2023 Property Tax Deduction Verkko You owned the home in 2022 for 243 days May 3 to December 31 so you can take a tax deduction on your 2023 return of 946 243 247 365 215 1 425 paid in 2023 for

Verkko 31 hein 228 k 2018 nbsp 0183 32 You may deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state Verkko 5 huhtik 2023 nbsp 0183 32 Property taxes are deductible in the year they re paid not the year they re assessed So if you got your property tax bill in December 2021 and you

2023 Property Tax Deduction

2023 Property Tax Deduction

https://newsilver.com/wp-content/uploads/2021/09/How-Does-Rental-Property-Tax-Deduction-Work.jpg

/car-salesman-and-female-customer-in-driver-s-seat-of-new-car-in-car-dealership-showroom-922707694-f707b8227b334aaaa0ac55e90d4ec89f.jpg)

The Personal Property Tax Deduction And What Can Be Claimed

https://www.thebalance.com/thmb/pPpoj-cHgM7FnGuqqhSuu1nE3G8=/5120x3413/filters:fill(auto,1)/car-salesman-and-female-customer-in-driver-s-seat-of-new-car-in-car-dealership-showroom-922707694-f707b8227b334aaaa0ac55e90d4ec89f.jpg

Rental Property Tax Deduction Guide Picnic

https://www.picnictax.com/wp-content/uploads/2021/12/shutterstock_541675543-768x532.jpg

Verkko 22 syysk 2023 nbsp 0183 32 How the mortgage interest tax deduction works In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary Verkko 6 tammik 2023 nbsp 0183 32 Nov 17 2023 01 00pm EST Black Friday 2023 How To Splurge Without Breaking The Bank The amount you can deduct from your property taxes will depend on your location and marital status

Verkko 26 kes 228 k 2023 nbsp 0183 32 Learn about the biggest tax breaks for homeowners and whether it s worth the You can deduct mortgage interest property taxes and other expenses Verkko 18 hein 228 k 2023 nbsp 0183 32 If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file

Download 2023 Property Tax Deduction

More picture related to 2023 Property Tax Deduction

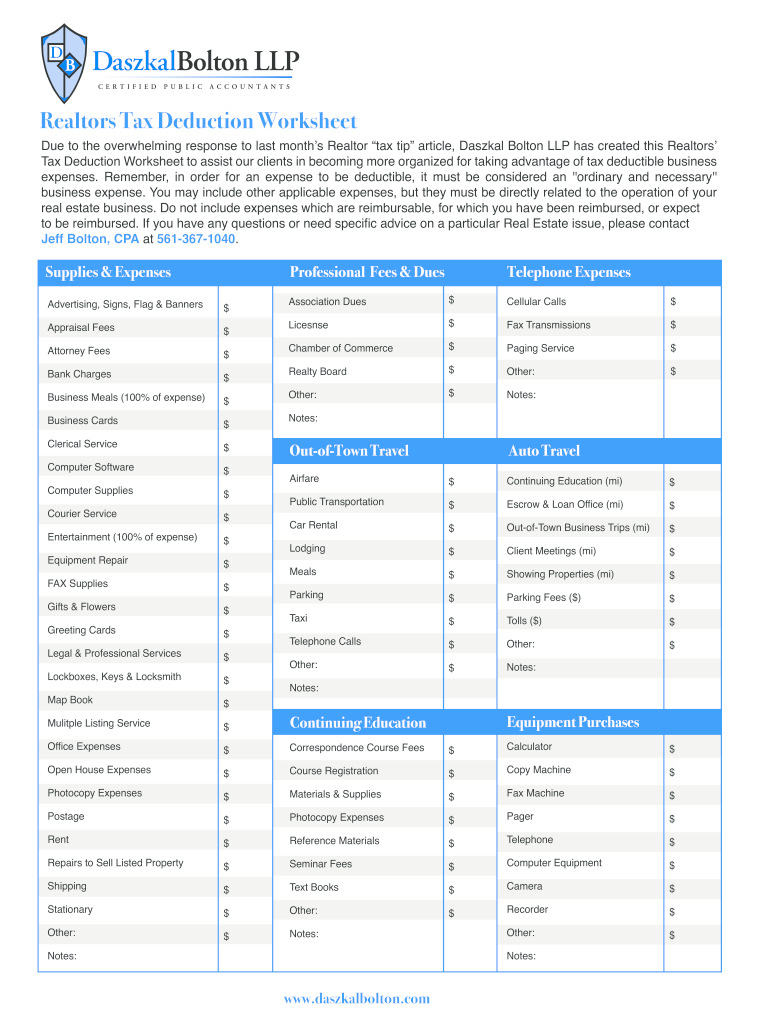

Real Estate Agent Tax Deductions Worksheet 2022 Form Fill Out And

https://www.signnow.com/preview/100/284/100284604/large.png

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

https://cbsnews1.cbsistatic.com/hub/i/2017/10/31/df5af00f-8fe0-48d6-b509-d1a3f546cc01/istock-850718528.jpg

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

https://db-excel.com/wp-content/uploads/2019/01/goodwill-donation-spreadsheet-template-throughout-clothing-donation-worksheet-for-taxes-fresh-goodwill-spreadsheet.jpg

Verkko 28 tammik 2023 nbsp 0183 32 Property Tax Deduction State and local property taxes that are generally deductible from United States federal income taxes These include real Verkko 21 huhtik 2023 nbsp 0183 32 The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your

Verkko 15 lokak 2023 nbsp 0183 32 Property Tax Deduction Limit 2023 October 15 2023 by Marco Santarelli If you own a home in the United States you may be eligible to deduct your Verkko 22 maalisk 2023 nbsp 0183 32 To learn more check the instructions for Form 1040 Schedule A If you paid property taxes in 2022 but also sold your house you should get those

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs-1187x1536.png

Can You Deduct Your 2018 Property Taxes Or Not Rocket Lawyer

https://www.rocketlawyer.com/blog/wp-content/uploads/2018/03/property-tax-deduction-c.jpg

https://www.irs.gov/publications/p530

Verkko You owned the home in 2022 for 243 days May 3 to December 31 so you can take a tax deduction on your 2023 return of 946 243 247 365 215 1 425 paid in 2023 for

/car-salesman-and-female-customer-in-driver-s-seat-of-new-car-in-car-dealership-showroom-922707694-f707b8227b334aaaa0ac55e90d4ec89f.jpg?w=186)

https://www.nerdwallet.com/article/taxes/tax-…

Verkko 31 hein 228 k 2018 nbsp 0183 32 You may deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state

Printable Itemized Deductions Worksheet

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

House Won t Agree With Senate Proposal To Nix Property Tax Deduction

Investment Property Tax Deduction

Free Of Charge Creative Commons Real Estate Property Tax Deduction

Realtor Tax Deductions Worksheet Form Fill Out And Sign Printable PDF

Realtor Tax Deductions Worksheet Form Fill Out And Sign Printable PDF

5 Most Overlooked Rental Property Tax Deductions AccidentalRental

How To Deduct Property Taxes On IRS Tax Forms

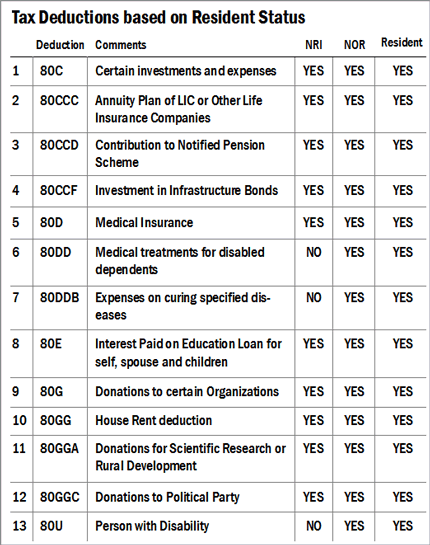

Income Tax Deduction U s 80C 80U Rajput Jain Associates

2023 Property Tax Deduction - Verkko 22 syysk 2023 nbsp 0183 32 How the mortgage interest tax deduction works In general you can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary