2020 Recovery Rebate Credit Amount If you didn t receive the full amount s of the first and second Economic Impact Payment then the Recovery Rebate Credit Worksheet will help you find out how much of the

An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate You received 1 200 plus 500 for each qualifying child you had in 2020 or You re filing a joint return for 2020 and together you and your spouse received 2 400 plus 500 for each

2020 Recovery Rebate Credit Amount

2020 Recovery Rebate Credit Amount

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

2020 Recovery Rebate Credit FAQs Updated Again Business IT IS

https://businessitis.com/wp-content/uploads/2022/04/2020-recovery-rebate-credit-faqs-updated-again.png

Recovery Rebate Credit What You Need To Know Before Filing Your 2020

https://www.kahntaxlaw.com/wp-content/uploads/2021/02/What-you-need-to-know-before-filing-your-2020-income-tax-returns-1030x441.jpg

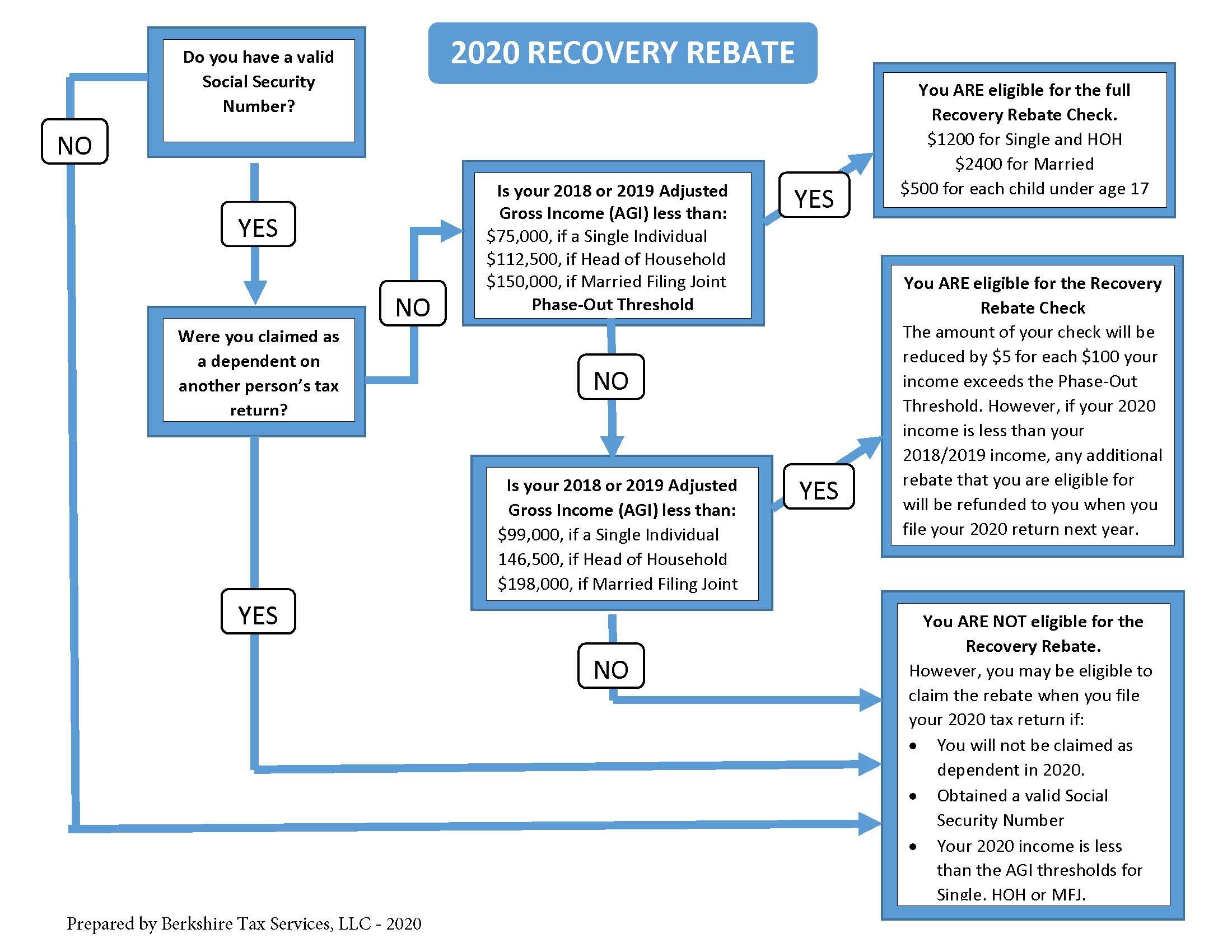

The Economic Impact Payments were advance payments of the Recovery Rebate Credit a refundable credit that taxpayers could claim on their returns for tax years 2020 and or 2021 if they did not receive the full amount of The 2020 recovery rebates equal 1 200 per eligible individual 2 400 for married taxpayers filing a joint tax return and 500 per eligible child These amounts phase down for

How is the 2020 Recovery Rebate Credit calculated The Recovery Rebate Credit amount is figured just like the first and second economic impact stimulus payments except that it uses To claim a missing stimulus payment for stimulus 1 or 2 or the 2020 Recovery Rebate Credit file 2020 Taxes and include this on Line 30 of the Form 1040 2020 Tax Returns can no longer be e filed use the link to prepare

Download 2020 Recovery Rebate Credit Amount

More picture related to 2020 Recovery Rebate Credit Amount

Recovery Rebate Credit Economic Impact Payment And Other Items For 2020

https://cookco.us/news/wp-content/uploads/2020/12/2020-tax-time.jpg

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

https://www.expatforum.com/attachments/1633512360704-png.100433/

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

The Recovery Rebate Credit provides up to 1 400 per individual and is designed to assist taxpayers who did not receive the full amount of stimulus payments during the The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020

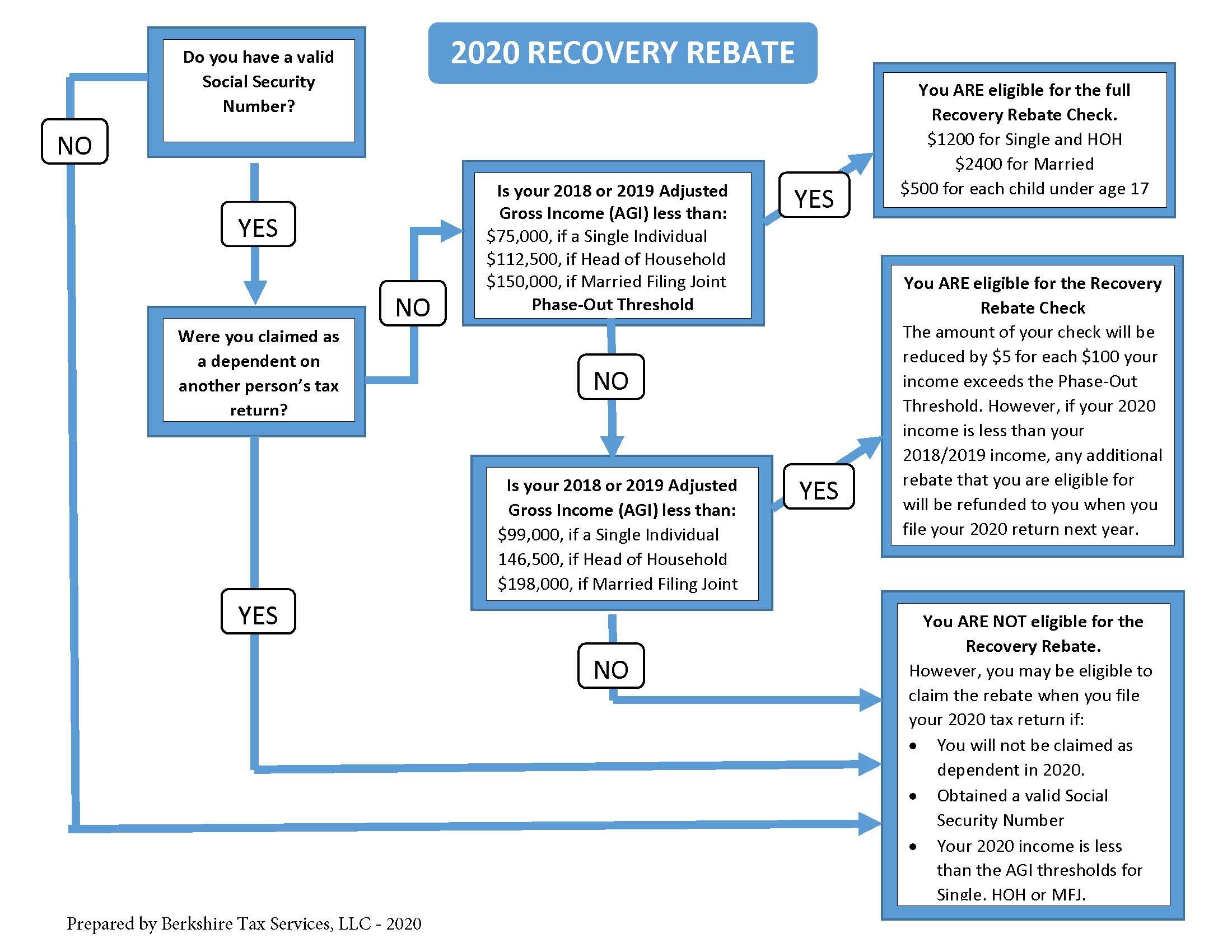

The proposed 2020 recovery rebates equal 1 200 per person 2 400 for married taxpayers filing a joint tax return and 500 per child These amounts would phase down for higher income Your 2020 Recovery Rebate Credit will reduce the amount of tax you owe for 2020 or if the credit is more than the tax you owe it will be included as part of your 2020 tax refund

2020 Recovery Rebate Berkshire Tax Services LLC

https://images.squarespace-cdn.com/content/v1/52caf6c5e4b0037bd0e4a70a/1585419420514-5DT2E0XW0WWV0TNEKPVR/ke17ZwdGBToddI8pDm48kEQ6y1VX0aZAxlj4LlOVZN17gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1UW5znIOGZ0PL5UJcvUdgE9hQRCTTLvo4bUTSMbxfZ9FdJitFceF7jkM1Ao3HHk8GrA/image-asset.jpeg

How To Use The Recovery Rebate Credit Worksheet TY2020

https://kb.erosupport.com/assets/img_5ffe310db9ba8.png

https://www.irs.gov › newsroom

If you didn t receive the full amount s of the first and second Economic Impact Payment then the Recovery Rebate Credit Worksheet will help you find out how much of the

https://www.irs.gov › newsroom

An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate

Recovery Rebate Credit 2020 Calculator KwameDawson

2020 Recovery Rebate Berkshire Tax Services LLC

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

2020 Recovery Rebate Credits Bayshore CPA s P A

Strategies To Maximize The 2021 Recovery Rebate Credit

Strategies To Maximize The 2021 Recovery Rebate Credit

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit 2021

Recovery Rebate Credit Form Printable Rebate Form

2020 Recovery Rebate Credit Amount - To claim a missing stimulus payment for stimulus 1 or 2 or the 2020 Recovery Rebate Credit file 2020 Taxes and include this on Line 30 of the Form 1040 2020 Tax Returns can no longer be e filed use the link to prepare