2022 Standard Deduction For Charitable Contributions To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more

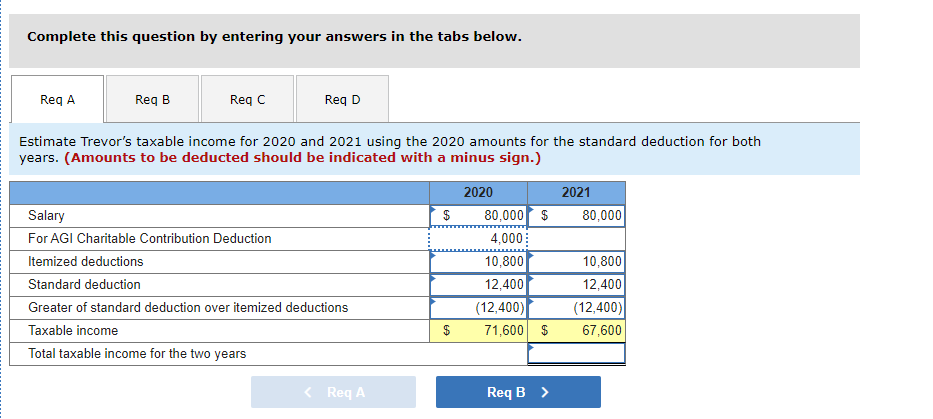

Your standard deduction lowers your taxable income It is not a refund You will see your standard or itemized deduction amount on line 12 of your 2022 Form 1040 For 2022 the standard deduction is 12 950 for single filers or 25 900 for married couples filing together And if you take the standard deduction in 2022 you can t claim an itemized

2022 Standard Deduction For Charitable Contributions

2022 Standard Deduction For Charitable Contributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

2021 Giving Tax Incentives Judi s House

https://judishouse.org/wp-content/uploads/2021/11/Charitable-Giving-Incentives-2021-Table.png

:max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg)

The Basics Of Tax Deductions For Charitable Donations

https://www.liveabout.com/thmb/7EZtrSVGS0XEmYgUNarq0UEA7CM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg

Charitable contributions or donations are gifts of goods or money to a qualified organization Deductions for these amounts are generally taken on Schedule A Itemized For single taxpayers and married individuals filing separately the standard deduction increases by 400 for 2022 For heads of households the standard deduction goes up another 600 for

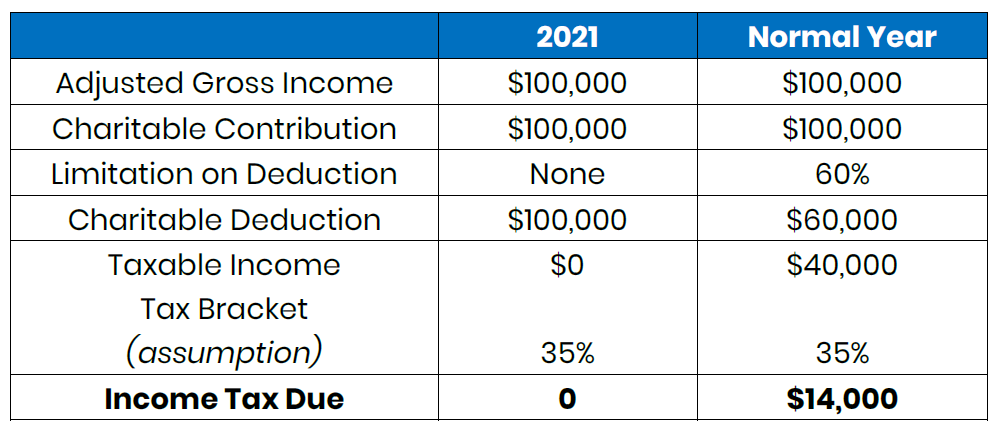

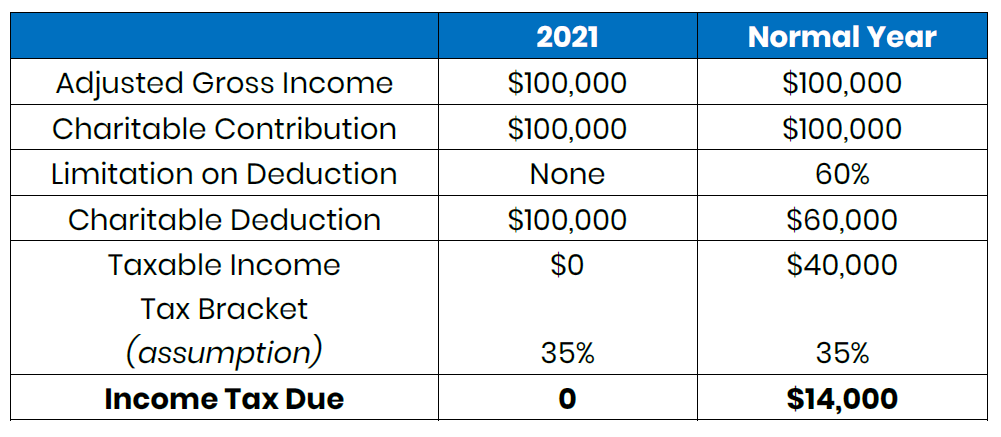

Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040 Charitable cash contributions to qualified charities cannot exceed 60 of an individual s AGI You can only deduct your gifts to charity from your taxable income for 2022 if you itemize your deductions using Form 1040 Schedule A

Download 2022 Standard Deduction For Charitable Contributions

More picture related to 2022 Standard Deduction For Charitable Contributions

The IRS Encourages Taxpayers To Consider Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

12 Tax Smart Charitable Giving Tips For 2023 Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/IE_0523_Tax-Smart Charitable Giving Tips_chart_deductions_bunching.jpg

Pre tax And Post tax Deductions Paper Trails

https://www.papertrails.com/wp-content/uploads/2022/03/Blog-Post-Background-1.png

Deductions for charitable donations are limited to a percentage of the taxpayer s adjusted gross income AGI The property donated and type of qualifying organization Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes The amount of

The IRS offers a deduction for eligible charitable contributions But there are rules for qualifying so not every donation counts Here s what to know as you figure out your strategy for You must itemize your deductions on your tax return to claim these contributions making it important to evaluate whether itemizing exceeds the standard deduction for your

Charitable Contributions Tax Strategies Fidelity Charitable

https://www.fidelitycharitable.org/content/dam/fc-public/shared/images/glasses-pencil-tax-form.jpg.transform/viewport-share-image/image.20211105.jpeg

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

https://i.pinimg.com/originals/6c/16/af/6c16af3ad58c7b51e20fad31e7bb90ad.jpg

https://money.usnews.com › money › pers…

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more

https://ttlc.intuit.com › community › tax-credits...

Your standard deduction lowers your taxable income It is not a refund You will see your standard or itemized deduction amount on line 12 of your 2022 Form 1040

Trevor Is A Single Individual Who Is A Cash method Chegg

Charitable Contributions Tax Strategies Fidelity Charitable

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

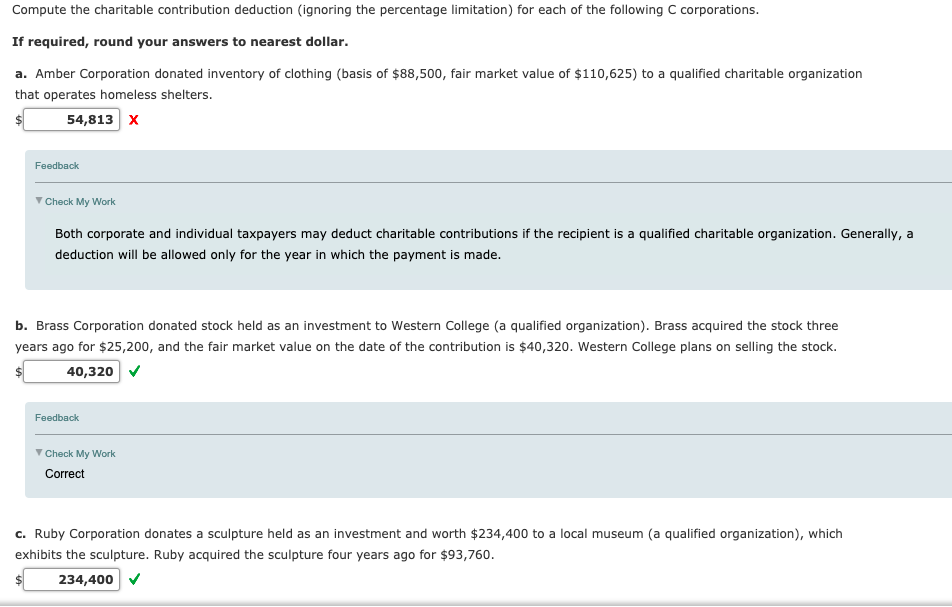

Solved Compute The Charitable Contribution Deduction Chegg

Make Sure You Claim Your Charitable Tax Deductions On Form 1040 Or

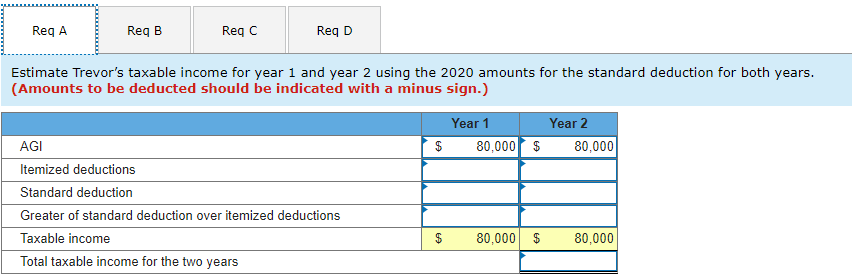

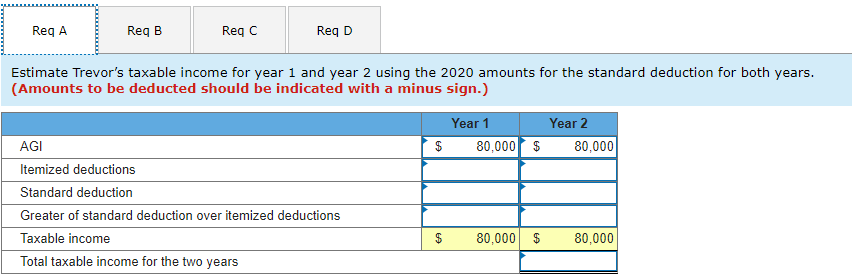

Solved Trevor Is A Single Individual Who Is A Chegg

Solved Trevor Is A Single Individual Who Is A Chegg

Anne Sheets Non Cash Charitable Contributions Donations Worksheet 2019 Pdf

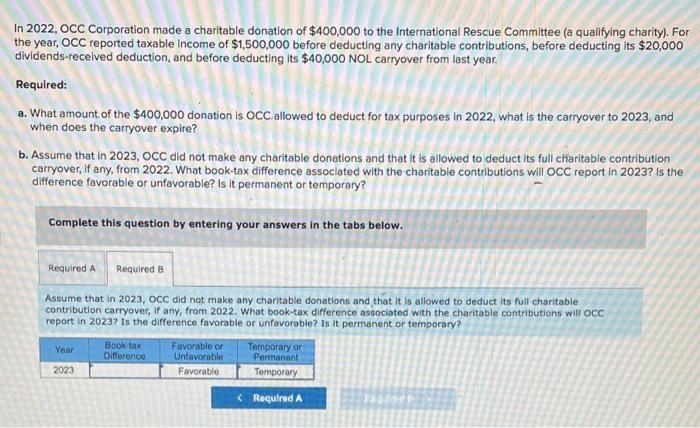

Solved In 2022 OCC Corporation Made A Charitable Donation Chegg

Standard Deduction How Much Can You Claim On Your Declarations For

2022 Standard Deduction For Charitable Contributions - For 2022 corporations will still be able to make this election and deduct up to 25 of their taxable income Contributions that exceed 25 of taxable income may be carried forward for up to 5