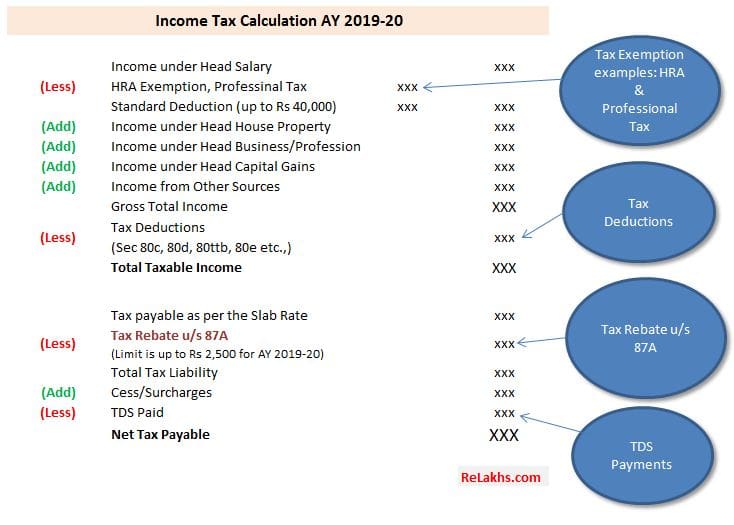

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Business News New Income Tax Slabs 2023 24 From Income Tax Exemption

https://st1.latestly.com/wp-content/uploads/2023/02/Income-Tax-2023-24_2.jpg

Web 8 mars 2022 nbsp 0183 32 To claim the Recovery Rebate Credit you must file a US tax return for the year in which the Economic Impact Payment was sent out For example if you re hoping Web The Issuer reasonably expects as of the issue date that the aggregate face amount of all tax exempt bonds other than private activity bonds issued by it and subordinate

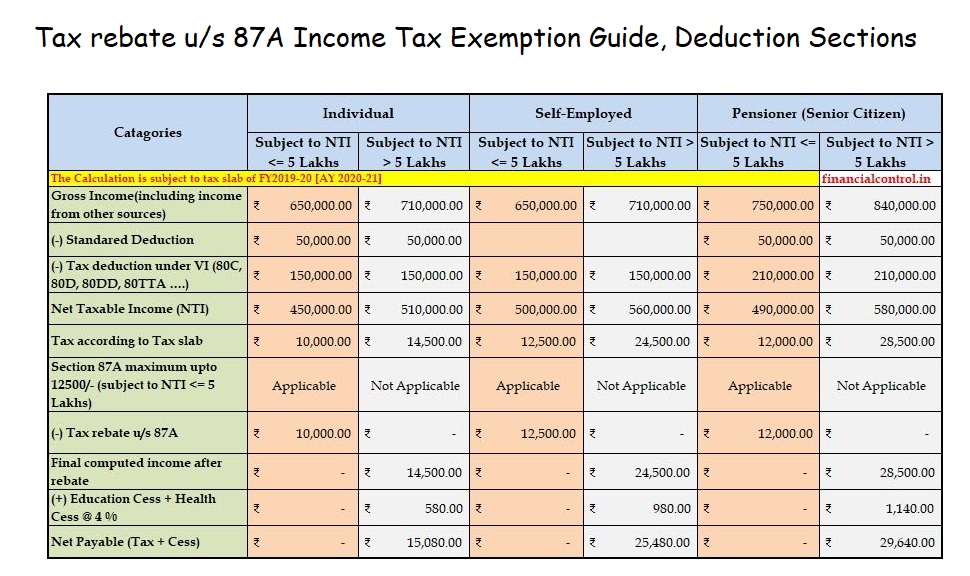

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the Web 12 juil 2023 nbsp 0183 32 Additional years of tax exemption will be added to the standard tax incentives received as follows Investment expenditure based on the sales revenue in the

Download 2 Year Tax Exemption Rebate

More picture related to 2 Year Tax Exemption Rebate

Advisor Today Insurance Microfinance Bank banking life

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Request Letter For Tax Certificate For Income Tax SemiOffice Com

https://semioffice.com/wp-content/uploads/2021/09/Letter-Asking-for-Payment-Details-for-Tax-Payments.png

Web 18 juil 2023 nbsp 0183 32 Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c Web So on taxable income of Rs 5 lakh the income tax outgo is nil Tax calculation after claiming deductions and exemptions Total Taxable income Rs 5 lakh Income Tax A

Web 28 juin 2023 nbsp 0183 32 Tax reduction and exemption CIT may be reduced or exempted on income derived from the following projects Notes 2 3 years tax holiday refers to two years of Web tax exempt obligations is not includable in their gross income for federal income tax purposes Which monies are proceeds subject to rebate 2 Which investments are

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Rebate VS Tax Deduction Vs Tax Exemption Tax Term Explain YouTube

https://i.ytimg.com/vi/fVmLlcI45_0/maxresdefault.jpg

https://demarchesadministratives.fr/actualites/taxe-fonciere-2022-les...

Web 5 avr 2022 nbsp 0183 32 Taxe fonci 232 re 2022 une exon 233 ration temporaire de 2 ans pour certains propri 233 taires Ainsi certains propri 233 taires b 233 n 233 ficient d une exon 233 ration temporaire de la

https://www.law.cornell.edu/cfr/text/26/1.148-7

Web If an issuer elects to pay penalty in lieu of rebate under the 2 year exception however the issuer must apply those penalty provisions b Rules applicable for all spending

Tax Rebate For Individual Deductions For Individuals reliefs

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Tax Rebate Checks Come Early This Year Yonkers Times

Confused Between The Terms Tax Exemption Tax Deduction And Tax Rebate

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

When Do Star Rebate Checks Go Out StarRebate

When Do Star Rebate Checks Go Out StarRebate

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections

Income Tax Deduction Exemption FY 2021 22 WealthTech Speaks

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

2 Year Tax Exemption Rebate - Web 31 d 233 c 2022 nbsp 0183 32 Generally tax incentives are available for tax resident companies Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies