Recovery Rebate Requirements Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax Web 10 d 233 c 2021 nbsp 0183 32 The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic

Recovery Rebate Requirements

Recovery Rebate Requirements

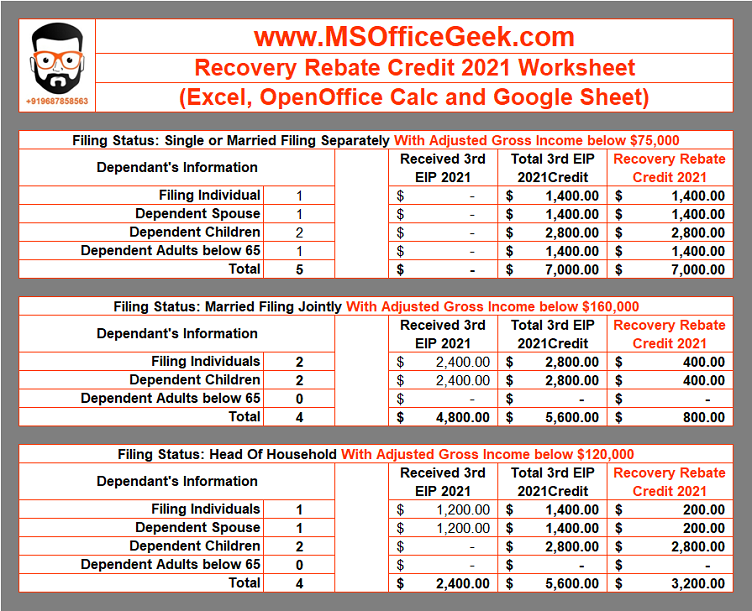

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 17 ao 251 t 2022 nbsp 0183 32 Once eligible you could qualify for a full or partial Recovery Rebate Credit on your 2020 and or 2021 returns if any of the following applied You were eligible for payment but did not receive one

Web 12 oct 2022 nbsp 0183 32 You re generally eligible to claim the recovery rebate credit if in 2021 you Were a U S citizen or U S resident alien Web 10 d 233 c 2021 nbsp 0183 32 Recovery Rebate Credits may be claimed for individuals who died in 2020 or 2021 when filing the decedent s 2020 tax return This includes someone who filed joint

Download Recovery Rebate Requirements

More picture related to Recovery Rebate Requirements

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

Recovery Rebates Threshold Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/consolidated-appropriations-act-provides-relief-to-individuals-and.png?fit=593%2C454&ssl=1

Web The Coronavirus Aid Relief and Economic Security CARES Act established Internal Revenue Code IRC section 6428 2020 Recovery Rebates for Individuals which can Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for Ethan

Web 26 d 233 c 2022 nbsp 0183 32 Recovery Rebate Credit Requirements Taxpayers can receive tax credits through the Recovery Rebate program This allows them to get a refund on their tax Web 30 d 233 c 2020 nbsp 0183 32 Do I qualify for a Recovery Rebate Tax Credit Generally you are eligible to claim the Recovery Rebate Credit if you Were a U S citizen or U S resident alien in

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

10 Recovery Rebate Credit Worksheet

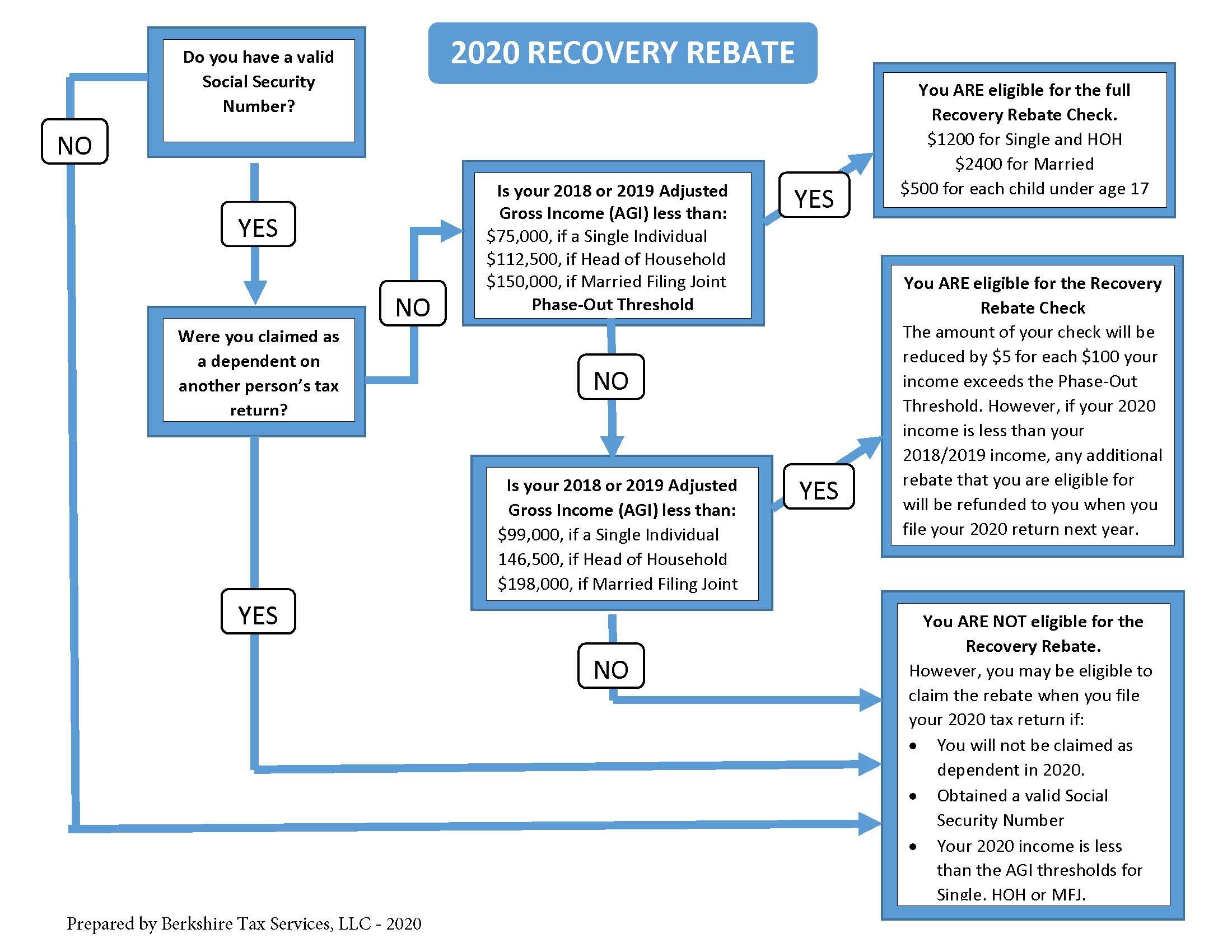

2020 Recovery Rebate Berkshire Tax Services LLC

1040 Recovery Rebate Credit Drake20

1040 Recovery Rebate Credit Drake20

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Recovery Rebate Credit Worksheet Example Recovery Rebate

Strategies To Maximize The 2021 Recovery Rebate Credit

Recovery Rebate Requirements - Web One eligibility for the credit is that you must have a valid SSN or have a dependent who has one If either spouse is an active member of the military only one spouse must