2024 Home Energy Rebates About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

2024 Home Energy Rebates

2024 Home Energy Rebates

https://hosbak.com/wp-content/uploads/smud-brochure-port2.jpg

Reasons Why Utility Companies Offer Energy Rebates And Home Insulation Techniques You Can Do To

https://geo-insulation.com/wp-content/uploads/2021/03/energy-efficient-5019261_1920.jpg

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

https://weaverexterior.ca/wp-content/uploads/2022/01/2022-home-energy-rebates-grants-incentives-Weaver-Exterior-1024x640.jpg

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments The U S Department of Energy Home Energy Rebates Program will provide 8 8 billion in rebates for home energy efficiency and electrification projects as part of the Inflation Reduction Act States territories and Indian Tribes will administer these pr ograms which will help households save money on energy bills improve in home comfort

HEEHRA rebate amounts for non appliance upgrades These energy efficiency and electrification rebates are expected to be rolled out in late 2024 and early 2025 and run through September 30 2031 Who qualifies for energy efficiency rebates Not all households will qualify for HEEHRA rebates There are two initiatives the Home Efficiency Rebates program and the Home Electrification and Appliance Rebates program Consumers can potentially get up to 14 000 or more toward the

Download 2024 Home Energy Rebates

More picture related to 2024 Home Energy Rebates

Free Printable Monthly Calendar 2024

https://i2.wp.com/calendarquickly.com/calendar/2024/2024-calendar-holidays.png

NJ Energy Rebate Guide Heat Pumps Insulation PSEG Rebates And More Sealed

https://storage.googleapis.com/sealed-prod.appspot.com/1/2023/02/GettyImages-528075461-1200x801-d21b45d.jpg

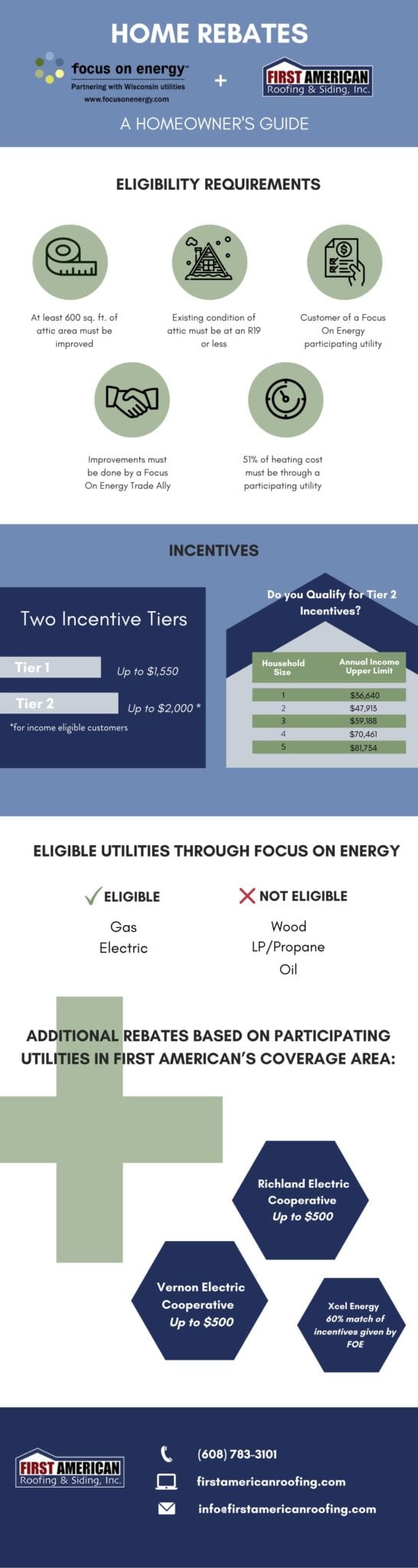

Focus On Energy A Wisconsin Homeowner s Guide To Rebates

https://firstamericanroofing.com/wp-content/uploads/2020/03/FOCUS-On-ENERGY-Rebates-for-your-home-scaled.jpg

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent We ve rounded up 24 ways to boost your home s energy efficiency in 2024 let s jump in Getting started 1 Take our free DIY Home Energy Assessment Answer questions about your home s current energy use and at the end of the assessment you ll get an easy to read report with energy improvement recommendations specific to your home

2024 Home Energy Eficiency Rebate Program Application SoCalGas offers a variety of rebates on natural gas products that could help you save money and make your home more energy efficient This application contains details on qualifying products rebate amounts and how to apply Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Home Energy Rebates Middleborough Gas Electric MA

https://www.mged.com/ImageRepository/Document?documentId=627

ESES 2024

https://www.eses2024.org/wp-content/uploads/2023/05/Locandina-web-768x537.jpg

https://www.energy.gov/scep/articles/first-group-states-apply-landmark-home-energy-rebates-funding-lower-energy-costs

About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

Home Energy Rebates Middleborough Gas Electric MA

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits Affect My Refund Fabalabse

Denver Climate Action Sustainability Resiliency On Twitter Happy ValentinesDay Want To

Home Energy Rebates The Energuy Inc

Rebates For Home Energy Evaluations YouTube

Rebates For Home Energy Evaluations YouTube

Zutari Internship Programme 2024 Jobcare

These Air Conditioning Myths Are Costing You Money Qualify For Our Enbridge Home Energy Rebates

Seresto Rebate Form PrintableRebateForm

2024 Home Energy Rebates - There are two initiatives the Home Efficiency Rebates program and the Home Electrification and Appliance Rebates program Consumers can potentially get up to 14 000 or more toward the