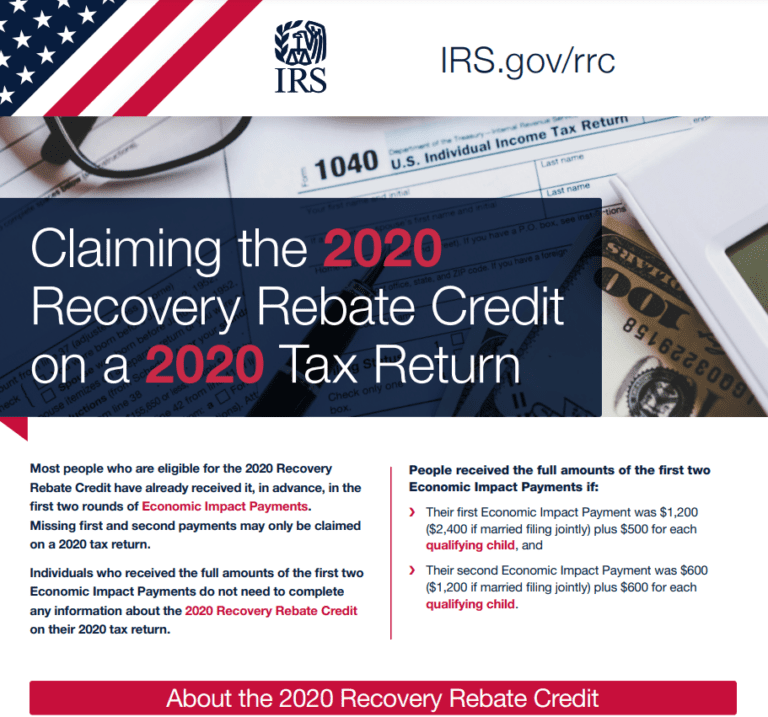

202 Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 Recovery Rebate Credit Topics Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web 13 avr 2022 nbsp 0183 32 Generally if the Recovery Rebate Credit amount is more than the tax you owe it will be included as part of your 2020 tax refund You will receive your 2020

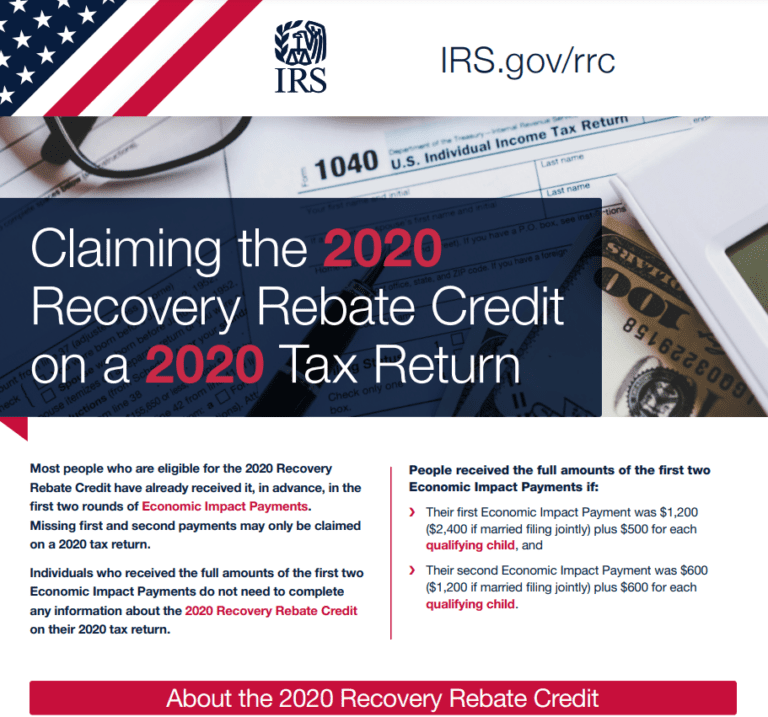

202 Recovery Rebate Credit

202 Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-calculate-recovery-rebate-credit-2022-rebate2022-recovery-rebate-8.png?fit=770%2C1024&ssl=1

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/the-recovery-rebate-credit-calculator-shauntelraya-2.png?resize=768%2C472&ssl=1

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate

Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is Web 10 d 233 c 2021 nbsp 0183 32 These updated FAQs were released to the public in Fact Sheet 2022 26 PDF April 13 2022 If you didn t get the full first and second Economic Impact Payment

Download 202 Recovery Rebate Credit

More picture related to 202 Recovery Rebate Credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

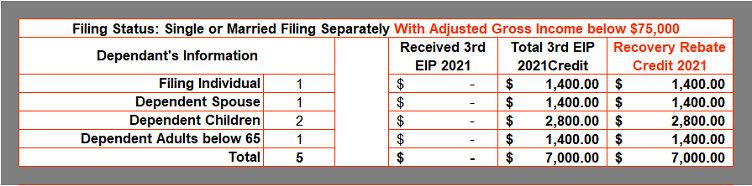

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/RRC-2021-Single-or-Married-Filing-Separately.png?is-pending-load=1

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of Web 28 nov 2022 nbsp 0183 32 In 2021 federal tax returns on income are eligible for the Recovery Rebate You could receive up to 1 400 for each tax dependent who is eligible married couples

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

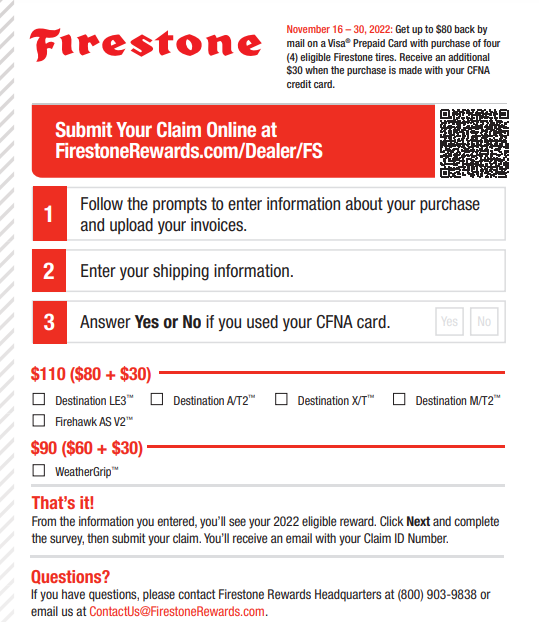

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 d 233 c 2021 nbsp 0183 32 Recovery Rebate Credit Topics Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

2023 Recovery Rebate Form Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Credit Printable Rebate Form

Recovery Credit Printable Rebate Form

2023 Recovery Rebate Credi Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Cares Act Recovery Rebate Credit Recovery Rebate

202 Recovery Rebate Credit - Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is