2023 Child Tax Credit Release Date 2023 and 2024 Child Tax Credit Thanks to the tax law changes in the Tax Cuts and Jobs Act of 2017 the Child Tax Credit CTC is now worth up to 2 000 per qualifying child A tax credit is a powerful tool because it reduces

Congress is still negotiating a 78 billion tax package with retroactive changes including a boost for the child tax credit If enacted the child tax credit changes could affect 2023 filings See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

2023 Child Tax Credit Release Date

2023 Child Tax Credit Release Date

https://www.pdffiller.com/preview/100/19/100019284/big.png

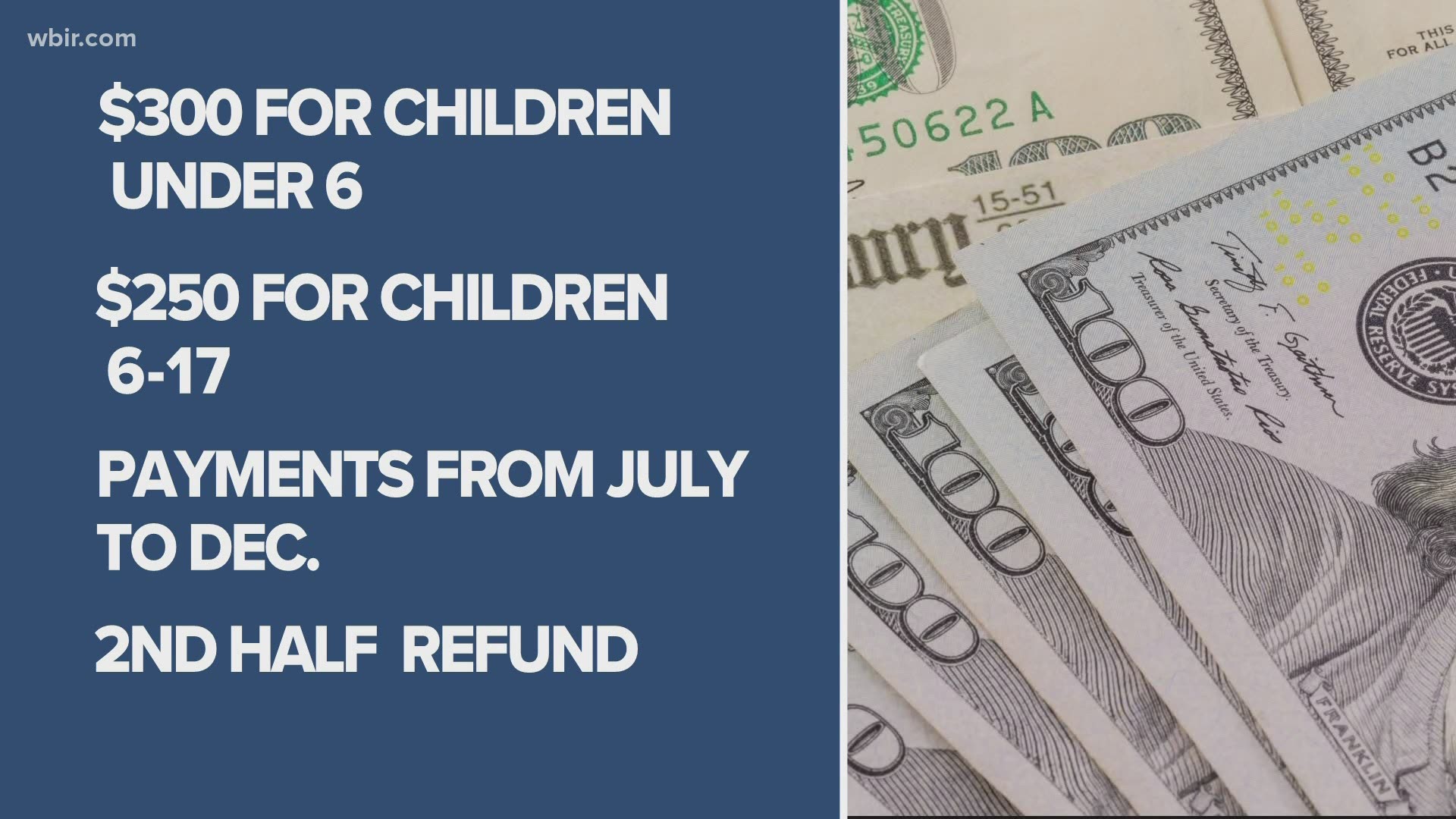

Child Tax Credit Release Date Why Your August 300 Payment Is Coming

https://1401700980.rsc.cdn77.org/data/images/full/101218/child-tax-credit-release-date-why-your-august-300-payment-is-coming-early-how-to-track.jpg?w=640

T14 0048 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0048.gif?itok=p2LRkHoI

Here is what you should know about the child tax credit for this year s tax season and whether you qualify The maximum tax credit per qualifying child is 2 000 for children The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the

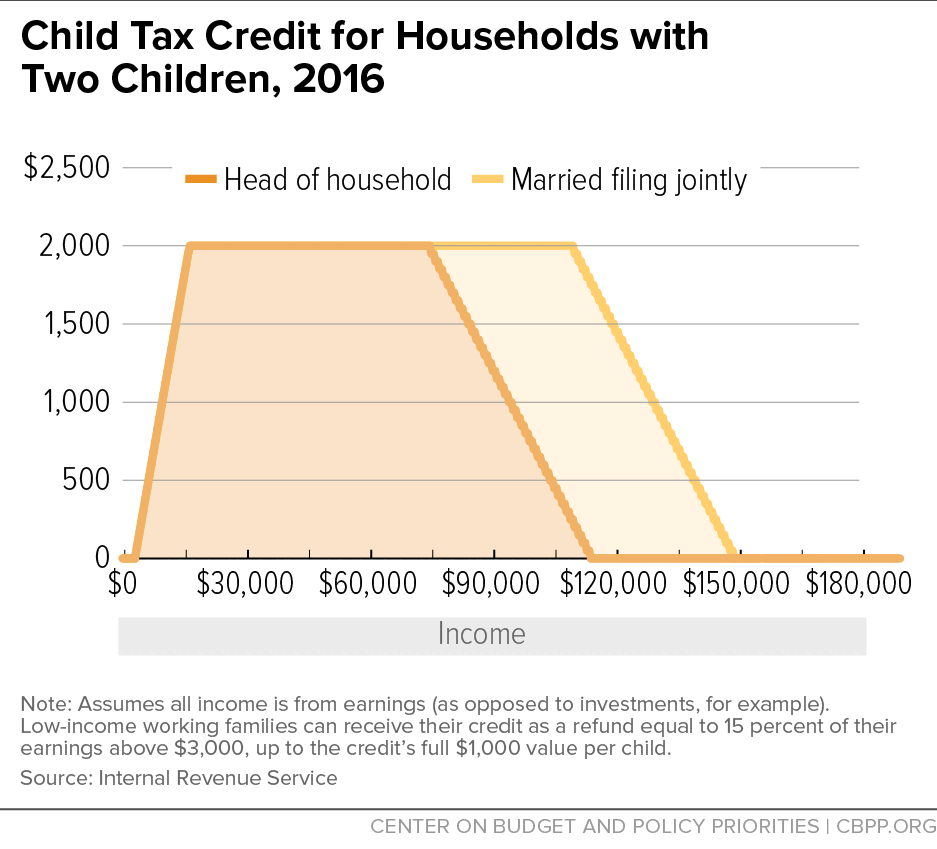

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit In addition the For a married couple earning a combined 60 000 per year and two children under six their Child Tax Credit will equal 7 200 and this year s expansion means an additional 3 200 per year in tax relief

Download 2023 Child Tax Credit Release Date

More picture related to 2023 Child Tax Credit Release Date

T14 0047 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0047.gif?itok=5kNtR7oI

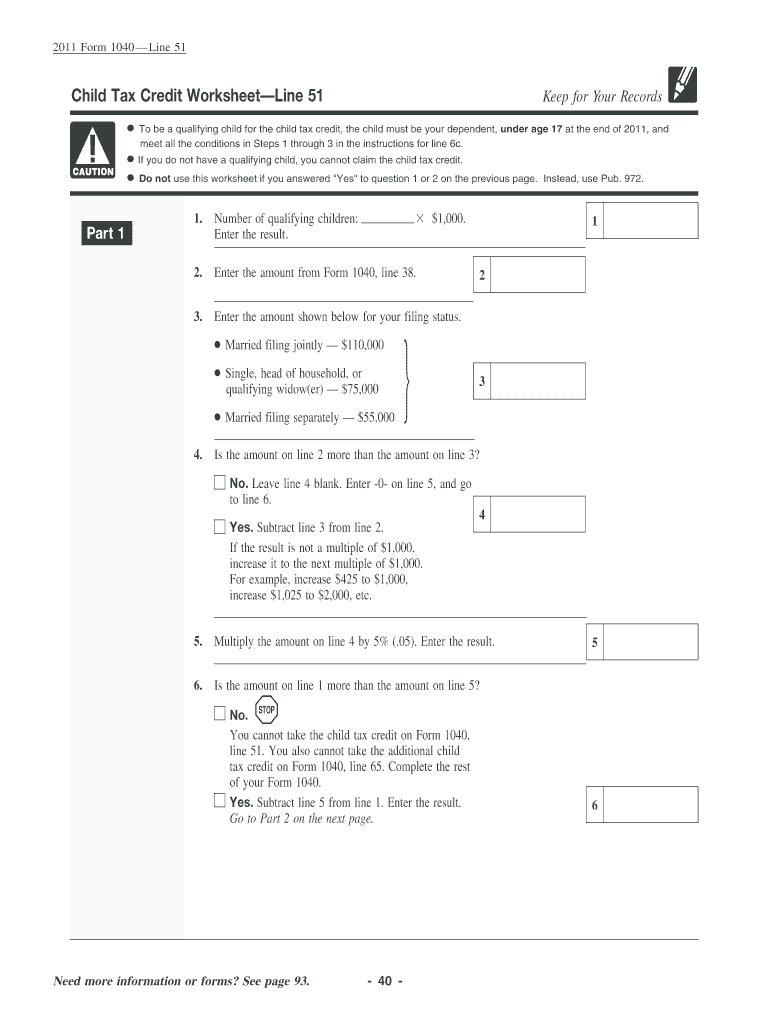

Child Credit Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/58/100058528/large.png

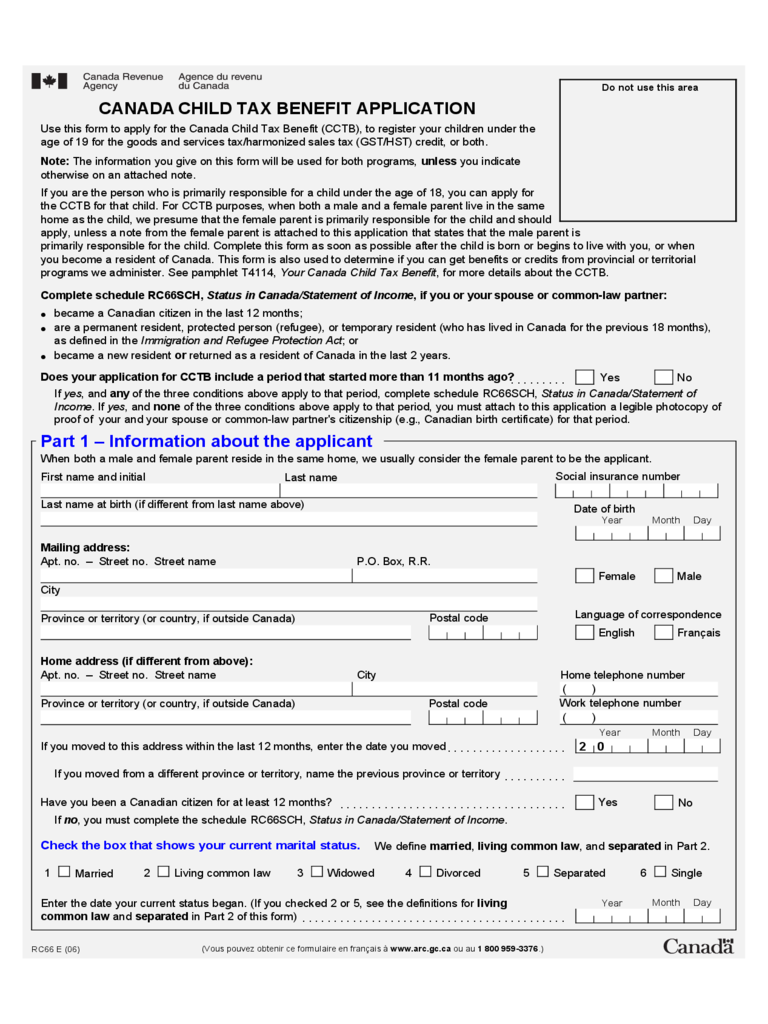

2023 Child Tax Benefit Application Form Fillable Printable PDF

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-benefit-application-form-canada-d1.png

According to the IRS the nonrefundable 2023 child tax credit is currently 2 000 per child The refundable portion of the credit known as the additional child tax credit is worth up to If you haven t received your money yet and you re claiming the credit you should be able to see your projected deposit date by checking the IRS Where s My Refund tool

However taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits A bipartisan tax deal aims to expand the child tax credit and restore business deductions for tax year 2023 But it still needs to get passed

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

https://ppittman.com/wp-content/uploads/2021/08/Child_Tax_Credit.jpg

Child Tax Credit You Can Opt out Of Monthly Payment Soon Wnep

https://media.tegna-media.com/assets/WBIR/images/b623d726-e494-4ce3-9e5e-7a9b8470caf3/b623d726-e494-4ce3-9e5e-7a9b8470caf3_1920x1080.jpg

https://turbotax.intuit.com › tax-tips › fa…

2023 and 2024 Child Tax Credit Thanks to the tax law changes in the Tax Cuts and Jobs Act of 2017 the Child Tax Credit CTC is now worth up to 2 000 per qualifying child A tax credit is a powerful tool because it reduces

https://www.cnbc.com › child-tax-credi…

Congress is still negotiating a 78 billion tax package with retroactive changes including a boost for the child tax credit If enacted the child tax credit changes could affect 2023 filings

Advance Child Tax Credit Payments Start Today Cook Co News

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

New Child Tax Credit Opens The Door For Old Scams

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

T21 0045 Tax Benefit Of The Child Tax Credit By Expanded Cash Income

T21 0045 Tax Benefit Of The Child Tax Credit By Expanded Cash Income

Mayor Duggan Addressed Detroiters July 12 About Importance Of Child Tax

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

Russian Army Beheads Ukrainian Prisoner Of War Video On The Internet

2023 Child Tax Credit Release Date - Families who successfully sign up before the deadline will receive their payments in December as a lump sum Non filer families that haven t signed up by the deadline can still claim their full