2023 Child Tax Rebate Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or Web 15 ao 251 t 2023 nbsp 0183 32 Up to 1 600 of the credit is refundable in 2023 and the refundable portion is called the Additional Child Tax Credit ACTC The current design expires after 2025 at

2023 Child Tax Rebate

2023 Child Tax Rebate

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

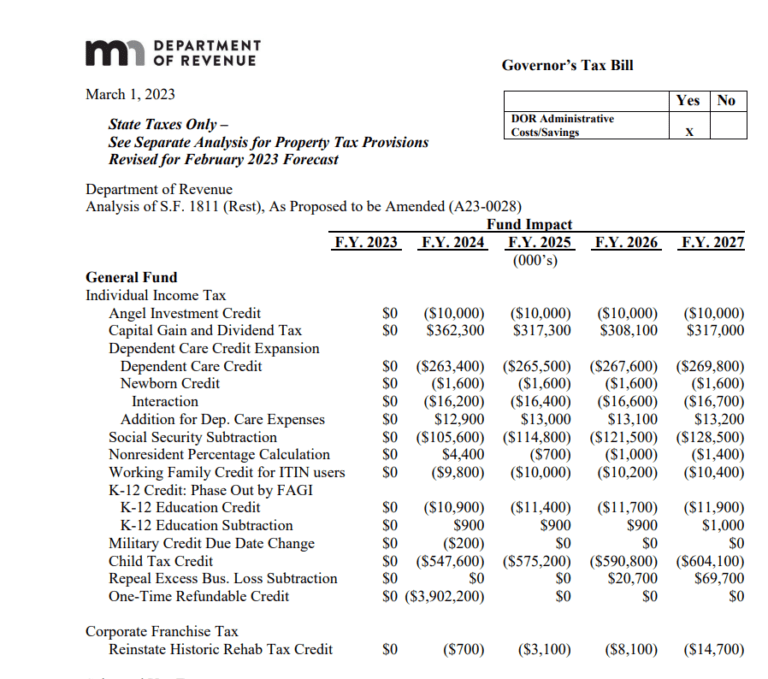

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023.png

Web 6 juil 2023 nbsp 0183 32 For the 2023 tax year taxes filed in 2024 the maximum child tax credit will remain 2 000 per qualifying dependent but the partially refundable payment will increase up to 1 600 per the IRS Web 4 avr 2023 nbsp 0183 32 The Child Tax Rebate 2023 is a tax credit offered by the government to families with eligible dependents It is designed to help offset the costs of raising children

Web The child tax credit will be worth 1 600 in 2023 The amount is refundable The child tax credit is a special tax break for parents of qualifying children The credit is available to single and married filers who have a child of at Web 3 f 233 vr 2022 nbsp 0183 32 If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 for your third and

Download 2023 Child Tax Rebate

More picture related to 2023 Child Tax Rebate

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/parents-of-children-born-in-2021-could-get-1-400-tax-credit-miami-herald-2.jpg

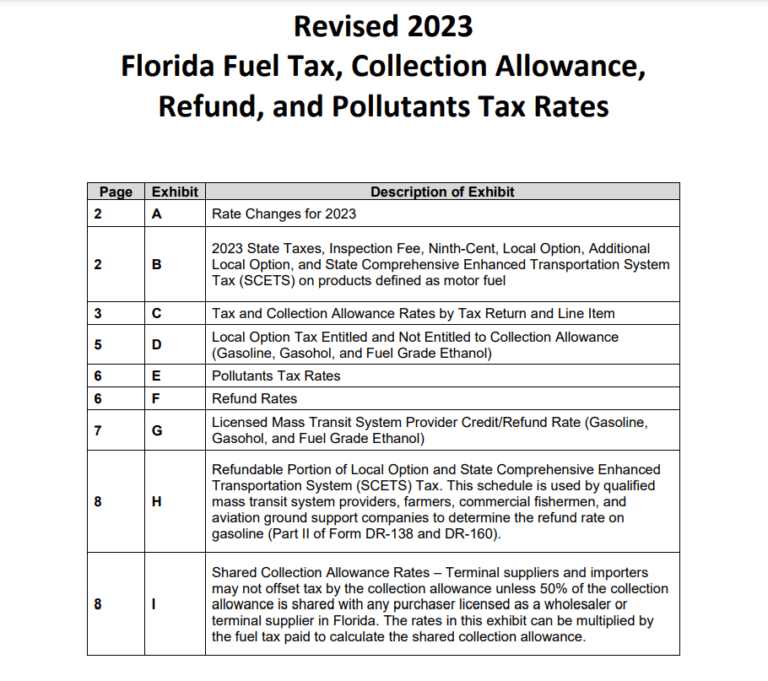

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

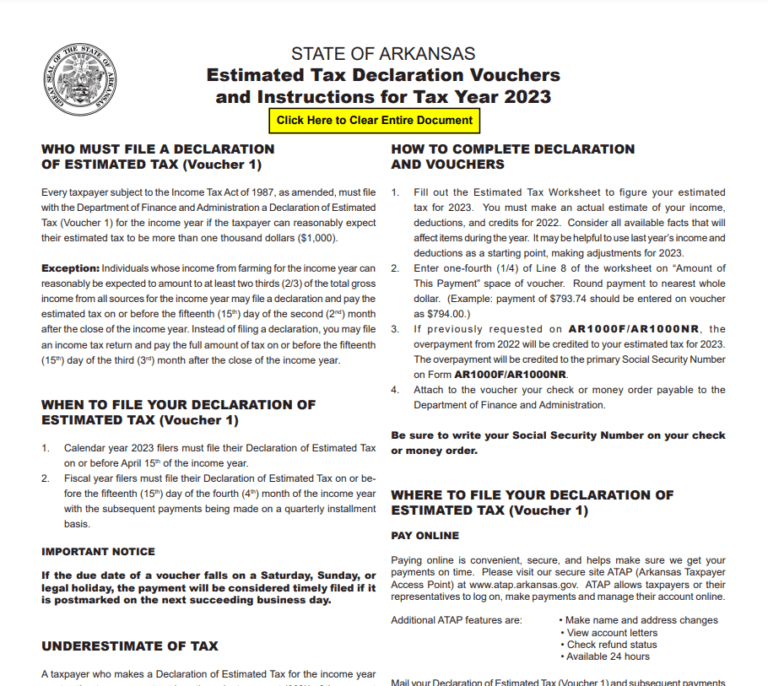

Arkansas Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Arkansas-Tax-Rebate-2023-768x686.png

Web 23 mars 2023 nbsp 0183 32 There are a myriad of rebate programs that will be available in 2023 It is crucial that you know the kinds of rebates the latest fashions and how to make the most Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the

Web 24 janv 2023 nbsp 0183 32 The maximum tax credit per qualifying child you could receive for a child born last year went down to 2 000 from 3 600 for children five and under or 3 000 Web 3 f 233 vr 2023 nbsp 0183 32 Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for kids 5 and younger or 3 000 for those 6 through 17 Additionally you can t

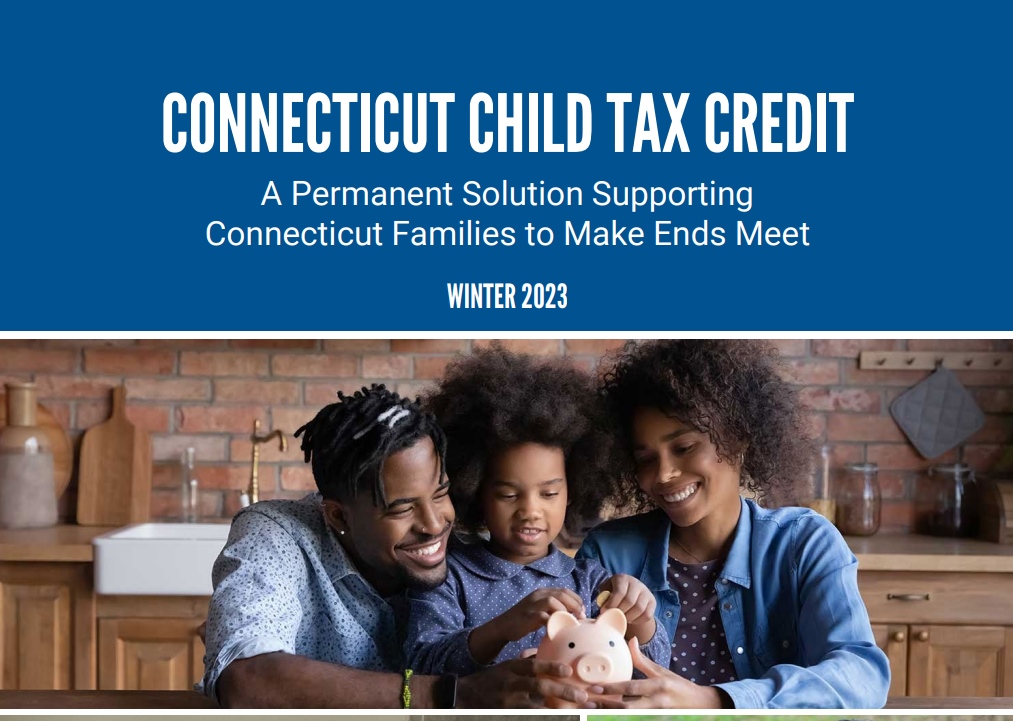

Ct Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/who-s-eligible-for-the-connecticut-child-tax-rebate.jpg

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ct-Child-Tax-Rebate-2023.jpg

https://www.usatoday.com/story/news/politics/2023/08/01/revive...

Web 1 ao 251 t 2023 nbsp 0183 32 Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their

https://www.nerdwallet.com/article/taxes/qual…

Web 5 juil 2017 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or

Delaware Tax Rebate 2023 Printable Rebate Form

Ct Rebate Check 2023 RebateCheck

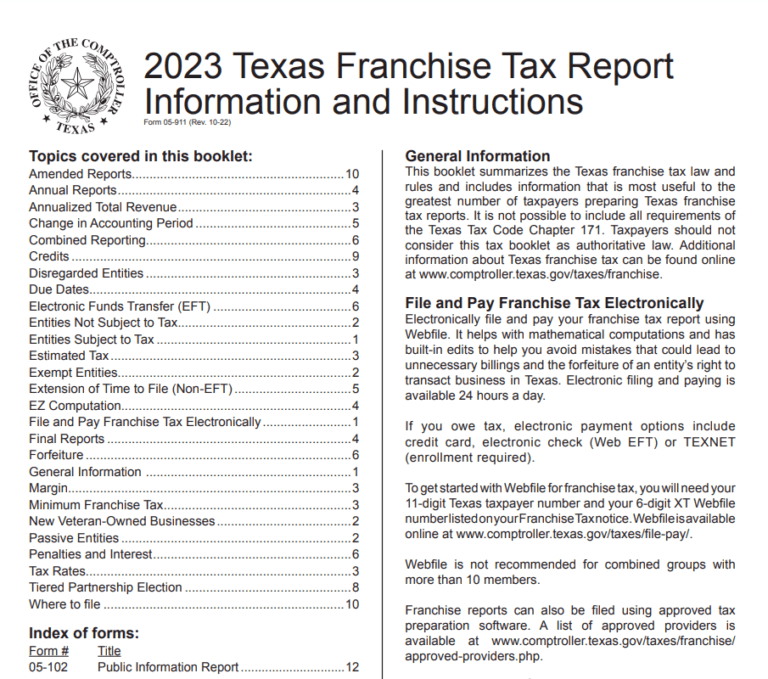

Texas Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

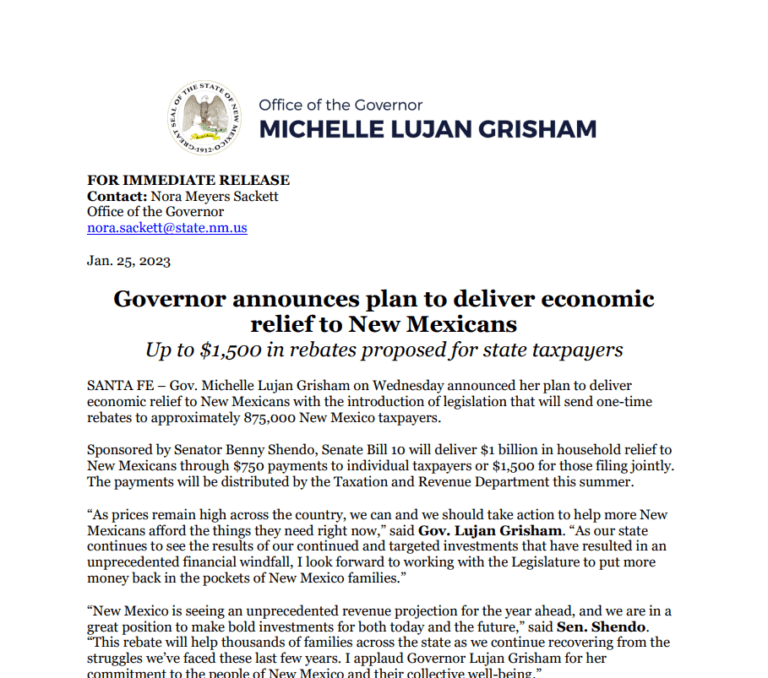

New Mexico Tax Rebate 2023 Eligibility How To Claim And Deadlines

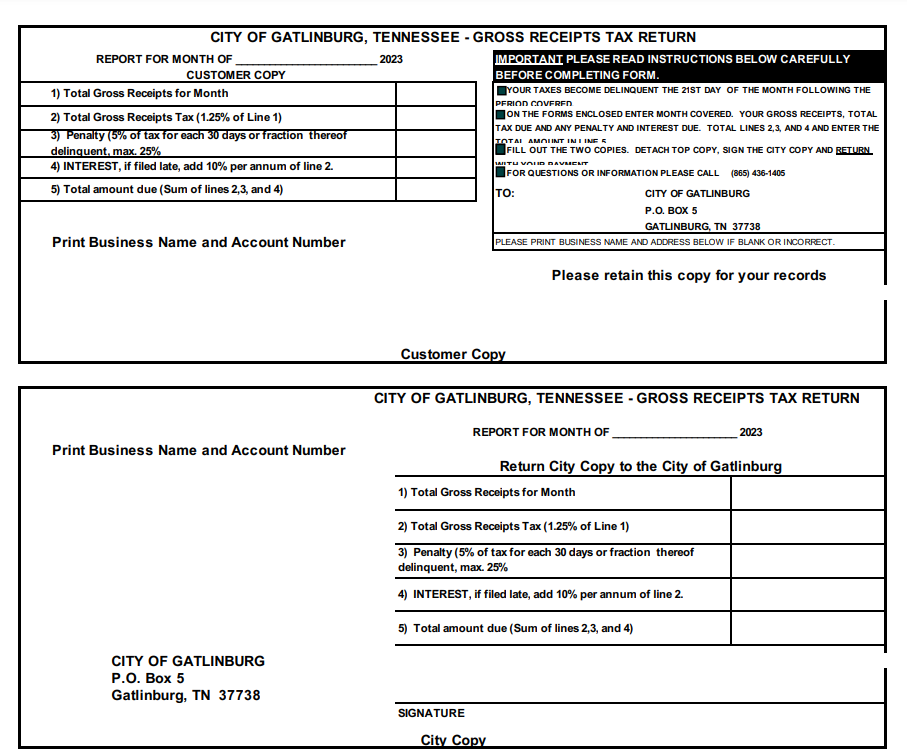

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Vermont Tax Rebate 2023 Printable Rebate Form

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

2023 Child Tax Rebate - Web 4 avr 2023 nbsp 0183 32 The Child Tax Rebate 2023 is a tax credit offered by the government to families with eligible dependents It is designed to help offset the costs of raising children